Quick Snapshot

Ather Energy IPO is finally here to charge up the sleepy primary market! 🛵⚡

After nearly two months of no action, investors can finally gear up as Ather Energy opens its public issue on Monday, April 28, 2025. Backed by Tiger Global, this company plans to raise a whopping ₹2,980.76 crore through a mix of fresh issue and offer for sale (OFS) of shares.

With the electric vehicle boom gaining momentum, could this IPO be the next hot ticket for investors? Let’s dive into the IPO details, company story, financials, risks — and help you decide whether to jump on this electric ride!

🗓️ Ather Energy IPO Details & Timetable

The Ather Energy IPO is set to open for subscription on April 28, 2025, offering investors a chance to ride India’s booming EV wave. Here’s a quick look at the key information:

📋 Key IPO Details

| Detail | Information |

|---|---|

| IPO Open Date | April 28, 2025 (Monday) |

| IPO Close Date | April 30, 2025 (Wednesday) |

| Listing Date | May 6, 2025 (Tuesday) |

| Price Band | ₹304 to ₹321 per share |

| Face Value | ₹1 per share |

| Lot Size | 46 shares |

| Total Issue Size | ₹2,980.76 crore |

| Fresh Issue | ₹2,626.00 crore |

| Offer for Sale (OFS) | ₹354.76 crore |

| Listing At | BSE, NSE |

| Employee Discount | ₹30 per share |

| Retail Minimum Investment | 46 shares (~₹14,766) |

🗓️ Important Dates to Remember

- IPO Allotment Date: May 2, 2025

- Refund Initiation: May 5, 2025

- Shares Credited to Demat: May 5, 2025

- Tentative Listing Date: May 6, 2025

About Ather Energy: Company Overview

Ather Energy is a pioneer in India’s electric two-wheeler (E2W) market, according to the CRISIL Report. This company is a pure-play EV brand that not only sells electric scooters but also offers a complete ecosystem — including charging solutions, smart accessories, and in-house developed software.

Founded by Tarun Mehta and Swapnil Jain in 2013, Ather Energy is all about building premium, tech-driven products right here in India. Their major focus? Quality, performance, and user experience.

Products and Innovation

- Ather launched its first scooter, Ather 450, in 2018, bringing India’s first touchscreen dashboard, cloud integration, and a top speed of 80 km/h — matching petrol scooters of that time!

- Today, their portfolio includes:

- Ather 450 Series – for performance enthusiasts.

- Ather Rizta Series – launched in April 2024, made for families, offering comfort features like a large seat, WhatsApp dashboard notifications, voice commands via Alexa Skills, and even traction control!

Ather Energy designs most critical components like motor controllers, dashboards, and vehicle control units in-house while outsourcing manufacturing. Battery packs are built at their own factories.

Software and Charging Network

- Ather has developed Atherstack, a powerful software platform that delivers Over-The-Air (OTA) updates, ride statistics, and dozens of smart features.

- They also built Ather Grid, India’s first fast-charging network for two-wheelers, helping solve the biggest EV pain point — charging!

Manufacturing & Distribution

- Manufacturing is done at their Hosur Factory in Tamil Nadu with an annual capacity of 420,000 scooters and 379,800 battery packs (as of Dec 31, 2024).

- They are expanding with a mega facility at Chhatrapati Sambhajinagar (Aurangabad) to boost production to 1.42 million units.

- Ather runs an asset-light model with 265 experience centres and 233 service centres across India, plus presence in Nepal and Sri Lanka.

Strong Focus on Sustainability

Being a pure-play EV company, Ather is serious about environmental and ethical business practices. Their ESG strategy focuses on clean tech, governance, and social responsibility — backed by solid policies on anti-bribery, anti-corruption, and fraud prevention.

Financial Overview

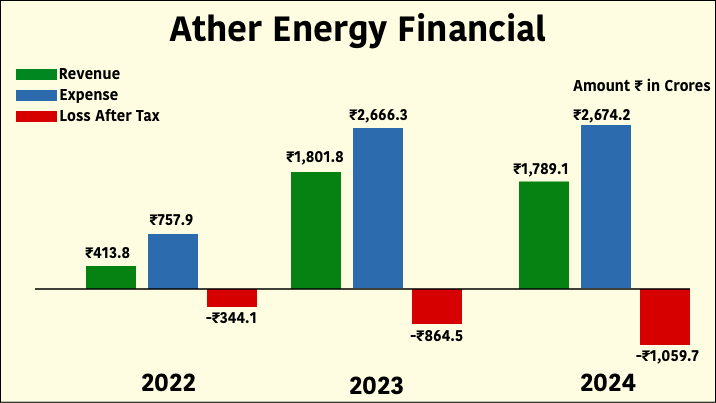

Ather Energy has shown strong revenue growth over the years, although it continues to report losses as it invests heavily in scaling operations.

