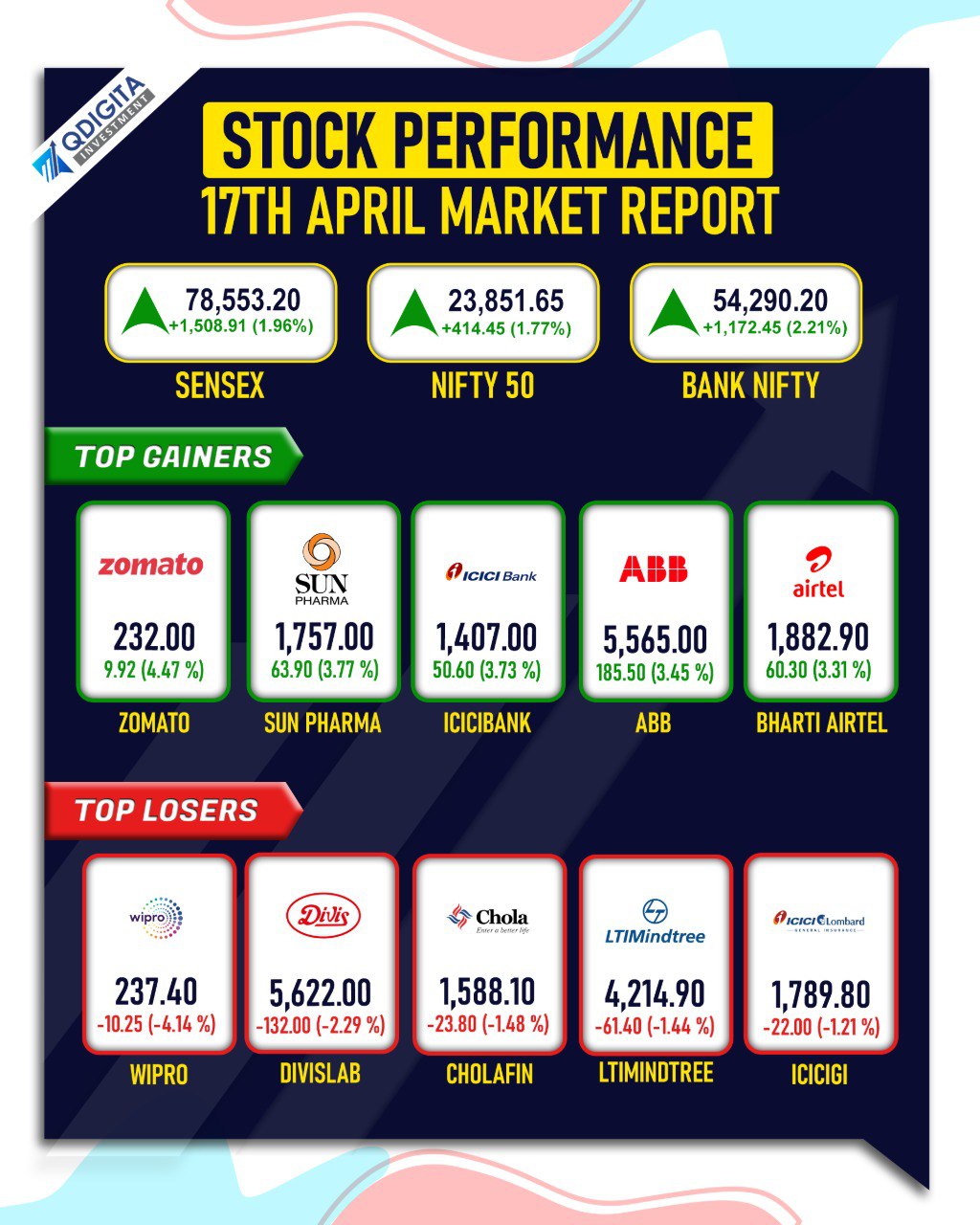

How was Indian Stock Market Today? The Sensex and Nifty 50 are both seeing strong upward movement today, and there are five key reasons behind this rally. Let’s break it down in simple terms with all the important data!

