Introduction:

Did you know a new weight loss drug just dropped in India—and it can help you lose significant weight without intense gym routines or crash diets? The catch? It’ll cost you ₹17,345 per month for the basic dose, and up to ₹26,050 per month for the highest strength.

Too expensive? Maybe. But here’s why it matters more than you think.

India is in the grip of a silent but deadly epidemic: obesity. Over 254 million Indians are already living with generalized obesity, while 351 million face abdominal obesity. That means nearly half the adult population is at serious risk.

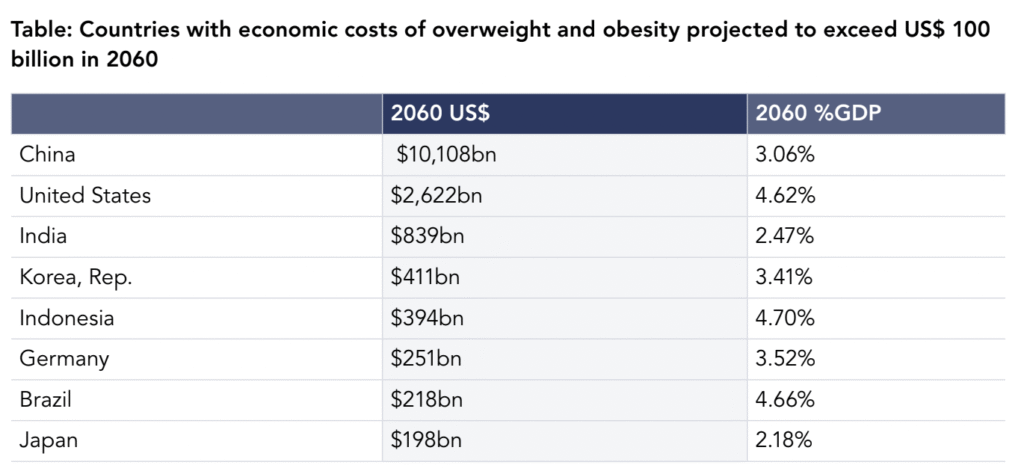

This isn’t just about looks—it’s about lives. Obesity is fueling a surge in type 2 diabetes, cardiovascular disease, hypertension, and liver complications. By 2060, the economic burden from obesity is expected to cross $838 billion, potentially consuming over 2% of India’s GDP.

Amid this growing crisis, a powerful new industry is emerging. Weight loss drug companies are racing to dominate the market with advanced therapies like GLP-1 receptor agonists. What was once considered elite medicine is now on the brink of mass adoption—especially with Indian pharma giants preparing to launch affordable generics by 2026.

This blog explores the hard facts behind India’s obesity challenge, the booming anti-obesity drug industry, and the top weight loss drug companies you should be watching closely—whether you’re an investor, a policymaker, or a concerned citizen.

Let’s dive in.

India’s Obesity Crisis: A Public Health Emergency in the Making

India is no longer battling just malnutrition. Today, the nation is facing the opposite problem—over-nutrition—on an alarming scale. What was once considered a “Western” lifestyle disease has now become one of India’s most pressing public health challenges.

The Numbers Tell a Troubling Story

According to the latest estimates:

- 254 million Indians are now living with generalized obesity.

- 351 million more suffer from abdominal obesity, which is strongly linked to chronic illnesses such as diabetes and heart disease.

- Nearly 1 in 4 urban Indians is overweight or obese, based on NFHS-5 data.

Meanwhile, the obesity burden is growing among women and children too:

- 10% of Indian women over the age of 20 are clinically obese—up sevenfold since 1990.

- 5% of men in the same age group fall into the obese category.

- Among youth, 5.2 million girls and 7.3 million boys (ages 5–19) are already affected.

Urban vs. Rural Divide

Urban lifestyles have significantly contributed to this epidemic. In fact, According to the National Family Health Survey (NFHS-5, 2019-2021), 33.2% of urban women and 29.8% of urban men in India are classified as overweight or obese. By contrast, the rates in rural India are lower—but the gap is narrowing, as lifestyle patterns in rural areas begin to resemble those in cities.

