Just a day after forming a red Shooting Star candle—classic signal of a potential trend reversal—the Nifty dropped 82 points to close at 24,246.70, snapping its bullish streak.

Blame it on the technicals or just a classic case of “too high, too soon,” but even Bank Nifty and Sensex couldn’t hold up, both slipping around 0.3%.

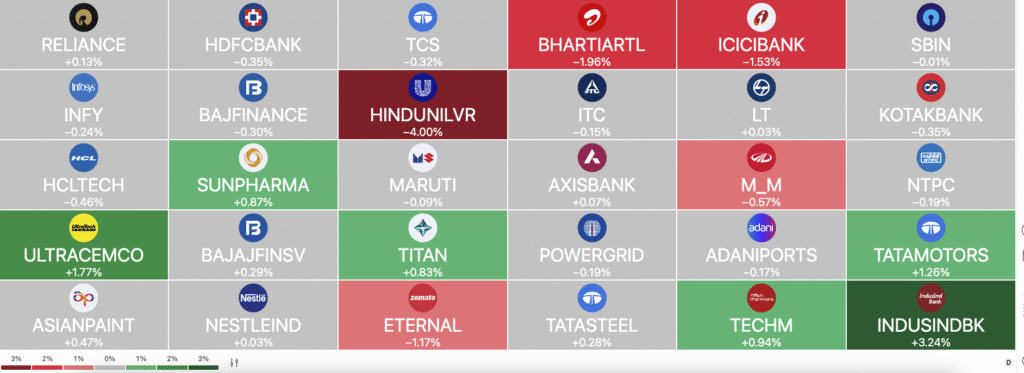

HUL turned into the day’s villain, crashing over 4%, while IndusInd Bank tried to be the hero, gaining 3.2%. Sector-wise, it was a tug-of-war: Pharma stocks popped, while FMCG got a reality check.

So… was this just a hiccup, or is the market finally catching its breath after its vertical sprint?

Let’s decode the charts and headlines.

