Happy Maharashtra Day and Labour Day! Markets may be shut today, but yesterday’s session on Akshaya Tritiya was a quiet one. The flat market saw the Sensex dip 46 points (-0.06%) to 80,242, while the Nifty 50 closed almost unchanged at 24,334, down just 1.75 points (-0.01%).

The day looked dull on the surface, but under the hood, things moved. HDFC Life climbed 4.01%, topping the gainers list, while Bajaj Finserv plunged 5.58%, dragging the financial space. Pharma emerged as the best-performing sector (+0.44%), while PSU Banks got hit hardest, falling 2.23%.

In this special edition, we decode how India’s calm compares to global market noise, break down headline-driven stock shifts, and bring you a long-term stock idea to watch after the break.

Global Market vs Nifty – Who’s Beating Whom?

While the Nifty 50 closed almost flat (-0.01%), global markets showed far more energy — each telling a different story. Here’s how they stack up:

🇺🇸 S&P 500 (US):

The US market bounced nicely this week and is now up 3.44% in just 5 days, despite being negative for the month.

📉 YTD: -5.45%

📈 1-Year: +10.81%

✅ Stronger than Nifty in short term, but India still leads over 3 years.

🇩🇪 DAX (Germany):

One of the strongest performers globally. Up 13.29% in 2024, and a massive +25.78% in 1 year.

✅ Outperforming Nifty across all timeframes.

Germany is riding strong industrial momentum.

🇪🇺 Euro Stoxx 50:

A mixed bag. Slight upmove yesterday, but down this month.

📉 1-Month: -1.46%

📈 3-Year: +36%

⚖️ In line with Nifty long term, but underperforming this month.

🇯🇵 Nikkei 225 (Japan):

Looks strong this week but is still down 9.65% YTD.

📉 1-Year: -5.83%

❌ Clearly lagging behind Nifty in all timeframes.

🇭🇰 Hang Seng (Hong Kong):

Mild bounce yesterday, but still in pain.

📉 1-Month: -4.33%

📈 1-Year: +24.5%

⚠️ Volatile, but showing signs of recovery. Still behind Nifty YTD.

🇮🇳 Nifty 50 (India):

📈 1-Month: +3.46%

📈 YTD: +2.92%

📈 3-Year: +42.28%

✅ May look slow this week, but India still beats most markets long term.

Let’s cut the noise — here’s how global markets stack up against the Nifty across different timeframes:

| Index | 1-Day | 1-Week | 1-Month | YTD | 1-Year | 3-Year | Verdict |

|---|---|---|---|---|---|---|---|

| Nifty 50 | -0.01% | +0.02% | +3.46% | +2.92% | +7.65% | +42.28% | 🔄 Flat now, but strong long-term |

| S&P 500 🇺🇸 | +0.58% | +3.44% | -0.91% | -5.45% | +10.81% | +34.58% | 🔼 Strong rebound, still behind Nifty 3Y |

| DAX 🇩🇪 | +0.47% | +2.70% | +1.76% | +13.29% | +25.78% | +59.98% | 🔥 Leading globally |

| Euro Stoxx 50🇪🇺 | +0.19% | +1.44% | -1.46% | +5.64% | +5.09% | +36.00% | ⚖️ Mixed, weaker this month |

| Nikkei 225 🇯🇵 | +0.57% | +3.37% | +1.20% | -9.65% | -5.83% | +34.25% | ❌ Lagging, despite short-term rise |

| Hang Seng 🇭🇰 | +0.51% | +0.21% | -4.33% | +10.27% | +24.52% | +4.88% | ⚠️ Bouncing, still weak overall |

What It Means:

Don’t be fooled by India’s flat market this week — Nifty continues to outperform over 3 years. Global markets are rebounding, but India remains a steady compounder, not a chaser. The calm could be hiding strength.