Why This Is More Than a Cosmetic Concern

Obesity is not just a visual or social issue—it is a biomedical condition with serious health implications. It increases the risk of:

- Type 2 diabetes

- Hypertension

- Cardiovascular disease

- Certain cancers

- Non-alcoholic fatty liver disease (NAFLD)

Moreover, a high Body Mass Index (BMI) is now among the top five contributors to cardiovascular-related deaths in India. Therefore, the health consequences are not theoretical—they are happening now and worsening every year.

The Economic Fallout Is Equally Severe

Beyond healthcare, obesity is becoming an enormous financial burden:

- In 2019, obesity-related conditions cost the Indian economy $28.95 billion.

- By 2030, this figure is expected to rise to $81.53 billion.

- Looking further ahead, the estimated cost balloons to $838.6 billion by 2060, threatening to consume up to 2% of India’s GDP.

As a result, addressing obesity is no longer optional—it’s a strategic imperative for both health policy and economic stability.

In summary, India’s obesity crisis is large, growing, and deeply embedded in our health and economy. However, this challenge is also giving rise to a powerful industry transformation.

In the next section, we’ll explore how weight loss drug companies and digital health startups are stepping in—and scaling fast—to meet this urgent demand.

India’s Weight Loss Industry Is Booming in Response

India’s obesity crisis may be spiraling, but the market’s response has been swift and strategic. As a result of rising health risks and growing public awareness, the weight management industry in India is undergoing a rapid transformation—and it’s attracting serious investment.

A Market on the Move

The Indian weight management market—which includes functional foods, supplements, fitness equipment, bariatric services, and digital platforms—was valued at USD 25.2 billion in 2024. By 2033, it’s projected to reach USD 55.9 billion, growing at a CAGR of 8.79%.

While some sources project the market to reach figures like USD 71.59 billion by 2030, others estimate it as high as USD 135.7 billion by 2030, This signals a growing shift toward consumer-led solutions like protein powders, fat burners, and metabolism boosters.

The Rise of Anti-Obesity Drugs

However, the most disruptive growth is happening in the pharmaceutical segment—particularly among weight loss drug companies. The Indian anti-obesity drug market has expanded more than fourfold in just five years, reaching ₹576 crore (≈USD 69 million) as of March 2025.

Moreover, this segment is expected to skyrocket with the entry of new, highly effective drugs such as GLP-1 receptor agonists, which help regulate blood sugar, appetite, and weight. Drugs like semaglutide (marketed as Wegovy and Rybelsus) and tirzepatide (Mounjaro) are already seeing massive demand.

In fact, the market for GLP-1 drugs in India—originally developed for type 2 diabetes—doubled to $3.6 billion in 2024, and is increasingly being repurposed for weight loss.

Key Drivers Behind the Boom

Several factors are fueling this surge:

- Firstly, the explosion in obesity and related diseases has created an urgent demand for solutions.

- Secondly, rising income levels and greater willingness to invest in personal health are driving consumer spending.

- Thirdly, the launch of advanced medications like GLP-1s is opening up entirely new segments of the population to treatment.

In addition, digital innovation is accelerating adoption. Platforms offering AI-powered diet coaching, teleconsultations, and fitness tracking are making weight management more accessible than ever.

Integration Across Sectors

This growth is not siloed. Rather, we’re witnessing an ecosystem shift:

- Fitness centers and bariatric clinics are expanding into tier-2 and tier-3 cities.

- Digital health startups like HealthifyMe are integrating prescription drug tracking with coaching services.

- Global pharma giants and Indian generics companies are racing to capture market share ahead of key patent expiries in 2026.

Therefore, India’s weight loss industry is no longer niche—it’s mainstream. And within this mainstream, weight loss drug companies are emerging as the key drivers of both innovation and accessibility.

The GLP-1 Revolution: Redefining Obesity Treatment in India

Until recently, weight loss treatments in India were limited to fad diets, under-regulated supplements, and costly surgical interventions. However, the arrival of GLP-1 receptor agonists has completely redefined the landscape—offering science-backed, prescription-based solutions with powerful clinical results.

What Are GLP-1s and Why Do They Matter?

GLP-1 (Glucagon-Like Peptide-1) receptor agonists are a class of medications originally developed for type 2 diabetes. Over time, researchers discovered that these drugs also helped patients significantly reduce body weight by curbing appetite, slowing digestion, and regulating insulin.

