Introduction

India isn’t just aiming for global domination in IT services or digital payments anymore. According to a new report by NITI Aayog, the Hand & Power Tools Sector is quietly emerging as a high-potential goldmine—worth $25 billion in exports and 35 lakh new jobs in just 10 years.

Yes, you read that right.

But before you dismiss this as another government dream, let’s break it down—and more importantly, see how you can benefit from this by investing in the right stocks.

The Big Picture: A Market Worth $190 Billion by 2035

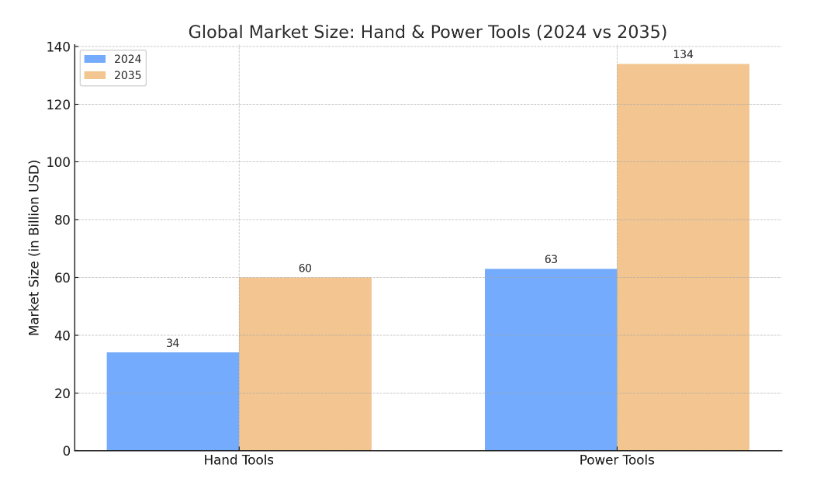

The global market for hand and power tools is currently valued at $100 billion, expected to touch $190 billion by 2035. Here’s how the pie is sliced:

- Hand Tools: From $34 billion → $60 billion

- Power Tools: From $63 billion → $134 billion

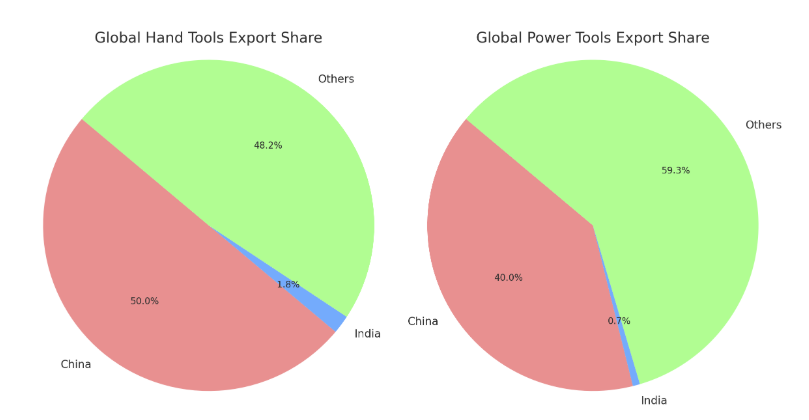

India currently exports:

- $600 million in hand tools (1.8% market share)

- $470 million in power tools (0.7% market share)

Meanwhile, China rules the toolbox:

- $13 billion in hand tools exports (50% market share)

- $22 billion in power tools (40% market share)

India’s ambition? Grab 25% of the hand tools and 10% of the power tools market.

That’s a massive leap—and it opens up exciting opportunities for manufacturers, suppliers, and, yes, investors.

Stock #1: Stanley Lifestyles Ltd. – Luxury Meets Manufacturing Muscle

Why it fits: Stanley Lifestyles started as a premium furniture brand but has now diversified into lifestyle tools and leather accessories manufacturing, aiming at both Indian and international customers. It represents India’s move from cheap-labour factory setups to high-quality, design-forward manufacturing.

Why it benefits: With exports being the focus, Stanley’s premium image can appeal to Western markets. Plus, its manufacturing base in Karnataka gives it a competitive edge in logistics and cost efficiency.

💡 Pro tip: Stanley is a mid-cap momentum stock worth watching.