Stock in News & Impacted Players

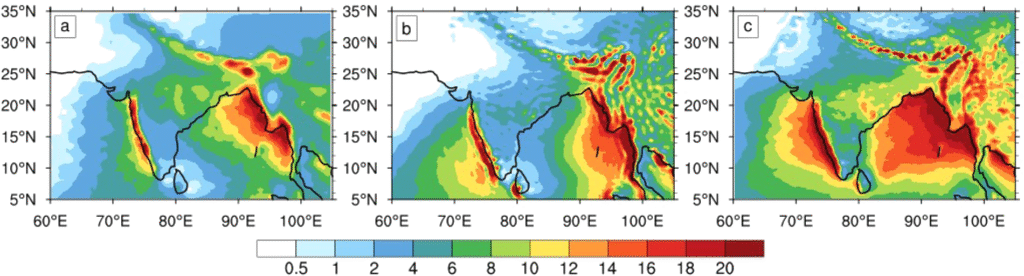

No Fishy Business: Climate Risk Hits Bay of Bengal

A major study published in Nature Geoscience found that food availability for marine life in the Bay of Bengal dropped by nearly 50% during extreme monsoon events — both too strong and too weak. With climate change making monsoons more erratic, this threatens India’s fisheries, which account for 8% of the world’s fish catch.

Impacted Stocks:

- Avanti Feeds, Coastal Corporation, Waterbase Ltd. — companies dependent on marine yields may face long-term climate pressure.

Jharkhand Hikes Power Tariffs — But Keeps Relief for 40 Lakh Users

Starting May 1, Jharkhand electricity tariffs are up 6.34% for most urban and rural users. However, 40 lakh households consuming under 200 units monthly remain fully subsidized.

Impacted Stocks:

- Tata Power, NTPC, and JSW Energy — marginal sentiment boost as tariff hikes improve DISCOM viability, which helps generators get paid on time.

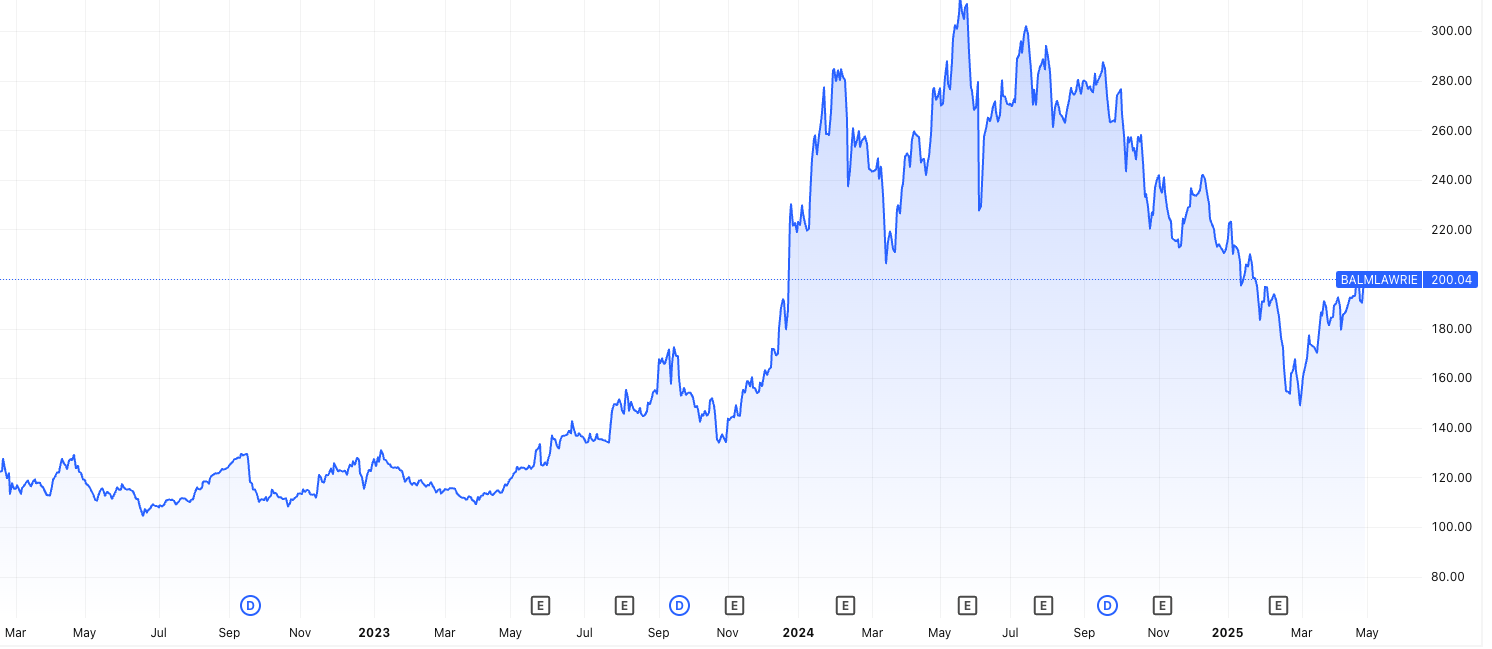

Balmer Lawrie Investments Sparks Buzz with Buyback, Split, Bonus Plans

The board of Balmer Lawrie Investments will meet on May 21 to consider a share buyback, stock split, bonus issue, and dividend. The stock had already seen a rally post this news.

