Introduction: From Playground to Powerhouse

Sports in India used to be about street cricket, dusty fields, and dreams of national glory. Today, they’re about billion-dollar franchises, fierce media bidding wars, and brands fighting for space on a cricketer’s jersey. The economics of sports in India has gone from casual to corporate—and it’s just getting started.

As cricket remains the crown jewel, kabaddi is sprinting up the charts, and even traditional games are being rebranded into cash-rich leagues. But it’s not just about the players or the passion anymore—it’s also about profits. And behind every bat swing and goalpost lies a business decision. Let’s peel back the layers.

Cricket: The Undisputed King of Indian Sports Business

When it comes to returns, cricket in India is like blue-chip stock—reliable, high-value, and almost recession-proof. At the heart of it sits the Indian Premier League (IPL), which is less a tournament and more a financial juggernaut.

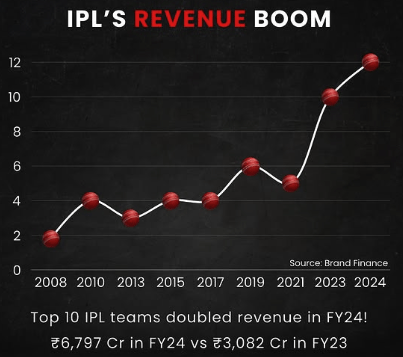

By 2024, the IPL’s brand value had touched $12 billion, with some estimates placing it even higher at $16.4 billion. Top teams like Chennai Super Kings, Mumbai Indians, KKR and Royal Challengers Bangalore are each valued at over $100 million, making them more profitable than many listed Indian companies.

📌 Companies That Benefit:

- Reliance Industries (Owner of Mumbai Indians)

- India Cements (Chennai Super Kings’ legacy sponsor)

- Dream11 and Tata Group (key sponsors and rights holders)

And it’s not just the men. The Women’s Premier League (WPL) is quietly but confidently becoming the next big thing. With media rights sold for ₹951 crore over five years, it’s attracting the kind of attention—and investment—that only a few years ago seemed impossible.

Beyond Cricket: The Rise of India’s Alternative Leagues

While cricket hogs the limelight, other sports are carving out their own economic niches. Leading this charge is the Pro Kabaddi League (PKL), which has turned a rural sport into a prime-time spectacle.

In its 10th season, PKL attracted 351 million viewers, a 20% jump. With ad revenue close to ₹350 crore, it’s a strong contender for brands aiming beyond cricket.

Similarly, the Indian Super League (ISL) has been steadily growing in both fan base and franchise value. Some clubs now command valuations of ₹35–65 crore, buoyed by sponsorships, local loyalty, and increasing grassroots engagement.

📌 Companies That Benefit:

- JSW Group (Bengaluru FC)

- Hero MotoCorp (Title sponsor of ISL)

- Star Sports/Viacom18 (broadcasters earning through rising ad revenue)

Even niche leagues like Premier Badminton League and Hockey India League are re-emerging. HIL’s recent comeback came with a ₹3,640 crore investment plan over the next decade—a clear signal that brands see value in diversified sports exposure.

The Real MVP: Sponsorships That Power Indian Sports

Behind every glittering jersey and flashy on-ground banner is a sponsor with a business plan. Sponsorships are the lifeblood of Indian sports economics, connecting brands with millions of fans.

In 2024, the Indian sports sponsorship market hit ₹7,421 crore, and it wasn’t just cricket reaping the benefits. Dream11, Byju’s, CEAT, and Paytm are just a few names that have turned sporting associations into brand recognition engines.

A study found that 91% of urban fans recalled ads seen during IPL matches, and 68% explored the advertised brand afterward. That’s marketing gold.

📌 Companies That Benefit:

- Tata Group (₹2500 crore IPL title sponsorship)

- Dream Sports (backers of Dream11)

- Unacademy, Swiggy, Jio, and many more regularly seen on team kits and digital ads

Government Initiatives: Fueling the Sports Engine from the Ground Up

While private players dominate the top, it’s the government that’s laying the foundation. The Khelo India program has become the heartbeat of grassroots sports.

With an increased budget of ₹1,000 crore for FY 2025-26, the program has supported over 2,781 athletes, sanctioned 323 infrastructure projects, and set up 1,041 centers across India.

📌 Companies That Benefit:

- L&T, Shapoorji Pallonji, NCC Ltd. (infrastructure developers bidding for sports-related contracts)

- Decathlon India, SS Sports (equipment suppliers)

- Event management companies tapped for Khelo India events

The Broadcasting Boom: Where the Big Bucks Flow

Broadcasting rights are the golden goose of Indian sports. The IPL’s media rights auction alone fetched over ₹48,390 crore, making it the most expensive sports property outside the US.

Viacom18 bagged ISL rights, while JioCinema disrupted the market with free streaming of IPL, which led to a whopping 225 million monthly active users.

