Gold and Silver Go Full Bollywood – ₹95,000 and Climbing!

Let’s get one thing straight — gold and silver aren’t just shining in 2025, they’re downright blinding. As of this week, gold has smashed past ₹95,000 per 10 grams, setting a brand-new all-time high. Not to be outdone, silver sprinted past ₹95,000 per kilogram, matching gold in both price and drama.

Yep, both metals have now officially entered the “NRI wedding budget crisis” zone.

This isn’t just some sparkly coincidence. Precious metals are having a full-blown rally, and everyone’s asking the same question:

“Is this the beginning of a golden era… or just another bubble waiting to burst?”

And more importantly…

“How does the stock market behave when gold and silver lose their chill?”

That’s exactly what we’re unpacking in this blog. From past price trends to the current economic chaos, from which sectors win to which stocks lose, and finally — what you, the humble investor, should be doing while gold and silver throw a high-voltage tantrum.

So grab your chai, sit tight, and let’s decode the gold and silver price trend — past, present, and the glittering (or crashing) future.

Historical Price Patterns: Gold and Silver’s Greatest Hits and Crashes

If you think gold at ₹95,000/10gm and silver at ₹95,000/kg is insane, wait till you hear about their dramatic history. These metals have had more mood swings than a Twitter user during exam season. And trust us — whenever the world panics, gold and silver love to party.

Let’s dive into the gold and silver price trend from an Indian perspective and look at the times when these metals went full-on Bollywood drama.

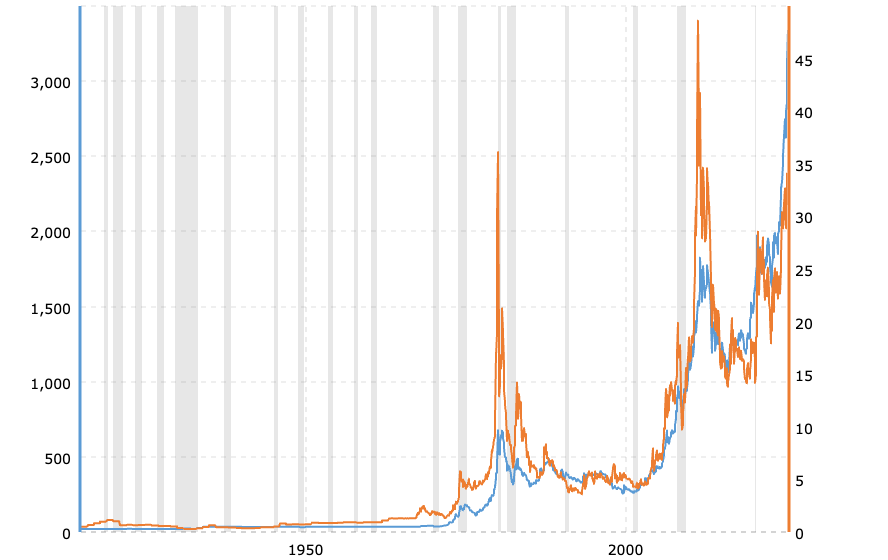

📼 1980s – The Original “Gold Boom” (Inflation + Oil Shock)

Back in the disco era, the global oil crisis and inflation made gold the star. In India:

- Gold prices shot up to around ₹1,800/10gm (a fortune back then).

- Silver? It touched nearly ₹3,000/kg — a huge deal for that time.

But the fun didn’t last. Once inflation cooled and the party ended, gold crashed 65%, and silver dropped nearly 80%. And no, there were no “stop-loss” features back then.

💸 2008 Global Financial Crisis – Gold’s Big Comeback

While banks were collapsing like poorly built Jenga towers, people rushed to buy gold.

- Gold prices in India jumped from ₹12,000 to ₹31,000/10gm (2008–2011).

- Silver climbed from ₹19,000 to ₹73,000/kg in the same period.

That’s a 159% return for gold and nearly 280% for silver. But then the market said, “Okay, calm down,” and:

- Gold corrected 30% by 2015

- Silver lost over 55%

🏦 2011 Eurozone Debt Crisis – Mini Sequel

Greece, Spain, and Italy were in financial ICU, and gold again became the hero.

- Gold crossed ₹31,000/10gm

- Silver hovered around ₹68,000–₹73,000/kg

But it wasn’t as explosive as 2008, and corrections came quicker this time.

🦠 2020 Pandemic: Lockdown, Fear & Gold Obsession

This one’s fresh in your memory. Everyone was sanitizing their hands and hoarding gold biscuits.