Impacted Stock:

- Balmer Lawrie Inv. — continues to remain in focus as a deep-value PSU play with strong shareholder-friendly signals.

“Everyone’s Betting on India” — Says Piper Serica CIO

According to Piper Serica’s Abhay Agarwal, global asset allocators are placing long-term bets on India. Why? A mix of domestic SIP-driven flows, increasing passive FII flows, and India’s relatively smaller market cap compared to the US and China.

Impacted Theme:

- India-focused ETFs, AMC stocks like HDFC AMC, UTI AMC, Nippon Life — long-term capital inflow tailwind remains strong.

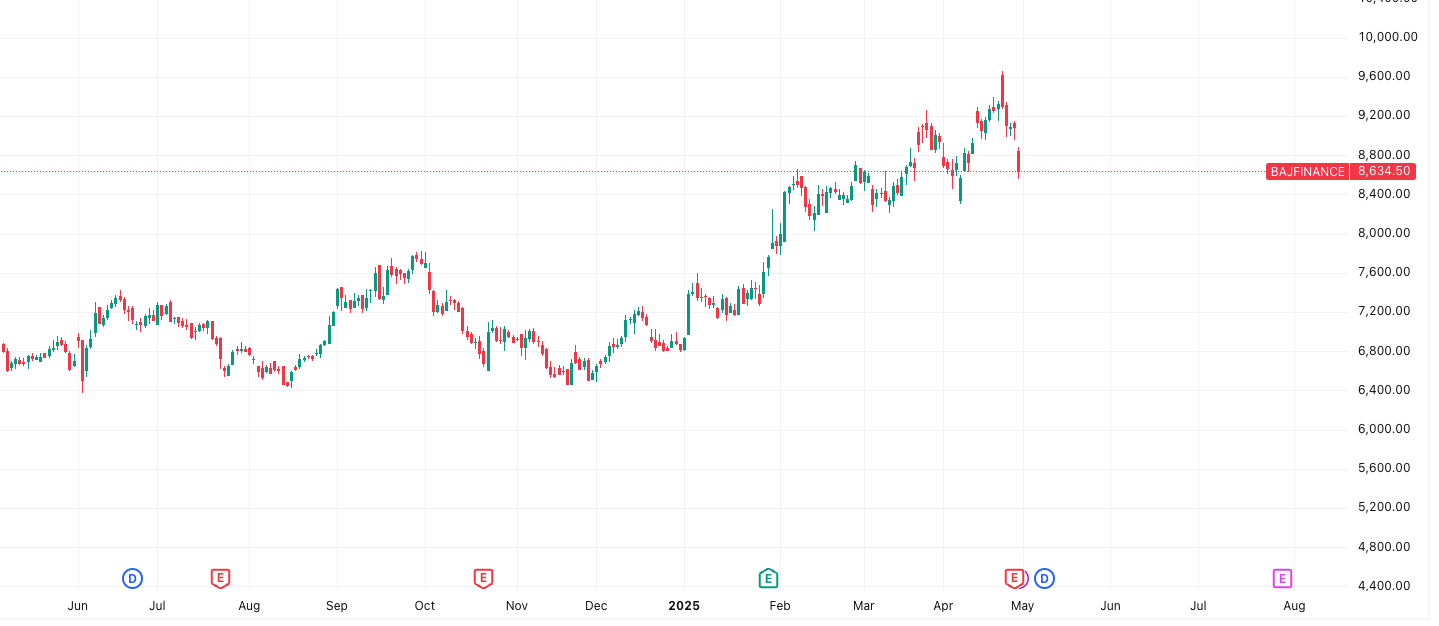

Bajaj Finance Goes Full Fireworks Mode: 1 Share Becomes 10!

In a bold move, Bajaj Finance announced a 1:1 stock split followed by a 4:1 bonus issue. Combined? You get 10 shares for every 1 share you currently hold. Plus, they announced a total dividend of ₹56 per share.

Impacted Stock:

- Bajaj Finance — short-term volatility expected, but retail buzz will likely drive strong participation ahead of record dates.

