Finding Opportunity When the World Looks Away

War stocks have a strange rhythm. In a time of fear and fire, they don’t hide—they rise. Because while war brings uncertainty and panic, it also reshapes economies, reorders priorities, and channels massive capital into defence, logistics, and infrastructure.

With India-Pakistan tensions flaring once again under the banner of Operation Sindoor, smart investors aren’t just watching—they’re preparing. The question is no longer if to act, but where. Which war stocks in India are worth buying? And perhaps more importantly, which ones will deliver multifold returns once the cannons fall silent and peace returns to the headlines?

War stirs emotions no chart can measure. For the market, it’s a storm of volatility—sharp dips, reactionary rallies, algorithmic chaos. But beneath the surface, some investors don’t retreat. They realign. Because in every war, there are stocks that don’t just survive—they quietly lead the charge.

Before we uncover which stocks thrive in conflict, let’s understand what really happens when nations go to war—and what the market reflexively does when it does.

When the Drums of War Beat, Markets Dance to a Different Tune

Fear is a powerful market mover. A small skirmish can wipe out crores in valuation overnight. But behind the fear lies a clear pattern. Wars are costly, not just in lives but in logistics. Governments pump in money—not into advertising or tourism—but into tanks, missiles, oil reserves, and satellite surveillance.

In those moments, while hospitality stocks bleed and aviation falters, a different breed of companies starts to rise. Quietly, steadily, and with the full weight of the government behind them.

And this isn’t just theory. History has already shown us how war rewrites the rules of the stock market.