Nifty Outlook: Trend Reversal

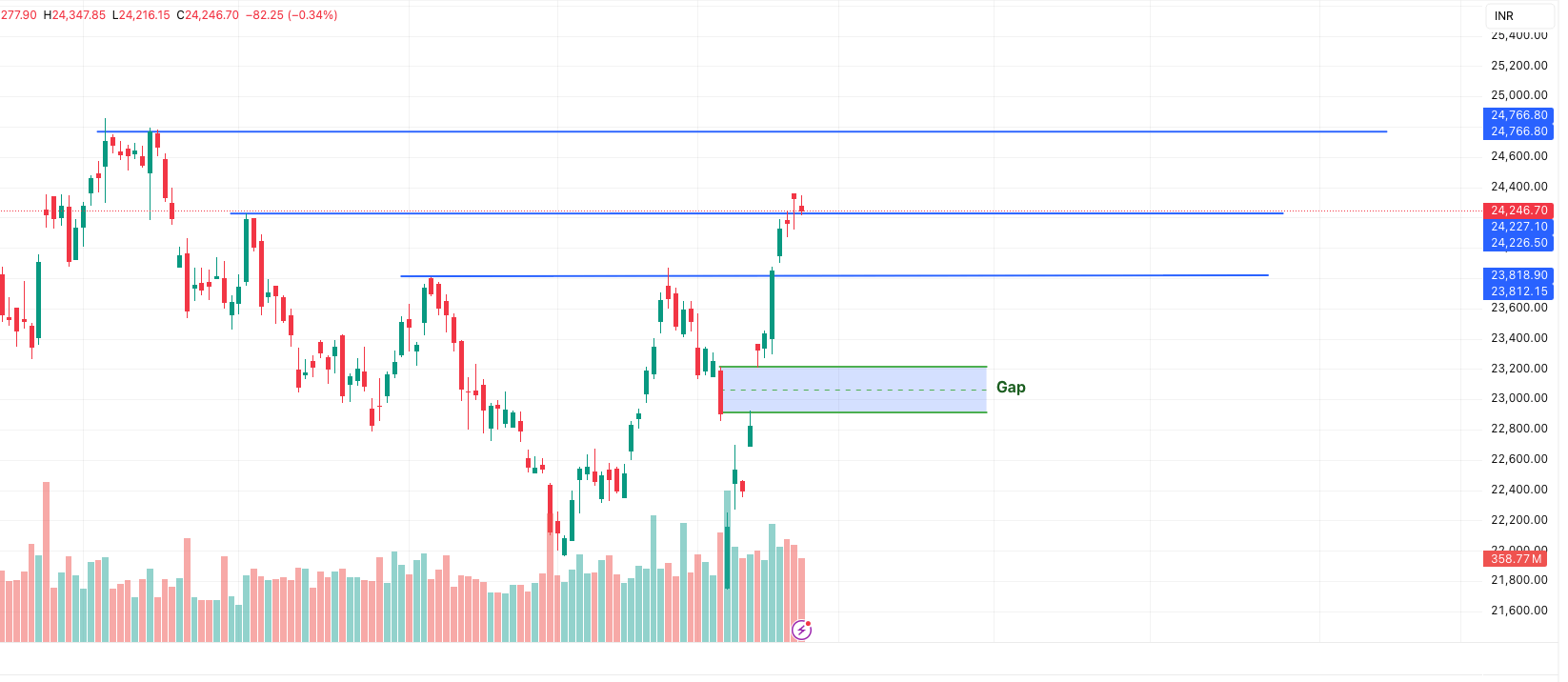

The Nifty 50 is flirting with a trend reversal zone, closing at ₹24,246, just below a key resistance. After a steady April rally from ₹22,300, this is the first real sign that the index might be losing steam.

📊 Where We Stand:

- Current Price: ₹24,246

- Nifty remains in a broader uptrend but is showing hesitation near resistance.

- An unfilled bullish gap between ₹22,900–₹23,200 offers strong support in case of a correction.

- Today’s move hints at a possible short-term trend reversal, especially if weakness persists tomorrow.

📌 Key Levels To Watch

| Zone | Price Range | Relevance |

|---|---|---|

| Resistance | ₹24,226 – ₹24,246 | Trend reversal zone if rejection continues |

| Resistance | ₹24,766 | Bullish target if resistance breaks |

| Minor Support | ₹23,818 – ₹23,812 | First cushion on downside |

| Gap Support | ₹22,900 – ₹23,200 | Strong area of support during pullback |

| Swing Support | ₹22,283 – ₹22,258 | Base for the recent uptrend |

📈 What Can Happen Next?

- Bullish Case:

A close above ₹24,250 with volume could wipe out the trend reversal threat and push Nifty toward ₹24,766. - Bearish Case:

Failure to break ₹24,250 or signs of rejection (like bearish candles) may lead to a trend reversal, dragging the index back to ₹23,800 or even the gap zone near ₹23,200.

📉 Volume Check:

Volumes are flat, but any uptick with a red candle could be the first alarm bell of a trend reversal in play.

💡 Final Word:

Nifty is caught in a moment of decision. A breakout confirms continuation, but a stall here might invite a quick trend reversal. Keep your eyes on tomorrow’s close—this could be the difference between a new high or a healthy correction.

News & Stock Impacted

🚛 India to Launch Safety Ratings for Trucks & Buses

Stock in Focus: Ashok Leyland, Tata Motors

India’s crash-prone roads may finally get a safety upgrade. Union Minister Nitin Gadkari announced safety ratings for commercial vehicles—yes, trucks and buses are getting their report cards.

Impact: Likely positive for auto manufacturers who are ahead on safety tech. Think Ashok Leyland and Tata Motors—they could benefit from demand shift toward rated vehicles.

🌱 NTPC Green Eyes ₹5,000 Cr via NCDs

Stock in Focus: NTPC

NTPC’s green arm wants to raise ₹5,000 crore via Non-Convertible Debentures. That’s bond-speak for: “We need money, but don’t want to share equity.”

Impact: A strong signal of expansion in renewables. Could keep NTPC in the limelight, especially for ESG-focused investors.

📈 NSE Tightens Rules for SME Migration to Main Board

Stock in Focus: SME-listed stocks like Droneacharya, Rachana Infra

NSE will now vet SME upgraders more strictly—starting May 1.

