Introduction

Another day, another trade war. This time, it’s Donald Trump threatening 60% tariffs on Chinese goods if re-elected. Cue market panic, economists on overdrive, and retail investors… Googling “Tariff and Great Depression.”

Let’s clarify something first: The tariff and Great Depression story is not as simple as “tariffs caused everything to collapse.” But they definitely didn’t help.

So today, we dig into what really happened during the 1930s, what’s happening now, and whether your Indian portfolio is about to take a global history lesson it didn’t ask for.

The Tariff and Great Depression: What Really Happened in the 1930s?

Ah, the 1930s—the time when movies were in black and white, and so was the economic outlook.

- In 1930, the US passed the Smoot-Hawley Tariff Act, hiking import duties on over 20,000 goods.

- It was meant to protect American jobs. Instead, it triggered retaliation.

- Over 25 countries responded with their own tariffs.

- Global trade shrank by nearly 40%.

- US GDP tanked by 26%; global GDP by 17%.

- Unemployment? Over 25% in the US.

But here’s the twist: most economists today agree that tariffs weren’t the main villain. The Wall Street crash of 1929, a banking crisis, credit crunch, and collapsing liquidity did most of the damage. Tariffs were just the salt in the wound.

So no, tariffs alone didn’t cause the Great Depression. But they did help it spiral out of control.

Today’s Tariff War: Echoes of the Past?

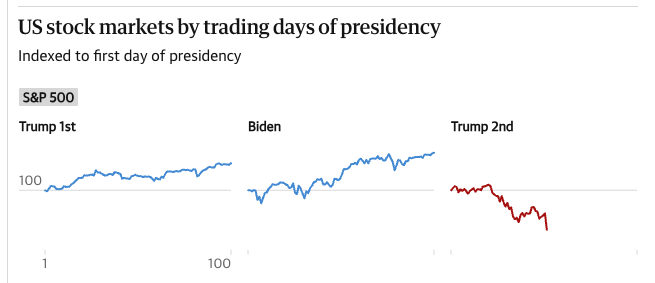

In 2024, we’re seeing a déjà vu moment.

- Donald Trump is back with his tariff playbook.

- He wants 60% tariffs on China, 10% on other countries, and America First in bold letters.

- China, not known for subtlety, will retaliate.

- Global trade tensions are rising.

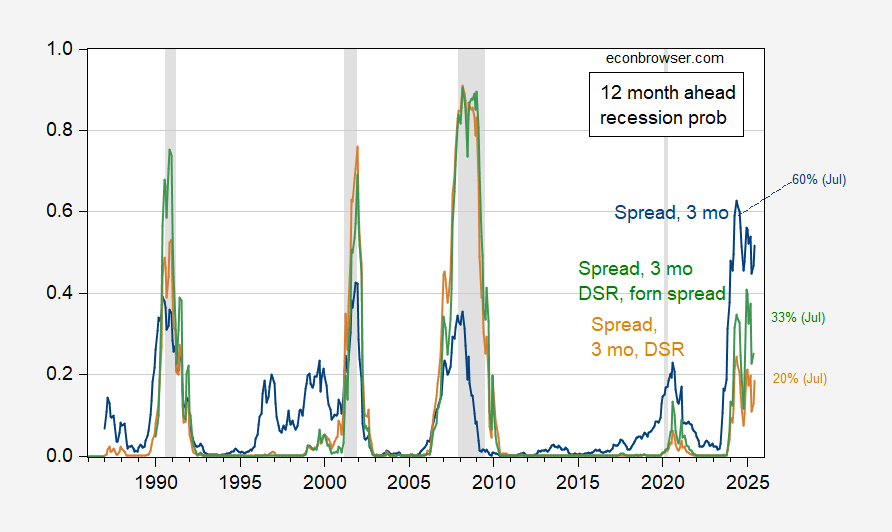

- The US is also flirting with a recession, thanks to sticky inflation and high interest rates.

- And yes, global markets, including India, are getting dragged down.

So, is history repeating?

Not exactly. But it’s rhyming. Loudly.

Tariff and Great Depression: Then vs Now

| Aspect | 1930s (Great Depression) | 2024 (Today) |

|---|---|---|

| Cause | Stock market crash + deflation + liquidity collapse | Inflation + trade war + tight monetary policy |

| Tariffs | Introduced after the recession began | Being proposed before recession |

| Global Trade Share | Just 9% of global GDP | Over 60% of global GDP |

| Response | Nationalism & closed economies | Interconnected supply chains & WTO (though weak) |

| India’s Role | British colony, minimal exposure | Fifth-largest economy, major trade player |

Tariffs and India: Not Our War, But We Bleed Too

You’re sitting in Mumbai, sipping chai, and wondering why your portfolio looks like it fought a bear and lost.

