Introduction – “Three days off and now… boom!”

The market’s had a 3-day break, but now it’s time for the Market Reboot — and things are about to get interesting. Will Nifty rise or take a dip? After the holiday pause, the market is ready to make some serious moves, and we’re here to make sense of it all. Expect volatility, as global cues, big news, and FPI exits could all have a major impact.

And hey — it’s not just the market that’s starting fresh.

Happy Poila Boishakh, Vishu, Puthandu, Bihu, and Baisakhi to all those celebrating across India! May your new year bring you green candles, booming breakouts, and fewer stop-loss hits.

While the world was taking a breather, stock movements were brewing under the surface, and now it’s time for a fresh start. As the Market Reboot kicks in, there’s plenty to watch out for today. So, let’s dive in — your trading day is about to get a lot more exciting.

Quick Snapshot – The Market Mood

Here’s your espresso shot of what’s brewing in the market today. Spoiler: it’s mostly green.

📈 Market Reboot Mood: Bullish vibes incoming

💸 FPI Update: They’re still ghosting us – ₹31,575 crore pulled in April so far

🌏 Global Markets: All green, everyone’s partying without us

📊 SGX Nifty: +1.36%, likely opening gap-up

🧨 Sectors in Focus: Defense, Green Energy, AI, Shrimp (yep, shrimp)

📉 Risk Factor: FPI outflow, high valuations, inflation worries still lurk

So yes, after a three-day nap, the market is expected to wake up either refreshed or confused. Either way — it’s go time.

Nifty Outlook – Where Are We Headed?

So here’s where we stand post-market nap: Nifty has officially filled the 7th April gap — that awkward post-tariff news crash? Yep, cleaned up. Last week, the index rallied hard and sealed that technical mess on Friday. With that behind us, it’s time to look forward.

Here’s what the technicals say in bold font:

🟢 Immediate Resistance:

- 23,400 — if that’s breached, then it’s lights on for

- 23,800, followed by a moon-shot attempt at 24,300

🔴 Major Support:

- 22,300 — this is the safety net. Below that? Things might get spicy (not the good kind).

Now, with SGX Nifty up 1.36%, we’re likely to open strong today. But will we sustain the rally or fizzle out like soda in the sun?

Volume will be key. If it shows up along with buying in defense, green energy, and PSU banks, we might finally break into new highs. On the flip side, if FIIs keep sulking (again), they could put a ceiling over our enthusiasm.

It’s a reboot, yes — but can Nifty break into beast mode? Watch the resistance zones closely.

News & Related Stocks – Big Moves, Bigger Impacts

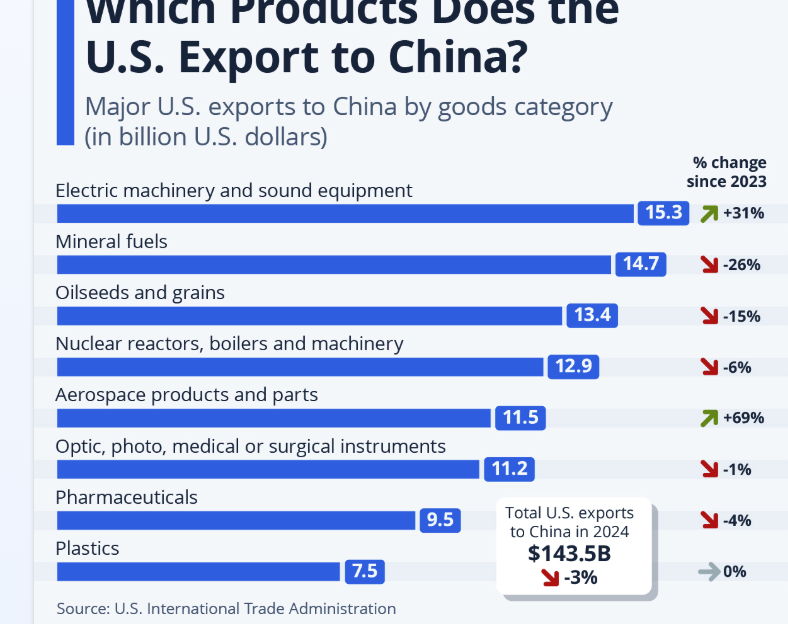

📰 U.S. Gives Temporary Tariff Relief to Chinese Electronics

The U.S. has decided to pause some tariffs on electronics imported from China, including items like smartphones, laptops, and other consumer tech. This move came as a bit of a surprise and gave global tech markets a solid push upward.

