The week ended with a loud thud, not a soft sigh. On Friday, May 9, Indian investors witnessed another sharp sell-off, with the share market down for the second straight day. It wasn’t just a dip; it was a geopolitical sucker punch to investor sentiment.

Let’s break it down.

What Happened in the Market Today?

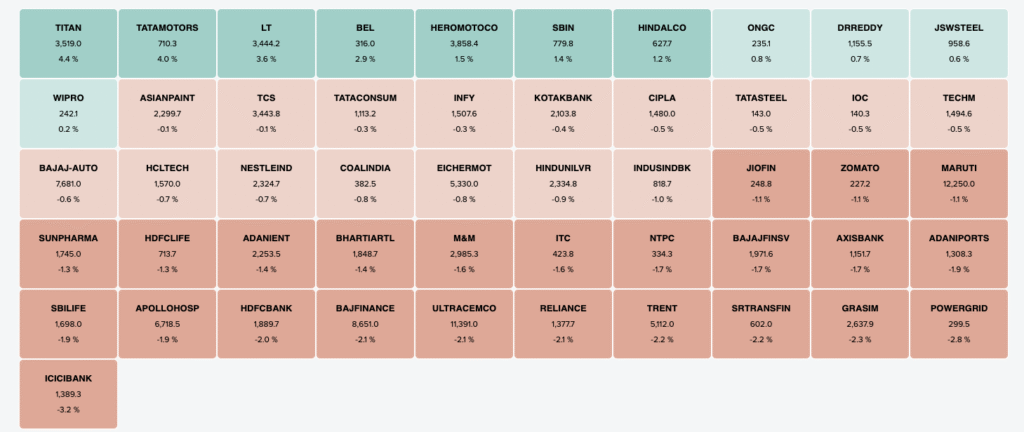

It started with some weakness at the open—then things got worse. As the day progressed, selling pressure intensified. The BSE Sensex crashed 880 points (-1.1%) while the NSE Nifty lost 266 points, ending below the 24,050 mark.

In short: red screens everywhere.

But not everything tanked. A few players stood tall—Titan, L&T, and Tata Motors posted gains. On the flip side, ICICI Bank, Grasim Industries, and Power Grid led the losers.

Meanwhile, GIFT Nifty (our mirror to global sentiment) ended 109 points lower at 24,080.

Share Market Down – Here’s Why

1. India-Pakistan Tensions Escalate

The biggest trigger? The border.

Indian forces reported multiple overnight drone and munition attacks by Pakistan along the western border. What started as retaliation for India’s earlier drone strikes is quickly snowballing into something far more serious.

Markets were hoping for another “surgical-strike-then-done” scenario. But this time, it’s looking more like a prolonged conflict. When nuclear-armed neighbors get involved in tit-for-tat, investors prefer watching from the sidelines.

Risk-off mode: ON.

2. Massive Sell-Off Across the Board

The tension wasn’t just at the border—it spilled over to Dalal Street.

Small-cap and mid-cap stocks got hit the hardest, dropping nearly 2% over the past five days. The broader market saw investors fleeing anything remotely risky, preferring to hold cash or safer large caps.

The result? A uniform downslide, especially in finance and realty sectors.

Interestingly, capital goods and metals bucked the trend slightly—perhaps on hopes of defence-driven capex. But overall, the tone was clear: caution ruled the day.

3. Rupee’s Fall Adds Salt to the Wound

Just when we thought it couldn’t get worse, the rupee said, “Hold my chai.”

It opened at ₹85.84 per dollar, down 12 paise from the previous close. This continues Thursday’s sharp drop and marks the rupee’s worst session in over two years.

Why does a weak rupee hurt?

- Makes imports (like crude oil) expensive

- Triggers foreign investor exit

- Spooks inflation expectations

Basically, the rupee joined the bears in dragging sentiment lower.

Quick Market Recap

| Index | Closing Level | Change |

|---|---|---|

| Sensex | 79,443 | -880 pts |

| Nifty 50 | 24,008 | -266 pts |

| GIFT Nifty | 24,080 | -109 pts |

| Rupee | ₹85.84/USD | -12 paise |

| Gold (MCX) | ₹96,120/10g | Slightly down |

| Silver (MCX) | ₹96,315/kg | -0.2% |

What Are Sectors Doing?

- Finance & Realty: Under pressure due to risk-off sentiment

- Metals & Capital Goods: Showed buying, likely from defence spending hopes

- Midcaps & Smallcaps: Down across the board

And as usual, volatility jumped, reminding traders that fear travels faster than logic.

Should You Panic?

If you’re a long-term investor: Definitely not.

If you’re a short-term trader: Strap in, this ride isn’t over yet.

While the market is down, it’s reacting to fear—not fundamentals. Geopolitical tensions can cause sudden spikes and dips, but India’s economic engine is still running.

This might be a time to be cautious, not cowardly.

Final Word: When Missiles Fly, Markets Dive

Today’s market crash had less to do with earnings or inflation, and more with missiles and border headlines. The share market down move reflects investor fear—not corporate weakness.

It’s a reminder that stock markets aren’t always about balance sheets. Sometimes, they’re about battlefields.

📢 Bonus Tip

Whether the market is up or down, staying informed is your best strategy. Many investors rely on tools like Angel One to track market news, place trades smartly, and never miss a technical breakout—even during geopolitical mayhem.

FAQs

Why is the share market down on May 9, 2025?

Due to rising India-Pakistan tensions, a weak rupee, and broader market sell-off.

Which sectors are most affected?

Finance, realty, and mid-cap stocks saw the biggest losses.

Has the rupee fallen again?

Yes. It dropped to ₹85.84 per USD, its lowest in over 2 years.

Is this a good time to buy?

Only if you’re a long-term investor and can handle short-term volatility.

What can reverse the fall?

De-escalation of geopolitical tensions and rupee stabilization could help.

Related Articles

Operation Sindoor: Defence Stocks to Watch