As a result, GLP-1s like semaglutide (branded as Rybelsus and Wegovy) and tirzepatide (Mounjaro) are now driving a paradigm shift in obesity treatment globally—and increasingly in India.

Staggering Growth Numbers

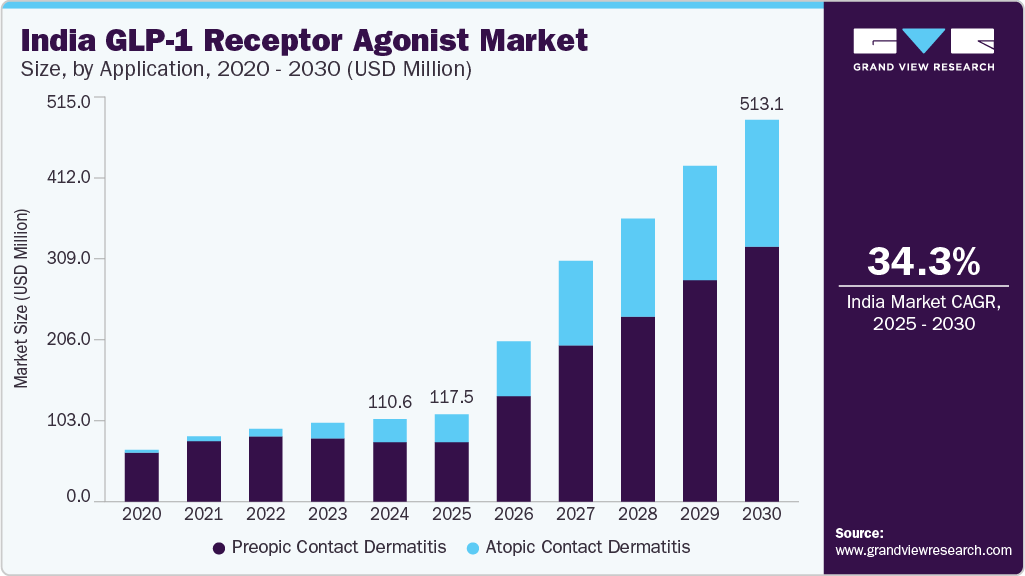

- In 2024, India’s GLP-1 receptor agonist market was valued at USD 82.2 million.

- It is projected to reach USD 352.3 million by 2030, registering a CAGR of 24.6%.

- Meanwhile, the broader anti-obesity drug market has grown more than 4x in five years, hitting ₹576 crore (≈USD 69 million) by March 2025.

Moreover, these figures are likely to surge even further post-2026—when key patents for semaglutide are set to expire in India.

Game-Changing Products and Launches

- Novo Nordisk officially launched Wegovy in India on June 24, 2025, with a bold plan to generate ₹8,600 crore (~USD 1 billion) in sales within 5–7 years.

- Eli Lilly, meanwhile, launched Mounjaro in March 2025, and within just three months, unit sales crossed 81,000—with a 60% month-on-month rise.

These launches are not only reshaping treatment protocols but also transforming the pharma landscape in India. In fact, they are setting the stage for one of the most competitive battles the Indian pharmaceutical market has seen in years.

Why GLP-1s Are Disruptive

- Unmatched Efficacy: Clinical studies show up to 23% body weight reduction, outperforming other drug classes.

- Dual Impact: Effective in managing both obesity and type 2 diabetes—a two-in-one solution for millions of Indians.

- Patient Compliance: Weekly injections or oral formats like Rybelsus are far easier to manage than traditional weight loss regimens.

Therefore, these drugs are not only medically superior—they’re patient-friendly and market-ready.

Challenges and Opportunities

However, affordability remains a hurdle. Currently, GLP-1 treatments like Wegovy are priced between ₹17,345 and ₹26,050 per month, limiting their access to high-income segments.

That said, this will likely change dramatically with the patent expiry of semaglutide in March 2026. Indian generics manufacturers are already preparing to enter the market with cost-effective alternatives—some projected to be 50–70% cheaper.

Consequently, the post-2026 period is expected to see mass-market adoption, turning obesity treatment from an elite option into a scalable public health solution.