Impact: Great for investor trust, tough love for small caps. Some SME darlings might stall in their main board dreams unless they clean up their financials.

⚡ ABB India Electrifies Its Operations—Literally

Stock in Focus: ABB India

ABB flagged off EVs for factory ops and last-mile delivery in Bengaluru. Internal transport goes green.

Impact: Sustainability brownie points unlocked. Expect ABB India to keep cruising on ESG tailwinds.

🪨 Government Digs Deep—Rebates for Underground Coal Miners

Stock in Focus: Coal India, Vedanta

Say goodbye to upfront payments. The govt will now give revenue-linked rebates to underground coal miners.

Impact: Positive for companies like Coal India and Vedanta that might now find deep mining less financially terrifying.

🍲 Devyani Intl Acquires Biryani By Kilo Parent for ₹419.6 Cr

Stock in Focus: Devyani International

Move aside pizzas, biryani is here. Devyani International just grabbed an 80% stake in Sky Gate Hospitality (think: Biryani By Kilo).

Impact: Smart expansion in delivery-first, premium food segment. Good long-term story if margins are spicy enough.

🤖 Databricks Bets Big on India: $250M Investment Incoming

Stock in Focus: IT Services (TCS, Infosys, Persistent)

The AI and data analytics biggie will pour $250 million into India over 3 years—because data scientists are our new cricketers.

Impact: Boosts sentiment for Indian IT. Firms like TCS, Infosys, and Persistent could benefit from partnership, hiring, and upskilling demand.

Technical Radar- Trend Reversal

In this trend reversal market, where bulls are pausing to catch their breath, a few strong stocks are still flexing their muscles. Yes, even when Nifty takes a nap, these technical setups could wake up your portfolio. Let’s dive into today’s chart stars…

