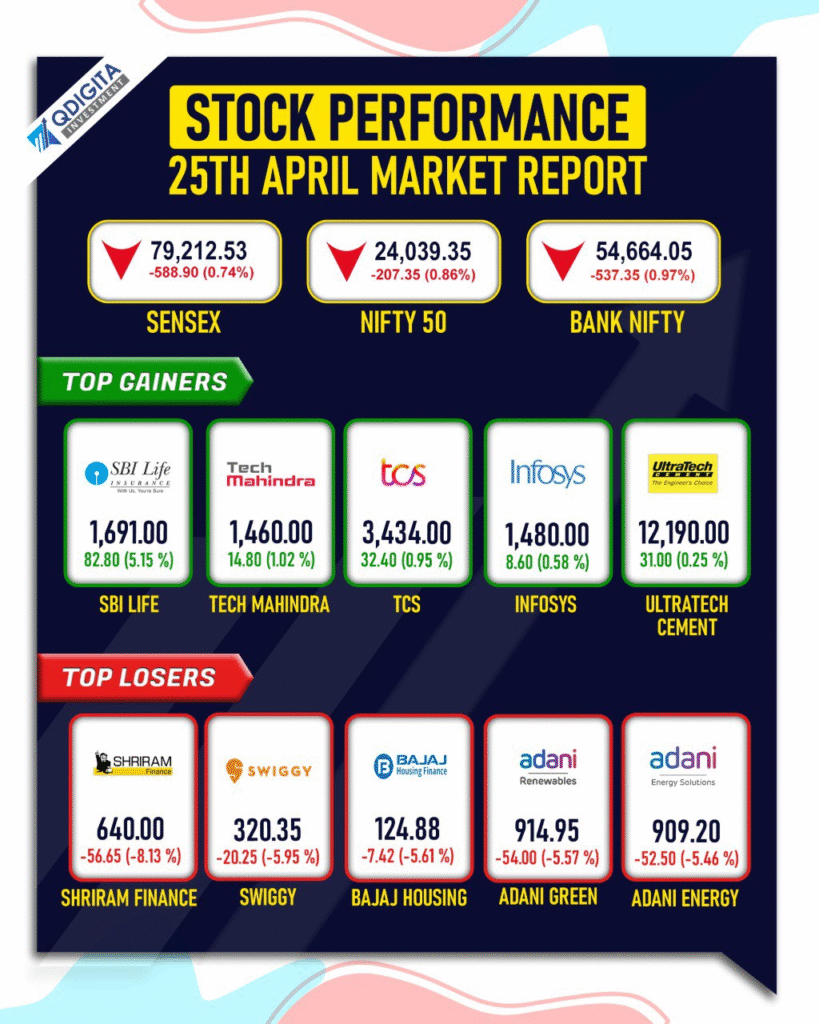

Well, well, well… looks like the stock market decided to take a bit of a nosedive today, and it wasn’t pretty. The Nifty dropped 207 points (-0.86%), while Sensex plummeted 588 points (-0.74%). If you thought the market would cruise smoothly into the weekend, think again! The real heartbreak came from the Bank Nifty, which slid almost 1%, and midcaps… oh boy, they took a hit too.