- Gold touched ₹56,200/10gm in August 2020

- Silver touched ₹76,000/kg

People said, “Ab toh ₹1 lakh ho hi jayega,” but… it didn’t. Both corrected as vaccines rolled out and equity markets recovered.

🔁 2023–24: Mini Rally & Dip

By now, gold was fluctuating between ₹58,000 and ₹63,000/10gm, thanks to inflation and geopolitical tension, but it couldn’t break out.

Silver? You guessed it — stuck in the ₹72,000–₹80,000/kg zone, occasionally acting like it’s going to shoot up, but mostly just being moody.

📊 Historical Table: Gold & Silver Peaks and What Happened After

| Year | Gold Price (₹/10gm) | Fall After Peak | Silver Price (₹/kg) | Fall After Peak |

|---|---|---|---|---|

| 1980 | ₹1,800 | -65% | ₹3,000 | -80% |

| 2011 | ₹31,000 | -30% | ₹73,000 | -55% |

| 2020 | ₹56,200 | -12% | ₹76,000 | -15% |

| 2025* | ₹95,000 | ? | ₹95,000 | ? |

*As of now. Correction coming or not? Nobody knows. But if history whispers anything — “be careful when everyone’s buying gold like it’s paneer.”

So, What’s the Pattern in the Gold and Silver Price Trend?

- Rallies? They’re real, and they’re exciting.

- But corrections? They hit hard — and they hit fast.

- Gold falls 20–40% after peaks, historically.

- Silver is worse — drops of 50–60% are common (ouch).

- Most rallies happen during economic panic, war, or inflation.

- And once the crisis fades, metals cool down faster than viral memes.

Right now in 2025, we’re once again in crisis mode: Trade wars, recession fears, and central bank hoarding. So yes — this rally may still have fuel.

But if history has taught us anything, it’s this: Don’t confuse a bull run with a no-brainer.

What’s Fueling the 2025 Gold and Silver Surge?

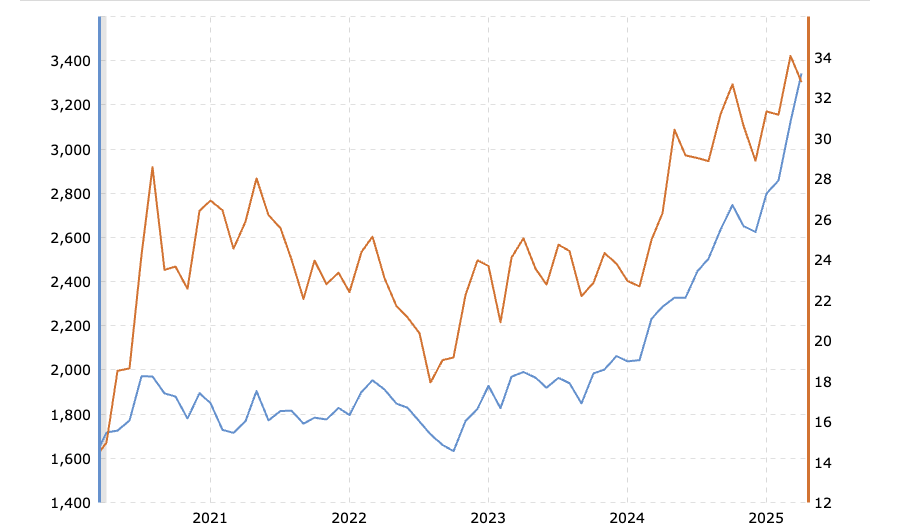

So gold is now sitting pretty above ₹95,000 per 10 grams (approx. $3,300 per ounce), and silver has crossed ₹95,000 per kg (about $35/oz). And no, it’s not just because Akshay Tritiya came early this year.

There’s a cocktail of global chaos and economic anxiety that’s made precious metals the life of the party. Let’s unpack what’s really sending gold and silver flying higher than our patience for interest rate hikes.

1. The Never-Ending US-China Trade War

America and China are back at it again — slapping tariffs like kids trading insults at recess. The US recently imposed massive duties on Chinese goods (some up to 245%). That kind of geopolitical drama always sends investors running to safety. And what’s safer than gold?

📌 Impact:

- Flight to safety = Surge in gold demand

- Weak stock sentiment = More ETF inflows into gold and silver

2. Central Banks Are Hoarding Gold Like It’s Going Out of Style

If you thought your mom’s obsession with gold was intense, wait till you see what central banks are doing.

- In Q1 2025, central banks (especially China, India, Turkey) bought a record 226.5 tonnes of gold — worth over ₹1.75 lakh crore or $21.1 billion.

- This is the highest quarterly gold buying since 2022, according to the World Gold Council.

