Market outlook looking shaky? You’re not wrong.

Yesterday, the market slipped into the red and didn’t look back. Nifty fell 81 points, Bank Nifty got hammered by 648 points, and PSU Banks? Absolutely wrecked—down 4.84% in a single session.

The biggest loser? Adani Enterprises, down 4.13%. The unlikely winner? Hero MotoCorp, up 2.79%, somehow revving higher while the rest hit the brakes.

Autos were the only sector clinging to green. Everything else looked like it needed CPR.

Now the big question: Was this a shakeout before the bounce—or the start of a bigger slide? Let’s break it all down and map out the market outlook for today.

Why Did PSU Banks Collapse Yesterday?

If you blinked, you might’ve missed the 4.84% nosedive in the Nifty PSU Bank Index. But this wasn’t just a bad day—it was a perfect storm.

Let’s break it down:

🔻 1. Bank of Baroda’s Not-So-Grand Finale

BoB’s Q4 numbers flopped hard.

- Net interest income fell 6.6% YoY,

- Margins narrowed to 3.02% from 3.45%.

Result? A brutal 10.83% intraday fall, wiping out investor confidence and dragging peers down with it.

⚖️ 2. Supreme Court’s Surprise on Bhushan Steel

The Supreme Court rejected JSW Steel’s 2019 resolution plan for Bhushan Power & Steel and ordered its liquidation.

That hit SBI, PNB, BoB, and Canara Bank—all lenders to BPSL—right in the balance sheets.

🌍 3. Weak Global Cues + Market Mood

With broader indices closing lower and Fed fears looming, high-risk sectors like PSU banks got punished first. This shift is key to understanding the near-term market outlook.

📉 4. 2025: PSU Banks Are Still the Laggards

Despite macro tailwinds and decent earnings, PSU banks have underperformed:

- Down ~9% YTD, vs.

- +8% for Nifty Bank and +2.5% for the Nifty.

Clearly, institutional money is cautious—and right now, so is the market outlook.

Nifty Bank – Top Stock Losers (Intra-day)

| Company | CMP (₹) | Change (%) | Volume (Shares) |

|---|---|---|---|

| Bank of Baroda | 222.15 | -10.83% | 53.57 million |

| Canara Bank | 92.09 | -5.22% | 27.35 million |

| PNB | 94.50 | -4.93% | 26.98 million |

| Federal Bank | 186.75 | -2.49% | 5.93 million |

| IDFC First Bank | 65.49 | -2.28% | 29.76 million |

| SBI | 772.95 | -2.16% | 18.86 million |

Market Outlook: What’s Next for PSU Banks?

Short-term? Expect volatility and caution.

Long-term? If margin pressure eases and asset quality holds, leaders like SBI and BoB could still be in the game.

From an investor’s lens, the market outlook says don’t write them off yet, but don’t jump in blind either.

