Blockchain and Cryptocurrency are powering a quiet revolution — one that’s unfolding behind the screens of our phones and laptops, challenging the very idea of how we store value, move money, and even trust each other.

It’s built on a new kind of infrastructure — one that removes middlemen, adds transparency, and lets anyone participate in a global financial network. At its heart are digital currencies like Bitcoin and Ethereum. You may have heard about crypto rising, crashing, or being taxed in India. But beyond the buzzwords, there’s a much deeper story unfolding. One that could reshape India’s financial landscape in the next decade.

Let’s take a moment to understand it — not with jargon, but with clarity.

What Exactly Is Blockchain, and Why Does Everyone Keep Talking About It?

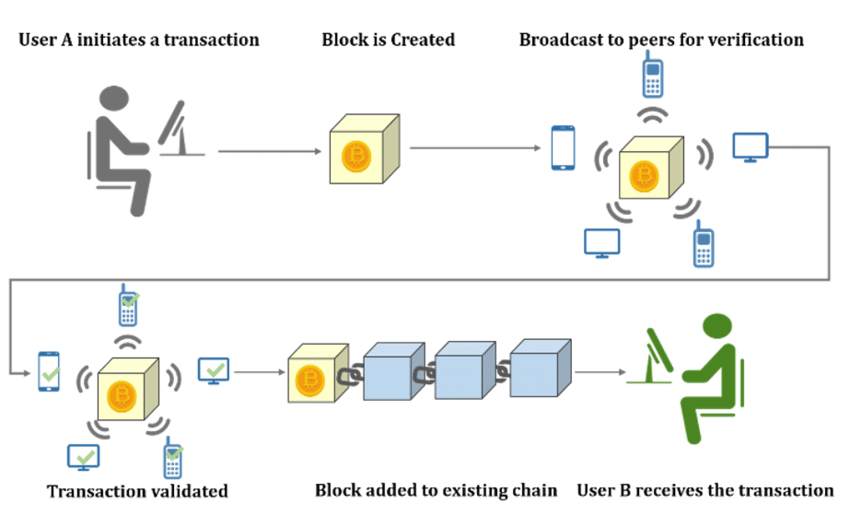

Think of blockchain as a digital ledger — like a Google Sheet shared across the globe. Every time someone makes a transaction, a new line is added to the sheet. But here’s the twist: once something is written, it can’t be edited or deleted.

That’s because blockchain isn’t controlled by one person or organization. Instead, thousands of computers (called nodes) validate and record every transaction. This makes it incredibly secure, transparent, and nearly impossible to tamper with.

Now imagine applying this system to not just money, but anything that needs trust — contracts, property records, supply chains. Suddenly, you have a tool that can remove middlemen, reduce fraud, and make systems faster and cheaper.

So Where Does Cryptocurrency Fit In?

If blockchain is the engine, cryptocurrency is the fuel.

Cryptocurrencies are digital tokens that run on a blockchain. They act like money — you can use them to pay for things, invest, or store value. Bitcoin is the most well-known, but it’s just one of thousands. Ethereum, for instance, goes beyond currency. It allows developers to build apps — like the iOS of the blockchain world.

The magic lies in how crypto works. You can send money to anyone in the world, 24×7, without needing a bank. Transactions settle in seconds. Fees are tiny. And everything is traceable — yet private.

Traditional Finance vs Blockchain: A Quiet Battle

Imagine you want to send ₹10,000 to a friend in the U.S. through your bank. It’s going to take 2–3 days, you’ll lose money in currency conversion, and both banks will take a slice of the transaction. The system is slow, expensive, and opaque.

Now do the same thing with crypto. The money reaches in seconds. The fee is just a few rupees. No middlemen. No delays.

That’s not science fiction. That’s already happening.

And it’s not just transfers. Smart contracts — powered by blockchains like Ethereum — allow people to lend, borrow, trade assets, and execute agreements without ever meeting or trusting each other. The code does the job. It replaces the need for banks, brokers, and middle layers.

India’s Complicated But Promising Relationship With Crypto

India hasn’t ignored crypto. But it hasn’t embraced it either. It’s been… cautious.

In 2018, the Reserve Bank of India asked banks not to deal with crypto companies. In 2020, the Supreme Court struck that down. Since then, the government has moved slowly — taxing crypto gains at 30%, and introducing a 1% TDS on transactions.

That scared off some investors. But it didn’t stop the growth.

India today has the largest number of crypto owners in the world — over 100 million and counting. Young investors are buying small amounts of Bitcoin and Ethereum. Developers are building tools on blockchains like Solana and Polygon (which, by the way, is an Indian-founded project making global waves).

And the government? It’s quietly working on its own blockchain-based solution — the Digital Rupee, which could completely change how we use money in the future.

What the Digital Rupee Tells Us

In December 2022, the Reserve Bank of India launched the pilot for India’s own Central Bank Digital Currency (CBDC) — the Digital Rupee.

It runs on blockchain. But unlike Bitcoin, it’s fully controlled by the RBI.

