After two sessions of nail-biting panic, the Indian stock market decided to chill a little — and how!

On Monday, Sensex jumped over 1,000 points, while Nifty crossed the 24,300 mark like it was no big deal.

But before we pop the bubbly, one big question remains:

Is this market recovery the start of a fresh rally… or just a classic bear trap in disguise?

Let’s dive into what’s really driving the action behind today’s stunning bounce.

Domestic Boosters: What’s Fueling India’s Market Recovery?

Global cheer was just the appetizer — India had its own reasons to feast today.

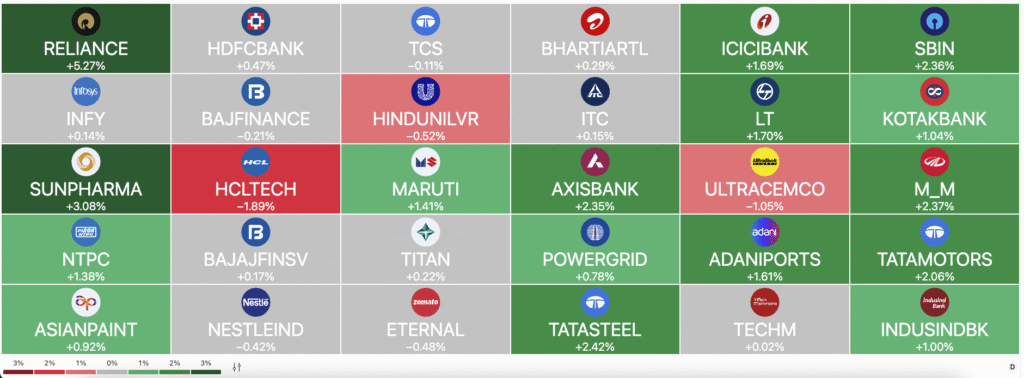

First, Reliance Industries delivered strong Q4 numbers, pushing its stock up over 5%.

Second, heavyweights like ICICI Bank, HDFC Bank, and Axis Bank joined the rally after better-than-expected earnings.

Adding more spice?

Foreign investors have pumped ₹32,465 crores into Indian stocks over the last 8 days, betting big on India’s growth story.

Plus, with a normal monsoon forecast on the cards, hopes for a robust economy are stronger than ever.

All these factors combined to supercharge today’s market recovery.

Nifty Outlook: After Market Recovery

The market recovery has pushed Nifty 50 back into bullish territory, but the battle isn’t over yet.

Today, Nifty closed at 24,328.50, rising over 1%. However, it faced resistance near the 24,355–24,360 zone, with sellers stepping in at higher levels.

The immediate support lies at 23,946 (around the 9-day EMA), while a stronger cushion sits between 23,800–23,860.

As long as Nifty holds above 23,946, the market recovery momentum remains intact.

But a failure to clear 24,355 decisively could trigger a minor pullback toward the 23,800 zone.

In short:

- Holding 24,355 = Rally likely towards 24,500–24,789

- Breaking below 23,946 = Watch for caution signs

For now, the tone remains slightly positive, supporting the broader market recovery narrative — but traders must stay alert near resistance zones.

Stock in News & Impacted Stocks

1. India Signs Rs 63,000 Crore Deal With France For 26 Rafale Marine Aircraft

India signed a huge deal with France worth ₹63,000 crore to buy 26 Rafale Marine fighter jets for its aircraft carrier INS Vikrant. These jets will replace older, problematic planes (MiG-29Ks) and boost India’s naval strength.

Stock Impacted: Hindustan Aeronautics Ltd (HAL)

HAL is involved in servicing and maintaining India’s military aircraft, including carrier-based operations. This Rafale Marine deal signals more spending on naval aviation infrastructure, where HAL plays a big role. Investors expect HAL to get maintenance and support contracts, boosting its business prospects.

2. FIIs are back but retail has started selling; caution on Auto, IT & FMCG sectors

Big foreign investors (FIIs) are buying Indian stocks again, bringing fresh money into the market. But small Indian investors (retail) are selling, especially mid and small-cap stocks. Experts are warning that Auto, IT, and FMCG sectors look expensive and risky right now.