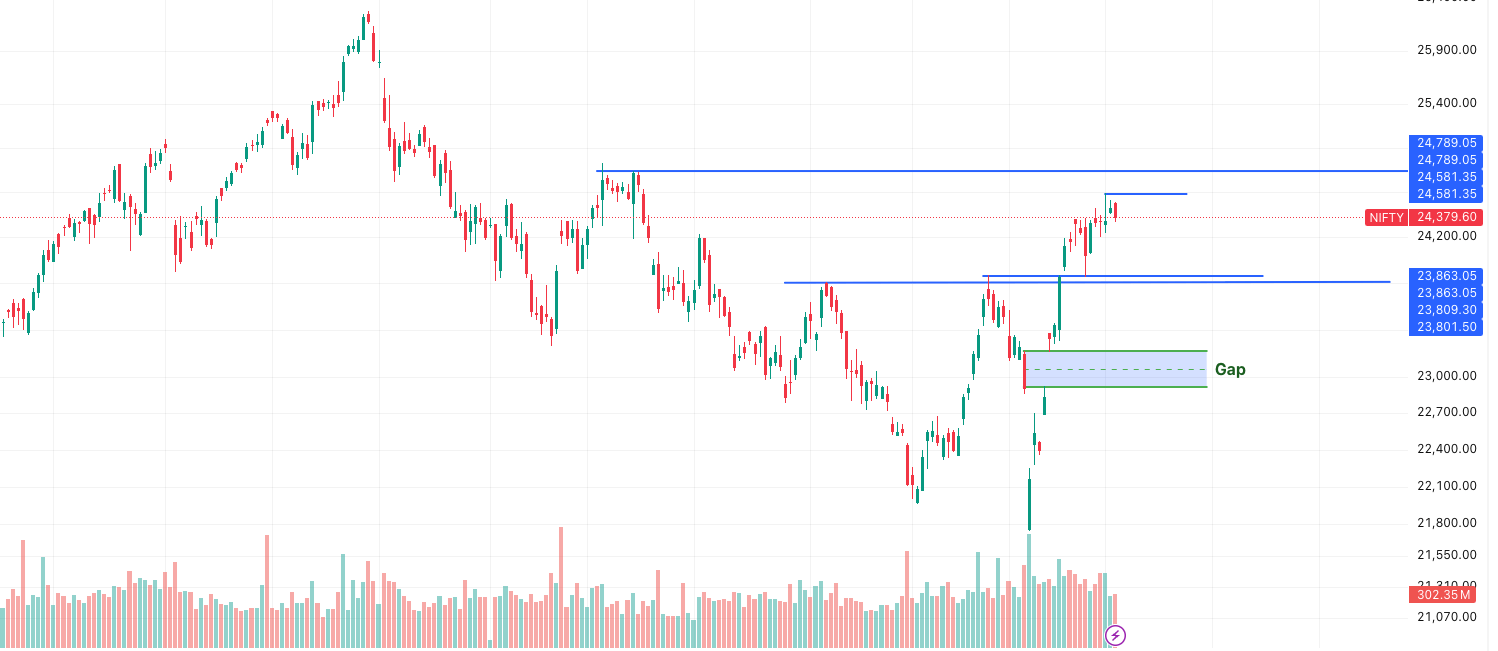

Nifty Outlook – Resistance Rising, Bulls Slowing

The market outlook for today? Cautiously neutral with a hint of bearish.

After yesterday’s dip, Nifty’s chart is flashing one clear message: resistance is real. The index is struggling to push past the 24,581–24,789 zone, and the latest candle shows sellers aren’t letting go that easily.

Technical Snapshot:

Resistance Levels:

- 24,581–24,789 is the zone to beat.

- Price rejection from here signals overhead supply and nervous bulls.

Support Levels:

- First line of defence: 23,800–23,863

- Bigger picture support: 23,300–23,600 gap zone—if we close below this, things could turn ugly fast.

Trend Check:

- Short-term trend is still bullish, but momentum is clearly stalling.

- Candlestick structure suggests consolidation—or even a mild pullback brewing.

What to Expect Today:

- A gap-down open below 24,300 could invite more selling pressure.

- If that happens, watch for a move toward 23,863.

- On the flip side, a clean breakout above 24,789 could push Nifty to fresh highs and re-ignite the bullish trend.

The market outlook today leans neutral to slightly bearish. If bulls want a comeback, they’ll need to reclaim 24,789 with strength. Until then? It’s all about defense.

News & Stocks in Focus – What Moved, What Matters

Yesterday’s market may have closed in the red, but under the hood, a lot happened—globally and locally—that could shape the market outlook for today and beyond. Here’s what investors need to know:

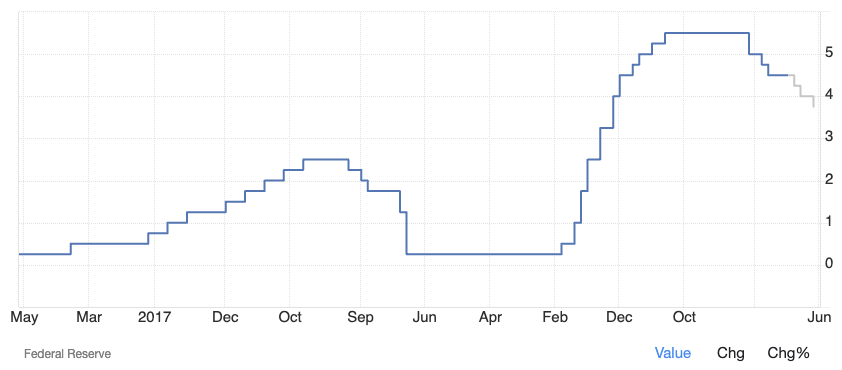

US Fed Rate Decision Today – Global Eyes Watching

The US Federal Reserve is set to announce its interest rate decision today.

Why should you care? Because whatever Jerome Powell says or doesn’t say will ripple through global markets.

Market Outlook: A rate pause may cheer equity markets. A hike or hawkish tone? Expect foreign outflows, pressure on the rupee, and volatility in rate-sensitive sectors.

LG’s ₹5,000 Cr Bet on Andhra Pradesh

LG Electronics is investing ₹5,000 crore to set up a mega plant in Sri City, Andhra Pradesh. This unit will churn out fridges, ACs, washing machines, and more.

📌 Impacted Sectors:

- Capital goods

- Consumer durables

- Andhra-based infra companies

Market Outlook: A strong signal for India’s “Make in India” dream—watch for investor interest in suppliers and logistics companies around Sri City.