Bajaj Finance: What Happens After Split & Bonus?

Current price: ₹8,634 (before any changes)

- Stock Split (1:1)

Your 1 share becomes 2 shares at ₹4,317 each. - Bonus Issue (4:1)

For every 1 share (post-split), you get 4 extra. So 2 shares become 10.

Final Result:

1 share at ₹8,634 becomes 10 shares at ₹863.40 each.

Value stays the same — just more shares, lower price.

Long-Term Stock Pick: Polycab India Ltd

In a market flooded with noisy midcaps, Polycab India stands out quietly — powering India’s infrastructure story with wires, cables, and solid numbers.

🔎 Why Polycab?

Polycab is India’s leading manufacturer of wires and cables, with a growing presence in FMEG (fans, lighting, switches) and industrial electricals. From high-rises to highways, wherever there’s power, chances are Polycab is behind the scenes.

But what makes it a long-term bet?

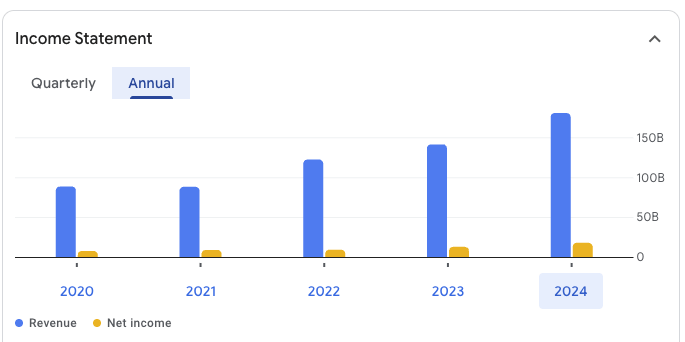

📈 Financial Strength

- Q2 FY25 Revenue: ₹5,498 crore (↑ 30% YoY)

- Net Profit: ₹445 crore (↑ 3.35% YoY)

- 3-Year PAT CAGR: ~36%

- ROE: Consistently above 20%

- Zero debt company with excellent cash flows

⚡ Growth Drivers

- Government push for rural electrification, smart cities, and real estate

- Aggressive capex in infrastructure and industrial corridors

- Expanding into FMEG, giving it access to higher-margin B2C markets

- Leadership in low-voltage power solutions

⚠️ Risks to Watch

- Valuation is expensive (P/E ~56x), so the stock may see short-term corrections

- Competitive industry — margins could shrink if raw material costs rise

- Still early in its FMEG expansion cycle

🎯 Bottom Line

Polycab is not a get-rich-quick stock — it’s a compounder.

If you’re looking to ride India’s electrification and manufacturing boom over the next 5–10 years, this midcap fits the bill.

Ideal Entry Range: ₹4,800–₹4,900 (on dips)

Target (3–5 Years): ₹8,000+

Risk-Reward: Strong fundamentals justify the wait.

What To Do Now: Your Post-Holiday Action Plan

Markets were closed today for Maharashtra Day and Labour Day, but that doesn’t mean you take a break from thinking smart.

Here’s how to position yourself ahead of tomorrow’s session:.

- Look for leadership in Pharma and FMCG: These sectors showed relative strength. If markets stay range-bound, defensives could shine.

- Track global leads overnight: DAX and S&P 500 have shown strength. If they hold or extend gains, expect Nifty to test 24,370 again.

- Get your watchlist ready: Stocks like Polycab (midcap quality), Balmer Lawrie (corporate action buzz), and Bajaj Finance (post-split effect) are setting up for volatility.

Bottom line:

Today was calm — tomorrow might not be. The flat market may just be the silence before the next sector rotation. Get ready.

Wrapping Up: Calm Today, Signals Tomorrow

Markets may have taken a break, but investors shouldn’t.

The flat market on April 30 looked quiet — but stock-specific moves, sector shifts, and upcoming IPO buzz all hint at action building beneath the surface. Whether it’s Balmer Lawrie’s shareholder-friendly streak, Polycab’s long-term story, or the pressure on PSU Banks, smart money will be watching closely as trade resumes.

Use today’s holiday wisely — realign, reassess, and reset.

And if you need a platform that lets you research, invest, and execute — all in one tap — Angel One has you covered.

Stay ready, stay sharp.

Related Articles

Buy Gold on Akshaya Tritiya? Only If You Know This First