Stock #2: Elgi Equipments Ltd. – Powering the Power Tools

Why it fits: Elgi is a leading manufacturer of air compressors—essential components used across assembly lines, pneumatic tools, and power tool manufacturing.

Why it benefits: As India’s tool production scales, the demand for industrial automation and compressed air solutions will shoot up. Elgi is already exporting globally, with a growing presence in the U.S. and Europe.

📊 Bonus: Its export revenue is consistently rising and it enjoys strong margins, making it a smart long-term bet.

Stock #3: Lakshmi Machine Works (LMW) – The Machine Behind the Machines

Why it fits: LMW is one of India’s top manufacturers of CNC and industrial machinery, including those used in tool-making and forging processes.

Why it benefits: As India scales tool exports, local toolmakers will need high-end equipment to compete globally. LMW stands to benefit from the “Make in India” push by being the go-to supplier for precision machines.

📌 Think of it as the guy who sells pickaxes during a gold rush.

Stock #4: Ramkrishna Forgings – Forged for Exports

Why it fits: Ramkrishna Forgings supplies high-strength forged components, which are the building blocks of hand tools like wrenches, hammers, and industrial spanners.

Why it benefits: With its exports already crossing ₹1,000 crore, this small-cap has the muscle and ambition to ride the export wave. Plus, it has a diversified client base in North America and Europe—exactly where India wants to increase tool exports.

Investor logic: If India wants to be the world’s toolbox, someone has to forge the steel—and that’s where Ramkrishna shines.

Stock #5: Bharat Forge – India’s Global Manufacturing Ace

Why it fits: Bharat Forge is more than an auto components giant—it’s a global engineering company involved in making high-performance forged components for tools, aerospace, oil & gas, and defence.

Why it benefits: With economies of scale and global presence, Bharat Forge can help India leapfrog its 14–17% cost disadvantage against China, as mentioned in the NITI report.

Also, expect it to play a major role in India’s tool exports to the U.S. and Europe, thanks to existing supply chains.

Bonus Stock: ASK Automotive Ltd.

While the five stocks mentioned above directly or indirectly benefit from the hand & power tools boom, there’s one more that made it to NITI Aayog’s report and deserves your attention—ASK Automotive Ltd.

This auto component maker isn’t just limited to the EV and two-wheeler world. It also manufactures precision components like brake systems, aluminum die-casting parts, and friction materials, many of which are used in power tools and tool accessories.

With India looking to grow its hand & power tools sector exports to $25 billion, the demand for reliable, indigenously manufactured components will rise. That’s where ASK fits in—quietly becoming the backbone of both automotive and industrial tools.

Why it matters:

- Tool & equipment manufacturers rely on precision parts for drills, saws, and grinders.

- ASK’s expertise in automation and friction technology is aligned with global tool design trends.

- The stock is already listed, well-capitalized, and growing its non-auto client base.

So while everyone is looking at flashy IPOs, ASK Automotive might just be the quiet compounder riding the tool-sector megatrend.

The Cost Problem: Can We Compete with China?

Unfortunately, no good story is complete without a villain. In this case, it’s higher costs:

- Raw materials (steel, plastic, motors)

- Overtime wages and labour rules

- Logistics cost from inland factories to ports

- Higher interest rates for MSMEs

According to NITI Aayog, this gives India a 14–17% cost disadvantage over China. Ouch.

But there’s hope—India can overcome this by:

- Scaling up cluster-based manufacturing

- Improving labour productivity

- Offering PLI schemes for MSMEs

- Building tooling parks near ports and logistics hubs

And if all goes right, we could be looking at an India that exports tools worth $25 billion and creates 35 lakh jobs by 2035.

