A Historic Shift: Tata Motors Just Hit the Reset Button

Tata Motors, one of India’s most iconic automobile companies, just announced a move that could reshape its entire future. After 78 years of operating as a unified business, the company has decided to split its operations into two distinct listed entities—separating its Passenger Vehicle (PV) and Commercial Vehicle (CV) businesses.

This strategic restructuring, known as the Tata Motors Demerger, was overwhelmingly approved by shareholders—with a jaw-dropping 99.9995% in favor.

But why now? And more importantly—what does it mean for investors?

Let’s dive in.

What Exactly Is the Tata Motors Demerger?

The Tata Motors Demerger, first announced in March 2024, is a classic case of a business trying to unlock hidden value. The plan?

Split into:

- Tata Motors Passenger Vehicles Ltd (TMPV): Includes PV, EVs, and luxury arm Jaguar Land Rover (JLR).

- Tata Motors Commercial Vehicles Ltd (TMLCV): Will focus on trucks, buses, and all commercial transport.

In short, each new company gets to run on its own track, with its own growth engine—and zero distractions.

Why Demerge Now?

This move isn’t random. It’s strategic—and overdue.

Minimal Synergies Between CV and PV Businesses

Their operations, growth drivers, and customer bases are different. While CV depends on infrastructure and logistics demand, PV thrives on consumer trends and tech innovation.

Enhanced Strategic Focus

With separate leadership and goals, both arms can chart clearer, faster paths. For example, TMPV can double down on JLR, EVs, and autonomous driving—without worrying about truck sales.

Value Unlocking

Two focused businesses = easier valuation = more investor interest. Think Reliance-Jio split kind of buzz (but in autos).

Why the Split Makes Strategic Sense

Let’s be honest: the PV and CV businesses are different beasts.

| Aspect | Passenger Vehicles (PV) | Commercial Vehicles (CV) |

|---|---|---|

| Customer Base | Individual consumers | Businesses, logistics companies |

| Growth Drivers | Innovation, tech, style, EVs | Infrastructure push, fleet demand |

| Key Brand | JLR, Tata Nexon, Tata EVs | Tata Trucks, Buses, LCVs |

| Future Focus | Electric mobility, premium offerings | Logistics, EV trucks, smart transport |

These two segments barely share synergies. So, running them under one roof only creates complexity.

Post-demerger, each business gets:

- Operational freedom

- Leadership focus

- Tailored capital allocation

- Clearer investor appeal

That’s corporate yoga—flexibility, clarity, and better balance.

What Will Shareholders Get?

Here’s the good news—nobody’s losing anything.

- Under the 1:1 demerger ratio, shareholders will receive equal shares in both listed companies.

- This means for every ₹2 share you own in Tata Motors today, you’ll get one share in TMLCV (the new CV arm).

It’s a value-neutral move upfront, with the potential for long-term value creation.

Recent Sales Numbers: Not All Sunshine and Sales

While the restructuring may be futuristic, recent sales data reveals some potholes:

🚗 April 2025 Total Vehicle Sales:

- Fell 6.1% YoY to 72,753 units

🚙 Passenger Vehicles:

- Down 5% YoY to 45,532 units

- Domestic PV sales dropped 6%

🚚 Commercial Vehicles:

- Down 8% YoY to 27,221 units

- Domestic CV sales fell 10%, led by a 23% crash in small CVs & pickups

So yes, demand is currently soft—but that’s exactly what the demerger hopes to fix: give each division the laser focus it needs to bounce back.

What About the Stock?

Here’s how the market is reacting:

| Metric | Value |

|---|---|

| Current Price (BSE) | ₹647.8 |

| 1-Year Return | -36% |

| 2-Year Return | +35% |

| Market Cap | ₹2,38,477 crore |

| Target Price (Trendlyne) | ₹812 |

| Upside Potential | +25% |

| Analyst Rating | ⭐ ‘Buy’ from 30 analysts |

Despite recent price pressure, analysts see strong upside potential, especially with the new structure unlocking value over time.

What’s Next for Tata Motors?

The demerger isn’t just a corporate formality—it’s the blueprint for future growth.

For the Passenger Vehicle Arm (TMPV):

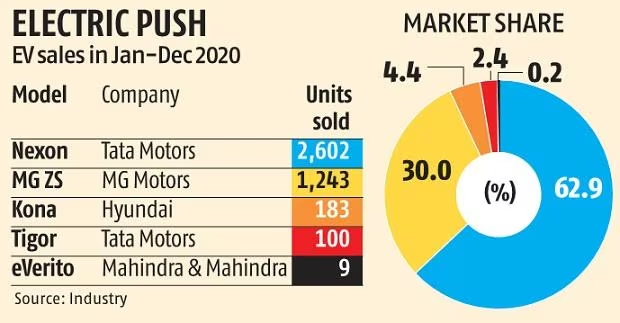

- Accelerate EV leadership (already owns 80% of India’s EV market)

- Launch 6 new EVs by March 2026

- Target 30% EV penetration by FY30

- Expand JLR’s global premium footprint

- Collaborate with firms like ChargeZone & Statiq to boost EV charging infra

For the Commercial Vehicle Arm (TMLCV):

- Dominate logistics & transport as infra booms

- Innovate with smart, electric commercial fleets

- Explore export markets and govt-driven fleet upgrades

What’s Cooking Post-Demerger?