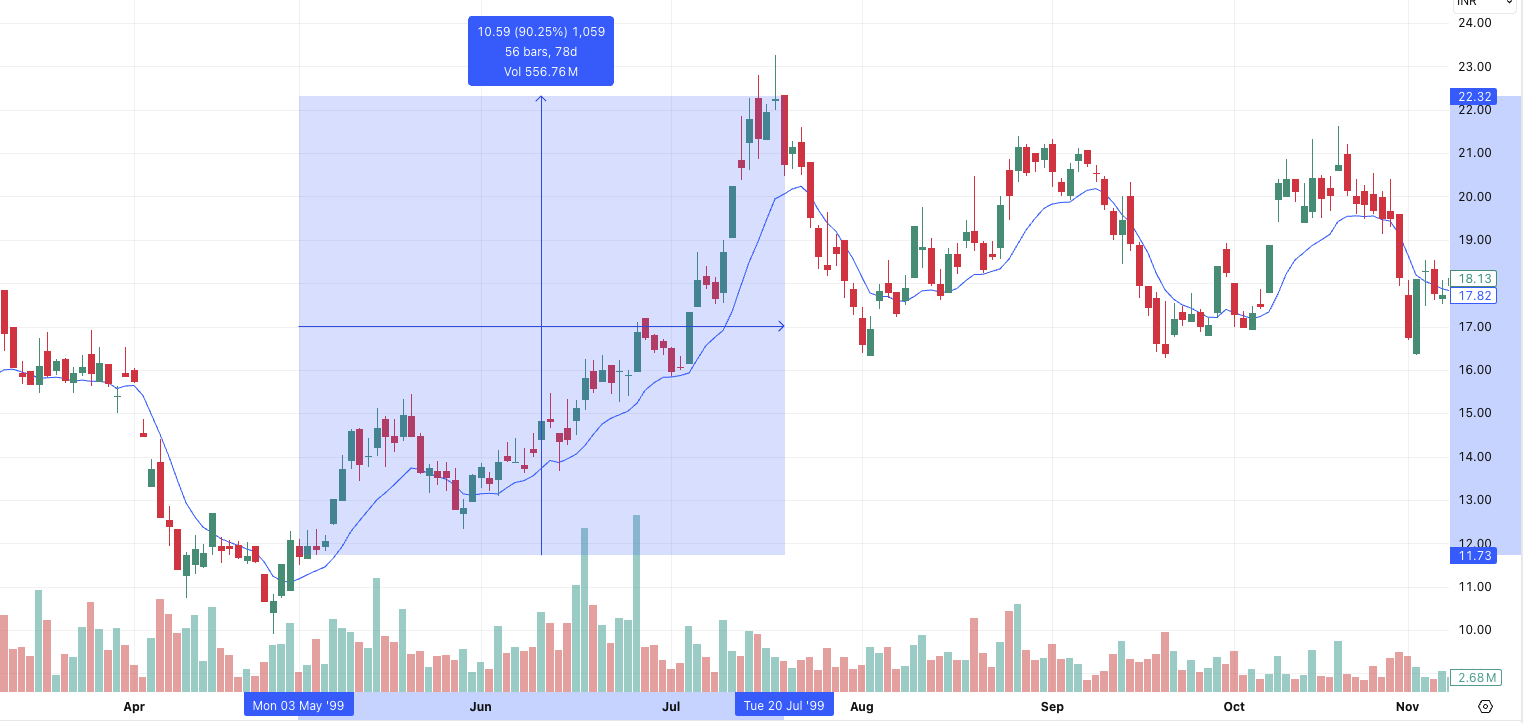

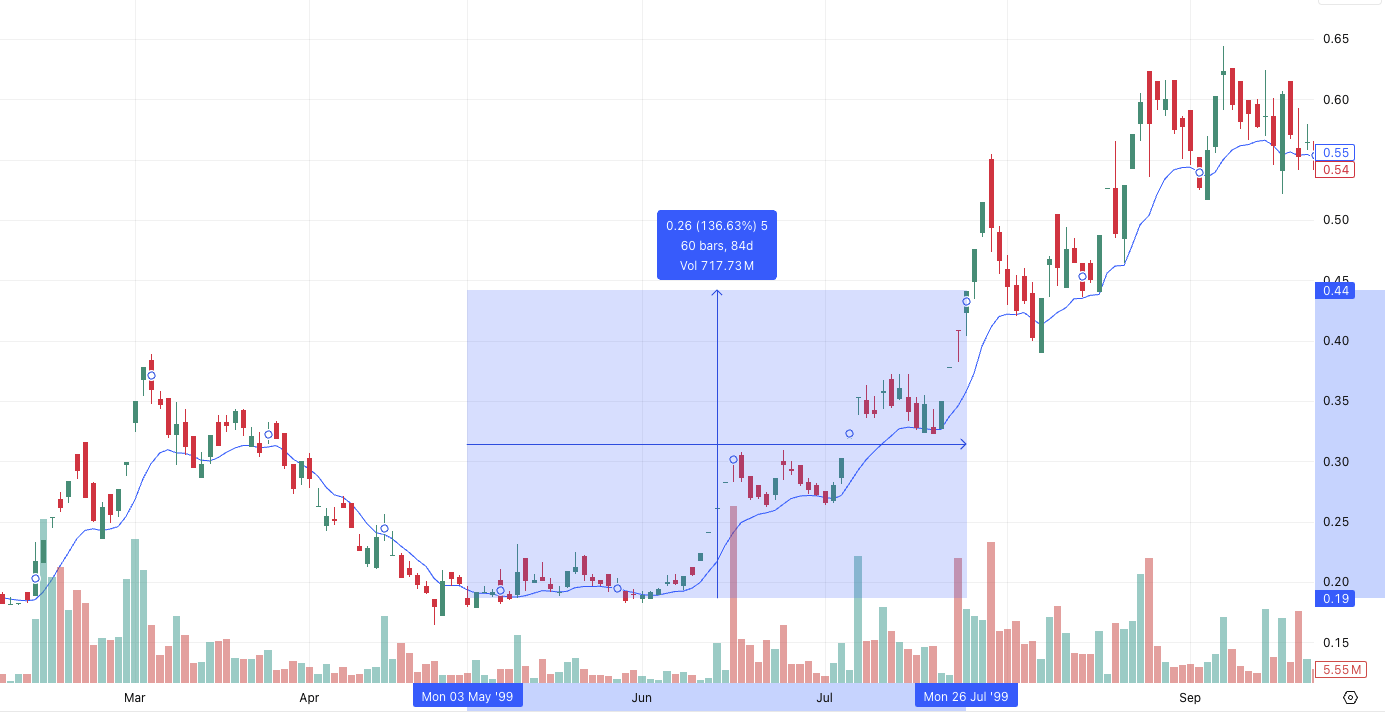

Flashback: Kargil War, 1999

From May to July 1999, as the Kargil conflict unfolded between India and Pakistan, the stock market plunged nearly 28%, gripped by panic and uncertainty. But hidden in that carnage were two extraordinary performers:

- BHEL nearly doubled in value.

