In the world of flashy tech IPOs and headline-hungry unicorns, it’s easy to miss companies that quietly build for decades—refining their product, expanding their customer base, and staying consistently profitable. Virtual Galaxy Infotech is one such company. And now, after 27 years of flying under the radar, it’s ready to list on the NSE SME platform.

Let’s be honest—most investors look at a small-town tech firm and move on. But this one? It deserves a closer look.

Not because of hype. But because of numbers, profitability, scale—and most importantly, potential.

A Tech Firm That’s Been Doing the Work for 27 Years

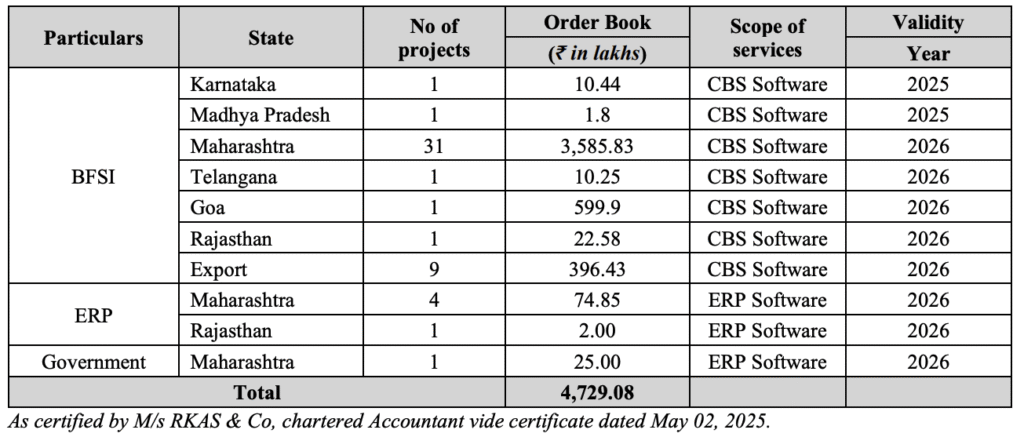

While everyone chased B2C glamour, Virtual Galaxy Infotech Ltd. (VGIL) quietly built B2B software solutions that now serve over 5,000 bank branches, dozens of manufacturing firms, and even clients in Tanzania and Malawi. Based in Nagpur, VGIL has made a name for itself in providing core banking software, ERP, e-governance platforms, cloud and data centre solutions.

At the heart of it lies their flagship platform—e-banker, a robust core banking solution used by cooperative banks, NBFCs, and other financial institutions to manage operations, customer service, and compliance.

This isn’t a “two-year-old startup” story. It’s a mature, deeply integrated tech firm that now wants to scale.

And it’s inviting investors to be part of that journey.

The IPO: Clean, Straightforward, and Growth-Driven

The Virtual Galaxy Infotech IPO is a ₹93.29 crore fresh issue of 65.7 lakh shares. No offer-for-sale gimmicks, no confusing dilution structures. Just a clear raise for building future capability.

| Details | Info |

|---|---|

| IPO Dates | May 9 to May 14, 2025 |

| Price Band | ₹135 to ₹142 |

| Lot Size | 1,000 shares |

| Retail Investment | ₹1,42,000 (suggested) |

| Listing Exchange | NSE SME |

| Tentative Listing | May 19, 2025 |

And what will they do with your money? Not burn it on branding or celebrity ads. VGIL will:

- Set up a new development centre in Nagpur

- Invest in data centre infrastructure (GPU, servers, storage)

- Hire tech talent for product upgrades

- Pay off borrowings

- Strengthen marketing and business development

In short: they’re raising funds to grow—not to exit.

Business Model: Recurring, Resilient, and Real

VGIL earns its money by offering software solutions across banking, manufacturing, education, and even agriculture.

Their products aren’t built for app store downloads—they’re built for critical infrastructure.

Once integrated into a bank or manufacturer, these systems are rarely replaced. That means long-term clients, annual renewals, and steady income.

Their revenue mix includes:

- Core product licenses

- AMC (Annual Maintenance Contracts)

- Consulting

- System integrations

- Cloud infra support

This isn’t a revenue model that depends on downloads. It’s grounded in mission-critical tech.

Financials That Speak Louder Than Marketing

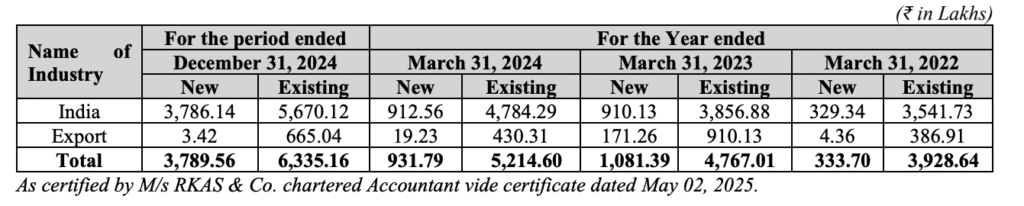

Over the past few years, VGIL has quietly built strong financials. Here’s a look:

| FY | Revenue (₹ Cr) | PAT (₹ Cr) |

|---|---|---|

| 2022 | 43.44 | 0.40 |

| 2023 | 59.76 | 0.72 |

| 2024 | 63.58 | 16.54 |

Yes, you read that right.