Why? They’re reducing their dependence on the US dollar and beefing up gold reserves.

3. The US Dollar is Tired (And That’s Good for Gold)

As the Dollar Index (DXY) weakens, gold looks juicier. Investors prefer gold when the dollar drops because it’s globally priced in USD.

- A weaker dollar = cheaper gold for other countries = more buying = higher prices.

🇮🇳 For Indian buyers, gold became pricier due to the double whammy: rising global prices + a slightly weak rupee.

4. Recession Fears = Gold’s Time to Shine

Talks of a potential US recession have surfaced again. Slowing GDP, tight credit conditions, and geopolitical uncertainty have created the perfect environment for safe-haven assets.

Result? Gold and silver are doing what they do best: offering “emotional insurance” for panicked investors.

5. Silver’s Secret Weapon: Industrial Demand

Unlike gold, silver has a job — it works in EVs, solar panels, and electronics.

- In 2024, India’s silver imports rose 55% due to demand from the solar sector.

- Globally, silver demand from industrial applications is expected to grow by 10% YoY.

This is a huge reason why silver crossed ₹95,000/kg (or $35/oz) — and analysts say ₹1,25,000/kg isn’t far off.

6. Tight Supply? Big Problem.

Silver mining hasn’t kept up. Blame it on:

- Low-grade ore

- Costly extractions

- Fewer new discoveries

According to USGS, the world’s extractable silver reserves could be depleted by 2025–2030 unless new sources are found.

Less silver = higher price. Simple math.

7. Indian + Chinese Retail Demand is Rocking

Let’s not forget the cultural angle.

- In India, festive and wedding seasons push retail demand up.

- China’s citizens are also shifting from real estate to gold as a safe investment.

In 2025 so far, Indian gold jewellery sales are up 12% YoY, and silver coin/bars up 19%.

Expert Forecasts: Where Do We Go From Here?

Here’s what some of the world’s top financial houses are predicting:

Goldman Sachs:

Gold to hit $3,700/oz (~₹1,06,000/10gm) by year-end if central bank buying continues.

Saxo Bank:

Silver could rally to $40/oz (~₹1,15,000/kg) due to clean energy demand and supply tightness.

Citi Group:

Sees gold sustaining above $3,200/oz (~₹92,000/10gm) but warns of a potential correction in 2026 if rate hikes return.

In Summary:

The rally isn’t random.

It’s being driven by a perfect storm of economic panic, global buying, dollar weakness, and industrial tailwinds.

Will this continue forever? Of course not.

As MorningStar analysis says-

Morningstar:

Contrary to the bullish outlook, Morningstar’s analysts project a potential decline in gold prices over the next five years. They anticipate gold could fall to $1,820/oz (~₹52,000/10gm), citing factors such as increased gold supply from new mining projects, potential reductions in central bank purchases, and signs of market saturation like heightened M&A activity and the proliferation of gold-based funds.

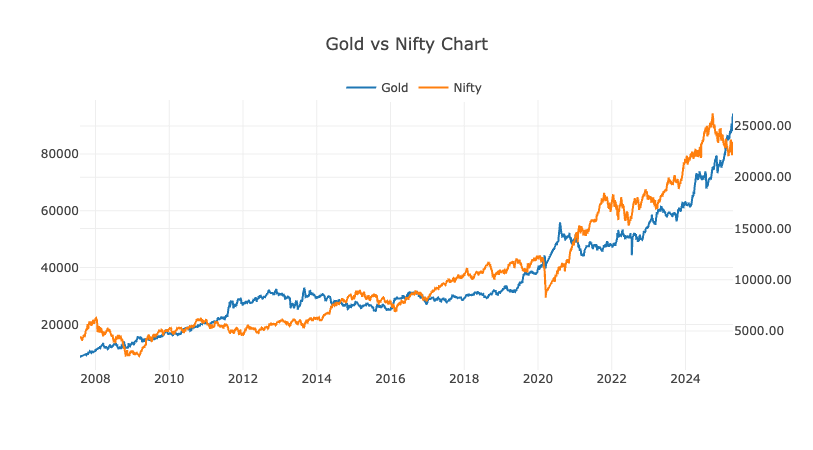

How Stock Markets React to Gold-Silver Surges: Gold Shines, Nifty Sinks?

Let’s talk about what really happens when gold and silver throw a party at ₹95,000 and leave the stock market outside sulking.

Because here’s the uncomfortable truth: when gold is booming, it usually means the stock market is not. Historically, every time gold puts on its dancing shoes, equities catch a cold.

But don’t just take our word for it — let’s look at the numbers.

