While the world struggles with slowing growth, trade wars, and geopolitical uncertainty, India is quietly building something much more stable—and powerful: its domestic market.

Over the past decade, India’s private consumption has doubled, rising from $1 trillion in 2013 to $2.1 trillion in 2024. Behind this surge lies a deep shift in consumer behavior—urban, upwardly mobile Indians are demanding more, better, and local. Companies that once chased global revenues are now doubling down on Indian soil. And honestly? It’s working.

Let’s explore how India’s domestic market is emerging as the country’s strongest growth engine, sector by sector.

Auto Giants Turn Homeward

India’s automobile market, now valued at $122.5 billion in FY24, has climbed from $74 billion in FY15, growing at a 6.4% CAGR and now contributing 7.1% to India’s GDP.

Once global exporters, Indian auto giants like Bajaj Auto and Mahindra & Mahindra are pivoting inward. Why? Because the numbers make sense.

Bajaj Auto

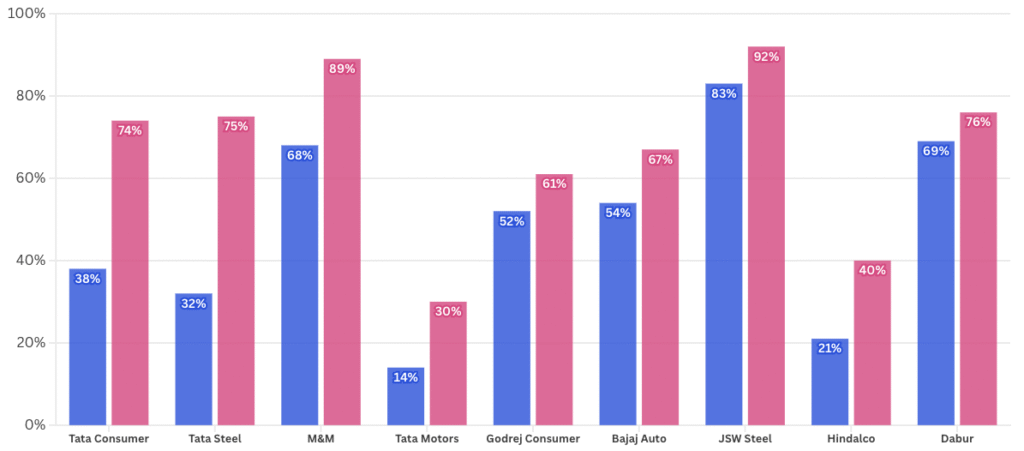

Operating in 70 countries, Bajaj Auto reduced its international revenue share from 46% in FY15 to 33% in FY25. The domestic market? Now accounts for 67% of revenue.

By launching affordable electric scooters and expanding into the premium segment via Triumph, Bajaj has covered both rural and aspirational markets. Domestic demand helped its revenue grow from ₹22,198 crore in FY15 to ₹46,306 crore in FY24, pushing its share price up by 285.9% in a decade.

Mahindra & Mahindra (M&M)

M&M exited unprofitable global ventures and doubled down on India. It boosted its domestic revenue share from 68% to 89% in 10 years. New SUVs like the Thar, XUV700, and Scorpio drove up its market share to 22.5% in the SUV segment, while profits quadrupled to ₹12,929 crore in FY25.

These numbers show one thing: India is now a self-sufficient growth playground for auto makers.

Steel and Manufacturing: Domestic First, Exports Later

With government initiatives like Make in India and PM Gati Shakti, domestic manufacturing is enjoying a renaissance.

India’s steel output surged from 90 MT in 2015 to 150 MT in 2025. Demand from infrastructure, auto, and defense is absorbing this capacity.

Tata Steel

It moved away from high-cost international operations, increasing its domestic revenue share from 32% to 75% between FY15 and FY25. Regulations, energy costs, and weak profitability in the UK and Netherlands made the Indian market far more attractive.

JSW Steel

Reduced its export revenue from 17% to 8%, following losses abroad. Aimed at boosting domestic output, it plans to hit 50 MTPA capacity by FY31, up from 28 MTPA, with a strong focus on mining projects in Karnataka, Goa, and Odisha.

The logic is clear: build at home, sell at home, grow at home.

FMCG: India Buys What the World Can’t

The FMCG sector, now valued at $245.39 billion in 2024, is booming. With a 27.9% CAGR expected by 2030, it’s one of the fastest-growing segments in India.

From premium products to Ayurvedic toothpaste, Indian consumers are shaping global FMCG strategies. Foreign market volatility, regulation, and currency woes are driving FMCG brands back to their roots.

Tata Consumer Products (TCPL)

Once international-heavy, TCPL now earns 74% of its revenue domestically (up from 38% in FY15). It expanded beyond tea into snacks, pulses, and spices, growing its retail footprint to 4 million outlets. Revenue doubled, and margins rose from 10.4% to 15%.

Dabur

Facing currency issues in North Africa and regulatory bottlenecks in Europe, Dabur doubled down on India. From 1,000 to 2,000 SKUs, and expanded into 122,000 rural towns, capitalizing on demand for natural and herbal products. Its focus on oral care and honey made it a rural favorite.

The Bigger Picture: FDI, Urbanization, and the Middle Class

The world may be slowing down, but India is gearing up.

Over $709.8 billion in FDI came into India between April 2014 and March 2024—thanks to domestic market confidence, infrastructure improvement, and a rising urban middle class with disposable income.

Companies are no longer waiting for global demand to rebound. They’re riding the wave of India’s rising aspirations, which, frankly, show no signs of slowing.

Final Thoughts: Local Is the New Global

A decade ago, export revenues were king. Today, India’s domestic market is the throne. From steel to scooters and snacks to SUVs, businesses are learning that growth lies right outside their front door.

If you’re an investor, a startup, or just someone watching India’s economic trajectory—this pivot toward the domestic economy is the trend you can’t afford to miss.

Want to Tap into India’s domestic market?

Open your free Demat account with Angel One and explore India’s best-performing auto, FMCG, and manufacturing stocks—all backed by data, driven by demand, and powered by India’s booming middle class.

📲 Don’t watch the trend—invest in it.

FAQs:

1. What is India’s domestic market trend?

Indian companies are shifting focus from exports to domestic growth due to rising consumption and policy support.

2. Why are Indian companies pulling out of global markets?

Regulatory hurdles, low margins, and global instability have made the Indian market more attractive.

3. Which sectors are most impacted by this shift?

Automotive, FMCG, and manufacturing—especially steel.

4. How big is India’s private consumption market?

It grew from $1 trillion in 2013 to $2.1 trillion in 2024.

5. What’s driving India’s domestic demand?

Urbanization, rising incomes, e-commerce, and government incentives like PLI and Make in India.

6. How is Bajaj Auto adapting to this shift?

It reduced global focus, launched budget EVs in India, and now earns 67% of its revenue domestically.

7. What is Tata Consumer’s strategy in India?

Expanded from tea into foods and wellness products, now earns 74% of revenue from India.

8. How has steel manufacturing evolved?

Output grew from 90 MT in 2015 to 150 MT in 2025, with domestic production becoming a key focus.

9. Is the FMCG market growing in India?

Yes, it’s valued at $245B and expected to grow at 27.9% CAGR by 2030.

10. How can investors benefit from this trend?

By investing in companies with strong domestic strategies through platforms like Angel One.

Related Articles

Tata Motors Demerger: What Is The Future of Tata Motors?