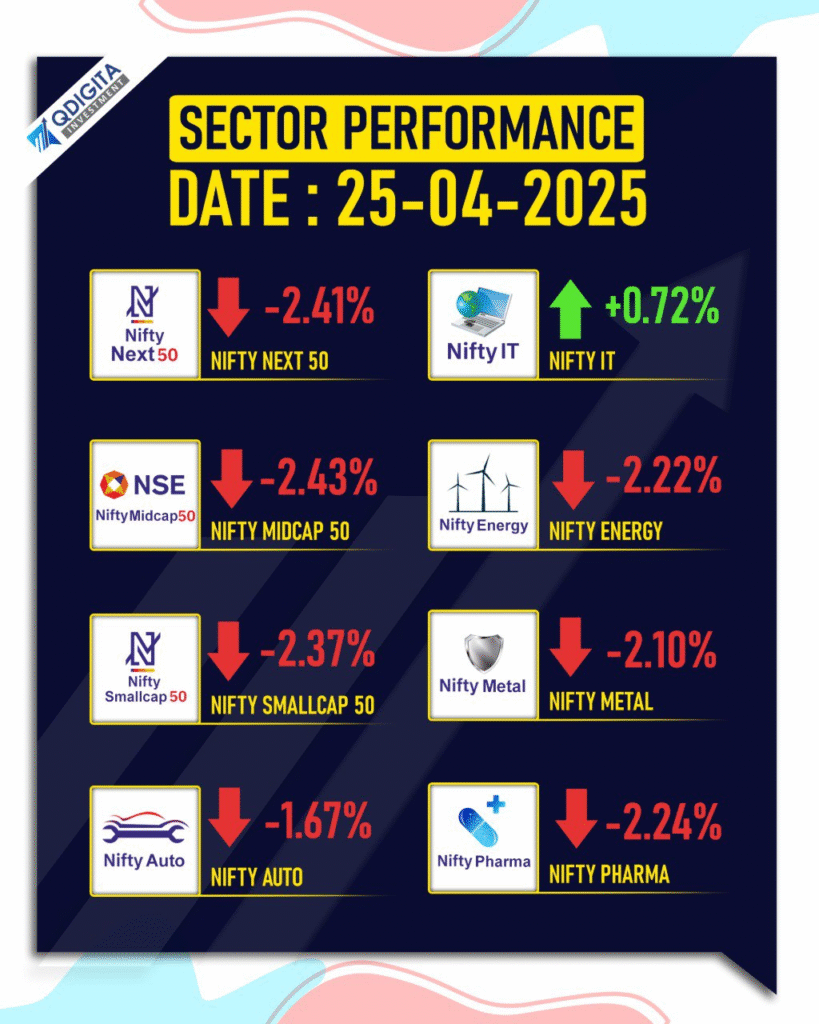

Midcap stocks were the worst off, with the Nifty Midcap 100 index falling 2.55%. Talk about being caught in the storm when it rains! On the flip side, SBI Life rose 5.4%, giving long-term investors a reason to crack a smile. Meanwhile, Shriram Finance saw a painful 6% drop, leading the charge for today’s market panic.

And here’s a plot twist: While the market was tumbling, Nifty IT quietly ended the day in the green (+0.72%). Guess when everyone panics, tech just chills and sips its coffee. But why exactly did the market fall today? Let’s break it down in the most fun and simplest way possible!

1) Geopolitical Tensions = Market Tension

The drama unfolded on the geopolitical stage, as tensions between India and Pakistan soared. The deadly Pahalgam terror attack, which claimed the lives of 26 civilians, sparked an avalanche of fear in the market. India responded by downgrading diplomatic ties and suspending the Indus Water Treaty. Guess what that did to the market? Investors started running for the hills, and market sentiment quickly turned risk-averse.

“Sentiment remains cautious as geopolitical tensions rise following the terror attack,” said Devarsh Vakil, Head of Prime Research at HDFC Securities. When countries exchange tense words and military threats, it’s no surprise the stock market gets jittery.

2) The Aftermath of a Wild Rally: Time for Profit Booking

Nifty had been on a tear—up 8.6% over the past seven sessions—so, naturally, today’s sell-off made sense. After such a strong rally, investors couldn’t resist the temptation to cash out. The market hit “overbought” territory, and that’s when the party ended.

“Mid- and small-cap stocks bore the brunt of the sell-off, driven by their high valuations and growing concerns over potential earnings downgrades,” said Vinod Nair, Head of Research at Geojit Investments. When everyone’s getting a little too happy about gains, it’s time to ring the bell for a correction.

3) Bank Stocks: The Big Culprits Behind the Market Fall

Bank stocks were the real drag on the market today. Axis Bank, SBI, Bajaj Finserv, and Bajaj Finance were all hanging their heads in shame, accounting for nearly 300 points of the Sensex’s overall decline. Axis Bank was the worst hit, reporting a marginal profit decline in Q4 FY25. This triggered a sell-off that weighed heavily on the broader market.

Financials were in full crisis mode, and that’s never a good sign for the market. If the banks are struggling, you know the panic is real.

4) Technical Indicators Say “Time for a Breather”

After seven days of non-stop gains, the Nifty started showing signs of exhaustion. Technical analysts had been warning of a correction, and guess what? Today, they were proven right. The Nifty slipped below its 200-day moving average, signaling the start of a bearish trend. For the uninitiated, this is the stock market equivalent of the “check engine” light turning on.

Rupak De, Senior Technical Analyst at LKP Securities, said it best: “Nifty has slipped after a consolidation on the daily chart, indicating a rise in bearish sentiment.” A correction was overdue, and here we are, with a slightly more cautious market outlook.

5) The Earnings Season is Underwhelming – More Red Flags for the Market

As if the geopolitical tension and profit booking weren’t enough, the earnings season threw another wrench in the works. Hindustan Unilever (HUL) and Axis Bank, among others, reported results that missed expectations, adding more fuel to the already cautious investor mood.

In the IT sector, companies like Infosys and Wipro came out with disappointing guidance, which only made matters worse. The earnings season, so far, has been more “meh” than “wow,” and that’s not something you want to hear when the market is already on shaky ground.

Conclusion: What Does This Market Fall Mean for You?

So, why did the market fall today? A cocktail of geopolitical tensions, profit-taking, weak earnings, and technical signals pointed to a market that was due for a correction. But don’t panic just yet. It’s not the end of the world—just a healthy reset after a strong rally.

For investors, this means it’s time to stay cautious and watch out for further market volatility. With geopolitical uncertainty and a lukewarm earnings season, we could see more fluctuations in the coming days.

Take this as a reminder: the market is like a roller coaster, and when it’s headed down, make sure you’re strapped in tight. But who knows? After this drop, a rebound could be around the corner. Only time will tell.

Key Takeaway: The market fall today was driven by a mix of geopolitical tensions, profit booking, and weak earnings. It’s a reminder that volatility is part of the game. Stay informed, stay alert, and buckle up for the ride!