🗓️ Good Morning!

Happy Ambedkar Jayanti!

The market is in ‘sleep mode’ today — guess even the stock market needs a holiday, right?

While it’s tempting to join in and take a break, this is actually the perfect time to get ahead. Sure, the market’s slow, but that doesn’t mean we can afford to be. It’s a golden opportunity to prepare a solid Post-Holiday Strategy before the action heats up tomorrow.

Big money doesn’t take naps, and neither should your portfolio! Let’s use today’s lull to set ourselves up for tomorrow’s market moves.

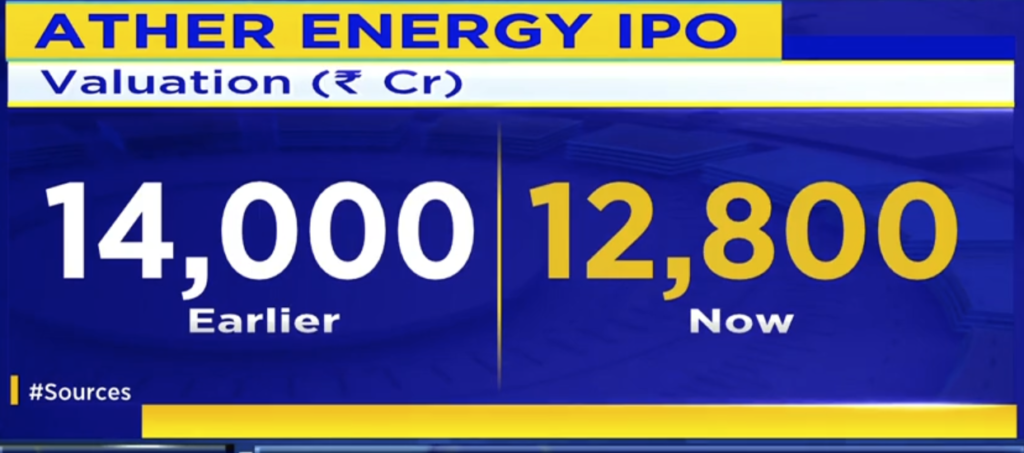

Ather Energy Lowers IPO Valuation-Post-Holiday Strategy Update

Ather Energy, the electric two-wheeler maker, has revised its IPO targets once again. Sources tell CNBC-TV18 that the company is now aiming for a post-money valuation of around ₹12,800 crore, down from the earlier target of ₹14,000 crore.

In addition, Ather Energy is revising its IPO expectations, now targeting ₹2,900 crore to ₹3,200 crore ($350 million – $375 million), down from ₹3,500 crore to ₹3,700 crore ($400 million).

This adjustment reflects market conditions, and the company plans to open the IPO on 23 April—an important factor to consider when shaping your Post-Holiday Strategy.

India’s Automotive Sector Poised for Global Growth: NITI Aayog’s Vision for 2030

India’s automotive industry is set for growth as it focuses on electric vehicles (EVs), autonomous driving, and advanced technologies, according to NITI Aayog.

The sector is targeting a $145 billion size by 2030, with auto component exports tripling and creating millions of jobs.

Stocks to Watch

- TVS Motor: Poised to benefit from the EV shift.

- Mahindra & Mahindra: Leads in EVs and global markets.

- Bajaj Auto: Thrives in both domestic and international markets.

- Motherson Sumi: Dominates as a leading auto component supplier.

- Sona Comstar: Focuses on EV parts and drives growth.

- Tata Motors: Leads in EVs and expands globally through Jaguar Land Rover.

India’s QSR Business: Fast, Flavourful, and Ready to Explode

The Quick Service Restaurant (QSR) business in India is on a thrilling ride toward massive growth. As urbanization picks up, the middle class expands, and busy lifestyles continue, Indians are looking for fast, affordable, and tasty food that fits into their hectic schedules.

The QSR industry is set to soar, with a forecasted growth rate of around 20% annually over the next few years. As per reports, the Indian QSR market is expected to reach ₹50,000 crores by 2026.

Top 5 Stocks to Watch in India’s QSR Growth

Restaurant Brands Asia

This company operates popular brands like KFC, Pizza Hut, and Taco Bell in India. With a diverse portfolio, Restaurant Brands Asia is capitalizing on the growing demand for international fast-food chains and expanding in both urban and suburban areas.

Jubilant FoodWorks

Known for brands like Domino’s and Dunkin’ Donuts, Jubilant FoodWorks is the leader in the pizza and donut segments in India. With a dominant market share in the organized pizza segment, it continues expanding through delivery and online ordering innovations.

Westlife Foodworld Ltd

The operator of McDonald’s in India, Westlife Development has a strong presence in both metropolitan and smaller cities. With a focus on affordable meals and digital ordering, it remains a key player in the fast-food market.

Devyani International

Manages KFC, Pizza Hut, and Costa Coffee in India. It’s well-placed in malls, highways, and urban hubs, tapping into the rising eating-out trend among young Indians.

Sapphire Foods

Another franchisee of KFC and Pizza Hut, mainly in South and West India. Competes closely with Devyani and focuses on store rollouts and high footfall locations.

Wrapping Up: What You Should Do Now

As the market gears up for the pre-holiday calm, don’t get too comfortable. Use this time to refine your post-holiday strategy, keep an eye on Ather’s IPO debut, and watch out for themes like auto sector transformation and the booming QSR space. These aren’t just buzzwords—they’re long-term plays shaping India’s next market cycle.

Whether you’re betting on EV stocks like Tata Motors and M&M or grabbing a slice of India’s burger economy with Jubilant or RBA, remember: The early bird gets the compounding worm. 🐦📈

See you after the holiday with more market moves decoded!

📲 One Last Thing…

Looking to act fast on your post-holiday strategy? Platforms like Angel One make it super easy to track IPOs, analyze stocks, and invest with just a few taps.

Whether you’re eyeing the next QSR breakout, auto sector leaders, or prepping for the Ather IPO, do it smartly—with real-time data, easy charts, and zero-balance investing.

👉 Open your free Angel One account today and start building a smarter portfolio.

Related Articles

5 Evergreen Stocks in India That Actually Survive Small Cap Chaos