- BEL skyrocketed with 130%+ returns during the same period.

These weren’t lucky spikes. They were the market’s response to the urgent demand for military infrastructure, electronics, and equipment—and the beginning of a trend that repeats almost every time conflict arises.

The Stocks That March When Armies Do

The Recent India-Pakistan Escalation: A Reminder of Market Reflexes

On May 7, 2025, the Indian Armed Forces launched Operation Sindoor, a swift and targeted military campaign that struck nine terror-linked sites across Pakistan and Pakistan-occupied Kashmir. Locations like Bahawalpur, Muridke, and Muzaffarabad—long believed to harbor anti-India terror infrastructure—were hit in a coordinated series of air and missile attacks.

The retaliation was equally sharp. Pakistan claimed to have downed five Indian fighter jets and responded with heavy artillery shelling along the Line of Control, resulting in tragic civilian casualties. The tension escalated further as both nations accused each other of drone incursions and cross-border missile fire, drawing concern from global powers and triggering a wave of diplomatic activity.

As Geopolitical Tensions Flared, Market Volatility Followed

But here’s the pattern seasoned investors know all too well: markets react sharply to military escalations, but they also reveal where confidence—and capital—quietly shift.

In the wake of Operation Sindoor, while broader indices like the Nifty slipped below 24,000, a different story was playing out in specific corners of the market. Stocks like Hindustan Aeronautics Ltd (HAL), Bharat Dynamics (BDL), and Bharat Electronics Ltd (BEL) surged between 4–7%, And the drone Stock IdeaForge Surged by 18% in single day, reflecting investor bets on increasing defence budgets and production orders.

From missile manufacturers to defence electronics giants, the war stocks India counts on are not just crisis plays—they’re long-term performers.

🔍 Read: Operation Sindoor: Defence Stocks to Watch

The India-Pakistan flare-up didn’t just test diplomatic channels. It once again reminded the investor class that amid geopolitical chaos, war stocks in India behave like pressure valves—rising when others fall, and stabilizing portfolios when fear dominates headlines.

| Company | Strength |

|---|---|

| HAL | Fighter jets, choppers, key to Air Force ops |

| BEL | Radar, electronic warfare systems |

| Bharat Dynamics | Missiles & weapon systems |

| BEML | Military trucks, tanks, logistics support |

| IdeaForge | Drone and Drone Technology |

But defence isn’t the only game in town.

Oil and gas come next. Every military movement demands fuel. Jet fuel, diesel for tanks, petrol for logistics convoys. During war, crude prices go haywire. And companies like Reliance, ONGC, and even BPCL benefit—not just from higher prices, but from increased domestic demand.

Meanwhile, while others panic, gold glows. Investors rush to it like moths to a flame. A simple investment in Gold ETFs or Sovereign Gold Bonds during wartime isn’t just safe—it’s often highly rewarding.

What You Shouldn’t Touch With a Bunker Pole

While some sectors rise, others crumble under the weight of war.

Travel and tourism are the first casualties. No one books a flight to Kashmir when missiles are flying overhead. Aviation bleeds. Hotels empty. Consumer durables take a back seat as households hold back on spending. No one’s buying new refrigerators when news channels are showing fighter jets.

So, avoid:

- Airlines and Travel Portals: InterGlobe Aviation (IndiGo), SpiceJet, EaseMyTrip (Easy Trip Planners)

- Hospitality Stocks: Indian Hotels Company Ltd (Taj), Lemon Tree Hotels, EIH Ltd (Oberoi Hotels)

- Discretionary Consumption (Luxury Goods, White Goods): Titan Company, Voltas, Blue Star, Crompton Greaves Consumer, Ethos.

These may recover later, but during war, they’re money traps.

But Here’s Where It Gets Really Interesting: The Aftermath

The war ends. Slowly, cautiously, but it ends.

And what follows is a different kind of rally—not one driven by fear, but by hope, recovery, and reconstruction.

Roads need to be rebuilt. Bridges, schools, and railways damaged in conflict zones demand immediate attention. Here, infrastructure companies step into the limelight. Think L&T, IRB Infra, NCC—these firms don’t benefit from war, but from what comes after: rebuilding a nation.

