Introduction: From Legos to Lifts, Nordic Miracles

Lego isn’t just something your nephew builds a spaceship with—it’s the world’s largest toymaker by revenue. Spotify? It’s not just your gym playlist provider—it’s the world’s biggest music streaming company. And Novo Nordisk, the Danish firm behind Ozempic? It’s currently the most valuable company in Europe. Not bad for countries whose combined population is smaller than Uttar Pradesh.

Welcome to the Nordic zone—where tiny economies punch way above their weight on the global stage. Companies from Sweden, Denmark, Norway, and Finland aren’t just thriving—they’re dominating. And they’re doing it without a huge home market to rely on.

Now here’s the twist: Some Indian small caps are beginning to show the same DNA—global ambitions, tech-first mindsets, and a long-term business vision. Could they be the next Spotifys or IKEAs, minus the cold weather and perfect public transport?

Let’s dig into how the Nordics did it—and what Indian investors should look for if they want to spot the next global champions while they’re still “small.”

Nordic Blueprint: How Small Markets Create Global Beasts

What do the Nordics know that the rest of the world doesn’t? How did countries with GDPs smaller than Maharashtra churn out companies that rule the world?

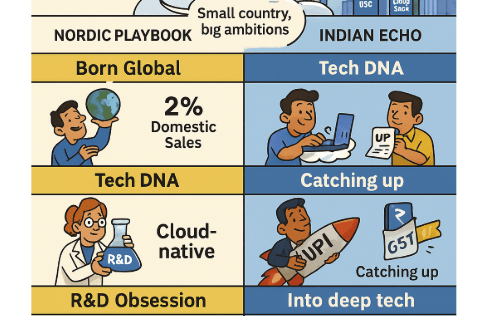

Let’s break it down. Four key pillars explain the Nordic miracle—and you’ll see how eerily similar these are to what’s brewing in some corners of India’s small-cap space.

1️⃣ Born Global: No Home Turf to Rely On

Nordic companies never had the luxury of a big domestic market. With only a few million people to sell to, they had no choice but to think global from day one. That’s why only 2% of their revenue comes from domestic sales, compared to 12% for the rest of Europe and 46% for the US.

📊 Reality check: Most Indian small caps don’t face this pressure—they can grow for years just selling to local customers. But guess what? The ones aiming global from the get-go are the real outliers. We’ll talk about those soon.

2️⃣ Tech DNA: Cloud First, Not Cloud Confused

While only 45% of EU small firms use cloud services, 73% of Nordic businesses are cloud-native. They’re lean, digital, and scalable.

Indian small caps? They’re catching up fast. With UPI, GST, and India Stack revolutionizing digital access, small companies are now growing using tech platforms, SaaS tools, and influencer-led D2C models. Think of a micro-cap skincare brand scaling via Instagram and Shopify.

3️⃣ R&D Obsession: More Than Just Jugaad

Four-fifths of listed Nordic companies outspend their global peers on R&D. It’s not just about building good products—it’s about constantly evolving them.

In India, we’ve long lagged—our total R&D spend as a % of GDP is just 0.7%, while the US is at 2.7% and Korea at 3.9%.

😎 The good news? That’s changing. Government-backed R&D from DRDO, ISRO, and IITs is now reaching private sector small caps—especially in defence, electronics, and space tech.

4️⃣ Long-Term Skin in the Game

Nordic companies like Lego and Maersk still have their founding families involved. This long-term ownership keeps the focus on sustainable growth, not quarterly results.

India’s small caps? Many are founder-led with high promoter holding, which often signals skin in the game. That’s why retail investors love these companies—they’re not run by hired suits who jump ship after a bad quarter.

🇮🇳 Indian Small Caps With Nordic-Level Potential

Not all small caps are future blue chips. But a few are quietly ticking all the right boxes: tech adoption, R&D focus, global ambition, and strong promoter skin in the game. Here are 4 standout candidates:

1. Tata Elxsi

Sector: Design & Engineering Services

Market Cap: ~₹ 35,297 Cr

Nordic Match: Tech-first + Global reach

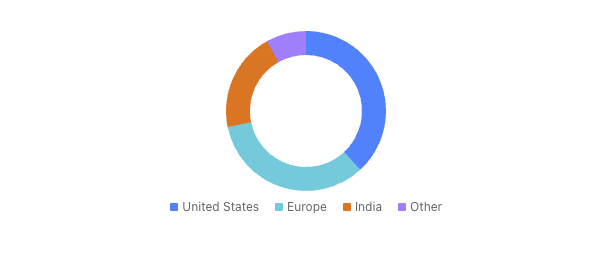

Tata Elxsi isn’t just a cool name—it’s the brain behind everything from self-driving cars to OTT user interfaces. It offers design and engineering services in automotive, healthcare, and media, and services clients in over 30 countries.

Why it screams Nordic:

- Over 80% of its revenue comes from outside India.

- R&D spending is rising, especially in EVs and AI.

- Its margins (25%+) rival global peers.

💡 The kicker: It operates in niche segments with insanely high entry barriers—which means, when the next big wave in tech hits (like autonomous vehicles), Elxsi is already at the front of the surfboard.

2. MTAR Technologies

Sector: Precision Engineering, Defence & Nuclear

Market Cap: ~₹ 4,245 Cr.

Nordic Match: R&D + Deep-tech exports

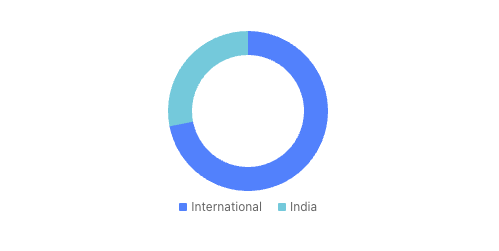

MTAR builds components for ISRO, DRDO, BARC, and global clean energy giants like Bloom Energy (US). It’s practically India’s hidden gem in aerospace and energy tech.