🇮🇳 India vs 🇨🇳 China: Hand & Power Tools Sector Snapshot

| Category | India | China |

|---|---|---|

| Current Exports (Hand Tools) | $600 million (1.8% market share) | $13 billion (50% market share) |

| Current Exports (Power Tools) | $470 million (0.7% market share) | $22 billion (40% market share) |

| Target by 2035 (Hand Tools) | 25% global market share (~$15B) | Likely to maintain lead |

| Target by 2035 (Power Tools) | 10% global market share (~$13B) | Dominant player |

| Global Market Share | Combined <2% | Combined ~45% |

| Cost Disadvantage | 14–17% higher costs | Lowest structural & operational costs |

| Manufacturing Scale | MSME-dominated, smaller scale | Large-scale factories & clusters |

| Raw Material Cost | Higher (steel, plastic, motors) | Lower due to scale and access |

| Labour Productivity | Lower, restricted overtime | High productivity, flexible labour |

| Logistics Efficiency | Inland factories = higher transport cost | Coastal clusters = export advantage |

| Government Support | PLI schemes, infra push, cluster dev | Long-standing subsidies, infra lead |

| Job Creation Potential | 35 lakh jobs in next 10 years | Already an employment hub |

What This Means for Investors

This is not just a manufacturing story—it’s a wealth creation story.

India is:

- Under-penetrated (less than 2% global market share)

- Cost-challenged but improving

- Government-backed with strategic support

The five stocks mentioned above—Stanley Lifestyles, Elgi Equipments, Lakshmi Machine Works, Ramkrishna Forgings, Ask Automobiles and Bharat Forge—are direct or indirect beneficiaries of this transformation.

They give you exposure to different parts of the value chain—from forged steel to precision machinery to air compression—and most importantly, to India’s export ambitions.

Final Thoughts

The Hand & Power Tools Sector might not sound as glamorous as AI or EVs, but when you peel back the layers, it’s one of the most underrated investment opportunities of this decade.

And as India tightens its grip on the global toolkit, the early investors will be the ones smiling.

Want to analyse these stocks with advanced screeners and live charts?

👉 Try Angel One for free – Click here to open your account in minutes.

FAQs on India’s Hand & Power Tools Sector

1. What is the hand & power tools sector?

The hand & power tools sector includes tools used for construction, manufacturing, repair, and DIY activities. Hand tools are operated manually (like hammers and spanners), while power tools are motor-driven (like drills, grinders, and saws).

2. Why is the hand & power tools sector important for India?

This sector is crucial because it can create 35 lakh jobs, attract MSME investments, and boost Make in India manufacturing. With global demand rising, India has a big chance to increase exports and reduce reliance on Chinese tools.

3. How much does India currently export in this sector?

India exports about $600 million worth of hand tools and $470 million in power tools, giving us less than 2% of the global market share. In comparison, China dominates with over 45% market share.

4. What is India’s export target for hand & power tools by 2035?

According to the NITI Aayog report, India is aiming for $25 billion in exports over the next 10 years—targeting 25% market share in hand tools and 10% in power tools.

5. What are the main challenges India faces in this sector?

India currently has a 14–17% cost disadvantage versus China due to:

- High raw material costs (steel, plastic, motors)

- Low labour productivity

- High logistics costs

- Limited economies of scale

But these can be overcome with the right government support, industrial clusters, and modern technology adoption.

6. Which Indian stocks can benefit from the growth of the hand & power tools sector?

Some listed companies likely to benefit are:

- Taparia Tools (unlisted but potential future IPO)

- Stanley Lifestyles Ltd. – recently listed, strong premium segment play

- Lakshmi Precision Screws – makes fasteners used in tool manufacturing

- RattanIndia Enterprises – entering smart tools via Revolt (EV-linked tech)

- Ramkrishna Forgings – supplies forgings to global tool and hardware brands

Each company has unique exposure to either tools, accessories, supply chains, or enabling technologies.

7. Can India really compete with China in tools manufacturing?

Yes, but it won’t be easy. With the right mix of cluster-based development, infrastructure upgrades, and support for MSMEs, India can chip away at China’s dominance. Rising global demand for China+1 sourcing also works in our favour.

8. What government initiatives are supporting this sector?

- PLI Schemes for manufacturing

- Skill India for labour upskilling

- PM Gati Shakti for better logistics

- Dedicated tool parks and industrial clusters under the Make in India push

9. How can small investors benefit from this opportunity?

Retail investors can:

- Invest in listed companies exposed to the hand & power tools sector

- Track announcements on PLI and cluster development

- Keep an eye on upcoming IPOs from MSMEs in the tools ecosystem

Related Articles

India Automotive Sector Stocks – NITI Aayog’s 2030 Vision