In short, GLP-1s are not just drugs—they represent a new category of obesity management. For weight loss drug companies, they offer the fastest-growing, most lucrative opportunity in India’s pharmaceutical landscape today.

Companies to Watch: Leaders in the Obesity Drug Race

India’s pharmaceutical landscape is shifting rapidly. As demand for obesity treatment rises, companies—both global and domestic—are racing to capture market share. These weight loss drug companies are not only introducing breakthrough medications but also reshaping strategies around access, pricing, and innovation.

1. Novo Nordisk India: First Mover, Deep Focus (Unlisted)

Novo Nordisk has led India’s GLP-1 drug wave. The company launched Wegovy—its flagship weight loss injection—on June 24, 2025. Its pricing ranges from ₹17,345 to ₹26,050 per month, depending on dosage.

They plan to generate ₹8,600 crore (~USD 1 billion) in sales over the next 5–7 years. To achieve this, Novo Nordisk has built a robust go-to-market strategy involving:

- Partnerships with hospitals and clinics

- Doctor education programs

- Multi-tiered pricing options for urban and semi-urban markets

Notably, their earlier GLP-1 drug Rybelsus (oral semaglutide) captured 69% of the Indian anti-obesity drug market by March 2025, soaring from ₹11 crore to ₹397 crore in sales within three years.

2. Eli Lilly India: High-Efficacy Challenger (Unlisted)

Eli Lilly entered the Indian market in March 2025 with Mounjaro (tirzepatide)—a dual-action GLP-1/GIP agonist.

In just three months, the drug recorded:

- Over 81,000 unit sales

- A 60% jump in month-on-month demand

- Revenue of nearly ₹24 crore

They’ve priced Mounjaro competitively—between ₹3,500 and ₹4,375 per vial—translating to ₹14,000–₹17,500 per month. Their strategy focuses on volume-driven growth, targeting chain pharmacies and physician networks.

3. Cipla, Sun Pharma, Dr. Reddy’s: Preparing for Generic Disruption

Indian pharma leaders know the real opportunity begins in March 2026, when the Indian patent for semaglutide expires.

- Cipla plans to launch oral semaglutide and expand its GLP-1 range. It has flagged obesity treatment as a “significant market opportunity.”

- Sun Pharma is developing Utreglutide (GL0034), a novel GLP-1 therapy already in early clinical trials. It aims for global rollout within five years.

- Dr. Reddy’s is building a pipeline of 15 GLP-1 drugs, registering them globally for swift launch post-patent.

These companies are not waiting for the opportunity—they’re building capacity, filing regulatory approvals, and investing in affordable large-scale production.

4. Biocon, Glenmark, Natco & Others: Focused on Biosimilars

- Biocon recently launched liraglutide biosimilars in the UK and is preparing to bring similar offerings to India post-2026.

- Glenmark released Lirafit, a liraglutide biosimilar, and is seeing strong adoption among Indian doctors.

- Natco Pharma and Zydus Lifesciences are investing in semaglutide production lines, aiming to cut manufacturing costs significantly.

- Lupin, Mankind, Aristo, and Torrent Pharma are also positioning themselves for an aggressive generic rollout after 2026.

Each of these companies brings strong distribution networks, cost-efficiency, and brand recognition—key ingredients to winning in India’s highly price-sensitive market.

Why Investors Should Watch Closely

The next 12–24 months will determine market leadership in India’s weight-loss revolution. Companies that move fast, scale smart, and price accessibly will dominate.

In fact, many of these weight loss drug companies are laying the foundation for India’s next blockbuster pharma segment—one that directly addresses a growing public health crisis.

Digital Health & Integration: Scaling Obesity Care Beyond Clinics

As India’s healthcare system becomes more digitally enabled, a new class of startups and digital platforms is stepping in to support—and in many cases, amplify—the impact of weight loss drug companies.

The Numbers Prove the Trend

India’s digital health for obesity market stood at USD 1.89 billion in 2023, and projections indicate it will reach USD 8.63 billion by 2030, growing at an impressive CAGR of 24.2%.

