Once upon a time, India used to queue up at foreign embassies with a shopping list — fighter jets from France, submarines from Russia, rifles from Israel. The tag of “world’s largest arms importer” wasn’t just a statistic — it was a wound. A wound on national pride and on economic logic.

But that story is changing. Quietly, steadily, and now — profitably.

India is no longer just protecting its borders. It’s building an entire ecosystem that could turn the country into one of the top defense exporters in the world. And if you’re watching the stock market, you’ll see the early signs: defense stocks are rallying, mutual funds are getting created around the theme, and boardrooms are buzzing with government orders that were once pipedreams.

This isn’t just a policy shift. It’s the making of India’s next multibagger moment.

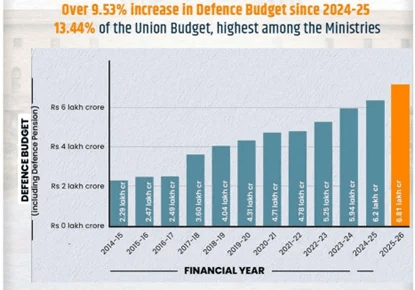

The 6-Lakh Crore Statement: India Means Business in Defense

India’s defense budget for FY25 stands tall at ₹6.2 lakh crore. That’s more than the GDP of Sri Lanka.

But it’s not the headline number that’s exciting — it’s how the money is being used. Out of that massive allocation, ₹1.72 lakh crore is reserved as capital outlay — which means new assets, new tech, and fresh manufacturing.

This is not about maintaining old tanks anymore. It’s about indigenously producing fighter jets like Tejas, long-range missiles like Agni, and warships like INS Vikrant — all made, assembled, and maintained on Indian soil.

The target is crystal clear: India wants to touch $25 billion in defense production by 2025, with at least $5 billion from exports.

And no, this isn’t a “Vision 2047” kind of dream. In FY21, India’s defense exports stood at ₹8,434 crore. By FY24? That number touched ₹21,083 crore. That’s 2.5x growth in just three years — and the government has already cleared exports to 85+ countries.

What’s on India’s Arms Menu? A Growing Inventory of Firepower

From fighter jets and battle tanks to drones and anti-aircraft missiles, India’s defense production line is growing longer by the month.

HAL is building fighter jets. BEL is producing surveillance radars. DRDO is developing missiles that fly faster than sound. And Cochin Shipyard? It built India’s first homegrown aircraft carrier — the majestic INS Vikrant — which now guards the seas with pride.

Weapons that once arrived in crates with Cyrillic or French markings are now rolling out of Indian factories with “Bharat” stamped on the side.

More impressively, this homegrown hardware isn’t just for Indian forces anymore.

In 2023, the Philippines signed a $375 million deal to buy India’s BrahMos supersonic missiles. Egypt is in talks for Tejas fighter jets. Armenia has already received defense systems from India, while countries in Africa and Southeast Asia are asking for our radars, drones, and artillery.

India is no longer importing peace — it’s exporting power.

The Rise of Desi Defense Stocks: Missiles and Multibaggers

Now comes the most exciting part for investors.

As this defense manufacturing surge unfolds, a handful of companies are quietly becoming market darlings. Stocks that once moved like retired submarines now fly like cruise missiles.

Take Hindustan Aeronautics Ltd (HAL) for example. A company once known for assembling aircraft is now a strategic partner for global aerospace giants. In FY24, HAL posted revenues of over ₹29,800 crore and sits on an order book worth ₹94,000 crore. With exports on the horizon and new fighter jet engines being co-developed with General Electric, HAL’s stock has soared more than 85% in just one year.

Then there’s Bharat Electronics Ltd (BEL) — the digital backbone of India’s military. From electronic warfare systems to border radars, BEL is quietly inking export orders while delivering ₹20,000+ crore in revenue. The stock? Up 60% over the last year, and still going strong.

But if missiles are your thing, Bharat Dynamics Ltd (BDL) is building them. Whether it’s the Akash, Astra, or Invar missile systems, BDL is at the heart of India’s missile arsenal. It reported profits of over ₹600 crore in FY24, and holds confirmed orders worth ₹19,000 crore. That’s a pipeline many companies would kill for — and the market knows it.

Even Solar Industries, a company that once made mining explosives, is now getting defense contracts to produce rocket systems and PINAKA launchers. Its transformation has been so solid, the stock has returned nearly 40% in a year.

And while everyone’s looking at the giants, Zen Technologies is playing the quiet genius. With expertise in anti-drone systems and military simulation software, Zen is tapping into the high-tech side of war — with a modest ₹280 crore in revenue and fat margins. Motilal Oswal pegs its upside potential at over 30%.