Stock Impacted: Tata Motors, Infosys, Hindustan Unilever

- Tata Motors could see pressure due to concerns over competition and slowing growth.

- Infosys and other IT firms may struggle if AI disruption eats into traditional services.

- Hindustan Unilever (and other FMCG names) could face selling due to expensive valuations and slowing rural demand.

3. Indian PV Industry To Hit Record 50 Lakh Units in FY26: Crisil Report

India’s car and SUV sales (domestic + exports) are set to hit a record 50 lakh units this year. SUVs continue to drive growth, while Electric Vehicle (EV) sales are rising slower than expected because of high prices and limited charging points.

Stock Impacted: Maruti Suzuki, Tata Motors, M&M

- Maruti Suzuki is expected to benefit big-time because it dominates the affordable SUV market.

- Tata Motors remains strong but faces slow momentum in EVs.

- M&M could also gain from rising SUV sales, although exports growth is expected to cool down slightly.

4. Hindustan Zinc Plans Foray Into Potash Mining, Eyes Lithium Reserves

Hindustan Zinc (HZL) plans to start mining potash, a key fertilizer material, and is eyeing a block that might also have lithium (critical for EV batteries). This move could diversify its business into high-demand sectors beyond just metals like zinc and silver.

Stock Impacted: Hindustan Zinc Ltd (HZL)

Investors are excited because potash mining could open up new revenue streams for HZL, and lithium discovery could be a game-changer in the future energy and battery market. This diversification reduces the company’s dependence on base metals alone.

5. Used EV Batteries Could Power Homes and Towns if Data is Shared

Even after an EV battery becomes too weak for a car, it still has life left to power smaller vehicles or even homes. But unless manufacturers share key battery health data, it’s risky and difficult to reuse them safely — slowing down second-life battery adoption.

Read here: Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch

Stock Impacted: Tata Power, Exide Industries, Amara Raja Energy

- Tata Power could benefit if battery storage becomes widespread for homes and grids.

- Exide Industries and Amara Raja (both battery makers) could profit by offering second-life battery solutions once the ecosystem improves, especially if regulations push manufacturers to open up battery data.

IPO Update: Ather Energy IPO Subscription & GMP Trend

Ather Energy IPO Subscription Status (Day 1)

The Ather Energy IPO saw a slow start on Day 1 of bidding (April 28, 2025).

- Overall Subscription: 0.17 times

- Retail Investors: 0.66 times subscribed

- Non-Institutional Investors (NII): 0.17 times

- Qualified Institutional Buyers (QIB): 0 times

- Employee Quota: 1.74 times fully subscribed

➡️ So far, interest has mainly come from retail investors and employees, while big institutions are still sitting on the sidelines.

🔍 Reminder: IPO subscription is open till April 30, 2025. Action could heat up closer to the closing day, especially from QIBs!

Ather Energy IPO GMP (Grey Market Premium) Trend

The Ather Energy IPO GMP is showing weak momentum right now:

| Date | GMP | Estimated Listing Price |

|---|---|---|

| 28-Apr-2025 | ₹1 | ₹322 (0.31% premium) |

| 27-Apr-2025 | ₹0 | ₹321 (No premium) |

| 26-Apr-2025 | ₹3 | ₹324 (0.93% premium) |

| 25-Apr-2025 | ₹3 | ₹324 (0.93% premium) |

| 24-Apr-2025 | ₹5 | ₹326 (1.56% premium) |

| 23-Apr-2025 | ₹10 | ₹331 (3.12% premium) |

🔵 Current GMP: ₹1

🔵 Trend: Continuously declining over the past week.

What it means:

The excitement around Ather’s listing has cooled down sharply, and listing gains (if any) are likely to be very small unless subscription picks up strongly in the next two days.

Read Ather IPO full analysis Here: Ather Energy IPO: Should You Ride This Electric Wave?

Stock on Technical Radar: AIA Engineering

Quick Technical Overview (As of April 28, 2025)

- Current Market Price (CMP): ₹3,176.80

- Trend: Sideways to mildly bullish

- MACD Signal: Fresh bullish crossover (but still below zero line)

- Volume: Needs a spike for a strong breakout

What’s Happening:

After a long correction from ₹4,600 to ₹3,000, AIA Engineering has been consolidating quietly between ₹3,000–₹3,350.