Here’s why:

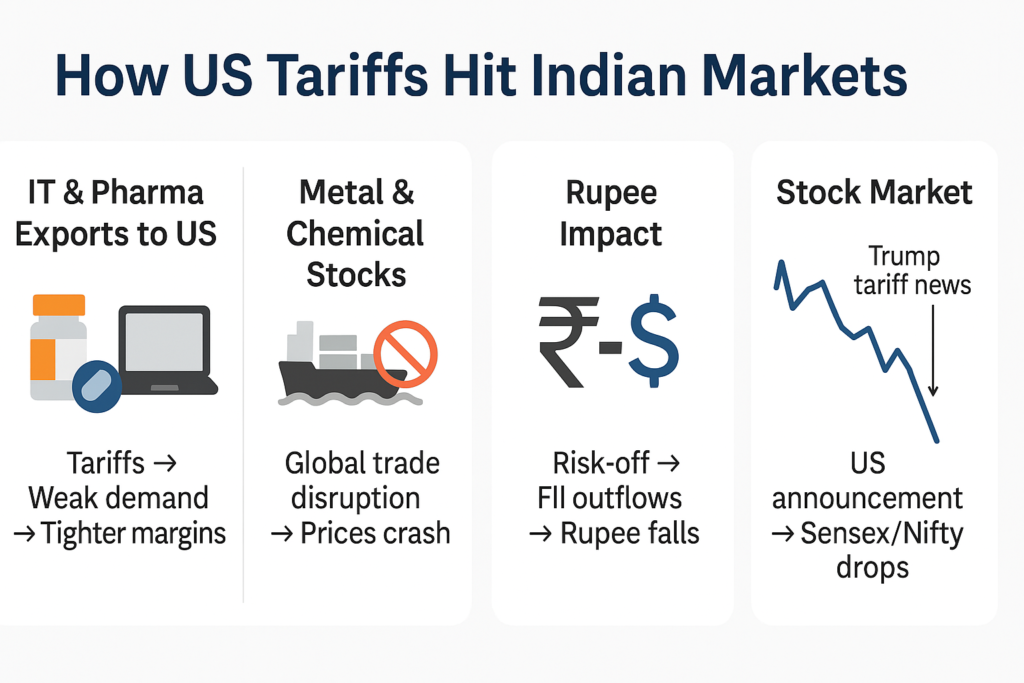

- IT & Pharma: Major exporters to the US. Tariffs and recession fears in the US mean weaker demand and tighter margins.

- Metal & Chemical Stocks: Global trade sensitive. If supply chains break, prices crash.

- Rupee: Risk-off sentiment leads to FII outflows, weakening the rupee.

- Sensex/Nifty: If the US sneezes, we catch a cold. Already down after Trump’s announcement.

Basically, you did nothing wrong—but you’re still paying the price.

Tariff and Great Depression: Could It Happen Again?

Let’s not jump to conclusions, but yes—risks are rising.

- Global trade wars rarely have winners.

- Protectionism slows down growth in the long run.

- If the US goes into recession, it’ll cut imports, hit corporate earnings, and slow capital flows.

- India, being export-dependent and investment-hungry, will feel the pressure.

Even the IMF and World Bank have warned that escalating tariffs in a fragile post-COVID world could shave off 1.5%–2% of global GDP.

And remember what William Bernstein said: In the 1930s, trade shrinkage explained just 1–2% of GDP loss, but the psychological shock triggered panic, bank runs, and long-term scarring.

How Indian Investors Should Respond to Tariff Chaos

Worried? Maybe a little.

Panicking? Definitely not.

Here’s what Indian investors should do:

- Diversify across domestic and global funds.

- Focus on companies with strong domestic demand.

- Hold some exposure to gold, which usually shines when the world doesn’t.

- Avoid knee-jerk exits based on headlines. We’re investing, not reacting to Twitter trends.

And no, Trump’s tariffs won’t drag us into a 1930-style depression. But they might trigger some volatility-induced blood pressure spikes. So sip some haldi doodh and relax.

🔍 Tariff and Great Depression: Myth Busted

❌ Myth: Smoot-Hawley Tariffs caused the Great Depression.

✅ Truth: The Depression started before the tariffs. Major damage was done by deflation, banking collapse, and lack of international liquidity. Tariffs made things worse, but they didn’t start the fire.

💼 Final Word: Tariff and Great Depression Lessons for India

Tariffs might not be the main villain in the global recession story, but they’re certainly playing a supporting role.

India is far more connected to the global economy than it was in the 1930s. So yes, these moves in the US could ripple across your portfolio. But with the right strategy—diversification, patience, and a little common sense—you won’t be dragged into economic history class again.

So, next time the market crashes because someone tweets “TARIFFS!”, just smile, sip your chai, and check your portfolio—not your blood pressure.

☕ Pro Tip Before You Go

Want to build a globally diversified, recession-resistant portfolio without losing sleep (or your savings)?

Open a free demat account with Angel One and get access to stocks, mutual funds, and ETFs that help you beat market drama—Trump or no Trump.

FAQs

Q1. Did high US tariffs cause the Great Depression?

No. While they worsened the situation, most economists agree the Depression had deeper causes like liquidity crisis, banking failures, and collapsing demand.

Q2. How do US tariffs affect the Indian stock market?

Tariffs increase global uncertainty. This leads to risk-off sentiment, FII withdrawals, and short-term stock market declines in emerging markets like India.

Q3. Is now a good time to invest more?

If you’re investing via SIPs, absolutely. Market dips are when SIPs shine brightest. But don’t invest lump sums without evaluating your asset mix.

Q4. Should I sell my international mutual funds?

Not immediately. Watch how the tariff story unfolds. Diversification across geographies still helps in the long run.

Related Articles

Trump’s 26% Tariffs: Which Sectors Will Win & Who’s in Trouble?