Introduction: Why Cybersecurity Matters More Than Ever

In the age of digital everything—payments, healthcare, government, and even groceries—cybersecurity has become a non-negotiable need. As India rapidly transforms into a digitally driven economy, the threats to data, infrastructure, and identity are growing at breakneck speed.

Globally, the cybersecurity market was valued at USD 245.62 billion in 2024, and it’s set to nearly double to USD 500.7 billion by 2030, growing at a CAGR of 12.9%, according to Grand View Research. This isn’t just a tech story—it’s an investment story. And it’s one that India is central to.

Let’s dive into why investing in cybersecurity is not only critical but also potentially rewarding.

The Growing Importance of Cybersecurity in India

Cyberattacks: A Rising National Threat

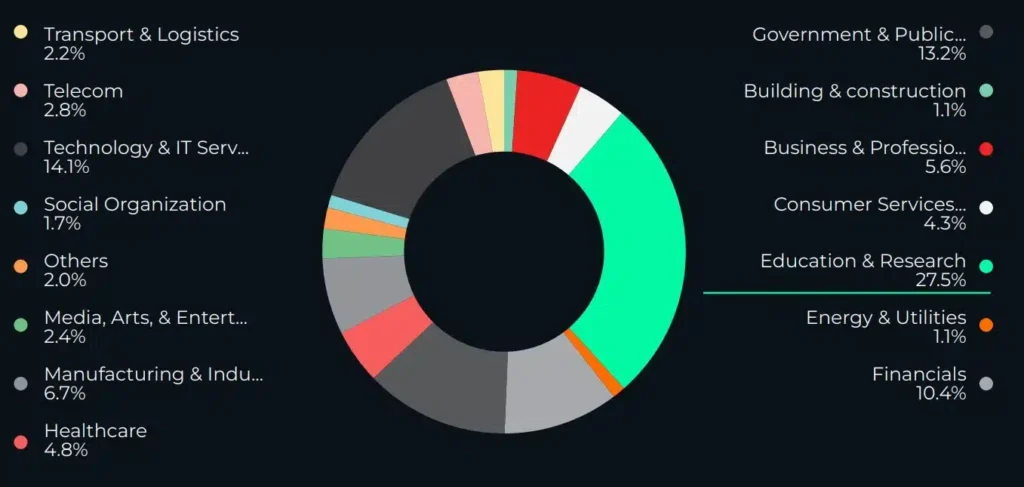

The number of cyberattacks is skyrocketing—especially in India. As per CERT-In, the number of incidents targeting government organizations jumped from ~48,000 in 2021 to over 192,000 in 2022. That’s a 4x spike in just one year.

Globally, sectors like healthcare are also under siege. The US alone saw 133 million patient records breached in 2023, revealing just how high the stakes are.

Enterprises like Check Point Software are seeing their future revenues (RPO) grow faster than current revenues—a sign that businesses are aggressively locking in cybersecurity investments.

Regulatory Push: India Tightens Digital Defenses

India is taking action. The Digital Personal Data Protection (DPDP) Act is a landmark law focused on protecting user data and mandating stringent cybersecurity compliance. It’s prompting businesses to ramp up investment in digital security.

Governments, infrastructure operators, and private enterprises are joining forces to build resilient systems. The infrastructure protection segment is booming, aimed at shielding everything from telecom networks to railways and logistics.

The Tech Multiplier: AI, IoT & Cloud Raise the Stakes

While tech brings efficiency, it also brings risk. The proliferation of AI, IoT, and cloud computing has made businesses more exposed to cyber threats.

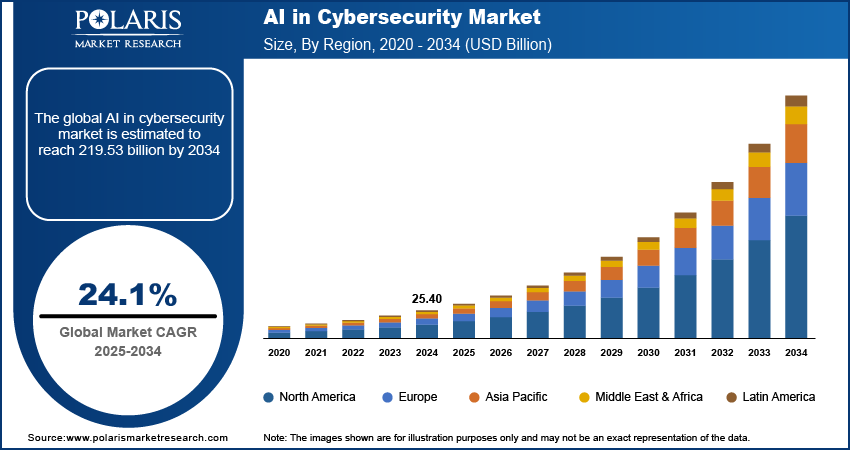

According to Polaris Market Research, AI in cybersecurity is expected to grow at 24% CAGR through 2034. Tools like Infinity Copilot by Check Point—an AI-based security assistant—are already seeing large-scale adoption. The demand for smarter, predictive cybersecurity tools is exploding.