Gold Price vs Nifty Index – 2010 to 2025

You’ll see:

- When gold rises rapidly (2011, 2020, 2025), the Nifty either falls or stagnates.

- When Nifty booms (2014–2017), gold stays sideways.

Inverse correlation? Almost always. Think of them as competitive cousins — only one gets the spotlight at a time.

🚨 2025 So Far?

- Gold is up 25% YTD

- Silver is up 31% YTD

- Meanwhile, Nifty has been flat for three months, struggling near the 22,000 mark

- Mid-cap and small-cap indices have corrected 5–8% amid global uncertainty

So yes, history is kinda repeating itself.

In short: the gold and silver price trend isn’t just a side story — it directly reflects risk appetite in the markets. When metals shine, it usually means the world is scared… and the markets are sweating.

Stocks to Watch: Who’s Riding the Gold-Silver Rally (and Who’s Just Getting Burned)

Whenever gold goes full-on Bollywood hero and silver tags along as the action sidekick, the gold and silver price trend doesn’t just affect metal traders—it shakes up the entire stock market.

Some companies cash in. Others… just crash quietly and hope nobody notices.

So, if you’re looking to play this precious metals wave, here are the stocks you should stalk—or avoid—for your watchlist.

🏆 The Winners (a.k.a. “Thank You, ₹95,000 Gold!”)

💰 Muthoot Finance

- 📈 YoY Return: ~28%

- India’s largest gold loan company. More gold = more pledges = more profit.

- High gold prices reduce loan-to-value (LTV) risk. This is Muthoot’s party, and they’re wearing the crown.

💸 Manappuram Finance

- 📈 YoY Return: ~21%

- Same story, different name. Also riding the gold loan wave, especially in rural markets.

- Bonus: Diversified into microfinance and vehicle loans.

📊 MCX (Multi Commodity Exchange)

- 📈 YoY Return: ~45%

- More volatility = more trading = higher revenue from gold and silver contracts.

- They’re basically the stage where the gold drama unfolds.

The Losers (a.k.a. “Not All That Glitters…”)

💍 Titan Company

- 📉 YoY Return: -6%

- High gold prices = fewer weddings = softer jewellery demand.

- Middle-class wallets are tight. Tanishq can only do so much heavy lifting.

🧿 Kalyan Jewellers

- 📉 YTD Return: ~-32%

- Same problem as Titan, but without the premium brand buffer.

- Heavy dependence on wedding/festival seasons, which get dull when gold hits ₹95K.

So, while the gold and silver price trend has investors cheering at one end, it’s quietly rearranging stock portfolios at the other. Play it smart: follow the supply chain, not the shine.

Smart Investor Strategy: How to Ride the Rally

Okay, so gold is shining, silver is sprinting, and you’re sitting there thinking:

“Should I buy now? What if it crashes tomorrow? What if it hits ₹1,10,000 and I miss out?”

Welcome to the emotional rollercoaster of investing in precious metals. But fear not—we’re here to break it down in a way that won’t give you a headache (or make you buy gold at the peak).

Let’s build your “Gold Rush Survival Kit”, shall we?

1. Don’t Go All-In Like It’s 2011

Investing in gold and silver is great—for diversification, inflation protection, and crisis insurance.

But they’re not your full portfolio. They’re like achaar — important, but not the whole meal.

✅ Ideal Allocation:

5–10% of your portfolio in gold/silver is enough to balance risk without going full panic mode.

2. Go Digital, Not Decorative

Yes, that gold chain from your cousin’s wedding is nice. But it won’t help you with liquidity, tax benefits, or price tracking.

✅ Better options:

- Gold ETFs / Silver ETFs: Easy to buy/sell, no making charges

- Sovereign Gold Bonds (SGBs): 2.5% interest + tax-free maturity

- Digital gold via brokers or apps

❌ Avoid physical gold unless it’s for gifting or tradition. We’re investing, not getting engaged.

3. Use SIPs to Average the Madness

Markets are moody. Prices will swing. Instead of guessing the top or bottom, go for Systematic Investment Plans (SIPs) in ETFs.

SIPs smooth out your cost over time, and you avoid the “bought at peak” regret syndrome.

Pro Tip: Use a Broker Who Makes Gold Easy

💡 If you’re planning to invest smartly without storage headaches,

Angel One lets you easily buy Gold ETFs, Silver ETFs, and SGBs with zero extra drama.

From research tools to seamless order execution — it’s all one click away.

👉 Open your Angel One account today and invest in gold like a pro, not like a panic buyer at a jewellery showroom.

Related Articles

Will Gold Price Hit ₹1 Lakh This Year? Or Is a Crash Coming?