The U.S. said this is not a complete removal of tariffs — it’s more like giving some breathing room before they strike again. But still, the global market took it as good news, and shares of companies like Apple were set to rise by over 5%!

This also means China might now get a short-term export boost, and Asian markets have already reacted positively. But for Indian exporters and electronics assemblers, this could be a mixed bag.

📌 Stocks Impacted

Dixon Technologies, Amber Enterprises, and Syrma SGS

Why? These are major players in contract manufacturing and electronics assembly in India. A drop in tariffs for Chinese competitors could increase competition, meaning Indian manufacturers may lose out on orders — at least in the short term.

Impact: Slightly Negative

Expect mild pressure on stock prices as investors worry about tougher global competition.

📰 India to Export 40,000 Tonnes of Shrimp to the U.S. After Tariff Pause

Here’s a rare combo — seafood and trade policy in the same headline.

After the U.S. decided to pause some import tariffs, India is now preparing to ship 40,000 tonnes of shrimp to American markets. That’s a huge number — and for Indian seafood companies, it’s basically the business version of winning the lottery.

Why is this such a big deal? The U.S. is India’s largest market for seafood exports, and tariffs had made it harder to compete with other countries. With this pause, Indian exporters can now push their shipments faster, and possibly at better prices.

This move is also expected to reduce supply pressures in India, stabilize prices, and improve earnings for seafood companies.

📌 Stocks Impacted

Avanti Feeds, Apex Frozen Foods, Waterbase

Why? These companies are big players in shrimp farming and exports. A large export order to the U.S. means higher sales volumes, better realizations, and possibly margin expansion.

Impact: Strongly Positive

Expect bullish momentum in these stocks — especially if global shrimp prices remain firm.

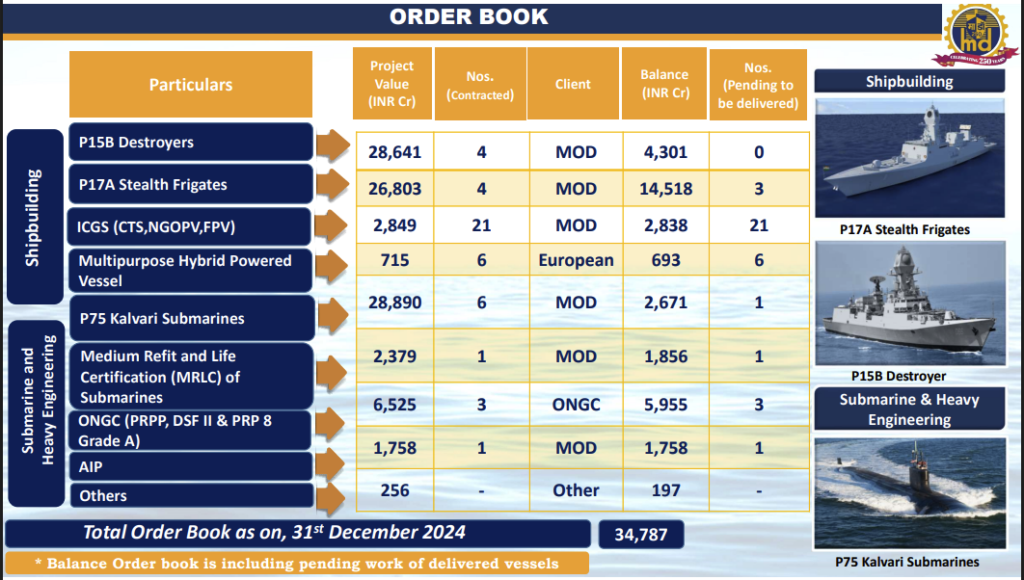

📰 Mazagon Dock Sets ₹10,000 Crore Order Target for FY26

While most of us were figuring out what to do during the long weekend, Mazagon Dock Shipbuilders quietly dropped a bombshell (figuratively, of course): the company is aiming to execute orders worth ₹10,000 crore in FY26.

For context — Mazagon Dock is one of India’s biggest defense shipbuilders, responsible for submarines, warships, and other naval vessels. This ₹10,000 crore target isn’t just big — it’s a sign that India’s defense manufacturing push is gaining serious speed.

The Indian government’s “Make in India” defense policy has already shifted focus to domestic production, and companies like Mazagon Dock are right in the driver’s seat. As defense budgets rise and India looks to reduce dependence on imports, this move could lock in long-term growth.

