After a relentless seven-day winning streak, Nifty finally showed signs of getting tired yesterday. 🥱

On Wednesday, the index formed a red shooting star candle — a classic chart pattern that often hints at a possible reversal or at least a pause in the rally.

Yet, the headline numbers didn’t reveal the brewing tension:

Among sectors, Nifty IT danced ahead (+4.34%), while PSU Banks quietly slipped (-0.57%).

With a shooting star flashing after such a strong uptrend, the market now faces a big question: Is this the start of a reversal, or just a healthy breather before the next leg up?

Let’s dive into the charts, global cues, and stocks impacted!

Nifty Outlook: Reversal or Not?

Yesterday’s shooting star candle has thrown a little suspense into the mix! 📉

After a powerful rally, Nifty faced clear rejection near the ₹24,360 zone — a strong resistance area.

While the overall trend remains bullish, this setup hints at a potential short-term reversal.

Here’s the play-by-play:

- If Nifty opens lower and slides below ₹24,227, brace for a dip towards ₹23,818.

- If selling intensifies, the gap-fill zone near ₹23,200 could also come into play.

- However, unless the price breaks ₹23,812 decisively, the bigger bullish trend stays intact.

In short: Caution is advised near the highs.

A proper confirmation is needed today to decide whether this is just a pause or the start of a real reversal.

📍 Key Levels to Watch:

- Resistance: ₹24,360 → ₹24,766

- Support: ₹24,227 → ₹23,818 → ₹23,200 (gap zone)

Stocks in News

👉 RBI Announces Early Redemption of Sovereign Gold Bonds (SGBs)

The RBI has allowed early redemption for two old Sovereign Gold Bond series at ₹9,669 per unit. This move provides liquidity for gold bond investors and highlights the strength in gold prices. However, with gold rallying for months, there could be a short-term reversal in sentiment if redemption pressures rise.

Stocks Impacted:

- Muthoot Finance, Manappuram Finance (gold loan NBFCs)

- Gold ETFs like Nippon GoldBees, HDFC Gold ETF

👉 BankBazaar Partners with Muthoot FinCorp for Digital Gold Loans

BankBazaar has partnered with Muthoot FinCorp to launch digital gold loans after its successful fundraise. The gold loan sector is rapidly digitizing, and while this news is positive, sudden competition could also create a reversal of margins for traditional players over time.

Stocks Impacted:

- Muthoot Finance, Manappuram Finance (positive sentiment boost)

👉 Suraksha Diagnostics Acquires Fetomat Wellness

Suraksha Diagnostics acquired a 63% stake in Fetomat to expand in maternal-fetal healthcare. Although Suraksha itself is unlisted, this highlights growing specialization in healthcare diagnostics, a sector that could face sharp reversals if price wars increase.

Stocks Impacted:

- Dr. Lal PathLabs, Metropolis Healthcare, Krsnaa Diagnostics (sentiment positive)

👉 MEIL Gets ₹13,000 Crore Nuclear Reactor Order from NPCIL

Megha Engineering and Infrastructures Ltd secured a ₹13,000 crore contract to build two nuclear reactors. MEIL is unlisted, but nuclear energy investments tend to trigger strong sector rallies followed by sharp reversals if order execution gets delayed.

Stocks Impacted:

- L&T, BHEL, Walchandnagar Industries, KSB Ltd. (positive momentum)

👉 Aurobindo Pharma Gets USFDA Nod for Cancer Drug

Aurobindo Pharma received USFDA approval to launch its generic Dasatinib tablets for cancer treatment. Positive approvals like these can drive a stock rally, but traders should stay alert for possible reversal signs after strong initial moves.

Stocks Impacted:

- Aurobindo Pharma (direct positive impact)

- Pharma sector sentiment mildly positive

👉 Kashmir Tour Cancellations Surge After Pahalgam Attack

Tourism in Kashmir has taken a hit after a security incident led to 25% tour cancellations. Companies with exposure to Kashmir tourism could see pressure, and there is a risk of reversal in travel sector sentiment if security issues persist.