Profit shot up from ₹0.72 crore in FY23 to ₹16.54 crore in FY24, thanks to scale efficiencies, a stronger product lineup, and improved margins.

With a PAT margin of 26.04%, the business is not just growing—it’s highly profitable.

And in case you love performance metrics:

- ROE: 53.52%

- ROCE: 31.68%

- RoNW: 39.95%

- Debt/Equity: 0.93 (conservative)

Even among its SME peers, VGIL is standing tall.

Peer Comparison: How Virtual Galaxy Infotech IPO Stacks Up?

Here’s how VGIL stacks up against similar tech players recently listed on the SME platform:

| Company Name | EPS (₹) | NAV (₹) | RoNW (%) | P/E (x) | P/BV |

|---|---|---|---|---|---|

| Virtual Galaxy Infotech | 9.88 | 24.81 | 39.82 | 21.35 | 5.92 |

| Veefin Solutions Ltd | 2.74 | 52.70 | 6.95 | 216.22 | 5.90 |

| Trust Fintech Ltd | 7.13 | 25.71 | 34.58 | 25.53 | 3.76 |

| Network People Services Tech (NPST) | 13.78 | 29.67 | 62.04 | 201.86 | — |

While NPST edges out in RoNW, VGIL leads in profitability, consistency, and growth quality. It also benefits from stronger diversified revenues and deeper vertical focus.

A Growth Story with Roots in Bharat

Unlike flashy urban tech startups, VGIL is rooted in tier-2 India—Nagpur. And from there, it has expanded across 15 Indian states and two African nations.

That’s strategic. Rural banks, co-operatives, and public systems are undergoing rapid digitalisation. This is VGIL’s stronghold.

And while the tech bros talk about “AI in Finance,” VGIL is out there actually powering financial inclusion through its core banking stack.

Add to that the strong demand for BFSI tech, and you have a recipe for sustained growth.

Virtual Galaxy Infotech IPO Apply or Not?

If you’re looking for:

- A tech business with real earnings

- A listing on NSE SME with solid growth plans

- Reasonable valuation (compared to other recent tech IPOs)

- Exposure to India’s fintech infra wave

Then yes, VGIL is worth your attention.

Is there risk? Of course. It’s an SME IPO. Liquidity will be limited. And small-cap volatility is a given.

But if you’re an investor who looks for strong fundamentals, sticky business, and tech depth, this is not one to ignore.

Final Thought

Virtual Galaxy Infotech is not here to dazzle you with hype. It’s here to quietly deliver consistent software solutions that power financial institutions and governments across India—and now, the world.

Its IPO is not a media circus. It’s a focused capital raise aimed at infrastructure, expansion, and R&D.

🟢 If that sounds like your kind of investment, it’s time to act. Open a free Demat account on Angel One, apply for SME IPOs with ease, and start building a portfolio rooted in logic—not noise.

FAQs: Virtual Galaxy Infotech IPO

1. What is the price band for Virtual Galaxy Infotech IPO?

The IPO price band is ₹135 to ₹142 per share. Experts suggest applying at the upper end (₹142) to avoid missing out due to oversubscription.

2. When does the IPO open and close?

The IPO opens on May 9, 2025, and will close on May 14, 2025.

3. How much do retail investors need to apply?

Retail investors must invest ₹1,42,000 for 1 lot (1,000 shares), which is the minimum and maximum allowed for retail applications.

4. Where will the shares be listed?

The shares will be listed on the NSE SME platform, with a tentative listing date of May 19, 2025.

5. Who are the promoters of Virtual Galaxy Infotech?

The company is promoted by Avinash Narayanrao Shende and Sachin Purushottam Pande.

6. What does Virtual Galaxy Infotech do?

It is an IT services company offering core banking software, ERP, and digital solutions to banks, NBFCs, cooperatives, and manufacturers.

7. Is the company financially strong?

Yes. It reported ₹16.54 crore PAT in FY24 with a RoNW of 39.82%, and maintains a healthy PAT margin of 26.04%.

8. How does it compare to its listed peers?

Compared to Veefin and Trust Fintech, VGIL has a higher EPS and RoNW, with a more reasonable valuation and steady margins.

9. What will the IPO proceeds be used for?

The company plans to spend on R&D, hiring, infra upgrades, data center equipment, and marketing.

10. Should you apply for this IPO?

If you’re looking for an SME IPO with strong fundamentals, steady clients, and growth in BFSI tech, this one looks promising. As always, evaluate your risk profile.

Related Articles

India’s MSME Revolution: Growth, Gaps & Stocks to Watch