If you’re wondering why the Indian stock market is shining brighter than ever today — you’re not alone. The Sensex has jumped over 500 points, the Nifty crossed 24,300, and the buzzword everywhere is Market Up!

But this isn’t just random. There are five strong reasons why the markets are riding this bullish wave today. Let’s dive into them.

1. India’s Calm Response After Pahalgam Terror Attack

Despite tensions rising after the tragic Pahalgam terror attack, India’s approach has been strategic and diplomatic — not impulsive.

The Indian government has avoided any knee-jerk military reaction, which the stock market clearly appreciates. Experts like VK Vijayakumar highlight that while Indo-Pak tensions remain a worry, the market is pricing in no immediate war scenario.

The global community, including the US, has condemned the attack and called for a peaceful solution — bringing some calmness back to investors. This diplomatic maturity is helping keep the Market Up.

2. Easing Global Trade War Jitters

Good news from across the seas: the US and China are back at the negotiation table.

President Trump’s comments about working towards a “favorable trade deal” have cooled off global trade tensions.

Pankaj Pandey of ICICI Securities notes that “the peak of tariff-related anxiety appears to be behind us” — and it shows. Less fear globally often means more fuel for emerging markets like India to push Market Up.

3. Foreign Portfolio Investors (FPIs) Are Back in Buying Mode

FPIs have been in an aggressive buying spree since April 15, pouring nearly ₹32,465 crores into Indian equities in just eight days!

This surge is a big turnaround from their earlier selling spree and is partly because US markets and the dollar are looking weaker.

When foreign money comes rushing in, it’s no surprise to see the Market Up so strongly.

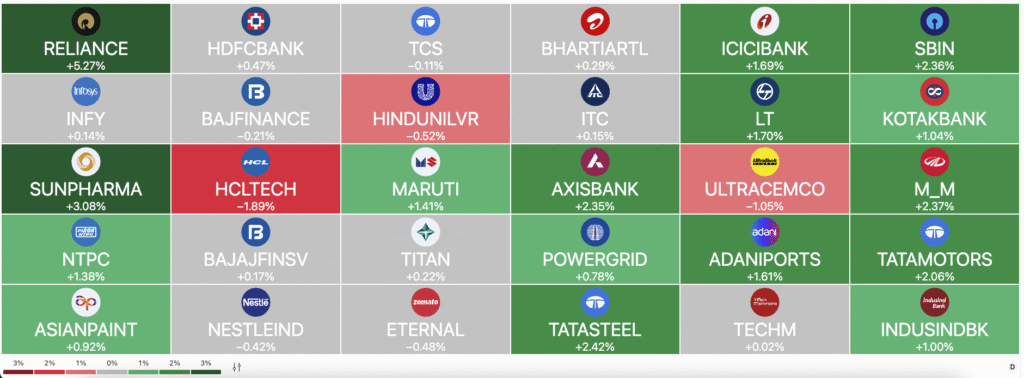

4. Reliance and Banking Heavyweights Lead the Charge

Reliance Industries — the stock market’s favorite child — is once again lifting the market spirit.

Post strong Q4 numbers (6% YoY profit growth), Reliance shares jumped over 5%, and analysts are even raising their targets.

Not to be left behind, banking giants like ICICI Bank, Axis Bank, SBI, and HDFC Bank are also reporting strong results, boosting market indices further.

When big boys move, they drag the entire Market Up with them!

5. Positive Sentiment Leading to Buy-on-Dips Strategy

After two weak sessions, investors seem eager to “buy the dip,” backed by strong macro fundamentals and hopes of a normal monsoon.

Sectors like healthcare, electronics manufacturing, capital goods, and defense are showing long-term potential, and India’s growth story remains firmly in place.

Varun Sharma from Motilal Oswal sums it up perfectly — India’s domestic strength makes it less vulnerable to external shocks.

This underlying optimism is keeping the Market Up, even amid global uncertainties.

Conclusion: A Perfect Storm of Positivity

From geopolitical maturity to strong earnings and foreign fund inflows, everything is aligning to keep the Market Up today.

While risks always remain, especially with international tensions, the market’s current mood is largely optimistic.

As an investor, it’s important to stay informed — and remember: while rallies are exciting, disciplined investing wins the marathon!

Related Articles

India-Pakistan War Tension: Defense Stocks Under Radar