Introduction

India’s automotive sector stocks are entering a phase of massive opportunity, driven by bold government planning and shifting global trade patterns.

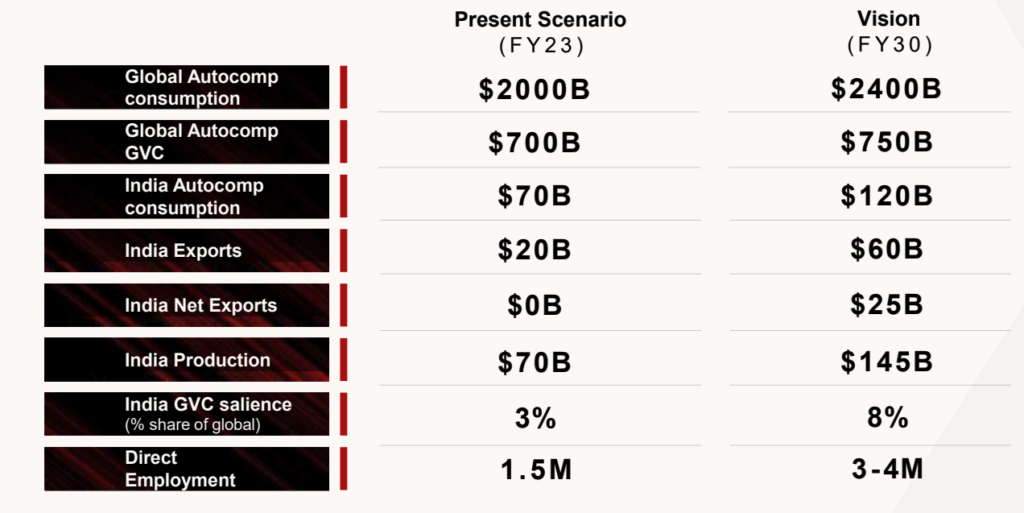

According to a recent report by NITI Aayog, the automotive sector in India is poised for a transformative shift. With a projected target of $145 billion in auto component production and $60 billion in exports by 2030, India could more than double its global market share in traded auto parts — from 3% to 8%.

In this blog, we break down:

- The current challenges and future goals laid out by NITI Aayog

- How India fits into the changing global automotive supply chain

- The top Indian stocks that could benefit from this shift

How Automotive Sector Stocks Reflect India’s Global Potential

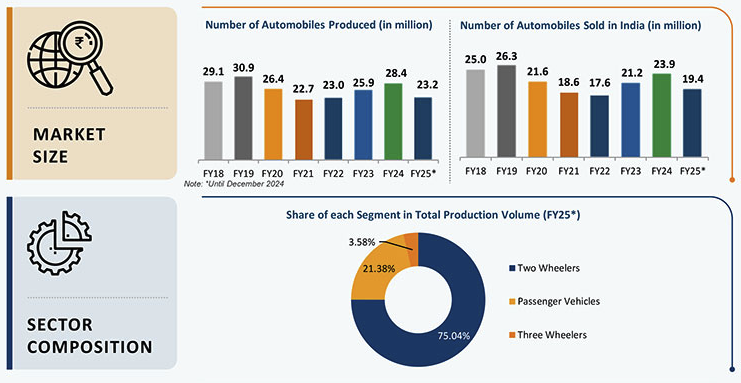

India is already the 4th largest automobile producer globally, trailing only China, the U.S., and Japan. Despite this, its share of the $700 billion global traded auto component market is just 3% (~$20 billion) — clearly signaling massive untapped potential.

NITI Aayog’s Vision for 2030 Includes:

- $145 billion in auto component production (from ~$56 billion in 2022 And $70 billion in 2023)

- $60 billion in exports, up from $20 billion

- Creation of 2–2.5 million direct jobs

- A share of 8% in the global value chain (GVC)

- Strategic focus on EVs, ADAS, semiconductors, and AI integration

This vision is powered by India’s skilled workforce, competitive manufacturing base, and policy initiatives like Make in India, PLI schemes, and upcoming Free Trade Agreements (FTAs).

Key Challenges That Must Be Addressed

Despite the optimism, India’s auto component industry faces significant barriers:

- Cost Disadvantage: Indian firms face a 10% cost disability compared to competitors like China

- Supply Chain Inefficiencies: Fragmented logistics and outdated infrastructure slow global competitiveness

- Limited High-Tech Capabilities: India lacks depth in precision manufacturing, engine systems, and semiconductors

Addressing these challenges is central to realizing the sector’s potential by 2030.

Why the World is Looking at India Now

Global supply chains are being reshaped. COVID-19 and rising geopolitical risks have made Western countries rethink reliance on Chinese manufacturing. As a result, countries are now actively adopting the “China +1” strategy — looking for secondary sourcing hubs.

India fits perfectly into this new world order:

- Large-scale, cost-efficient production capacity

- Political and economic stability

- Ongoing investment in semiconductors, clean mobility, and battery technologies

- Strong domestic demand to support economies of scale

The global traded auto component market, worth $700 billion out of a $2 trillion total market, offers ample room for Indian companies to grow.