Here’s what makes it interesting: when it scales, you won’t need cash. You won’t need UPI either. You’ll simply hold your Digital Rupees in a wallet issued by the RBI. You’ll pay and receive money instantly, with every transaction traceable, secure, and cheap.

And that’s just the start. The underlying tech — blockchain — could also help the government manage subsidies better, stop leakage in welfare schemes, and simplify tax payments.

Blockchain vs UPI: Aren’t We Already Digital?

It’s a fair question.

India already leads the world in digital payments. Every kirana store has a UPI QR code. We split bills over PhonePe. We send rent in seconds. So why fix something that’s working?

Because UPI is digital — but not decentralized.

Let’s break it down:

| Feature | UPI | Blockchain-based Payments |

|---|---|---|

| Who controls it? | Centralized (NPCI, banks) | Decentralized (runs on blockchain) |

| Operational hours | Linked to bank timings | 24×7, even on Sundays |

| Settlement time | Real-time on front-end, but T+1 for banks | True instant (T+0) settlement |

| Cross-border | Limited, expensive | Borderless and low-cost |

| Privacy | Banks know everything | Anonymous but traceable |

| Smart contracts | Not supported | Fully programmable money |

UPI is efficient — no doubt. But it’s like sending an email through your office server. Blockchain lets you send the same message, instantly and securely, without relying on the office.

Now imagine merging the ease of UPI with the power of blockchain. That’s where the Digital Rupee and blockchain-based finance start making sense.

It’s not a replacement. It’s an evolution.

Real Disruption: Beyond Coins and Charts

Too often, people think crypto is about making a quick buck — buy low, sell high. And sure, there’s speculation. But the real power is much bigger.

Blockchain could transform how India stores land records (goodbye fraud), distributes food rations (hello transparency), and even votes in elections (imagine voting securely from your home).

Banks are exploring blockchain for faster settlements. Startups are building blockchain-based supply chains for agriculture. Artists are using NFTs to monetize their work directly. Every industry — from insurance to logistics — has a use case.

It’s not a question of if, but when.

But Is It Safe? Should You Invest?

That depends.

Crypto is volatile. It’s like the early internet — full of promise but full of scams too. Prices swing wildly. Regulations are still murky. And for every solid project, there are dozens of shady coins waiting to collapse.

So yes, you can invest — but do it with eyes open.

Start small. Stick to big names like Bitcoin and Ethereum. Use reliable Indian exchanges like CoinDCX, CoinSwitch, or WazirX. Never invest what you can’t afford to lose.

And don’t just chase profits. Understand the tech. That’s where the real value lies.

Final Thoughts: A Technology That Builds Trust

Blockchain is not just about decentralisation. It’s about restoring trust in systems. And India — with its mix of digital ambition and on-ground challenges — could benefit more than most.

Whether it’s transferring ₹100 across borders, tracking a packet of rice from farm to ration shop, or issuing land titles no one can fake — blockchain offers a new way to build the future.

Cryptocurrency may be just one chapter in the story. The bigger one is still being written. And if India plays it right, it could become not just a user — but a global leader.

So keep your eyes on the headlines, but also read between the blocks.

Ready to explore the future of finance? Start your journey with Angel One and invest in tomorrow’s technology—today

FAQs

What is blockchain in simple words?

Blockchain is a digital ledger that records transactions securely across many computers. Once recorded, the data can’t be changed, making it highly trustworthy.

How does cryptocurrency work with blockchain?

Cryptocurrency uses blockchain to track every transaction. This removes the need for banks and enables instant, transparent, peer-to-peer money transfers.

Is cryptocurrency legal in India?

Cryptocurrency is not illegal in India, but it is taxed heavily (30% on profits and 1% TDS on every trade). The regulatory environment remains uncertain.

What is the difference between UPI and blockchain?

UPI is a digital payment system controlled by banks, while blockchain is a decentralized system that allows borderless and programmable payments without middlemen.

Can I invest in cryptocurrency in India?

Yes, you can invest in crypto using Indian platforms like CoinDCX or CoinSwitch. But it’s volatile, so only invest small amounts you can afford to lose.

What is the Digital Rupee?

The Digital Rupee is India’s Central Bank Digital Currency (CBDC). It runs on blockchain but is issued and controlled by the Reserve Bank of India.

Which Indian companies are working on blockchain?

Polygon (originally Matic) is a globally recognized Indian blockchain project. Other tech firms and banks are experimenting with blockchain in logistics, insurance, and fintech.

How is blockchain useful beyond cryptocurrency?

Blockchain can be used in land records, voting, food supply chains, insurance claims, and any sector where secure and tamper-proof data is essential.

Is blockchain safer than traditional systems?

Yes, blockchain is more secure because it is decentralized and transparent. Once data is added, it cannot be modified without consensus.

Should I learn about blockchain even if I don’t invest?

Absolutely. Blockchain is a foundational technology that could power everything from payments to public records. Understanding it prepares you for the future.

Related Articles

Natural Hydrogen Fuel: Could It Power the Future of Clean Energy?