Why it screams Nordic:

- 30%+ revenue from exports—high-tech parts no one else makes in India.

- Close R&D integration with ISRO and DRDO.

- Scalable moat in the nuclear & hydrogen energy ecosystem.

💡 Think of MTAR as India’s version of a deep-tech Nordic firm—small in size, but working on moonshots (literally).

3. Syrma SGS Technology

Sector: Electronics Manufacturing (EMS)

Market Cap: ~₹ 8,695 Cr.

Nordic Match: Tech + IP-led manufacturing

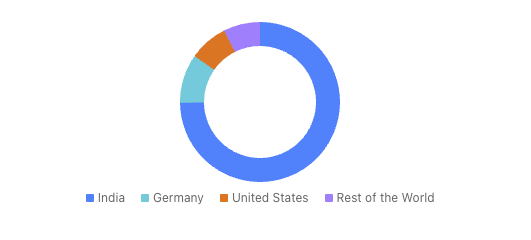

EMS is a booming sector globally, and Syrma is one of the few Indian small caps combining contract manufacturing with design capabilities—a rare combo.

Why it screams Nordic:

- Clients across US, Europe, and Japan.

- Owns over 100+ IPs in RFID, sensors, and power management.

- Benefits massively from India’s PLI schemes.

💡 Syrma isn’t just an assembler—it’s building the brain inside the hardware. That’s a major differentiator for long-term valuation re-rating.

4. Neuland Laboratories

Sector: Pharma APIs

Market Cap: ~₹ 15,748 Cr.

Nordic Match: Innovation + Global niche focus

Neuland is a quiet compounder in the pharma world, specializing in complex APIs (Active Pharma Ingredients). Its clientele includes some of the world’s biggest generic and specialty pharma giants.

Why it screams Nordic:

- 40%+ revenue from exports.

- Zero dependency on Chinese raw material—hello, supply chain moat!

- Constant R&D upgrades to stay relevant in high-margin APIs.

💡 While Indian pharma often gets flak for commoditization, Neuland has carved out a niche that’s protected, profitable, and global.

Small Caps ≠ Lottery Tickets

Just because these small caps look good today doesn’t mean you should YOLO into them without caution. Here’s the Nordic wisdom:

“Greatness takes decades. Volatility takes days.”

Like their Nordic peers, Indian small caps will go through bad quarters, tech shifts, regulatory curveballs, and investor mood swings. But if you focus on businesses—not just stock prices—some of them will graduate into tomorrow’s blue chips.

Your Action Plan: Spotting India’s Junior Blue Chips

Let’s be real—investing in small caps feels like dating in college. Lots of excitement, occasional heartbreak, and only a few lead to “happily ever after.”

So how do you pick the right small cap? Think like a Nordic CEO—obsessed with efficiency, innovation, and going global. Here’s a handy checklist:

✅ 1. Global Revenue Exposure

If more than 30% of a company’s revenue comes from outside India, that’s a green flag.

This proves the product/service is globally competitive. Companies like Tata Elxsi and Neuland Labs thrive globally because they meet international standards and can’t afford to slack off.

✅ 2. R&D Spending

Look for companies that treat R&D like compounding, not cost.

Check annual reports: is the company spending at least 3-5% of revenue on innovation? MTAR and Syrma SGS both show a steady rise in R&D, which fuels long-term growth.

✅ 3. Strong Promoter Holding

Skin in the game = serious business.

If the promoters own 50%+ of the company and aren’t pledging shares left and right, it shows alignment with minority shareholders. Nordic giants like LEGO still have family control for this very reason.

✅ 4. Government + Institutional Ties

Bonus points if the company works with DRDO, ISRO, PLI schemes, or global Fortune 500 clients.

These partnerships signal that the company is solving big problems—not just riding market fads.

✅ 5. Niche Dominance

Find companies doing something weird—but doing it better than anyone else.

Be it precision aerospace (MTAR) or RFID design (Syrma), you want companies that own a niche and are hard to replicate.

Final Thoughts: Think Nordic, Invest Local

If tiny countries like Denmark and Sweden can give us Spotify, Klarna, and LEGO… why can’t India’s small caps become tomorrow’s global titans?

They can. And some already are.

But unlike viral stocks that pump and dump with zero fundamentals, these small caps need your patience, conviction, and a long-term mindset. The next time you feel like selling just because the price dips 10%, ask yourself:

“Am I holding a stock… or a future LEGO?”

Want to track these rising stars without losing sleep over price swings?

Use Angel One’s Smartwatchlist to track R&D spend, global revenues, and insider activity in one place. Because stock picks age well—only when tracked smartly.

FAQs: Investing in Small Caps Like a Pro

Q1. What makes Nordic companies globally successful?

Nordic companies succeed due to their early focus on international markets, heavy R&D spending, technology adoption, and long-term ownership mindset.

Q2. Can Indian small caps replicate the Nordic success story?

Yes. Indian small caps like Tata Elxsi, MTAR Technologies, Syrma SGS, and Neuland Labs are showing similar traits—global revenue, R&D focus, and innovation.

Q3. Are Indian small caps risky to invest in?

Like any small cap, they carry short-term risks. But if they follow the Nordic model of sustainable, long-term growth, they can become blue chips in the future.

Q4. How do I find small caps with strong fundamentals?

Look for global exposure, high promoter holding, tech adoption, institutional partnerships, and consistent R&D investments.

Q5. Should I hold or sell small caps during market corrections?

Instead of panic selling, evaluate the company’s fundamentals and growth trajectory. Great small caps can bounce back stronger post-corrections.

Related Articles

Quess Corp Demerger Explained: What Investors Should Know