📉 Indian Market Today – Who Pressed the Panic Button?

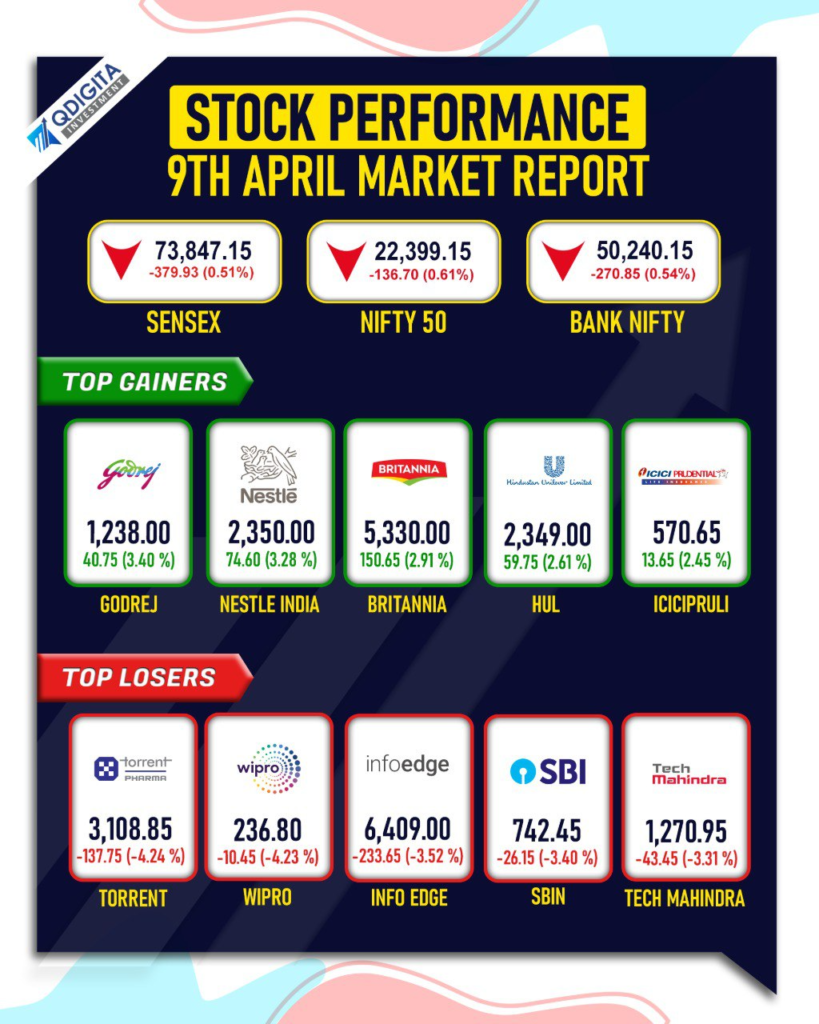

It’s Wednesday, and the bulls decided to take a mid-week vacation. The Indian market today fell flat on its face, with Nifty and Sensex both closing deep in red. What went wrong? Global drama, local stress, and the usual “RBI surprise that’s not really a surprise.”

Let’s break it down, point by point, like a to-do list the stock market didn’t follow today.

1. 🌍 Global Trade War Returns – And It’s Personal

Remember the good old U.S.–China trade tension? Yeah, that’s back — but now with steroid-level tariffs.

- US slapped a 104% tariff on Chinese imports

- China responded with 84% tariffs on US goods

Basically, both countries are throwing bricks at each other and hoping nobody else gets hit. Spoiler: everyone else is getting hit — especially emerging markets like India.

👉 Impact: Investors worldwide ran for cover. Asian markets tanked, and the Indian market today followed suit.

2. 🏯 Asian Markets in Red = India in Redder

Global sentiment spilled over fast:

- Japan’s Nikkei: -4%

- Taiwan’s Taiex: -5.8%

- South Korea’s Kospi: -1.7%

It was like Asia collectively decided, “Nope, not today.” And Indian markets agreed.

👉 Impact: FIIs (Foreign Investors) started pulling out money faster than you pull out of a bad Tinder date.

3. 🏦 RBI Rate Cut – Surprise That Wasn’t Surprising

The RBI tried to play hero by cutting interest rates.

- Repo rate reduced for the second time this year

- Policy stance shifted from ‘Neutral’ to ‘Accommodative’

Sounds nice on paper, right? But the market already expected it, so there was zero enthusiasm.

👉 Impact: Rate-sensitive sectors didn’t react much. Banks sulked. The market shrugged.

