Introduction

Flexi Cap Mutual Fund is suddenly the star of 2025. In the last quarter, while the stock market crashed over 12%, most mutual fund investors saw their portfolios drenched in red—large-cap, mid-cap, small-cap, everything was bleeding.

Except one.

The lone warrior? Flexi Cap Mutual Fund. Especially the Parag Parikh Flexi Cap Fund, which shocked everyone by delivering a +12% return—right when everything else was sinking.

So why are investors flocking to this category now? Let’s break down the numbers, the reasons, and the rising trend.

What is a Flexi Cap Mutual Fund?

A Flexi Cap Mutual Fund is a type of equity fund that can invest across:

- Large-cap stocks (stable, well-established companies)

- Mid-cap stocks (growing companies with potential)

- Small-cap stocks (high-growth, high-risk plays)

Unlike other equity funds, Flexi Cap funds don’t have restrictions on where to invest. This flexibility allows fund managers to move money to whichever market segment they believe will perform best.

Think of it as a cricket all-rounder—able to bat, bowl, and field, depending on the match.

Mutual Fund Flows in March 2025: The Shift is Clear

According to AMFI data released on April 11, 2025:

- Equity mutual fund inflow fell 14% in March to ₹25,082 crore (from ₹29,303 crore in February).

- This was the third straight month of declining inflows.

- Yet, net inflows continue for the 49th month in a row—a sign that investors are still in the game, but becoming more selective.

Let’s look at how the major categories performed:

| Category | Inflow (Feb 2025) | Inflow (Mar 2025) |

|---|---|---|

| Sectoral/Thematic Funds | ₹5,711 crore | ₹735 crore |

| Flexi Cap Funds | ₹5,165 crore | ₹170 crore |

| Small Cap Funds | ₹3,722 crore | ₹4,092 crore |

| Mid Cap Funds | ₹3,406 crore | ₹3,439 crore |

| Large Cap Funds | ₹2,866 crore | ₹2,479 crore |

Observation:

- Sectoral/thematic funds saw a massive drop of nearly ₹5,000 crore in just one month. These are high-risk funds focused on specific industries.

- Investors are now pulling out of concentrated sector bets and moving towards diversified, flexible funds.

- Flexi Cap Mutual Funds, while down from February, still saw net positive inflows—unlike the sharp exit from thematic funds.

This clearly shows a shift in investor strategy: From “hot themes” to “smart diversification.”

Why Are Flexi Cap Mutual Funds Becoming a Safe Bet?

1. Full Freedom to Fund Managers

Flexi Cap funds allow managers to move between large, mid, and small caps based on market conditions. In a volatile or falling market, this flexibility becomes a big advantage.

Whereas sectoral funds are stuck in one theme—like IT, Pharma, or Infrastructure—Flexi Cap funds go wherever the opportunity lies.

2. Better Risk Management

By not putting all your eggs in one basket, Flexi Cap Mutual Funds help in balancing risk and reward. This is especially helpful when one segment (say, small caps) is too hot to handle, or when large caps are underperforming.

This balance is why they can outperform in bear markets and still do well during rallies.

3. Real-World Proof: Parag Parikh Flexi Cap

One of the most popular Flexi Cap funds, Parag Parikh Flexi Cap, delivered a 12% positive return in Q1 2025. At the same time, most other mutual funds were in the negative zone.

