Happy Monday… or is it?

Markets opened after a two-day weekend, but instead of fresh energy, they walked straight into tension. The India-Pakistan border is making headlines again, investors are jittery, and the word “War” has crept back into trading rooms.

📉 Nifty might dropped below 24,000.

🚨 And just to spice things up—Ather Energy’s IPO launched today.

So, what’s causing this war of nerves on Dalal Street? And more importantly—should you fight, flight, or buy the dip?

Let’s dive in.

Global Markets Update: Calm Before the (War) Storm?

While Indian markets are sweating over the word “War,” global indices spent the weekend dancing.

📈 S&P 500 jumped +0.74% and Nasdaq surged +1.26%, powered by Big Tech earnings and hopes of a soft landing for the US economy.

📈 Nikkei 225 flew up +1.90%—looks like Japan didn’t get the war memo.

📉 Only the Shanghai Composite looked mildly moody, down -0.07%.

Even European indices like DAX (+0.81%), CAC 40 (+0.45%), and FTSE 100 (+0.09%) had a green day.

But here’s the catch—global investors are watching South Asia closely. If the India-Pakistan situation escalates, don’t be surprised if “War” becomes a global keyword, not just a local headache.

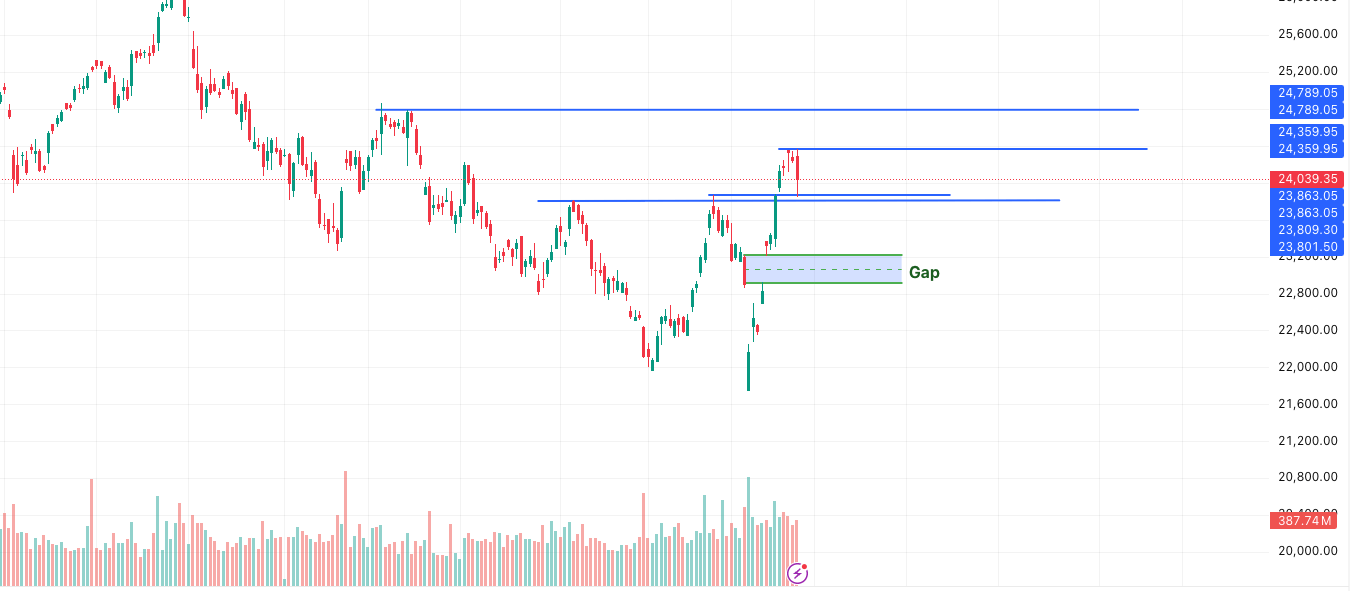

Nifty Outlook: There’s a visible resistance zone at 24,359–24,789, and Nifty just got slapped right at the entry gate. Plus, it has left behind a clean gap around 23,200–23,400, which may act like a magnet if selling pressure continues.

But all’s not gloomy. As long as Nifty holds above 23,863–23,800, the uptrend’s still safe. Break that? The bears might get brave and drag it to fill that gap zone.