This growth reflects more than just fitness apps—it includes:

- AI-powered nutrition and fitness coaching

- Remote monitoring of patients using GLP-1 drugs

- Teleconsultations and prescription platforms

- Weight management SaaS platforms for doctors and clinics

The Role of Homegrown Startups

Startups like HealthifyMe, Noom India, and Fitterfly have raised fresh capital in 2024–25 to expand their digital care services. Their platforms now integrate:

- GLP-1 treatment tracking

- Personalized diet planning

- Exercise guidance based on real-time metrics

- Mental health coaching to support behavior change

Moreover, some of these platforms are partnering with hospitals and diagnostic labs to offer complete obesity management programs—without needing in-person visits.

Why This Integration Matters

- Firstly, it brings GLP-1 drugs to patients outside metros.

- Secondly, it helps ensure treatment adherence—critical to long-term outcomes.

- Thirdly, it enables early detection of side effects and supports medication adjustments.

Consequently, digital integration isn’t a parallel trend—it’s a necessary enabler. As more Indians turn to weight loss drug companies for pharmacological support, digital tools will serve as the infrastructure for delivery, monitoring, and behavior reinforcement.

Conclusion: India’s Pharma Megatrend Is Here—and You Shouldn’t Miss It

India is confronting one of its biggest health threats in decades. But at the same time, it is nurturing one of its biggest healthcare opportunities: the rise of the anti-obesity drug market.

From urban health clinics to rural telemedicine setups, a multi-billion-dollar shift is underway. Weight loss drug companies—once niche players—are now poised to become household names. GLP-1 receptor agonists, in particular, could revolutionize how India treats both obesity and type 2 diabetes, especially once generics flood the market post-2026.

If you’re an investor, a healthcare entrepreneur, or a policymaker, this is the trend to watch.

- The numbers are massive

- The science is solid

- The demand is urgent

- And the disruption is already happening

The next blockbuster pharma wave in India isn’t about painkillers, antibiotics, or even cancer drugs. It’s about weight loss drug companies that are tackling the nation’s most visible, yet most under-addressed, health crisis.

Now is the time to watch this space—or better yet, participate in it.

Explore pharma stocks poised to ride India’s obesity drug boom.

Track top weight loss drug companies, get early insights, and invest smarter with Angel One—India’s trusted platform for data-backed investing. 👉 Open your free Demat account now!

FAQs: Indian Obesity Drug Market & Weight Loss Drug Companies

1. What are GLP-1 receptor agonists and how do they help with weight loss?

GLP-1s regulate appetite and blood sugar. They slow digestion and reduce food intake, leading to sustained weight loss.

2. Which companies currently sell GLP-1 drugs in India?

Novo Nordisk (Wegovy, Rybelsus) and Eli Lilly (Mounjaro) are the current leaders, with others like Cipla, Dr. Reddy’s, and Sun Pharma preparing to enter.

3. Why are these weight loss drugs so expensive right now?

Current prices (₹17,000–₹26,000/month) reflect patent protection and import costs. Prices will drop significantly after 2026 as Indian generics enter the market.

4. When will cheaper, generic versions be available in India?

The Indian patent for semaglutide expires in March 2026, unlocking the market for generics from Indian pharma giants.

5. Are Indian companies investing in obesity drugs?

Yes. Cipla, Sun Pharma, Biocon, and Dr. Reddy’s are actively building manufacturing pipelines and biosimilar programs.

6. Is the demand for these drugs actually strong in India?

Yes. GLP-1 sales have surged over 4x in the past 5 years. Urban demand is especially high, and uptake is expected to rise with lower prices.

7. What’s the link between diabetes and obesity drugs?

Many GLP-1 drugs treat both type 2 diabetes and obesity. They help manage weight, improve insulin sensitivity, and lower cardiovascular risk.

8. Will digital health startups benefit from this trend?

Definitely. Platforms like HealthifyMe and Fitterfly are already integrating GLP-1 tracking and remote obesity management services.

9. Is this just a short-term trend or a long-term opportunity?

It’s a long-term megatrend. India’s obesity burden is projected to rise through 2050, making pharmacological and digital solutions critical.

10. How can I invest in this opportunity?

Look at listed Indian pharma companies entering the GLP-1 space (Cipla, Sun Pharma, etc.) or invest through mutual funds with strong healthcare exposure—track them on Angel One.

Related Articles

India’s Yoga Economy: How Baba Ramdev Bent the Wellness Industry into a Business Empire

India’s Sparkling Shift to Lab-Grown Diamonds