In Fiscal 2024, the company reported revenue of ₹1,789.1 crores, slightly lower than ₹1,801.8 crores in Fiscal 2023. Losses widened to ₹1,059.7 crores in 2024 compared to ₹864.5 crores in 2023, reflecting increased operational expenses linked to expansion and R&D efforts.

Here’s a snapshot of Ather Energy’s key financial figures:

Market Opportunity for Ather Energy IPO

India is the largest two-wheeler (2W) market in the world, with 18.4 million 2Ws sold in FY24, and it’s expected to grow to 30 million units by FY31. Exports are also strong — 17% of Indian 2Ws are sold overseas, mainly in Africa, Asia, and North America.

At the same time, India’s middle class is growing fast — from 432 million in FY21 to 715 million by FY31. With rising incomes, more people now prefer premium 2Ws, especially scooters and bikes with engines of 125cc and above, which made up over 50% of sales in FY24.

What’s really changing the game is the shift to electric two-wheelers (E2Ws).

- E2W penetration hit 5.5% by end of 2024

- E-scooters now make up 15.2% of all scooter sales

- EVs are cheaper to run — 52% lower total cost than petrol 2Ws

- By FY31, electric scooters could make up 70% of the market

The E2W segment is expected to grow at a 41%–44% CAGR, reaching up to 12.3 million units by FY31.

With India’s big market, export potential, and EV growth, the Ather Energy IPO comes at the right time — as the country shifts toward cleaner, smarter, and more premium mobility options.

Key Risks To Watch in the Ather Energy IPO

Because not every EV journey is a joyride…

The Ather Energy IPO is making noise, but before you hit the apply button, let’s hit the brakes and check for speed bumps:

🧾 Still Burning Cash Like Petrol:

Ather clocked losses of ₹1,059.7 crores in 2024, up from ₹864.5 crores in 2023. While revenues were in the ₹1,700 crore range, the profit graph is still stuck in reverse. If this were a road trip, we’d say they’ve got fuel — but forgot the map.

⚔️ EV Battle Royale:

The Indian EV market isn’t a quiet charging station anymore — it’s a battlefield. Ola, TVS, Bajaj, Hero… all want a piece of the pie (and the charging plug). Ather needs to keep innovating like a caffeinated coder just to survive, let alone lead.

⚖️ Government Mood Swings:

Subsidies and policies (read: FAME II) have a huge impact on EV pricing. One policy tweak and demand can go from zoom zoom to doom doom. The Ather Energy IPO is riding on government goodwill — and that can flip faster than fuel prices.

🏗️ Scale or Fail:

They want to ramp up production, build new plants, expand service networks, and still look premium. Sounds great on paper. But if scaling hiccups creep in, investors might end up with more jolt than joy.

In summary:

The Ather Energy IPO may be shiny and smart, but remember — even Teslas hit potholes. Do your homework, wear your risk helmet, and don’t let FOMO drive your portfolio.

Should You Invest?

The Ather Energy IPO brings a fresh opportunity to invest in one of India’s premium electric two-wheeler (E2W) brands. Ather has built strong brand equity with its focus on in-house innovation, premium experience, and growing customer loyalty.

Growth Potential 🚀

- Strong Brand Recall: Ather is now synonymous with quality in India’s premium E2W segment.

- Tech and Innovation: Proprietary technologies like AtherStack, connected vehicle features, and the expanding Ather Grid charging network give it a competitive edge.

- Expansion on Track: New manufacturing plant (Factory 3.0) in Maharashtra will significantly boost production capacity, supporting future volume growth.

Risks to Watch ⚠️

- Profitability Woes: Despite steady revenue (~₹1,789 crore in FY24), Ather’s losses widened to ₹1,059.7 crore. Breakeven is still a few years away.

- Tough Competition: Ola Electric (already listed now), TVS iQube, Bajaj Chetak, and Hero Vida are all fighting for the same pie.

- Subsidy Uncertainty: Any reduction in EV subsidies or policy support could impact demand and margins.

