In 2010, Bitcoin was worth less than ₹10 then In 2021, it crossed ₹50 lakh.

After that In 2023, it was taxed in India.

And in 2025? Everyone’s still asking the same question — what’s next?

The future of Bitcoin in India is a topic filled with curiosity, confusion, and controversy. It’s praised by tech founders, feared by central banks, loved by Gen Z, and taxed like sin.

So, where is it all headed?

Let’s cut through the noise and explore what’s shaping Bitcoin’s future in India — from regulations and adoption trends to investor behavior and what the government really wants.

A Love-Hate History: India’s Rocky Ride With Bitcoin

India’s relationship with Bitcoin has always been a rollercoaster. It began as a curiosity, grew into a community, then became a legal grey area.

- In 2018, the RBI banned banks from dealing with crypto.

- In 2020, the Supreme Court reversed the ban.

- In 2022, the government imposed a 30% tax on crypto gains and 1% TDS on every trade.

- In 2023, India launched its own Digital Rupee (CBDC).

Today, Bitcoin is not illegal in India — but it’s also not regulated like stocks or mutual funds. It sits in a strange space: taxed, but not recognised as legal tender.

So, what does this mean for the future?

Growing Adoption Despite Uncertainty

Despite legal ambiguity, India is one of the fastest-growing Bitcoin markets in the world.

According to Chainalysis, India ranked #1 in grassroots crypto adoption in 2023. That means regular users — not just whales — are buying, holding, and trading Bitcoin.

Young Indians, especially those under 35, are driving this trend. With inflation concerns, limited access to global assets, and growing digital literacy, Bitcoin has emerged as a new-age asset class.

Even Indian crypto exchanges like CoinDCX, CoinSwitch, and WazirX report that Bitcoin remains the most-held and most-traded coin on their platforms.

Clearly, public interest is not fading.

Regulation: The Elephant in the (Blockchain) Room

The biggest factor shaping the future of Bitcoin in India is regulation.

So far, the government has taken a cautious — almost passive — stance. Instead of banning it, they chose to tax it harshly, likely to discourage speculation while buying time to create a framework.

But here’s the twist: India is now part of the G20 Financial Stability Board, which is working on global crypto regulation standards. That means Indian rules will likely align with international norms — not random bans.

Already, there are whispers of a Crypto Bill being reintroduced in Parliament — this time focused on investor protection, tax clarity, and AML (anti-money laundering) compliance.

If done right, it could unlock a new wave of legit Bitcoin innovation and institutional participation.

Banks, Startups & Big Tech: Quietly Embracing the Future

While public statements stay cautious, some of India’s biggest players are preparing for a crypto-integrated future behind the scenes.

- HDFC and ICICI have begun testing blockchain for internal processes.

- Infosys and TCS are developing crypto-compliant fintech platforms for global clients.

- Polygon (originally Matic Network), founded by Indians, is one of the top blockchain projects globally and integrates well with Bitcoin sidechains.

In short, the tech foundation is already being built. The only missing piece is policy clarity.

Investor Mindset: From FOMO to Fundamentals

The early crypto rush in India was driven by hype — everyone wanted in. But the 2022–23 crash, combined with high taxes and a TDS deduction on every trade, cooled down the noise.

Now, we see smarter behavior:

- Investors are HODLing (holding) for long-term gains.

- More people are using SIP-style investments in Bitcoin.

- There’s growing interest in cold storage wallets and tax-friendly strategies.

This maturing behavior is a very bullish sign for the future of Bitcoin in India.

What Robert Kiyosaki Just Said About Bitcoin — And Why India Should Listen

Robert Kiyosaki, the bestselling author of Rich Dad Poor Dad, is famous for challenging traditional financial thinking. For decades, he’s been urging people to avoid “saving cash” and instead own assets like real estate, gold, and silver.

Lately, he’s added a new name to that list — Bitcoin.

And this time, he’s not holding back.

In a recent statement, Kiyosaki predicted that

Bitcoin could reach $180,000 to $200,000 by the end of 2025.

Why? Because he believes the U.S. economy is heading toward what he calls a “Greater Depression” — something worse than 2008.