KPIT Tech Expands with $191 Million Acquisition

KPIT Technologies is buying four entities from Caresoft Global for $191 million to boost its off-highway, trucking, and manufacturing solutions business.

📌 Impacted Stock: KPIT Tech

Market Outlook: Strategic deal that expands KPIT’s reach—this could translate to medium-term earnings upgrades if the integration is smooth.

Apple Likes India. That’s Not Small.

According to Minister Scindia, Apple is ramping up iPhone sourcing from India—a major vote of confidence in India as a global manufacturing hub.

📌 Impacted Stocks: iPhone component suppliers (e.g., Dixon, Syrma SGS, Bharat FIH)

Market Outlook: India’s electronics supply chain could be the next big sector theme if Apple continues to deepen its footprint.

Ather Energy’s Lukewarm Debut—But Can It Ride the EV Wave?

After much hype, Ather Energy’s IPO debut was underwhelming—thanks to sky-high valuations and a competitive EV landscape. But don’t write it off just yet.

📌 Impacted Space: EV ecosystem (battery, motor, charging infra)

Market Outlook: High risk, high reward. Near-term pain could turn into long-term gain—if Ather executes well.

SEBI Tightens Screws on Securitised Debt Instruments

SEBI is cleaning up the SDI (Securitised Debt Instruments) space with two big moves:

- ₹1 crore minimum investment

- Mandatory demat holding

📌 Impacted Players: NBFCs, mutual funds, wealth platforms

Market Outlook: A more regulated SDI space = greater transparency, safer access for HNIs and institutions—but retail? Probably not invited to this party yet.

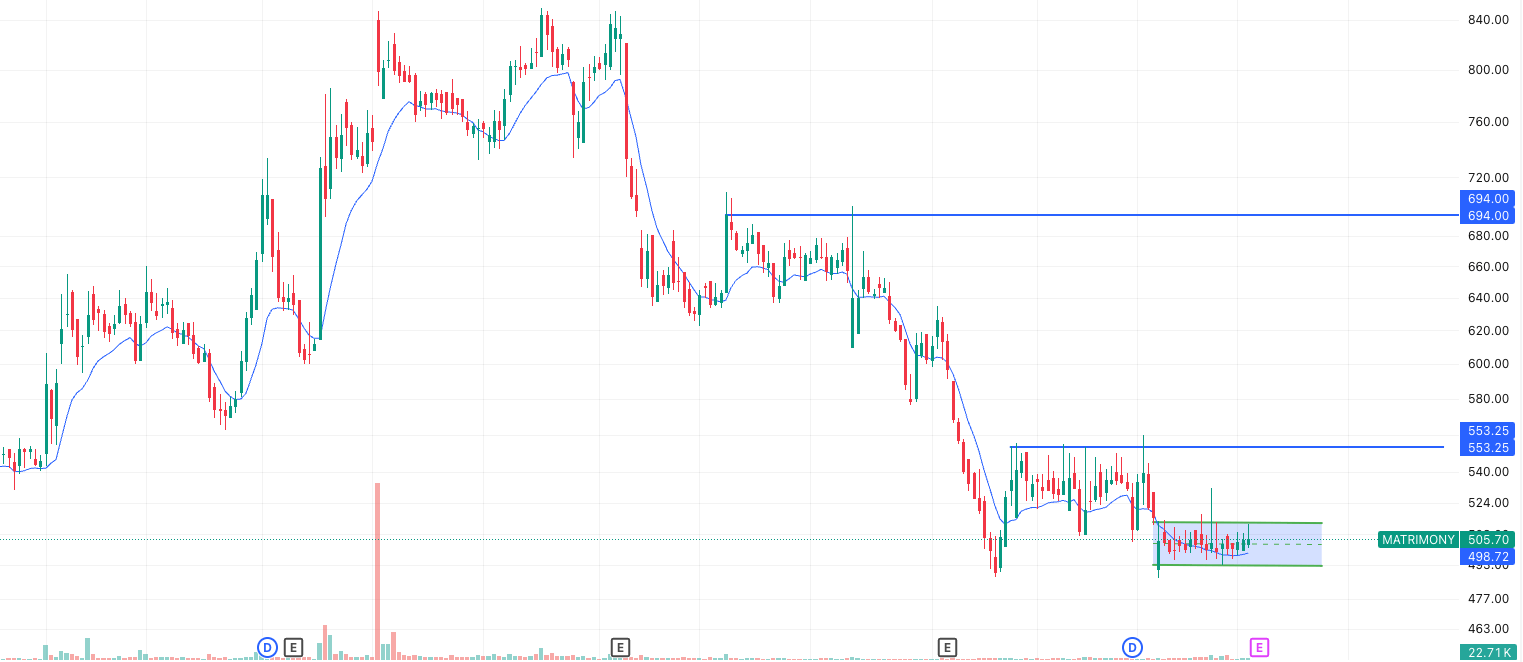

Technical Radar – Matrimony.com Ltd

Some stocks move fast. Others take their time. Matrimony.com seems to be in no rush—quietly consolidating, not too hot, not too cold.