Best Automotive Sector Stocks Backed by NITI Aayog’s Vision

Based on global positioning, product focus, and alignment with NITI Aayog’s roadmap, these are the top stocks to watch:

1. Tata Motors Ltd.

Segments: Passenger Vehicles, EVs, Commercial Vehicles, Global JLR Brand

Why It Stands Out:

- Electric Vehicles Leader in India: With models like Tata Nexon EV and Tigor EV, Tata Motors holds over 70% EV market share in India

- Global Presence via Jaguar Land Rover (JLR): Exposure to premium global markets including Europe, UK, and China

- Commercial Vehicle Innovation: Focused on clean fuel technologies like hydrogen, CNG, and electric buses

- R&D & Capex: Strong investments in EV infrastructure, battery technology, and ADAS

NITI Aayog Alignment:

EV leadership, global brand exposure, and investment in smart mobility align directly with India’s automotive vision for 2030.

2. Mahindra & Mahindra Ltd.

Segments: SUVs, Tractors, EVs, Global Utility Vehicles

Why It Stands Out:

- Investing ₹10,000+ crore in electric mobility

- Global markets across Africa, ASEAN, and Latin America

- Owns Pininfarina (Italy), enhancing EV and design capabilities

- Launching a new ‘Born Electric’ EV platform by 2026

NITI Aayog Alignment:

Leads in clean tech, rugged utility vehicles, and exports — all core focus areas for India’s automotive push.

3. Motherson Sumi Wiring (Samvardhana Motherson International)

Segments: Wiring harnesses, polymers, cockpit modules, lighting systems

Why It Stands Out:

- Operates in 41 countries, supplies to OEMs like Volkswagen, BMW, and Ford

- Recently acquired multiple global component firms to increase reach

- Diversified into electric vehicle parts, especially wiring systems and battery modules

- Over 70% of revenue comes from international markets

NITI Aayog Alignment:

Fits into India’s goal of becoming a global auto parts hub through precision manufacturing and scale.

4. Sona BLW Precision Forgings (Sona Comstar)

Segments: EV drivetrain components, precision gears, motors

Why It Stands Out:

- Supplies to Tesla, Ford, Volvo, and Indian EV startups

- 75%+ of revenue from global markets

- Specialized in EV differential assemblies, traction motors, and BMS

- Strong focus on high-margin, high-tech parts

NITI Aayog Alignment:

Critical supplier in the EV value chain; directly supports India’s goal of deeper integration with global automotive innovation.

5. Bosch Ltd. (India)

Segments: Engine management systems, sensors, ADAS, electronics

Why It Stands Out:

- Leading supplier of high-end electronic and safety components

- Strong push into ADAS and electric mobility in India

- Collaborates with OEMs to integrate AI, IoT, and telematics

- Over ₹2,000 crore invested in smart mobility and digitalization in India

NITI Aayog Alignment:

Supports the report’s emphasis on Industry 4.0, semiconductors, and intelligent vehicle systems.

Comparison Table: India’s Auto Sector Growth Stocks

| Company | Focus Area | Export/Global Exposure | NITI Alignment Highlights |

|---|---|---|---|

| Tata Motors | EVs, CVs, JLR exports | JLR in 100+ countries | EVs, clean mobility, premium exports |

| Mahindra & Mahindra | SUVs, EVs, agri-machinery | ASEAN, Africa, Italy | EV, tractors, global utility market |

| Motherson Sumi | Auto components (OEM supply) | 70% revenue from exports | Precision parts, wiring systems, global footprint |

| Sona Comstar | EV drivetrain & electronics | 75%+ revenue from exports | EV-specific components, R&D-led growth |

| Bosch India | ADAS, electronics, IoT | Strong India + export mix | Industry 4.0, intelligent systems, smart mobility |

Conclusion: A Roadmap Backed by Execution

NITI Aayog’s roadmap for India’s automotive sector isn’t just a policy paper — it’s a national-level business strategy. With the right execution, India could become a preferred global supplier of vehicles and components, especially in next-generation segments like EVs, ADAS, and precision electronics.

For investors, this is a strategic moment. The global market is realigning, and India’s strengths in cost-efficiency, engineering talent, and scale make it a compelling bet.

The right automotive sector stocks could deliver multi-year returns as India’s position in the global value chain strengthens. The companies listed here are not just riding the wave — they’re building the road. And that could mean multi-year wealth creation opportunities for smart investors.

Ready to take your investment game to the next level? With the auto sector set for major growth, now’s the perfect time to act.

Don’t wait for the market to pass you by – open your account with Angel One today and start investing in the best auto stocks! Click here to seize the opportunity and get started with Angel One!

FAQs

1. What is the NITI Aayog report and why is it important for auto stocks?

The NITI Aayog report outlines key insights and policy recommendations that could shape the future of India’s auto sector, making it a prime area for investment.

2. Which are the top auto stocks to invest in after the NITI Aayog report?

The top auto stocks to focus on include companies with strong growth potential, innovative technologies, and a good track record in the electric vehicle (EV) space, as highlighted in the report.

3. How can I invest in auto stocks?

You can easily invest in auto stocks by opening a trading account with platforms like Angel One. It offers a user-friendly interface and expert tools for smart investing.

4. What makes Angel One a good choice for investing in auto stocks?

Angel One offers competitive brokerage, an intuitive platform, real-time market updates, and detailed stock analysis to help you make informed investment decisions.

5. Is it a good time to invest in the auto sector?

Yes! With government initiatives supporting electric vehicles and the NITI Aayog’s roadmap for the industry, the auto sector is poised for significant growth in the coming years.

Related Articles

Why Investors Are Putting Their Money Into Flexi Cap Mutual Fund