Passenger Vehicles (TMPV + JLR + EV)

- Leading EV player in India (62.9% market share)

- Plans to launch 6 new EVs by FY26

- Targets 30% EV penetration in its own portfolio by FY30

- Aggressively investing ₹160–₹180 bn in EVs

- Building EV infra via partnerships with Glida, Statiq & ChargeZone

Commercial Vehicles (TMLCV)

- Benefiting from infra push & economic recovery

- High-margin business with consistent cash flow

- Sharper focus expected post-demerger, especially in electric buses and logistics vehicles

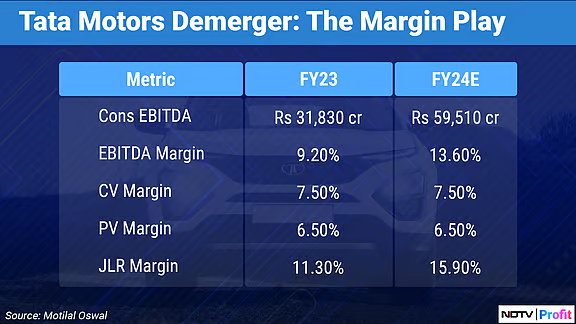

Industry Trends That Work in Tata’s Favor

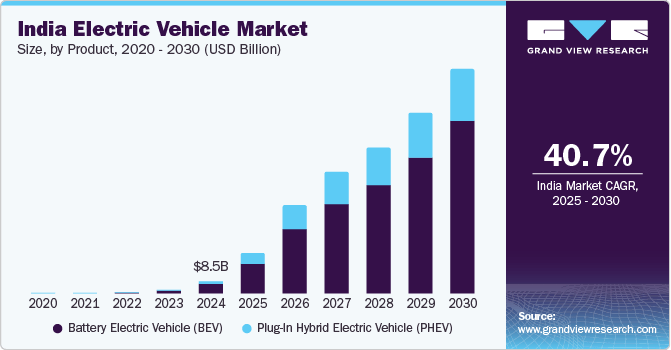

🔌 India’s EV Market:

- Expected to grow from $8.5B in 2024 to $600B by 2030

- Projected 10 million annual EV sales by 2030

🌍 Global EV Market:

- Estimated to hit $2.1 trillion by 2033 with a 23% CAGR

🚛 CV Sector Tailwinds:

- Urbanisation, e-commerce, and government infra push expected to boost truck demand

The Bigger Picture: What Investors Should Watch

📌 Record Date: Yet to be announced—this will decide who’s eligible for shares in the new company.

📌 Listing Timeline: Both entities to list on NSE & BSE in 12–15 months

📌 Valuation Gap: Analysts believe the PV+JLR business could command a higher valuation standalone

Final Verdict: Should You Be Bullish on Tata Motors?

The Tata Motors Demerger is a textbook example of doing the right thing at the right time.

✅ It gives investors two focused plays—one on India’s EV boom and the other on infrastructure-led CV demand.

✅ It simplifies Tata Motors’ story, making it easier for analysts and institutions to track and bet on.

✅ It ensures long-term shareholder wealth creation through clarity, efficiency, and strategic focus.

If you believe in India’s auto growth story—Tata Motors just handed you two rides instead of one.

Want to track Tata Motors’ transformation and invest smartly in both arms post-demerger?

Use Angel One—a trusted platform that helps you make informed investment decisions with ease.

Frequently Asked Questions (FAQs)

1. What is the Tata Motors Demerger?

The Tata Motors Demerger refers to the company’s decision to separate its operations into two listed entities—one focused on Passenger Vehicles (PV) including Jaguar Land Rover and EVs, and the other on Commercial Vehicles (CV) like trucks and buses.

2. Why is Tata Motors splitting its business?

The split aims to unlock shareholder value, improve operational efficiency, and give each business unit the independence to pursue focused strategies and attract dedicated investments.

3. What will shareholders receive in the Tata Motors Demerger?

Shareholders will receive an equal number of shares in both the demerged entities (1:1 ratio) for every share they hold in Tata Motors, ensuring equal ownership in both companies.

4. Will the Tata Motors Demerger affect my current shares?

Your existing Tata Motors shares remain valid. Post-demerger, you’ll receive equivalent shares in the newly formed company, giving you ownership in both PV and CV businesses.

5. When will the Tata Motors Demerger be completed?

The demerger is expected to be completed within 12 to 15 months, subject to necessary regulatory approvals and listing of the new entity on NSE and BSE.

6. How will the Tata Motors Demerger benefit investors?

It allows clearer valuation of each business, attracts targeted investors, enhances management focus, and potentially delivers better long-term returns.

7. Which segments will be part of the Passenger Vehicle business?

The Passenger Vehicle company will include Tata’s ICE cars, electric vehicles (EVs), and luxury offerings through Jaguar Land Rover (JLR).

8. What happens to the Commercial Vehicle business?

The CV business, now under Tata Motors Commercial Vehicles Ltd, will focus on trucks, buses, last-mile logistics, and electric commercial transport solutions.

Related Articles

Yes Bank Share Price Soars After SMBC Acquisition Buzz