Indian Cybersecurity Stocks to Watch: Deep Dive

India may not have pure-play global cybersecurity giants like Palo Alto Networks or CrowdStrike (yet), but it does have promising tech companies that are building serious capabilities in digital security. These companies are either directly offering cybersecurity products or embedding advanced security services into their broader digital solutions.

Let’s break down the key Indian cybersecurity-related stocks you should keep an eye on:

1. Happiest Minds Technologies (NSE: HAPPSTMNDS)

What it does:

Happiest Minds is a digital transformation company with a strong focus on cloud, analytics, artificial intelligence, and of course—cybersecurity. It provides security services across infrastructure, application, and data layers, including offerings like:

- Security information and event management (SIEM)

- Risk & compliance management

- Threat detection and response

- Identity & access management

Why it matters:

As Indian enterprises modernize their tech stack, Happiest Minds is positioning itself as a trusted digital partner. With over 20% of its revenue coming from digital infrastructure and security services, it is increasingly viewed as a cybersecurity enabler.

Recent performance & potential:

The company has delivered strong YoY revenue growth in previous quarters and maintains high EBITDA margins (~25–26%). It has long-standing partnerships with key cybersecurity vendors like Microsoft, AWS, and Palo Alto Networks, enhancing its credibility.

2. Quick Heal Technologies (NSE: QUICKHEAL)

What it does:

Quick Heal is perhaps India’s most recognizable consumer antivirus brand. But it has evolved beyond that, building an enterprise-focused cybersecurity arm under the brand Seqrite.

Quick Heal offers:

- Antivirus & anti-malware software

- Endpoint detection and response (EDR)

- Network security tools

- Data protection & encryption

Why it matters:

With rising attacks on MSMEs, schools, hospitals, and local governments, Quick Heal’s reach in Tier-2 and Tier-3 cities positions it uniquely to democratize cybersecurity. It also benefits from a strong legacy distribution network across India.

Recent moves:

Quick Heal has announced its intent to pivot more aggressively towards enterprise security, and its R&D spend remains consistently among the highest in its segment. While revenue growth has been flat in recent years, any success in enterprise market penetration could re-rate the stock.

3. Tata Elxsi (NSE: TATAELXSI)

What it does:

Tata Elxsi is a design and technology company under the Tata Group. While it’s better known for embedded systems, automotive software, and design-led digital transformation, cybersecurity is becoming a core offering—especially in IoT and autonomous tech.

Cybersecurity services from Tata Elxsi include:

- Secure architecture for embedded devices

- Automotive cybersecurity for connected vehicles (including EVs)

- Secure connectivity solutions in MedTech and consumer electronics

Why it matters:

Tata Elxsi’s relevance in cybersecurity is future-facing. As more industries adopt IoT, smart mobility, and connected devices, Elxsi is emerging as a key player ensuring those systems stay secure.

Financial edge:

The stock has been a multibagger over the past few years, driven by premium positioning and consistent growth. With global partnerships in EV and MedTech security, it’s well-placed in niche but scalable cybersecurity applications.

4. eMudhra (NSE: EMUDHRA)

What it does:

eMudhra is India’s leading licensed Certifying Authority under the Ministry of IT. It specializes in digital trust, identity management, and paperless transformation, all of which are tightly linked to cybersecurity.

Core services include:

- Digital signature certificates (DSCs)

- Public key infrastructure (PKI)

- Digital onboarding and document signing platforms

- Authentication, encryption & privacy tools

Why it matters:

With growing demand for secure digital documentation and electronic signatures—especially in BFSI, healthcare, and legal services—eMudhra plays a critical infrastructural role in cybersecurity and compliance.

Growth drivers:

eMudhra has over 35-40% market share in India’s DSC issuance and is expanding into international markets. It already has enterprise clients in over 20 countries and has partnered with governments and financial institutions, which gives it strong revenue visibility.

Honorable Mentions (Emerging or Indirect Players)

- Infosys and TCS: Not pure-play, but offer managed security services and cyber consulting to global enterprises.

- Cyient: Offers engineering security services, especially in aerospace and defence domains.