Even OTT platforms like Disney+ Hotstar have banked on sports to boost subscriptions—no surprise when 80% of their peak traffic comes during major tournaments.

📌 Companies That Benefit:

- Viacom18 (Reliance Industries) – key player in sports broadcasting

- Disney Star, Sony Sports Network

- Nazara Technologies, Zee Entertainment, JioCinema

Ad Revenue: When the Whistle Blows, the Cash Flows

Advertising during live matches is not just about selling chips and colas anymore—it’s hyper-targeted, data-driven marketing.

For IPL 2024, ad spending crossed ₹10,000 crore, and even leagues like PKL and ISL are catching up. With the rise of digital streaming, advertisers can now choose when, where, and how to show their ads—based on age, location, and even the team the viewer supports.

📌 Companies That Benefit:

- Adtech players like InMobi, Affle India

- Broadcasters and league owners monetizing viewer data and insights

The Local Impact: More Than Just Stadiums

Job Creation

The sports sector in India isn’t just about athletes. It’s a thriving job market—from fitness trainers and physiotherapists to commentators and cameramen. It currently supports millions of jobs, and projections suggest it could hit 10.5 million by 2030.

Tourism & Hospitality

Major events like the Cricket World Cup or IPL finals bring in thousands of fans, filling up hotels and lighting up local economies. In 2023, India’s sports tourism market hit $10.87 billion, and it’s still growing.

📌 Companies That Benefit:

- Indian Hotels Company (Taj Hotels), Lemon Tree, OYO

- MakeMyTrip, EaseMyTrip during sports seasons

- Zomato, Swiggy, Uber — the unofficial matchday MVPs

Challenges: Every Game Has Its Hurdles

Not all that glitters in Indian sports is gold. A lack of unified national sports policy, transparency issues in governing bodies, and financial fragility in smaller leagues are serious roadblocks.

For example, while IPL is a money-magnet, several ISL and kabaddi franchises are yet to break even. Fantasy sports platforms like Dream11 still face grey zones in regulations.

Opportunities: The Game Is Far From Over

There’s a world of untapped potential in niche sports like kho-kho, wrestling, and even eSports, which is now drawing over 500 million players and viewers in India.

Technology is reshaping how we watch and engage with sports. From AR/VR experiences to performance analytics, innovation is driving the next phase of growth.

📌 Companies That Benefit:

- Nazara Tech, JetSynthesys (in eSports and gaming)

- Tech Mahindra, Infosys (AR/VR, sports analytics partnerships)

- FanCraze, Rario (sports NFTs, digital fan experiences)

Conclusion: More Than Just a Game

The economics of sports in India isn’t just about money—it’s about movement. It moves capital, people, culture, and aspirations. Whether you’re a viewer, an investor, or an entrepreneur, this industry is no longer on the sidelines—it’s center stage.

And just like a good match, the stakes are high, the pace is fast, and the crowd? Well, it’s only getting bigger.

Ready to Bet on India’s Sports Boom?

The sports industry in India is no longer just entertainment—it’s a serious investment story. From listed companies riding the IPL wave to startups redefining fantasy gaming, the opportunities are endless.

Want to turn your sports obsession into smart investing?

Start exploring stock opportunities in companies like Nazara Tech, Reliance, Zee, and Indian Hotels—all part of this billion-dollar play.

And the easiest way to begin?

👉 Open a free Demat account with Angel One and start investing in the brands building India’s sports future.

FAQs on the Economics of Sports in India

1. Why is sports becoming such a big business in India?

Because viewership equals money. Leagues like IPL and PKL attract hundreds of millions of eyeballs, which means more ad revenue, sponsorships, and broadcasting rights. Add government support and rising fan engagement—voilà, it’s a booming industry.

2. Which Indian companies benefit the most from the sports economy?

Top gainers include Reliance Industries (Viacom18, Mumbai Indians), Nazara Technologies (gaming), Zee Entertainment, Star Sports (Disney), and companies like India Cements and Hero MotoCorp involved via sponsorships or ownership.

3. How big is the IPL in terms of revenue?

As of 2024, the IPL’s brand value crossed $12–16 billion, with media rights alone selling for over ₹48,000 crore. It’s among the world’s richest sports leagues now.

4. Are there investment opportunities beyond cricket?

Absolutely. Kabaddi, football (ISL), and eSports are fast-growing. Companies investing in these segments are beginning to show real revenue traction, and platforms like Angel One give you access to such stocks.

5. Is sports tourism or hospitality a good investment play?

Yes. Major events drive demand for hotels, travel, and food delivery. Stocks like Indian Hotels, Lemon Tree, Zomato, and EaseMyTrip benefit directly from large tournaments.

Related Articles

Can Indian Small Caps Become Global Giants? Lessons from Nordic Success