He points to signs like:

- Rising U.S. debt

- A collapsing middle class

- Struggling retirement systems

- High inflation and growing unemployment

Kiyosaki says that in such a fragile financial world, assets like Bitcoin, gold, and silver aren’t just investments — they’re survival tools.

But he didn’t stop at 2025.

In a follow-up forecast, he went much further:

By 2035, Kiyosaki expects Bitcoin to cross $1 million.

Alongside that, he expects gold to touch $30,000 per ounce and silver to hit $3,000.

To him, this isn’t just hype. It’s the logical outcome of governments printing too much money and people losing trust in fiat currencies.

💭 What does this mean for Indian investors?

Now, Kiyosaki isn’t talking specifically about India. But we’re not immune to the same global issues: inflation, rupee volatility, and geopolitical stress.

For many young Indians — especially those without access to global investments or dollar assets — Bitcoin feels like the digital version of gold. Something they can hold on to in uncertain times. Something that’s limited in supply. Something borderless.

Kiyosaki’s views don’t mean you should rush into crypto. But they do raise a powerful question:

Are we underestimating Bitcoin’s role in the next global financial cycle?

With India’s strict tax rules (30% on gains, 1% TDS on every trade) and no legal framework yet, it’s not a frictionless ride. But if global voices like Kiyosaki are even half-right, Bitcoin’s long-term role in India may be much larger than today’s headlines suggest.

For now, caution and clarity should guide every investor. But so should curiosity — because sometimes, early signals become tomorrow’s megatrends.

What the Future of Bitcoin in India Could Look Like (2025–2030)

Here’s a practical outlook based on current trends:

| Factor | Short-Term (2025) | Long-Term (2030) |

|---|---|---|

| Regulation | Tax regime, no ban | Clarity + global alignment |

| Adoption | Retail & youth driven | Institutional + government use |

| Investment options | Crypto apps & wallets | ETFs, pension funds, SEBI-backed |

| Risks | Volatility, scams | Scams reduce, volatility stabilizes |

| Innovation | Startups & exchanges | Banks, DeFi + Web3 expansion |

India might never “legalize” Bitcoin the way it does rupees — but it may end up recognizing and regulating it as a digital asset, much like gold.

Final Thought: Is Bitcoin’s Future in India Bright?

Bitcoin isn’t a fad anymore. It’s a phenomenon.

India may not be the first to regulate it. But it likely won’t be the last either. With over 100 million users, a rising middle class, and strong tech DNA, India is quietly shaping up as a major crypto powerhouse.

The future of Bitcoin in India depends not just on regulation, but on how investors, startups, and policymakers build trust and systems around it.

For now, Bitcoin remains legal, taxed, and widely traded. And in a country where financial inclusion and tech adoption are growing hand-in-hand, its future — though cautious — looks increasingly inevitable.

💹 Bitcoin may be the future — but for now, stocks are the smartest way to build wealth. Start investing confidently with Angel One today!

FAQs

Is Bitcoin legal in India?

Yes, Bitcoin is legal to buy, hold, and trade in India. However, it is taxed as a digital asset and not recognized as legal tender.