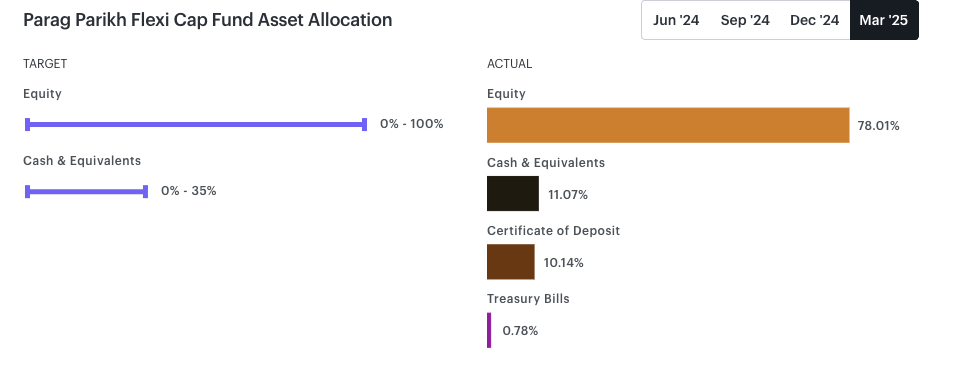

Part of its performance came from:

- Global exposure (stocks like Google, Meta, Amazon)

- Defensive Indian stocks like ITC and HDFC

- Smart asset allocation

Investors saw this and immediately recognised the value of a fund that adjusts itself without them needing to do anything.

So, Why the ₹170 Crore Inflow in March (vs ₹5,165 Crore in Feb)?

It’s true—the Flexi Cap category saw inflows drop to ₹170 crore in March from ₹5,165 crore in February.

Here’s how to interpret this:

- The huge February inflow was a direct reaction to the outperformance of funds like Parag Parikh.

- In March, investors turned slightly cautious due to overall market volatility.

- Yet, Flexi Cap still attracted inflows—unlike sectoral funds, which saw inflows crash from ₹5,711 crore to just ₹735 crore.

In short: Investors aren’t leaving Flexi Cap—they’re pausing to reassess.

Should You Consider Flexi Cap Mutual Funds in 2025?

If you’re:

- Tired of tracking which sector or cap is hot

- Want a long-term fund that adapts to market trends

- Prefer fewer surprises and smoother returns

Then Flexi Cap Mutual Fund is worth considering.

Instead of you switching funds every time the market mood changes, let the fund manager do the work. One SIP, multiple strategies.

Final Thoughts

March 2025 saw a visible shift in investor behavior. Money moved out of risky thematic funds and slowly into more flexible and balanced options.

The data is clear:

- Flexi Cap Mutual Funds continue to attract investor trust

- Performance, diversification, and adaptability make them a safer long-term choice

- Funds like Parag Parikh Flexi Cap show that the right strategy can beat the market, even in bad times

So while markets may go up and down, Flexi Cap Mutual Funds are proving they can handle both.

Looking for a low-stress, long-term way to invest?

Start exploring Flexi Cap Mutual Funds today.

🚀 Want to Start Investing in Flexi Cap Mutual Funds?

Start with Angel One, India’s trusted platform for smart investing.

Just one app, and you can explore top-rated Flexi Cap Mutual Funds, track performance, and start SIPs in minutes.

👉 No paperwork. No confusing jargon. Just intelligent investing, made simple.

Download Angel One now and take your first step towards smarter investing!

Frequently Asked Questions (FAQs)

1. What is a Flexi Cap Mutual Fund?

A Flexi Cap Mutual Fund is a type of equity fund that can invest in large-cap, mid-cap, and small-cap stocks—basically, it has the freedom to go anywhere. The fund manager can shift money based on where the best opportunities are.

2. Why did Flexi Cap Mutual Funds perform better in a falling market?

Because of their flexible strategy. While other funds were stuck in one segment, Flexi Cap funds like Parag Parikh Flexi Cap moved to safer or better-performing stocks and sectors. That helped them beat the market.

3. Is it safe to invest in Flexi Cap Mutual Funds now?

No mutual fund is 100% “safe,” but Flexi Cap funds offer a balanced risk-reward. They’re considered good for long-term investors who want diversification with flexibility.

4. Can beginners invest in Flexi Cap Mutual Funds?

Absolutely. They’re perfect for beginners because the fund manager handles allocation across market caps. It’s like getting a full-thali meal instead of picking one dish.

Related Articles

5 Evergreen Stocks in India That Actually Survive Small Cap Chaos