Turning Eighteen: The Age of Freedom—and Financial Fumbles?

Turning 18 is exciting—you’re officially stepping into adulthood, with independence and responsibilities tagging along. But with freedom comes the need for smart choices—especially about money. How to save money at 18 may not sound thrilling when you’ve just gained spending rights, but it’s one of the most powerful skills that can shape your financial future. The world suddenly starts treating you like an adult—you get to vote, apply for a PAN card, and even open your first bank account. But in the middle of all this new independence, one critical skill often slips through the cracks: money management.

At 18, most young Indians are either just stepping into college or preparing for it. Some start side hustles, some get pocket money from home, and others take their first internships. It might feel like too early to worry about savings—but that’s exactly why this is the best time to start.

Why Saving Money at 18 in India Is a Game-Changer

Let’s get this out of the way first: you don’t need to earn lakhs to save. Even small amounts, saved regularly, can build serious wealth over time. The earlier you start, the more time your money has to grow—this is called the power of compounding, and trust us, it works like magic.

Take this simple example:

| Start Saving Age | Monthly Saving | Interest (12% annually) | Age 40 Corpus |

|---|---|---|---|

| 18 | ₹500 | Compounded Monthly | ₹6 lakhs |

| 25 | ₹500 | Compounded Monthly | ₹2.3 lakhs |

The difference? A massive ₹3.7 lakhs—just because you started 7 years earlier.

But this blog isn’t just about numbers. It’s about building habits that your future self will thank you for.

Step Into the Real World: Your First Relationship—with a Bank

Most 18-year-olds in India don’t think about banking beyond UPI apps. But having your own savings account (not one your parents opened for you) is the foundation of financial adulthood. It gives you access to debit cards, online banking, and helps you track where your money goes.

Set up an auto-transfer: Move a fixed amount every month from your main account to a separate savings account. Don’t touch it unless it’s an emergency. You’ll be surprised how much grows in silence.

Cut the “Cool” Expenses—Without Killing the Vibe

We know the temptation—Zomato, Swiggy, Netflix, shopping sales, cab rides. Peer pressure is real, and so is the fear of missing out. But here’s a truth bomb: no one remembers your Rs. 300 coffee Instagram story after 24 hours—but your bank balance will remember it forever.

That doesn’t mean living like a monk. It means spending mindfully.

Instead of three overpriced meals outside per week, limit it to one. Instead of buying new clothes every month, invest in versatile basics that last longer.

Even cutting down ₹100 a day in unnecessary expenses means saving ₹36,500 in a year. That’s your college trip to Goa—or a starter mutual fund investment.

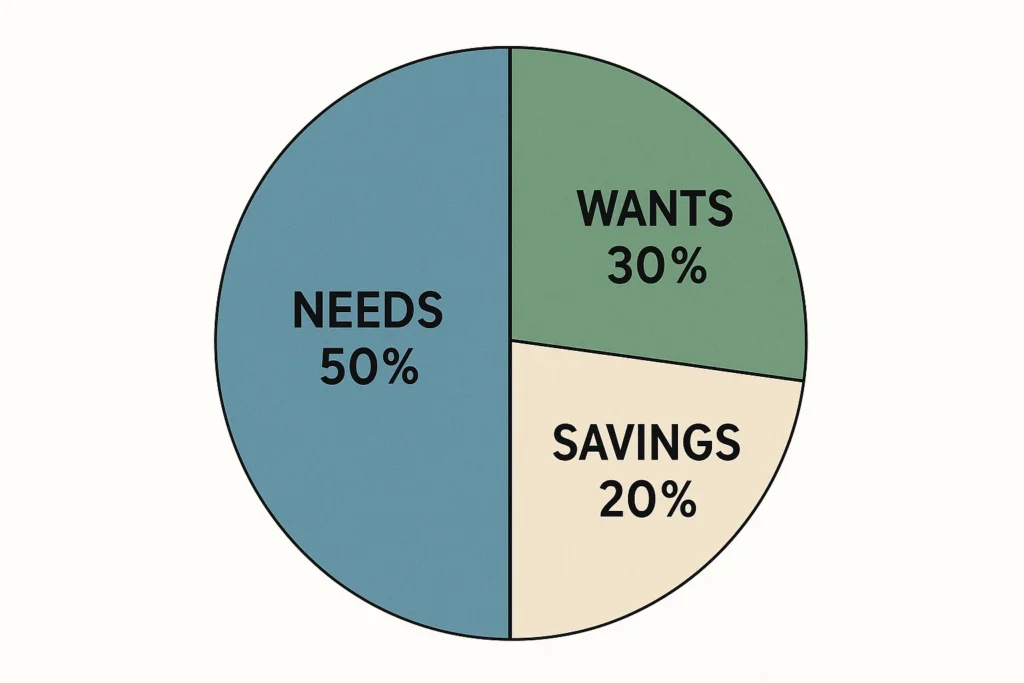

Learn the 50/30/20 Rule—With an Indian Twist

You might have heard of the 50-30-20 rule:

- 50% for needs

- 30% for wants

- 20% for savings

In India, this doesn’t always fit neatly—especially if you’re a student. So tweak it:

If you’re getting pocket money or earning ₹5000 a month from part-time work, consider saving at least ₹1000 (20%). The rest goes towards basic needs, travel, and fun.