Then comes the consumer. That delayed motorcycle purchase? It happens now. AC sales return. Hotel bookings spike. This is when companies like Hero MotoCorp, Voltas, and Indian Hotels shine—not because of the war, but because the war is over.

A Quiet Rebirth: The Small-Cap Surge

Perhaps the most dramatic returns don’t come from the big names at all.

While defence headlines usually spotlight the HALs and BELs of the world, some of the most explosive gains come from small-cap stocks—the agile, under-the-radar players building India’s next-gen war tech.

These companies don’t grab headlines, but they quietly win critical government contracts—drones, satellites, border surveillance, logistics, and mission-specific manufacturing. Their size makes them nimble. Their innovation makes them irreplaceable.

Once the war dust settles and their technology proves field-ready, these stocks often double or even triple, riding the tailwinds of scale, policy backing, and global interest.

Stocks to watch:

- ideaForge Technology: A drone maker with defence contracts and a fast-scaling order book.

- Data Patterns: Specialises in electronic systems for missiles and radars, with strong MoD ties.

- MTAR Technologies: Supplies components to ISRO, DRDO, and nuclear facilities—defence-grade precision engineering.

- Paras Defence and Space Technologies: Specialises in defence optics, EMP protection, drone subsystems, and has strong ties with DRDO, ISRO, and private-sector defence contracts.

- Avantel Ltd: Focused on satellite communications and secure military tech.

- Astra Microwave Products: Plays a key role in radar, space, and missile communications.

These are not hype-driven stocks. These are mission-critical enablers of India’s modern warfare and aerospace push.

These are not the companies you find on the front pages—but they’re the ones that quietly mint millionaires.

So, What Should You Do As an Investor?

You don’t need to gamble on war. That’s foolish.

But you can observe patterns, prepare wisely, and invest in sectors that have both wartime resilience and peacetime potential.

During war:

Stick to defence, energy, and gold.

After war:

Rotate into infrastructure, financials, and consumer durables.

And always keep some dry powder—cash or liquid funds—to buy the dip or act quickly. Because when the war ends, the best opportunities don’t last long.

Final Thoughts: Between Missiles and Markets

War is devastating. But markets are emotionless calculators. They price risk, they absorb panic, and then they move—rationally, predictably, almost coldly.

Understanding war stocks isn’t about profiting from misery. It’s about preparing for volatility, protecting your capital, and repositioning for the rebuild. If done right, it’s not just about surviving the storm—but coming out stronger on the other side.

So, next time the headlines scream conflict, don’t just close your apps and panic. Look at the defence counters. Track crude. Watch for that golden glow.

Because every war ends. And when it does, someone always makes a fortune. It might as well be you.

Want to stay ready no matter what the market throws at you?

Open your Angel One Demat Account today and invest like a pro—even in the most uncertain times.

FAQs

Q1. What are war stocks?

War stocks are shares of companies that typically perform well during times of conflict, such as defence manufacturers, oil and energy companies, and gold-related assets.

Q2. Which Indian stocks benefit most during war?

Companies like HAL, BEL, Bharat Dynamics, and BEML see strong performance during wars due to increased defence spending by the government.

Q3. Is it safe to invest in war stocks during geopolitical tensions?

While war stocks can offer upside during tensions, it’s important to invest carefully and diversify. They help hedge risk in uncertain times.

Q4. What should I invest in after a war ends?

Post-war periods often benefit infrastructure, reconstruction, and consumer stocks like L&T, IRB Infra, and Hero MotoCorp as economies recover.

Q5. Are gold ETFs a good investment during war?

Yes, gold is considered a safe-haven asset. During war, demand for gold rises, often pushing up the price and offering good returns through Gold ETFs or SGBs.

Q6. How did the market react to the recent India-Pakistan war?

Markets initially fell, but defence and energy stocks like HAL and BEL surged. Gold ETFs also saw significant inflows.

Q7. Can small-cap stocks also benefit from war?

Yes, small-cap companies in defence tech, logistics, and drones often receive government contracts during war, leading to strong gains post-conflict.

Related Articles

India’s Defense Dream: How Bharat is Building Bombs, Business, and Billion-Dollar Bets