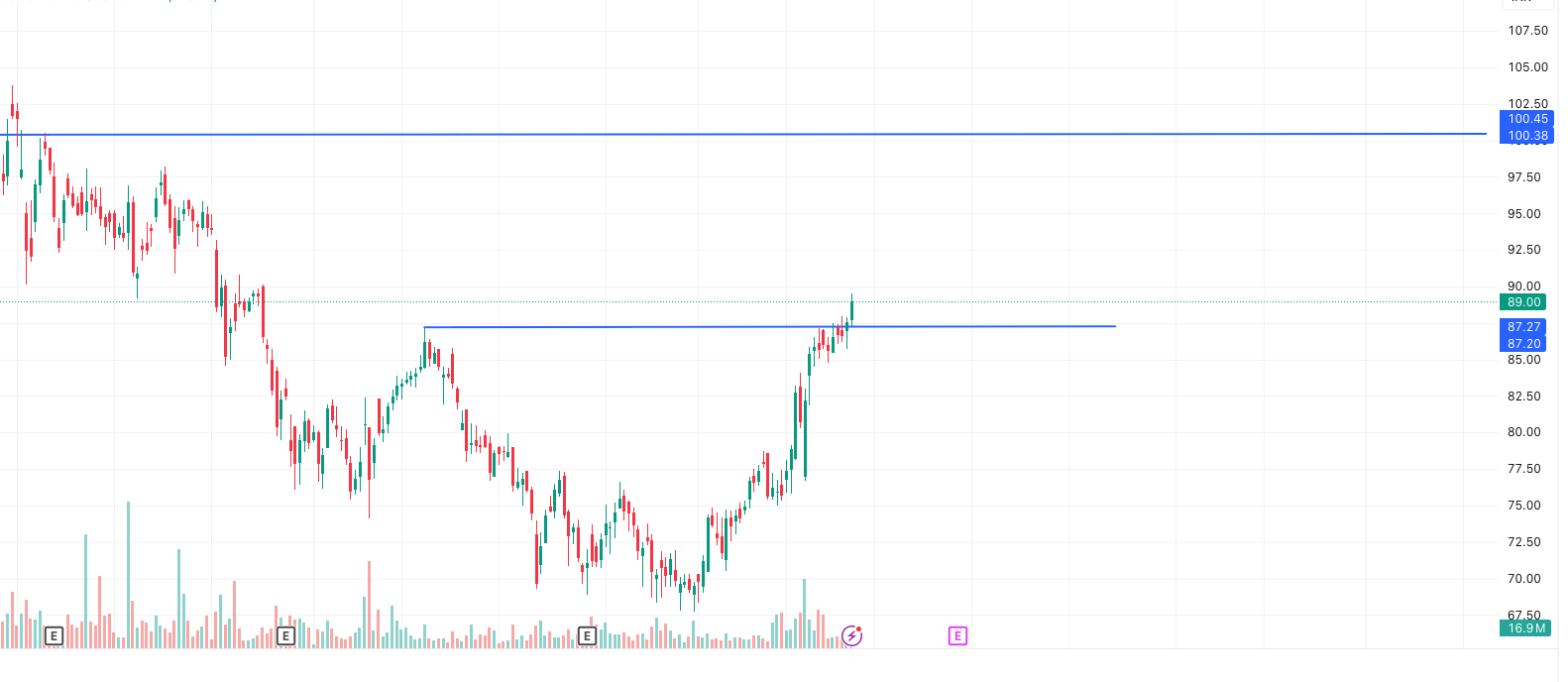

GMR Airports Ltd – Technical Breakout Analysis

Current Price: ₹89.00

📈 Change: +1.63%

📊 Volume: 16.9M (Healthy surge in volume)

Breakout Confirmed Above ₹87.20

- The stock has successfully broken above the key horizontal resistance zone of ₹87.20–₹87.27, which acted as a strong supply zone earlier.

- A breakout with a green candle and rising volume adds strength to the move.

Next Target Zone: ₹100 – ₹102.50

- The next major resistance lies at ₹100.38–₹100.45.

- This zone acted as a strong distribution zone back in August 2023.

Immediate Support Now: ₹87.20

- The broken resistance now acts as a new support (change of polarity).

- If the stock retests this level and holds, it offers a low-risk entry.

Momentum Analysis:

- Strong bullish momentum from the March low (~₹67).

- Clean uptrend with higher highs and higher lows.

- No immediate resistance until ₹100, indicating a free-run zone.

Conclusion (Short-Term View):

Bullish bias remains strong after today’s breakout. If volume sustains above ₹87 and there’s no bearish reversal, the stock may head towards ₹100+ levels in the short term. A dip near ₹87–₹88 can offer a buying opportunity with a stop below ₹85.