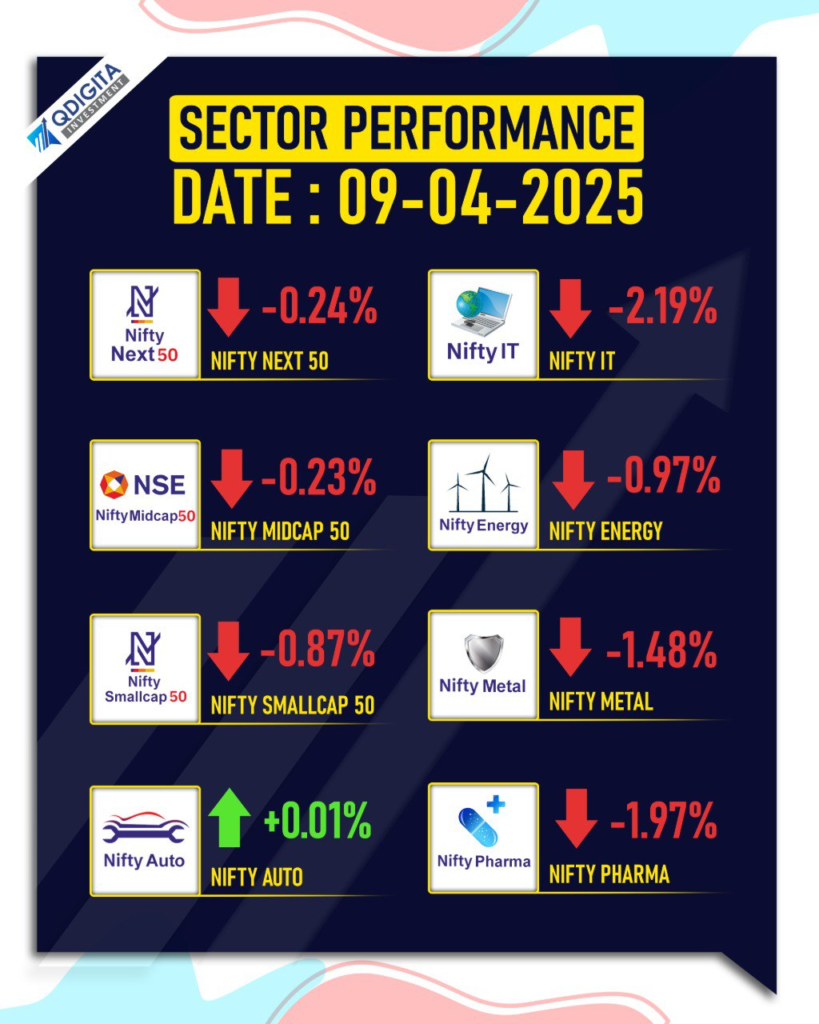

4. 💊 Pharma & 💻 IT – Export Kings Now in Trouble

Our beloved export-heavy sectors got hit:

- IT sector down 3%

- Pharma down 1.8%

Why? Because U.S. clients are nervous, and tariffs mean more cost pressure. Basically, “Sorry, we’ll get back to you later” emails from clients are back.

👉 Impact: Nifty IT and Nifty Pharma dragged the entire market down like toxic group members in a WhatsApp chat.

5. 💸 Rupee Sinks Like Your Monday Motivation

And just when you thought things couldn’t get worse…

- INR slipped 0.4% to ₹86.65/$

- Chinese yuan also fell, dragging other Asian currencies

- Rising U.S. bond yields = Investors running back to the dollar

👉 Impact: A weak rupee spooked importers, increased inflation concerns, and scared off FIIs. Lovely combo.

🧠 Bonus: What Investors Are Actually Thinking

“Should I sell everything?”

“Is this the 2020 crash part 2?”

“Should I hide under my desk?”

Relax. It’s a correction, not a doomsday event. Trade wars bring volatility, not apocalypse. The Indian market today reacted to fear, but not all is lost.

📌 So, What Should You Do Now?

- Don’t panic-sell. Unless you love regrets.

- Check sector exposure. If you’re overweight on IT or pharma, time to review.

- Look for opportunities. Auto, FMCG, and infra didn’t fall much today — maybe the smart money is already there.

- Track RBI moves. If inflation stays in check, rate cuts could boost the economy later.

🕵️♂️ Final Word: Not the End of the World

Yes, the Indian market today was a red mess. But it’s not unusual when global politics mess with economics. If you’re a long-term investor, sip your chai and stay calm. If you’re a trader, maybe keep an antacid nearby for the rest of the week.

☕ One Last Thing…

If you only have one hour a week and want to track or invest without losing your mind, check out Angel One – the app that helps you invest smarter, even on days like today.

Want tomorrow’s market drama decoded in your inbox?

Subscribe to our newsletter – it’s free, funny, and actually useful.

Related Articles

Tariff and Great Depression: Will History Repeat?