Stocks Impacted:

- Indian Hotels, Lemon Tree Hotels, EIH Ltd. (potential mild pressure)

👉 LG Electronics Puts Indian IPO Plans on Hold

LG Electronics has decided to pause its Indian unit’s IPO plans. This does not directly impact any listed stocks, but it reflects cautious market sentiment where IPO momentum could see a reversal if uncertainty persists.

Ather IPO Open Soon:

Focus Today: Watch for moves in gold loan NBFCs, pharma stocks, and nuclear-related engineering companies. However, given the reversal signs in broader indices, trade with caution near resistance zones.

Technical Stocks to Focus

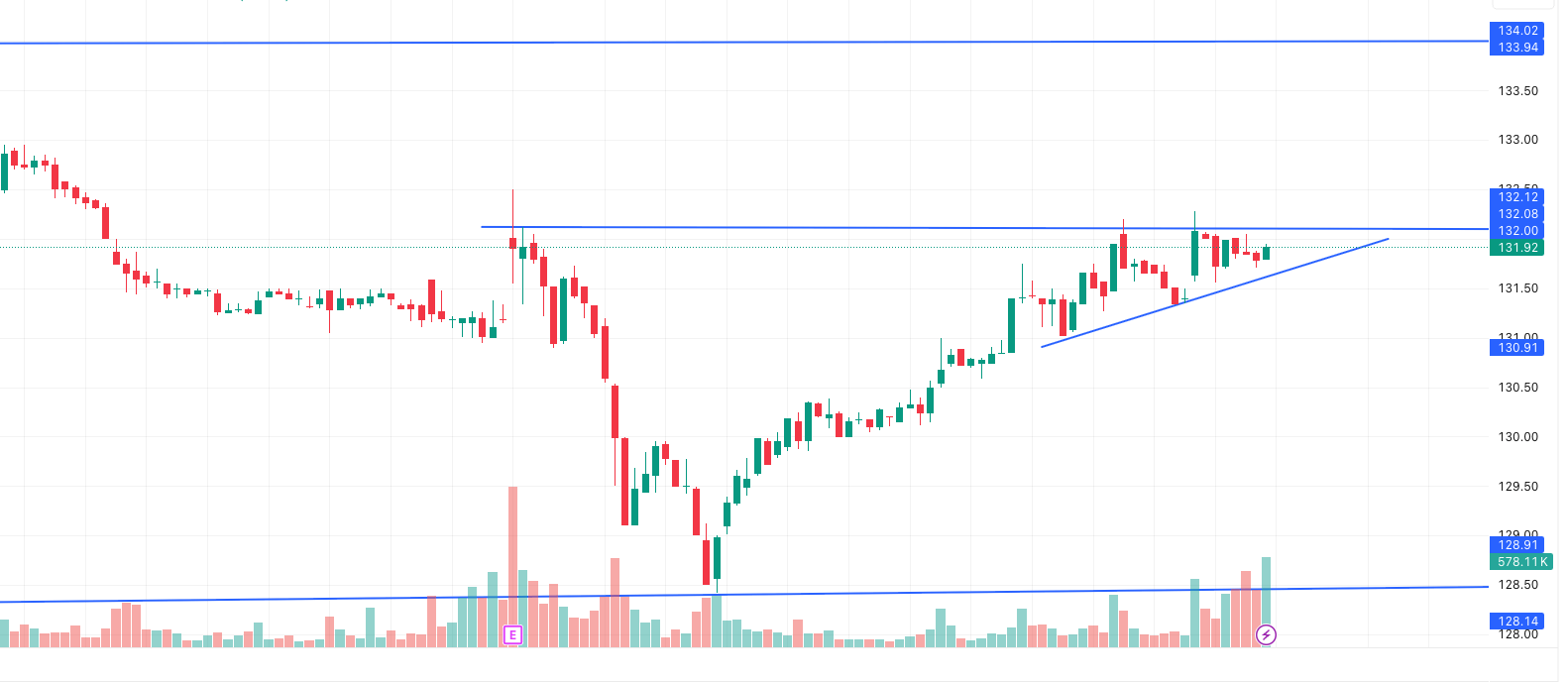

Bajaj Housing Finance: Potential Breakout Watch

On the 15-minute chart, Bajaj Housing Finance is showing a classic rising symmetrical triangle pattern. After consolidating nicely, the price is now flirting with the upper resistance zone around ₹132.10–₹134.