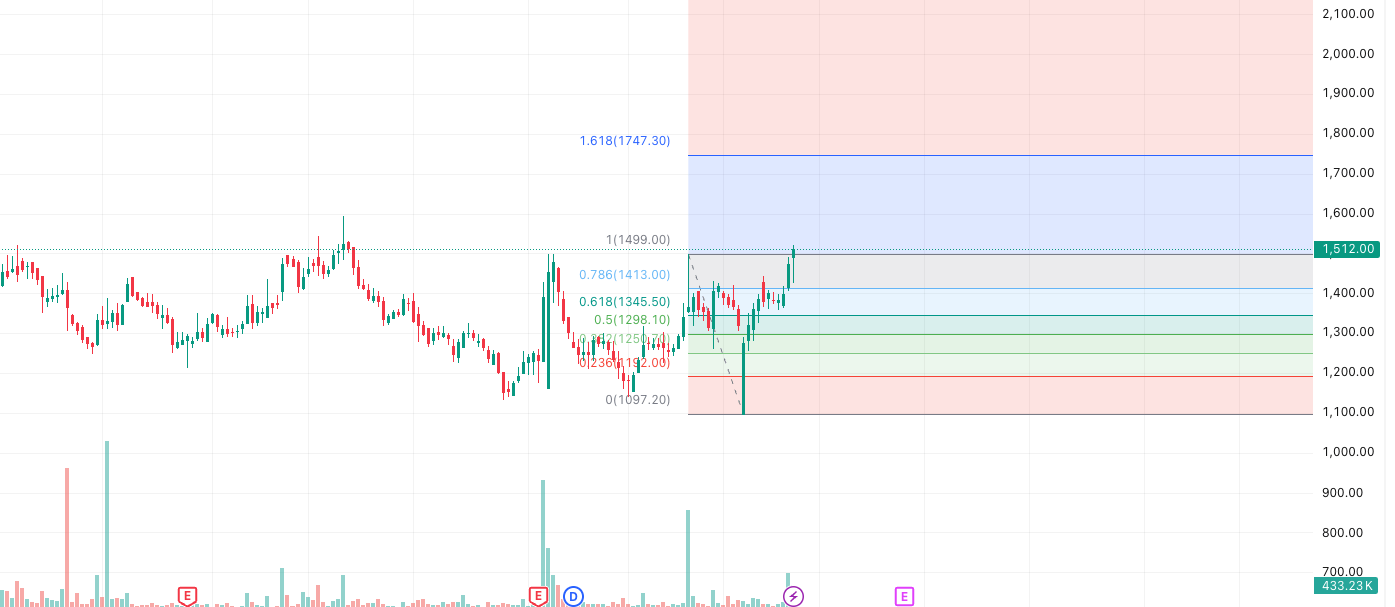

Eris Lifesciences– Breakout Mode ON

Eris Lifesciences just dropped a clean breakout above the ₹1,500 resistance level – and it didn’t whisper, it screamed with a strong candle and a volume spike to match. After spending months in sideways jail, the stock has now officially booked a one-way ticket out of consolidation.

What’s even more interesting? The Fibonacci extensions are pointing at possible short-term targets of ₹1,747 (1.618 level) and ₹2,149 (2.618 level). So, if this breakout holds above ₹1,490–₹1,500, bulls could ride this trend to some tasty upside.

Pullbacks? Watch ₹1,413 and ₹1,345 as dip-buying zones. Below ₹1,345, the party pauses.

🎯 Trade Setup Idea:

Hold or add above ₹1,500. Short-term targets: ₹1,747 / ₹2,149.

Stop-loss: ₹1,345 (just below the 61.8% Fib level).

Breakouts with volume + clean chart = no-brainer watchlist material.

Small Cap of the Day: KRBL Ltd

When you think of basmati rice, you think of India. And when the world thinks of Indian basmati, one name usually pops up: KRBL Ltd — the OG rice baron of India.

🌾 Business Model: More Than Just a Rice Company

KRBL is the world’s largest exporter of basmati rice, with brands like India Gate leading the charge. But it’s not just about shipping sacks of rice. KRBL controls the entire value chain — from farming to milling to branding to exports. That means they don’t just grow rice, they grow profits.

They’ve also diversified into renewable energy (solar + wind), agro-waste fuel, and even FMCG. Yes, your biryani could soon be powered by KRBL’s clean energy.

🚀 Future Plans: Growth With Global Appetite

As global demand for basmati continues to grow — especially in the Middle East, Europe, and the US — KRBL is ramping up capacity and expanding into new geographies. Their push into premium packaged foods and branded products means they’re chasing higher margins, not just higher volumes.

Also, the Indian government’s focus on branded exports and digital traceability for agri-products adds tailwinds to KRBL’s export business. Bonus? Softening freight costs and stable paddy prices are working in their favour this year.

📈 Why We Choose It

- Strong moat: Brand + scale + global distribution.

- Low debt, solid margins: Not many small caps boast this combo.

- Export champion: Global currency fluctuations may wobble others, but KRBL’s diversified base gives it a cushion.

- Rural demand boost: Recovery in domestic agri-demand post monsoon could add another growth lever.

In a market gripped by trend reversal, KRBL is a small-cap stock with a big-cap attitude. If food security is the new oil, KRBL might just be the next refinery.

Final Thought: Don’t Fear the Reversal – Ride It Smart

Yes, the trend reversal is making markets jittery. Nifty is dancing on a resistance rope, bears are sniffing around, and profit booking is suddenly the cool thing to do.

But remember — every market shake-up throws up new opportunities. Smart investors don’t panic… they pivot.

So whether you’re hunting the next breakout stock like KRBL, or just trying not to get whipsawed by the index, you need the right tools, real-time charts, and zero-balance investing to stay ahead.

This is where Angel One comes in.

Track technicals, set alerts, and invest in trending small-caps without any brokerage drama.

Because let’s be real — in this market, “free” tools might be your only consistent green candle.

👉 Open your FREE Demat Account with Angel One and trade smarter today.

Related Articles

Ather Energy IPO: Should You Ride This Electric Wave?