1. Hopes of a Trade Deal Between the US and India

A major factor driving the Indian stock market today is the growing optimism about a trade deal between India and the US. Reports are suggesting that US President Donald Trump might announce additional tariff exemptions after a 90-day pause on reciprocal tariffs. This has given investors hope that tensions between the two countries may soon ease, benefiting India’s trade relationship with the US.

- What Experts Are Saying:

- Pankaj Pandey, Head of Research at ICICI Securities, said, “Things are expected to normalize quickly, and India may reach a favorable trade agreement with the US.”

- Experts believe the Nifty could soon hit the 24,000–25,000 range within the next 2 to 3 weeks.

- Why This Matters:

Trade with the US has been uncertain lately, with tariffs affecting global markets. But India has been less impacted than other countries like China because it has lower exposure to US trade. Also, India’s strong domestic demand gives it an edge, which helps cushion the economy from global shocks.

2. Positive Macroeconomic Data is Boosting Sentiment

Another important factor is the positive macroeconomic data coming out of India. Let’s look at some numbers that show how well India is doing right now:

- Retail Inflation:

India’s retail inflation (the rise in prices for everyday goods) came in at just 3.34% in March 2025. This is lower than February’s 3.61% and much better than last year’s inflation of 4.85%.- This is the lowest inflation rate in over six years! This is great news because lower inflation means prices aren’t rising too fast, which helps people manage their expenses.

- GDP Growth:

India’s GDP growth is expected to stay strong at 6.5% in FY26. This means India’s economy is still growing well and should continue to grow at a healthy pace.- Why This Helps the Market:

Positive economic data like low inflation and strong GDP growth make investors feel more confident about the market’s future. It means that India is in a stable position, and growth is likely to continue.

- Why This Helps the Market:

3. A Normal Monsoon Could Benefit the Economy

India’s monsoon season plays a massive role in the country’s economy. The India Meteorological Department (IMD) has predicted above-normal rainfall this year, which is a good sign. Private weather forecasters like Skymet Weather have also said the monsoon will likely be normal.

- Why Does This Matter?

A normal monsoon means:- Better rural income: Many people in rural areas depend on farming, and good rains can lead to better crop yields.

- Control on inflation: Good rains help stabilize food prices, which keeps inflation low.

- Potential for Rate Cuts: If inflation stays low, the Reserve Bank of India (RBI) may lower interest rates, which could make borrowing cheaper and encourage investment.

4. Foreign Investors Are Coming Back

Foreign Portfolio Investors (FPIs), or foreign investors, are coming back to India. In the last two trading sessions, FPIs have bought ₹10,000 crore worth of Indian stocks.

- Why Are FPIs Returning? The main reasons FPIs are buying Indian stocks again are:

- Pause on Trump’s tariffs: With no new tariffs, the uncertainty in the markets has reduced.

- Optimistic growth: India’s strong economic growth and improving domestic conditions are attracting investors from all over the world.

- What This Means for India:

When foreign investors buy stocks, it increases the demand for Indian companies, which pushes up stock prices. This is a sign that global investors have confidence in India’s future.