Peer Comparison

| Company | FY24 Revenue (₹ Cr) | FY24 PAT (₹ Cr) | Estimated Valuation (₹ Cr) |

|---|---|---|---|

| Ather Energy | 1,789.1 | -1,059.7 | ~12,800 |

| Ola Electric | ~2,631.3 | -1,472.1 | ~37,500 (IPO) ~22,600 (Now) |

| TVS Motor | 39,145 | 2,200 | ~1,31,000 |

| Bajaj Auto | 44,685 | 7,479 | ~2,27,869 |

| Hero MotoCorp | ~38,000 | ~4,000 | ~77,688 |

(Source: Company filings, latest news updates)

🧹 Note: Ola Electric got listed recently and is valued much higher because of its larger scale and aggressive market share. Traditional players (TVS, Bajaj, Hero) also have diversified revenue from petrol bikes and scooters — giving them a safer financial profile.

Valuation Check

If we look at the valuation of Ather Energy’s IPO, the company’s estimated market capitalization post-IPO will be around ₹12,800 crore. In comparison, Ola Electric came with an IPO at a valuation of ₹37,500 crore, but its current market cap has dropped to around ₹22,600 crore.

Now, if we compare their Market Cap to Sales ratio,

Ola:

Market Cap to Sales = Market Cap / Sales = ₹23,426 Cr / ₹5,501 Cr = 4.26

Ather Energy:

Market Cap to Sales = Market Cap / Sales = ₹12,800 Cr / ₹1,754 Cr = 7.30

Ola’s stands at 4.26, while Ather’s comes out to a whopping 7.30. In simple terms, Ather is even more expensive than Ola was at the time of its IPO.

Because why stop at being pricey, when you can aim for premium-without-profit levels!

Final Verdict

For long-term EV believers and high-risk investors, the Ather Energy IPO could be an exciting opportunity to ride India’s electric boom from the ground up.

However, be ready for short-term volatility — this is not a “buy and forget” stock just yet.

Conclusion: Should You Apply for the Ather Energy IPO?

The Ather Energy IPO isn’t just another public issue — it represents a bet on the future of premium EVs in India. With a sharp brand image, strong tech backbone, and growing market share, Ather is clearly a front-runner in the electric two-wheeler race.

But let’s be real — this isn’t a low-risk, cash-rich, dividend-paying stock. It’s an ambitious, loss-making startup in a highly competitive space, still navigating its path to profitability.

🔍 So, what should you do?

If you’re a long-term investor who believes in India’s EV transformation, and you’re okay with short-term volatility, then yes — Ather Energy IPO is worth a serious look.

But if you’re expecting instant listing gains or stress-free holding, you might want to let the dust settle post-listing before jumping in.

Our Take:

Apply with a high-risk, high-reward mindset, and only allocate a portion of your IPO budget. This isn’t a FOMO play — it’s a conviction bet on the EV future.

Ready to Apply?

Don’t miss the EV wave because of a slow broker.

Open your Angel One Demat Account today and apply for the Ather Energy IPO in just a few clicks —

⚡ fast, reliable, and no drama!

👉 Apply for IPO with Angel One — because even electric dreams need a strong platfrom.

FAQs – Ather Energy IPO

What is the Ather Energy IPO date?

The IPO will open on April 28, 2025, and close on April 30, 2025.

What is the price band for the Ather Energy IPO?

The price band is set between ₹304 to ₹321 per share.

What is the lot size for retail investors?

The minimum application is for 46 shares, which amounts to approximately ₹14,766.

When will Ather Energy shares list on the stock market?

The tentative listing date is May 6, 2025, on both BSE and NSE.

Is Ather Energy profitable?

No, Ather Energy is not yet profitable. In FY24, it reported a net loss of ₹1,059.7 crore on revenue of ₹1,789.1 crore.

Should I apply for the Ather Energy IPO?

Long-term investors who believe in the EV sector and are comfortable with risk may consider applying. Short-term investors should be cautious.

What makes Ather different from competitors like Ola Electric?

Ather focuses on premium electric two-wheelers, in-house technology, and user experience. Ola is focused more on scale and price-driven mass adoption.

Where are Ather’s manufacturing facilities?

Ather manufactures at its plant in Hosur, Tamil Nadu, and is expanding with a new facility in Chhatrapati Sambhajinagar, Maharashtra.

Related Articles

Upcoming IPOs in 2025: IPO Wave Hit In 2025