📰 Good Morning, Investors

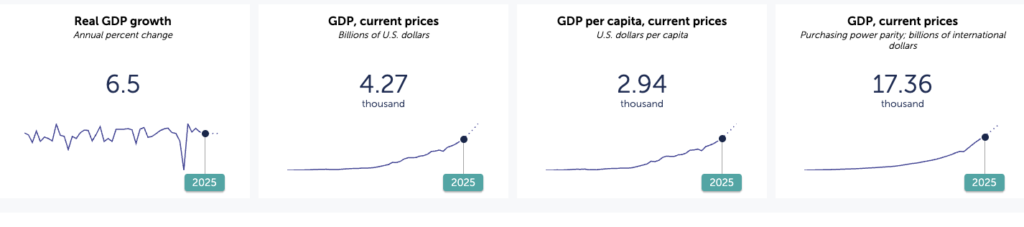

India is growing—but so is your grocery bill. The economy is clocking a solid 6.5% GDP growth, but inflation is sneaking into every shopping list. With global trade tensions, RBI rate cuts, and policy moves swirling around, India’s Future Outlook is a mixed bag of boom and caution.

In this edition, we decode what’s working, what’s wobbling, and where your money should be headed next.

🧮 Economic Indicators: Solid Growth, Sticky Inflation

🚀 GDP Growth

The RBI now expects 6.5% GDP growth for This Year (down from 6.8%), blaming—you guessed it—global trade slowdowns. But hey, with ₹10 lakh crore pumped into infrastructure, India still flexes as one of the fastest-growing major economies. Steel and cement stocks like Tata Steel and Ultratech Cement are already buzzing.

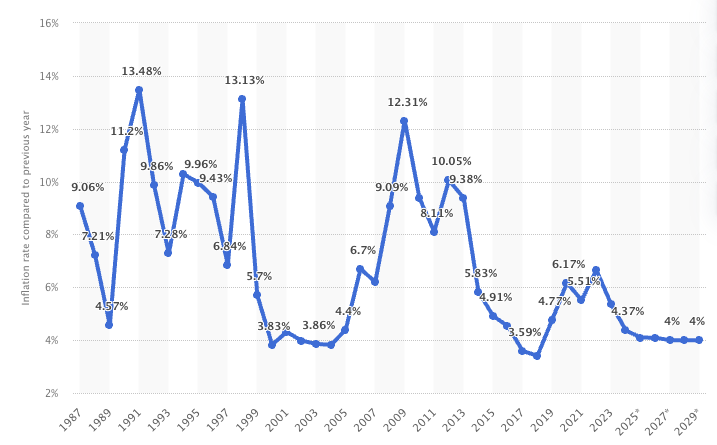

🔥 Inflation

Inflation took a chill pill in February—CPI eased to 3.61% (vs 4.31% in Jan), with the CPI index dipping to 192.5 points. March data isn’t fully out, but the trend suggests moderation, not a spike. Core inflation is likely stabilizing, not climbing. This could ease pressure on sectors like FMCG and autos.

Stocks like Marico might see better margins with lower input costs, while Hero MotoCorp could benefit from more manageable production expenses and potentially higher consumer spending, especially with the RBI cutting rates to 6.0%.

💼 Unemployment

Now some good news: Unemployment dropped to 8.2% in 2025, down from 8.4%. Thanks to job creation in manufacturing and services (thank you, PLI scheme). But youth unemployment at 15.67% is still yelling “What about us?”

Future Outlook: Manufacturing stocks like Bharat Forge and LTIMindtree may benefit as job growth continues.

🏦 Policy Changes: RBI’s Rate Cut + Government’s Big Bets

🔻 RBI’s Surprise Move

The RBI pulled a surprise from its monetary hat on April 5, cutting the repo rate to 6.0%. A second consecutive rate cut shows their “accommodative” mood. Market’s betting on 5.75% by December.

This is giving a boost to real estate and auto stocks. Think Godrej Properties and Eicher Motors—watch them closely!

🏗️ Government Initiatives

- Tariff Talks: India is playing tariff chess with the U.S., trying to ease pressure on exports.