Recently, it has made higher lows around ₹3,080 — a subtle sign that buyers are getting back into action.

📋 Short-Term Trading Plan

- Option 1: Buy on Dips

➡️ Enter near ₹3,150–₹3,170

➡️ Stop-loss: ₹3,080

➡️ Target 1: ₹3,300 | Target 2: ₹3,420 - Option 2: Buy on Breakout

➡️ Enter if ₹3,300 breaks with strong volume

➡️ Stop-loss: ₹3,210

➡️ Target Range: ₹3,420–₹3,500

✅ Volume Confirmation is crucial! A breakout without volume could fail.

⚠️ Risk Factors

- If ₹3,080 breaks, the stock may fall sharply to ₹3,000–₹2,850.

- Broader market weakness could spoil the bullish setup despite MACD signals.

Summary in Simple Words:

“AIA Engineering is finally waking up after a long nap. Bulls are stretching but the real sprint starts only if ₹3,300 breaks with strong volume. Until then, smart traders will tread carefully with tight stop-losses.”

Small Cap Stock of the Day: Lotus Eye Hospital

📋 Company Overview

Lotus Eye Hospital is a specialized healthcare player focused exclusively on ophthalmology (eye care) services.

Headquartered in Tamil Nadu, it operates multiple eye hospitals across South India, offering treatments like cataract surgery, LASIK, retina care, and cornea transplants.

In a country with an aging population, rising lifestyle diseases (like diabetes causing eye problems), and increasing healthcare spending, eye care is a secular long-term growth story — and Lotus Eye is well-positioned to benefit.

📈 Why Lotus Eye Hospital Looks Interesting Right Now

Sectoral Tailwinds:

The Indian eye care market is expected to grow at a CAGR of 6–7% over the next five years, driven by higher disposable incomes, increasing insurance penetration, and rising awareness around preventive eye health.

Niche Focus:

Unlike general hospitals, Lotus Eye is sharply focused only on ophthalmology — allowing it to build deep expertise, better margins, and a strong brand reputation in its chosen niche.

Clean Financials:

- The company is debt-free — a big plus for small caps.

- Steady cash flows from operations.

- Recent quarterly results show consistent revenue growth and improving operating margins post-COVID disruptions.

✅ Expansion Plan:

Lotus Eye is slowly expanding into new South Indian cities without taking aggressive risks — a good sign for sustainability.

✅ Technical Setup:

- Current Price: Around ₹75–₹80 range.

- Trend: Sideways to mildly bullish.

- Support Zone: ₹70–₹72.

- Resistance Zone: ₹88–₹90.

- Stock is trading above its 50-Day Moving Average, showing accumulation.

If ₹88 breaks on the upside with volume, the stock can quickly rally towards ₹100–₹105 in the short-to-medium term.

⚠️ Risk Factors to Watch

- Small-cap volatility: Stocks like Lotus Eye can be volatile; tight stop-loss discipline is essential.

- Regional concentration: Heavy dependency on South Indian markets could pose risks if local competition intensifies.

In Simple Words:

“Lotus Eye Hospital is like a focused sniper in healthcare — picking a booming niche (eye care) and quietly building strength. If the technical breakout above ₹88 happens, this small cap could offer sharp gains.”

Conclusion: The Road Ahead After the Market Recovery

Today’s rally was a much-needed breather for the markets after a tense week.

With strong buying in heavyweight stocks, easing global concerns, and consistent FPI inflows, the market recovery looks solid — at least for now.

However, with Nifty standing right near key resistance, it’s important to stay balanced:

➡️ Stay optimistic, but not reckless.

➡️ Focus on strong sectors and breakout stocks.

➡️ Be ready with a stop-loss strategy in case of sudden reversals.

Whether it’s tracking IPO opportunities like Ather Energy, monitoring technical setups like AIA Engineering, or hunting hidden gems like Lotus Eye Hospital, this is the time to invest smart — not just invest fast.

👉 If you’re looking for a trusted platform to track market moves, analyze technical setups, and invest in promising stocks — Angel One gives you all the tools in one place.

Start navigating the next phase of this market recovery with confidence.

Related Articles

India-Pakistan War Tension: Defense Stocks Under Radar