📌 Stocks Impacted

Mazagon Dock, Bharat Electronics (BEL), Hindustan Aeronautics (HAL)

Why? Mazagon Dock is the direct player here. But the order execution means more work for its suppliers too — and that includes companies like BEL (which makes electronics for defense) and HAL (which handles aerospace and defense manufacturing).

Impact: Strongly Positive

Expect buying interest in the entire defense sector — this news reinforces long-term revenue visibility and could attract both retail and institutional interest.

📰 Govt’s ₹10,000 Cr Startup Fund to Focus on AI & New-Age Tech

In what could be a game-changer for India’s startup ecosystem, the government is preparing to pump in a major chunk of its ₹10,000 crore startup fund into cutting-edge sectors like Artificial Intelligence (AI), semiconductors, green tech, deep tech, and fintech.

What’s different this time? Instead of spreading the money across random startups, the focus will be on high-impact, future-facing industries — the kind that could shape India’s digital economy over the next decade.

This fund will not only support early-stage ventures but also boost confidence among private investors and VCs, who’ve been sitting on the sidelines lately due to funding winters and valuation fears.

📌 Stocks Impacted

Tata Elxsi, Happiest Minds, KPIT Technologies, IdeaForge

Why? These are companies either working directly with AI, embedded tech, or developing platforms and services that benefit from advanced tech funding. Startups getting government support = more business for these enablers.

Impact: Moderately Positive

This is more of a long-term growth story, but the announcement itself can spark positive sentiment and re-rating for companies aligned with AI and new tech themes.

📰 NTPC Doubles Down on Green Energy with Big Moves

NTPC is not playing small when it comes to clean energy. First, its renewable arm NTPC Green recently acquired Ayana Renewable Power for a massive ₹6,248.50 crore. That deal alone expands NTPC’s reach in solar, wind, and green chemical projects across India.

But wait—there’s more.

Just yesterday, Tata Power Renewable Energy Ltd (TPREL) signed a power purchase agreement (PPA) with NTPC to develop a 200 MW clean energy project. This new project, which will be spread across multiple locations, is expected to generate about 1,300 million units (MUs) of electricity annually and will be completed in 24 months.

With this project, Tata Power’s total renewable capacity now touches 10.9 GW. Meanwhile, NTPC Green is chasing a bold goal—19 GW of renewable capacity by 2026-27, with a total planned investment of ₹1 lakh crore. These aren’t just numbers; they show how aggressively India is moving toward a sustainable, low-carbon future.

📌 Stocks Impacted

NTPC, Tata Power, ONGC, Adani Green, Suzlon Energy

Why?

NTPC’s acquisition of Ayana and its partnership with Tata Power send a strong signal: India’s biggest power producers are going green in a big way. This increases the visibility and potential of companies involved in solar, wind, and green chemical energy. It’s also great news for Tata Power, which gains a strong government-backed buyer in NTPC for its clean energy output.

Impact: Very Positive

We can expect bullish momentum in NTPC, Tata Power, and other green energy players. These developments not only increase their revenue visibility but also attract investor attention as ESG (Environmental, Social, and Governance) investing gains popularity.

📊 Stocks on Technical Radar

🔍 Varun Beverages Ltd. (Potential Breakout)

Varun Beverages is looking strong on the charts and might be gearing up for a breakout. The stock has been showing bullish momentum with a potential for significant upside. Keep an eye on this one as it could make a big move soon.

🔗 Interested? Check the technicals and trend here Varun Beverages Technical Analysis

📈 Inox Wind Ltd. (9-Day EMA Cross)

Inox Wind has crossed its 9-day EMA, signaling a possible change in trend. This could be the right time for traders to watch closely for further bullish confirmation. The stock is showing potential to build momentum over the next few days.

🔗 Want to know more? Get the latest chart and analysis here Inox Wind Technical Analysis

Conclusion – What’s the Big Picture?

After a three-day break, the markets are ready to pick up the pace again. With global optimism fueled by U.S. tariff news and strong updates from Indian sectors like defense and renewable energy, expect a positive start to trading tomorrow.

If you’re thinking long-term, defense and renewable stocks look like the place to be, but don’t forget about the tech sector, especially those benefiting from the government’s push for AI and new-age tech. Keep an eye on Varun Beverages for a potential breakout and Inox Wind for that fresh bullish signal with the 9-day EMA cross.

For anyone ready to experience a Market Reboot, Angel One offers the tools and insights to help you make smarter, faster decisions. Whether you’re analyzing trends or managing risk, it’s about staying ahead of the curve with the right platform by your side.

Related Articles

New Algo Trading Rules– What Retail Traders Must Know