- Infra Push: ₹10 lakh crore for roads, rail, and renewable energy. This fuels stocks like IRCON, Adani Green, and Siemens.

- PLI Expansion: Now covers semiconductors and green hydrogen. Stocks like Vedanta, Tata Elxsi, and Reliance are in focus.

Future Outlook: Sectors like infrastructure, green energy, and manufacturing are set for long-term wins. Eyes on capex-heavy stocks.

🌍 Global Factors: Trade Tensions + Tech Dreams

💥 U.S.-China Trade War, Now With India in the Mix

President Trump’s new 10% import tariff (and a spicy 26% on Indian goods) isn’t winning fans. Indian exports, especially textiles and electronics, are under pressure.

But here’s a twist: This may benefit India as U.S. firms look beyond China. Stocks like Dixon Tech, Amber Enterprises, and Page Industries are strategic plays.

💸 Rupee Drops to 86/USD

Thanks to tariffs and oil, the rupee is having a rough week. Good for exporters, bad for importers.

📉 Global Growth Slows

IMF cut global growth to 3.2%. Foreign investors are now cozying up to U.S. Treasuries, triggering outflows. But domestic investors are holding the fort. Cheers, SIP army.

🧠 Semiconductors: India’s Tech Jackpot

By 2030, India’s chip market could be $108 billion. That’s a lot of silicon. With Tata Group and Vedanta in the ring, the semiconductor wave is real.

Future Outlook: India could become a serious player in tech manufacturing. Early bets in semiconductors may pay off big.

🔍 Sectoral Spotlight: Where the Money’s Moving

🏢 Real Estate

- Ultra-luxury homes worth ₹850 crore were snapped up in early 2025.

- Meanwhile, affordable housing is ghosted due to high interest and cost inflation.

Stocks in focus:

- Macrotech Developers (Lodha) – Riding the luxury boom

- PNB Housing Finance – Struggling with rising cost of funds

🧼 FMCG

Inflation has rural India tightening its purse. Growth? Meh—low single digits expected this year. But companies are pivoting fast:

- HUL and ITC are going premium and online.

Future Outlook: Premium brands and D2C models could outperform old-school volume plays.

🔭 Outlook: What’s Ahead for India’s Economy?

Let’s summarize what the next few months could look like for investors:

- Growth: India’s GDP growth may hover around 6.3%-6.8%—respectable in a shaky global market.

- Rate Cuts: More easing means good news for real estate, banks, and auto.

- Global Trade Risks: Yes, they exist. But India’s export diversification and domestic consumption are buffers.

- Market Volatility: Buckle up for the short-term, but stay focused on long-term secular trends.

📈 Stocks & Sectors to Watch This Week

| Sector | Stock | Why Watch |

|---|---|---|

| Infrastructure | L&T, IRB Infra | Riding ₹10 lakh crore capex |

| Semiconductors | Tata Elxsi, Vedanta | PLI expansion + global demand |

| Auto | Eicher Motors, Tata Motors | Rate cuts + EV optimism |

| Real Estate | Prestige Estates, Godrej Prop | Luxury boom, rate tailwind |

| FMCG (Premium) | Nestle, HUL | Shifting to value-added products |

🧭 What Should You Do Now?

- Short-Term Traders: Look for rate-sensitive plays—real estate, NBFCs, autos.

- Long-Term Investors: Focus on infra, tech manufacturing, semiconductors, and green energy.

- Avoid Chasing: Sectors under inflation heat like rural FMCG or low-margin exporters.

Keep calm, diversify, and follow the Future Outlook—not the panic.

📬 Final Thoughts + Pro Tip

India’s story is still being written. Sure, inflation is poking holes in your budget, and global headlines can be dramatic—but your portfolio doesn’t need to be.

👀 Pro Tip:

Don’t try to time the market. Time in the market works better—especially if you’re investing through a smart platform like Angel One. It helps you spot strong sectors, manage risks, and stay on top of trends.

Ready to ride the wave?

👉 Open Your Free Demat Account with Angel One and unlock real-time insights for India’s Future Outlook.