Today’s session showed strong bullish momentum supported by higher volumes — a good early sign. If the stock manages a breakout above ₹134 with strong volume, a sharp move towards ₹137 or even higher could be on the cards.

Action Plan: Watch for a breakout above ₹134 with volume confirmation. If it fails and reverses, better to wait it out. Stop loss (SL) can be placed below ₹128.90 to manage the risk.

CDSL: Testing the Fibonacci Golden Ratio

On the daily chart with Auto Fibonacci levels, CDSL has had a strong rally and is now approaching the critical 1.618 Fibonacci extension zone around ₹1371.

Current price is ₹1360 — very close to this resistance. Typically, a reversal or short-term pause can happen at such golden ratio levels. But if it breaks through ₹1375 with good volume, we could see momentum pushing it quickly toward ₹1555.

Action Plan: Avoid aggressive buying here. Wait for a clear breakout above ₹1375. Alternatively, if there’s a healthy dip near ₹1300, it could offer a better risk-reward entry. Keep a strict stop loss below ₹1255.

Small Cap Stock of the Day: Zensar Technologies Ltd

Business Model and Strategy

Zensar Technologies is a mid-sized IT services company that helps businesses transform digitally. Their focus is on cloud solutions, data engineering, AI, enterprise applications, and improving customer experiences across sectors like BFSI (Banking & Financial Services), healthcare, manufacturing, and tech.

Instead of chasing low-margin projects, Zensar targets high-value digital deals. They help clients modernize old IT systems and build smarter, cloud-native operations — basically, they’re the tech upgrade partner companies need today.

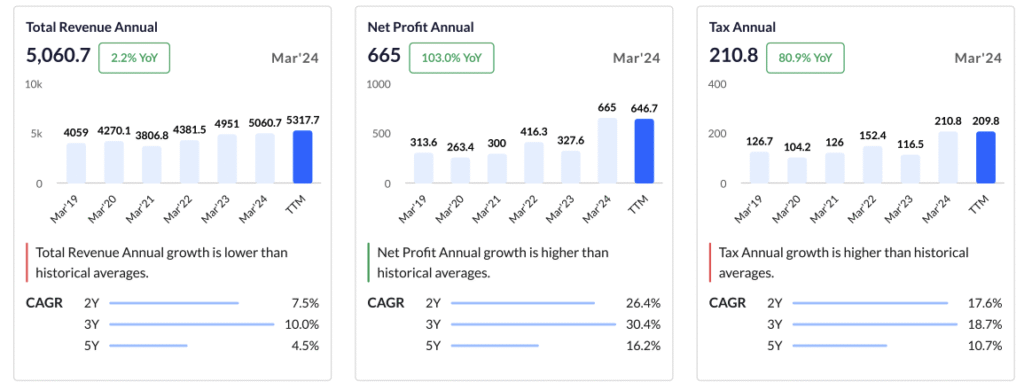

Financial Snapshot

Their order book looks healthy too, growing 22% year-on-year to $698 million. Plus, they improved their payment collections, bringing Days Sales Outstanding (DSO) down to 73 days. Simply put, they’re getting paid faster and managing cash better.

Future Potential

Zensar is doubling down on emerging tech — investing in Generative AI (Gen AI), cybersecurity, and next-gen cloud services. Given the way businesses worldwide are racing to upgrade their digital capabilities, Zensar’s services will likely stay in strong demand.

Final Thoughts

The shooting star candle hints at a possible reversal, but the trend still favors the bulls unless key support levels break. It’s a market where caution is needed — not panic. Watch how Nifty reacts tomorrow before taking any aggressive trades.

Technical setups like Bajaj Housing Finance and CDSL are shaping up, and small-caps like Zensar Technologies continue to show promise for patient investors.

Want to catch these opportunities early?

Open your free account with Angel One and get access to top-notch research, seamless trading tools, and smart portfolio insights — all in one place.

Open Free Account with Angel One ➔

Stay sharp. Stay ready.

See you tomorrow with fresh market moves!

Related Articles

Ather Energy IPO: Should You Ride This Electric Wave?