Investment Insight: Look Beyond Just Labels

Many of these Indian cybersecurity-related stocks are hybrid businesses—meaning cybersecurity is part of a broader IT or digital services offering. That’s why due diligence is key. Here are some red flags and green flags to consider:

Green Flags:

- Growing cybersecurity-specific revenues or segment reporting

- Strategic tie-ups with global security providers (like Palo Alto, Check Point)

- R&D in AI/ML-based threat detection

- Entry into regulated sectors like BFSI or government contracts

Red Flags:

- Lack of standalone revenue data for cybersecurity segments

- Slow pivot to cloud-native or enterprise solutions

- High customer concentration or legacy product reliance

How to Get Broader Exposure

While there’s no pure-play cybersecurity index on NSE or BSE, you can track the space via:

- Nifty IT Index

- S&P BSE IT Index

These indices often include companies with cybersecurity offerings as part of broader digital portfolios.

Alternatively, thematic ETFs and mutual funds focused on tech or digital innovation can offer partial exposure.

Top Cybersecurity Trends Investors Should Know

1. Cloud-Native Security: Growth Powerhouse

With businesses migrating to the cloud, cloud-native cybersecurity solutions are seeing explosive growth. This subsegment is projected to grow at 15.9% CAGR globally from 2025 to 2030.

Global players like CrowdStrike and Zscaler are innovating in this space, offering AI-powered endpoint and internet security for modern cloud architectures.

2. Zero-Trust Architecture: Never Trust, Always Verify

The old perimeter-based security model is out. Zero-trust frameworks demand that every access request be verified, regardless of the user’s location.

Global leaders like Okta (identity and access management) are at the forefront, and Indian firms are increasingly adopting similar models for enterprise networks.

3. AI & ML in Cyber Defense: Smart Security is the Future

AI is now a frontline warrior in cyber defense. It’s being used for threat detection, predictive analytics, and automated response.

As per Grand View Research, vendors are prioritizing AI-augmented tools to fight new-age threats. Expect a surge in adoption across banks, telecoms, healthcare, and even MSMEs.

Is Cybersecurity a Smart Long-Term Bet?

Absolutely. The digitalization of India is irreversible, and cyber risks are scaling with every transaction, login, or software update. For investors, this is more than just a short-term tech play—it’s a foundational pillar for the future economy.

However, the space is competitive, constantly evolving, and subject to regulatory and geopolitical risks. It’s crucial to track not just stock prices but also product pipelines, R&D investments, and partnerships.

Final Thoughts: Cybersecurity as a Strategic Investment

If there’s one thing we’ve learned from the digital revolution, it’s this: Cybersecurity is no longer optional—it’s foundational. For investors, that makes this sector a rare mix of necessity and growth.

Whether you’re bullish on AI, digital payments, cloud software, or just want to future-proof your portfolio—investing in cybersecurity offers one of the most compelling stories of the decade.

Ready to Invest in the Future of Cyber Security?

Start your journey with Angel One – get access to top-performing tech and cybersecurity stocks, in-depth research, and seamless investing tools.

👉 Open your free Demat account today and stay ahead in the digital game.

FAQs: Investing in Cyber Security

Q1. What is investing in cyber security?

It means putting money into companies that create or offer products and services to protect systems, data, and networks from cyber threats.

Q2. Why should I consider investing in cyber security now?

With rising cyberattacks, digital transformation, and stricter data laws, cybersecurity is a high-growth sector with long-term potential.

Q3. Is investing in cyber security a good idea for Indian investors?

Yes. India’s digital economy is booming, and cybersecurity companies are expected to benefit significantly from this growth.

Q4. Which Indian stocks are best for cyber security investments?

Notable companies include Happiest Minds, Quick Heal Technologies, Tata Elxsi, and eMudhra, all with strong exposure to cybersecurity.

Q5. Can I invest in international cybersecurity companies from India?

Yes. Through international mutual funds or brokers offering global access, Indian investors can invest in companies like Palo Alto Networks or CrowdStrike.

Q6. What are the risks of investing in cyber security stocks?

Cybersecurity is a competitive and fast-changing space. Risks include tech obsolescence, regulatory shifts, and market saturation.

Q7. Are there mutual funds or ETFs focused on cyber security?

Globally, yes. There are cybersecurity-specific ETFs like HACK and CIBR. In India, thematic tech funds may offer indirect exposure.

Q8. How does AI impact cyber security investing?

AI enhances threat detection and prevention. Companies using AI in cybersecurity are often seen as more future-ready and scalable.

Q9. How can beginners start investing in cyber security?

Use trusted brokers like Angel One to open a Demat account, research cybersecurity stocks or funds, and begin with a diversified portfolio.

Q10. Will cyber security continue to grow in the future?

Absolutely. With rising digital usage, IoT adoption, and cloud migration, the demand for cyber protection will only increase.

Related Articles

Virtual Galaxy Infotech IPO: All You Need to Know Before Investing