From Stocks to Funds: A Sector-Wide Bet on Bharat’s Arsenal

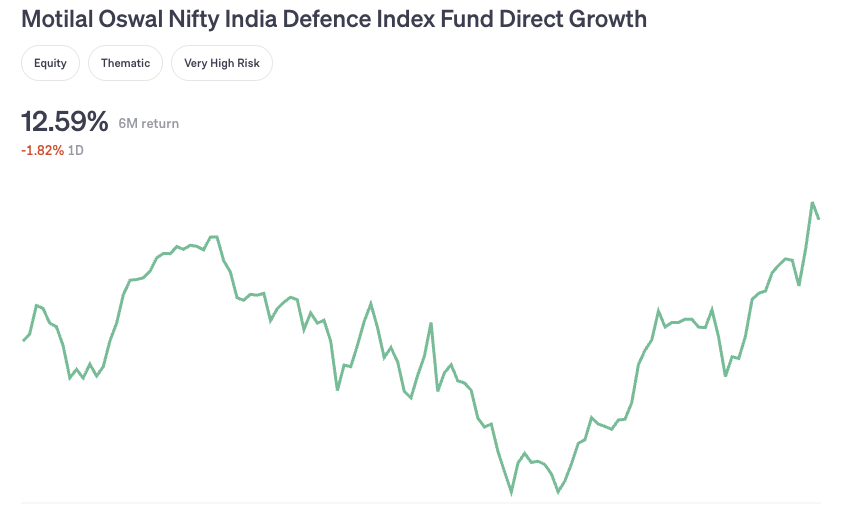

If handpicking stocks feels like picking the best gun in an armory, you can still ride the boom through India’s first dedicated defense mutual fund: the Motilal Oswal Nifty India Defence Index Fund.

It offers investors exposure to HAL, BEL, BDL, Solar Industries, Cochin Shipyard, and more — all under one missile-proof basket. With over ₹2,500 crore in assets and a low expense ratio of 0.29%, the fund gives you a sector-wide missile ride — without having to track individual stocks.

The best part? This fund didn’t exist two years ago. That tells you how quickly defense has gone from “national need” to “investment opportunity.”

Risks in the Line of Fire: Not All Bombs Bring Booms

Let’s not wear rose-tinted night-vision goggles. The defense sector, like any battlefield, comes with risks.

Most companies are still PSU-led, and any delays in government contracts can spook the markets. Valuations for stocks like HAL and BEL are no longer cheap — you’re paying a premium for predictability. Export deals, however promising, often take years to materialize. And the sector is vulnerable to political interference, policy reversals, or — ironically — peace.

So yes, the upside is massive. But this isn’t a day-trader’s playground. It’s a long-term runway — for those who have the patience to hold.

Final Word: India’s Defense Revolution is More Than Just Bullets — It’s Billion-Dollar Strategy

In the next 10 years, India won’t just secure its borders — it will export security to the world.

India will build fighter jets, warships, space-defense systems, and more. Deals won’t be limited to traditional partners like France and Russia — new defense ties are forming with nations like Indonesia, South Africa, and across Latin America. This isn’t just about manufacturing; it’s about training an economy to dominate the global defense landscape.

And in that rise, a new category of Indian companies will be born — defense-led, export-ready, investor-loved.

If you’re looking for the next multibagger, don’t just look at consumer tech or EVs.

Sometimes, the best stories wear camouflage.

Want to trade these stocks smarter, with advanced charts and zero-brokerage opportunities?

Try Angel One — where research meets execution, and strategy meets speed.

🛡️ Because in this market battlefield, it’s not just about defense — it’s about dominance.

FAQs

Q1. Why is India focusing so much on indigenous defense manufacturing?

India wants to reduce its dependence on foreign defense imports, increase self-reliance, boost exports, and create a strong strategic economy through local manufacturing under the “Atmanirbhar Bharat” vision.

Q2. Which companies are currently leading India’s defense manufacturing efforts?

Top players include Hindustan Aeronautics Ltd (HAL), Bharat Electronics Ltd (BEL), Bharat Dynamics Ltd (BDL), Solar Industries, and Zen Technologies — all of which have seen sharp growth in revenue and stock price.

Q3. Is it safe to invest in defense sector stocks now?

The sector has long-term potential, but valuations are rising. It’s better suited for patient investors with a long-term horizon. Diversified options like defense mutual funds may offer a safer entry.

Q4. What is the Motilal Oswal Nifty India Defence Index Fund?

It’s India’s first defense-themed mutual fund, offering exposure to top defense companies like HAL, BEL, and Cochin Shipyard, ideal for investors seeking broad sectoral exposure.

Q5. Can India really become a top arms exporter globally?

Yes. India’s defense exports have grown rapidly from ₹8,400 crore in FY21 to over ₹21,000 crore in FY24, with deals signed across Southeast Asia, Africa, and Latin America.

Related Articles

Future of Bitcoin in India: Hope, Hype, or a Historic Shift?