Over the past few weeks, it’s been moving in a tight band between ₹495 and ₹525. Right now, it’s sitting at ₹505—just above its 9-day EMA at ₹498. It’s not exactly a breakout, but it’s not weak either. Think of it as someone waiting for the right time to make a move.

Here’s what the chart is quietly hinting at:

- Short-Term View (1–2 Weeks):

The range is clear: ₹495–₹525. Price has respected both levels. A move above ₹525—with conviction—could open up a path toward ₹550–₹553. On the flip side, slipping below ₹495 might drag it back to ₹470. - 1–2 Month Outlook:

₹553 is the big hurdle. It’s been tested before and rejected. A decisive breakout here could shift the short-term trend in its favour. Until then, it stays in a “neutral” to “slightly bullish” zone, especially if it keeps bouncing from ₹470–₹495. - Mid-Term View (3–6 Months):

The larger structure shows a bearish-to-neutral tone, unless ₹553 and then ₹600 are cleared. If that happens, ₹650–₹694 is the next logical target zone.

But for now, it’s still building a base, with ₹450–₹470 acting as the safety net.

So what’s the market outlook here?

Matrimony.com is at a crossroads. It’s showing quiet strength, holding above its short-term averages, and respecting support levels. But it needs a strong push—above ₹525 and eventually ₹553—to really turn heads.

Until then, it’s a classic case of consolidation. One that traders and investors are watching closely… just waiting for that first move.

Small-Cap Stock of the Day – Bajaj Consumer Care Ltd

While the market was busy with banks and breakouts, Bajaj Consumer Care quietly ticked up 2.17%—not flashy, but steady. And sometimes, that’s all it takes to get noticed.

This is the company behind personal care products found in more homes than you might think. Think almond drops hair oil—that tiny bottle with surprisingly sticky brand recall. But this isn’t just an oil story anymore.

What Do They Do?

Bajaj Consumer operates in the cosmetics, toiletries, and personal care space. With a presence across domestic and international markets, it’s one of those classic FMCG plays that survives even when the economy sneezes.

And their numbers? Quietly decent.

Snapshot of Strength

- Market Cap: ₹2,450 Cr

- Sales: ₹965 Cr

- Dividend Yield: 1.74% (not bad for a small-cap)

- ROCE/ROE: 19.3% / 15.9% = Efficient and clean

- Debt-to-equity: Almost zero at 0.01

- Cash in hand: ₹112 Cr — Always a comforting cushion

Valuation-wise, it trades at P/E of 19.6, much lower than the industry average of 39.7. Whether that’s an opportunity or a value trap depends on how you see the company’s growth strategy in a highly competitive space.

The Catch?

Not everything’s rosy.

- EPS has declined over the last 3 years, showing that sales aren’t always translating into bottom-line growth.

- It’s still trying to break out of its oil-dominated identity and diversify its product portfolio.

- And while the margins are respectable (OPM 13.2%), they haven’t expanded much.

Market Outlook Takeaway

In a volatile market, steady small-caps with decent cash flows and almost no debt start looking more interesting. Bajaj Consumer isn’t trying to be the next big thing—but it might just end up being a stable compounder in the background.

The stock is trading well below its 52-week high (₹289), and technically, it’s holding ground above ₹170. For long-term watchers, the next big question is whether this one quietly turns the corner… or stays a value pick waiting for a catalyst.

What To Do Now: Your Action Plan

The market isn’t crashing—it’s just confused. Nifty’s flirting with resistance, PSU Banks are having a full-blown meltdown, and most sectors are in “wait and see” mode.

So what now?

If you’re trading, this is a rangebound market where patience beats panic. Jumping in too early—especially without volume or confirmation—might backfire. Key levels on Nifty and stocks like Matrimony.com will decide whether we break out or drift lower.

If you’re investing, this is where calm, cash-rich companies with low debt start standing out. Stocks like Bajaj Consumer Care may not trend daily, but they often hold up better when volatility picks up.

In short? The market outlook is neutral with a bearish bias—but opportunity hasn’t left the room. You just have to look closer.

And if you’re looking for smart tools to do that…

Angel One’s advanced charts, scanners, and fast trades help you stay ahead of the next move—check it out here.

Related Articles

Yes Bank Share Price Soars After SMBC Acquisition Buzz