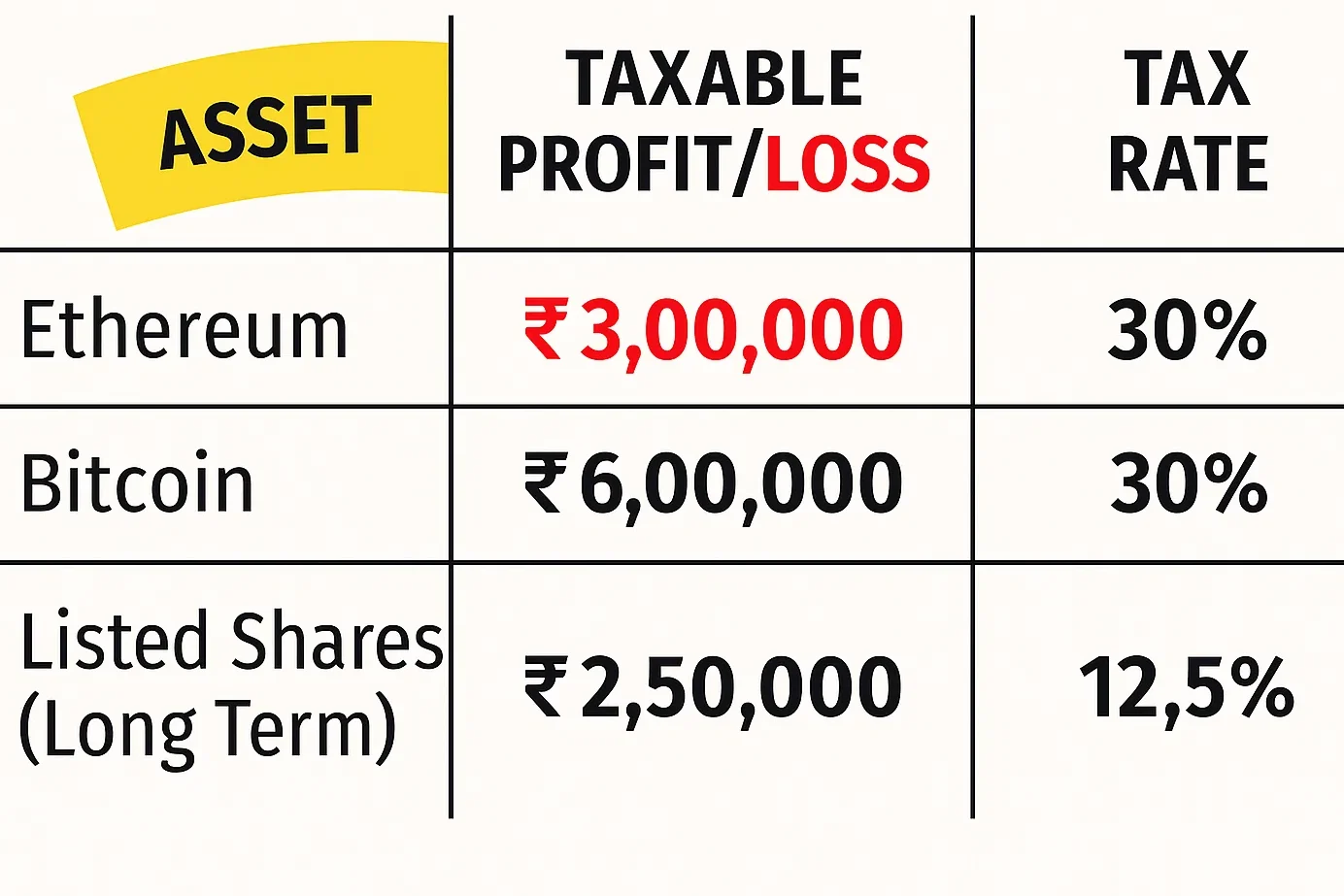

What is the current tax on Bitcoin in India?

Gains from Bitcoin are taxed at 30% with a 1% TDS on every trade. There is no provision for setting off losses against other income.

Can I invest in Bitcoin through Indian apps?

Yes, Indian platforms like CoinDCX, WazirX, and CoinSwitch allow you to buy and sell Bitcoin safely.

Will Bitcoin ever be banned in India?

As of now, there is no indication of a ban. The government is moving towards regulation, especially in sync with global standards via G20.

How popular is Bitcoin in India?

India has over 100 million crypto users, making it the largest crypto user base in the world according to Chainalysis.

What is the Digital Rupee and how is it different from Bitcoin?

The Digital Rupee is India’s official Central Bank Digital Currency (CBDC), controlled by the RBI. Bitcoin is decentralized and not controlled by any authority.

Should I invest in Bitcoin now or wait for regulation?

If you’re investing long-term, small allocations may make sense. But given the uncertainty, it’s wise to wait for more regulation if you’re risk-averse.

Is Bitcoin a good alternative to gold in India?

Some investors consider Bitcoin as “digital gold” due to its limited supply, but it is far more volatile. Use it for diversification, not replacement.

Can I do a SIP in Bitcoin?

Yes, some platforms allow monthly or weekly investments in Bitcoin, mimicking a SIP approach for rupee cost averaging.

Is Bitcoin safer than stocks in India?

Bitcoin is riskier due to price volatility and unclear regulation. For most Indian investors, stocks remain a safer and more regulated investment.

Related Articles

Blockchain and Cryptocurrency: How India Could Be the Next Big Story