It’s not about perfection. It’s about discipline. Make saving a monthly ritual, just like your Netflix binge.

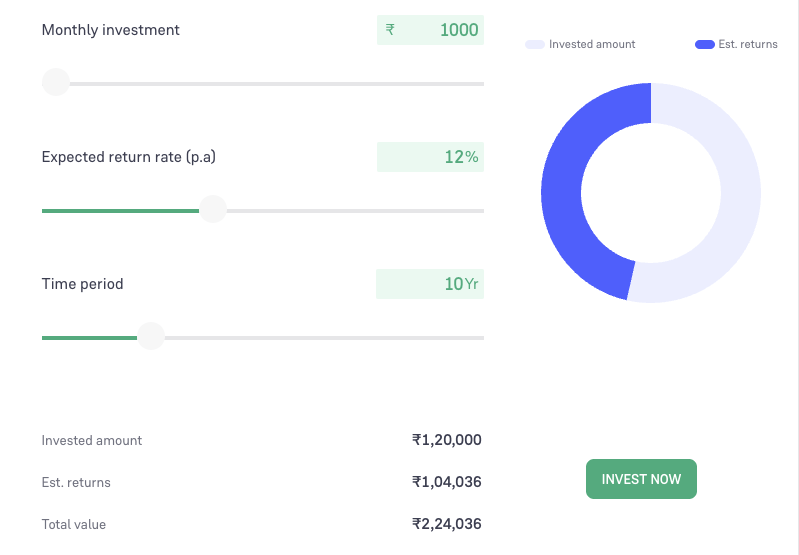

SIP: The Three Letters That Could Change Your Financial Life

If you save ₹1000 a month and keep it in your bank account, you’re doing okay.

If you invest ₹1000 a month in a mutual fund via SIP (Systematic Investment Plan), you’re doing smart.

Mutual funds are accessible even for 18-year-olds—you just need a PAN card and KYC done. With platforms like Angel One, you can start investing with as low as ₹100.

Let’s say you invest ₹1000 per month in a SIP giving 12% annual return. In 10 years, that becomes ₹2.3 lakhs, not ₹1.2 lakhs. That’s the magic of growing while you sleep.

Build Your Emergency Fund—Even If You Don’t Know What Emergencies Look Like Yet

Emergencies don’t always mean hospital bills. Sometimes it’s a broken phone, unexpected travel, or college project expenses. Having even ₹5,000–₹10,000 as a cushion means you don’t need to borrow or ask for money in a panic.

A good place to keep this? Liquid mutual funds or a high-interest digital savings account.

Think of Money as a Friend, Not a Fear

Money is not a scary thing—it’s a tool. The earlier you become comfortable managing it, the more freedom you’ll enjoy later. It’s okay to make mistakes. It’s okay to splurge sometimes. But it’s even better to start building good habits today, not tomorrow.

So talk about money. Learn about money. Take control.

What You Can Start Doing Today

Here’s your simple action plan for this week:

- Open your own savings account (if you haven’t already).

- Start tracking your expenses using any free app or even a notebook.

- Cut down ₹100 a day in impulse spends.

- Save ₹500–₹1000 and invest it in a basic SIP (like a balanced mutual fund).

- Read one article a week about money or investing.

- Follow finance creators who talk in simple terms (not just the hype).

Final Thoughts: Start Small, Dream Big

At 18, your world is just beginning to open up. And while saving money might not seem glamorous, it’s one of the smartest ways to gain control over your life early. Whether it’s for college, a future trip, a business idea, or just peace of mind—every rupee counts. How to save money at 18 isn’t just about cutting back on snacks or skipping the latest phone; it’s about building habits that pay off for decades. Start today, even if it’s small. Your future self will thank you—with interest.

Ready to begin your money-saving journey?

Open a free account with Angel One and get access to investment tools, expert insights, and everything you need to turn your savings into smart wealth.

FAQs (Frequently Asked Questions):

Why should I start saving money at 18?

Starting early gives your money more time to grow through compounding, helping you build wealth gradually and with less effort later.

How much money should I save monthly as an 18-year-old?

Ideally, aim for at least 20% of your monthly income or allowance, even if it’s as low as ₹500 to ₹1000.

What is the best way to save money in India at 18?

Open a savings account, track your expenses, avoid impulsive spending, and invest small amounts in SIPs or recurring deposits.

Can I invest in mutual funds at 18 in India?

Yes, as long as you have a PAN card and complete KYC, you can start investing via SIPs on platforms like Angel One.

What are some common money mistakes teenagers make?

Overspending on wants, ignoring budgeting, not saving, and falling for peer pressure are some common financial mistakes.

Is ₹500 a month enough to start saving?

Absolutely. It’s not about how much you save, but how consistently you do it. Even small amounts add up over time.

Should I use a budgeting app or write expenses manually?

Either works! Choose what you’ll stick with—apps are convenient, but writing in a journal helps build stronger awareness.

Where should I keep my emergency fund?

In a high-interest savings account or liquid mutual fund—so it’s safe, accessible, and earns modest returns.

What is the 50-30-20 rule in saving?

It’s a budgeting method where you spend 50% on needs, 30% on wants, and save 20%. Adapt it based on your lifestyle.

Can saving money help me become financially independent sooner?

Yes! Smart saving and investing early can give you financial freedom far earlier than most people achieve it.

Related Articles

How Stock Prices Are Determined: A Beginner’s Guide