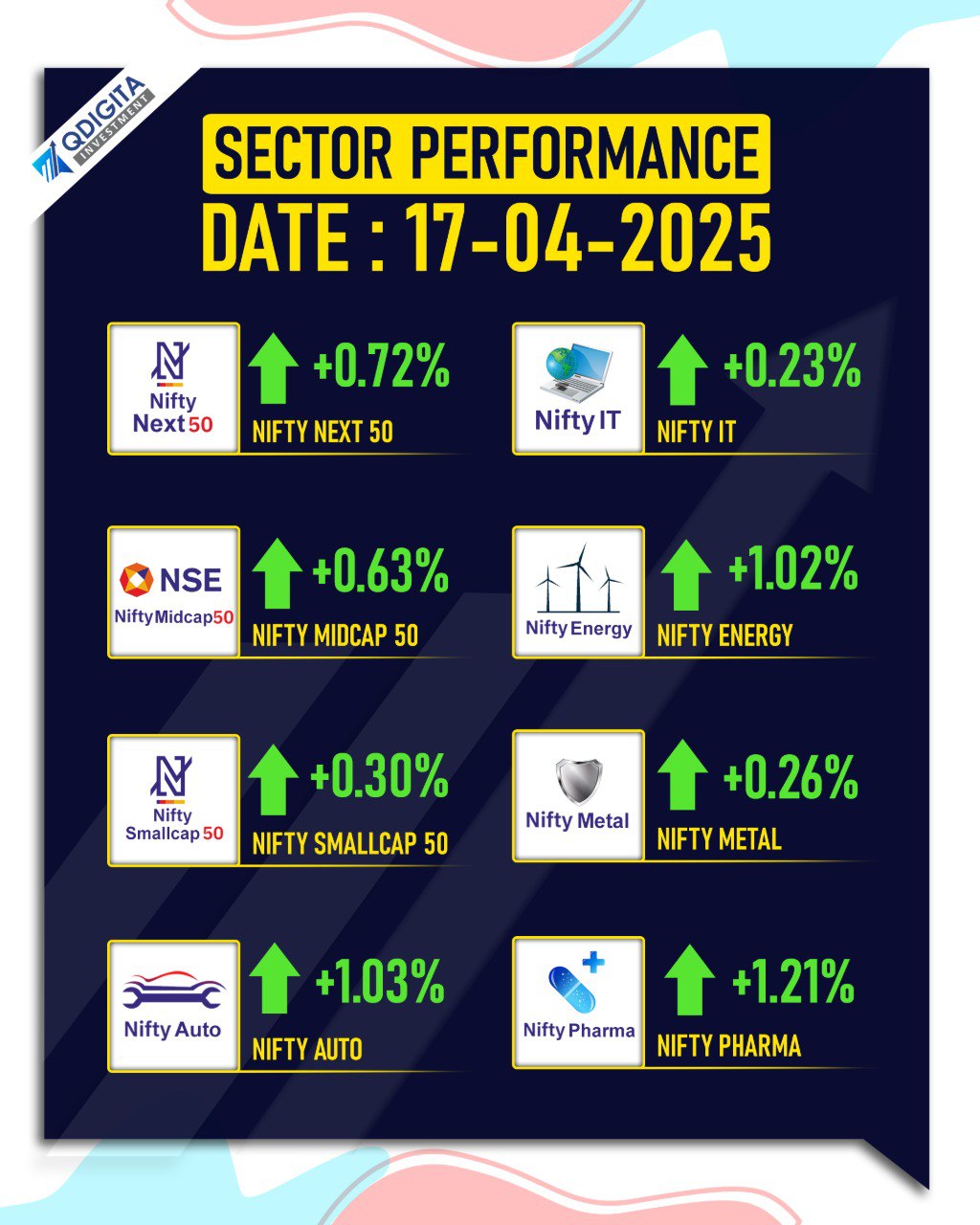

5. Strong Performance of Banking Stocks

The banking sector has been performing really well lately, and it’s one of the biggest drivers of today’s market rally.

- Top Banking Stocks:

- Big banks like ICICI Bank, SBI, HDFC Bank, and Axis Bank have all shown impressive gains, rising 2-4% today.

- The Nifty Bank Index has gone up by 2.21%, reaching 54,290.20, just short of its all-time high of 54,467.35 hit last year.

- Why This Matters:

Banks play a major role in India’s stock market, and when they do well, they push up the overall market. Since banking stocks have a large weight in the Sensex and Nifty, their strong performance has a big impact on the market’s rise.

Conclusion: What’s Next for India’s Stock Market?

These five factors—hope for a US-India trade deal, positive macroeconomic data, the promise of a normal monsoon, the return of foreign investors, and strong banking stocks—are all contributing to the Indian stock market’s surge today. With these factors in play, India’s stock market has a positive outlook in the near future.

For investors, it’s a good time to stay alert and watch for any updates on these developments. Whether you’re new to investing or experienced, understanding these factors will help you make better decisions.

Start Your Investment Journey with Angel One!

The market’s positive outlook could be your opportunity to start or diversify your investment portfolio. Angel One offers a user-friendly platform with real-time market data, investment insights, and cutting-edge tools to help you make informed decisions.

Ready to dive in? Open an account with Angel One today and make the most of today’s market opportunities! Get started with just a few clicks—your path to smarter investing is one step away.

Related Articles

Gold and Silver at ₹95,000: What History Tells Us About What’s Next