📰 News & Related Stocks: How War and IPO Buzz Are Shaping the Market

📉 Market May Fall 5-10% if War Tensions Rise: Anand Rathi Study

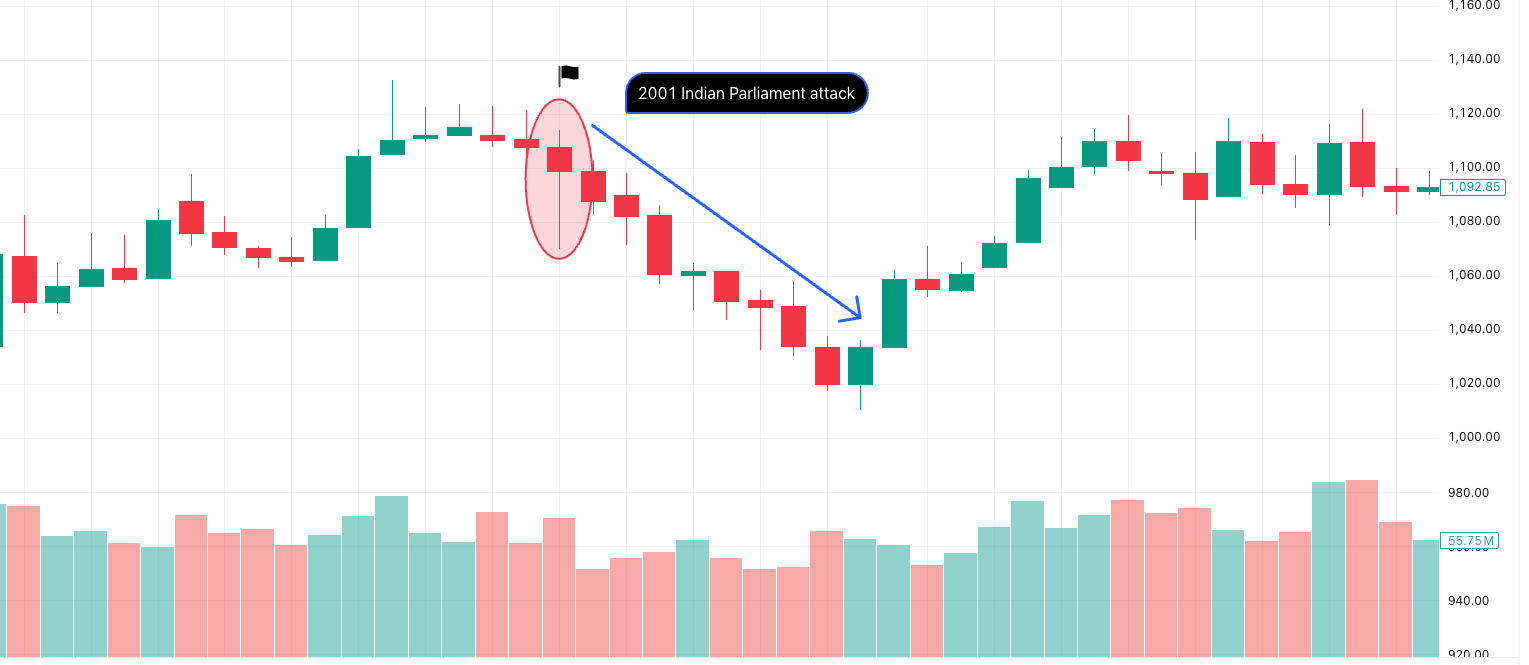

Financial services firm Anand Rathi studied how India’s stock market reacted during past India-Pakistan tensions. They found that usually, markets didn’t fall much—less than 2%.

The only big exception was after the 2001 Parliament attack, but even that was partly because US markets had already crashed.

This time, after the Pahalgam attack, Anand Rathi says that if War escalates, Nifty 50 could fall 5% to 10%.

Even though the market dropped on Friday (April 25), they advise long-term investors to stay calm and not panic-sell.

👉 Stock Impact:

- Defence sector stocks like HAL, BEL, and Bharat Dynamics could rise if tensions worsen.

- Overall market (Nifty 50, Bank Nifty) might see 5-10% downside if the situation escalates.

📈 Canara Robeco Files IPO Papers: Canara Bank To Sell Shares

Canara Robeco Asset Management is planning to go public. They filed the first documents (called DRHP) with SEBI.

This IPO won’t bring any new money to the company. Instead, Canara Bank and OCE (ORIX Corporation Europe) will sell some of their shares.

- Canara Bank will sell 2.59 crore shares (around 13% stake).

- OCE will sell 2.39 crore shares (around 12% stake).

- Total IPO size will be around ₹800-1,000 crore, depending on the final price.

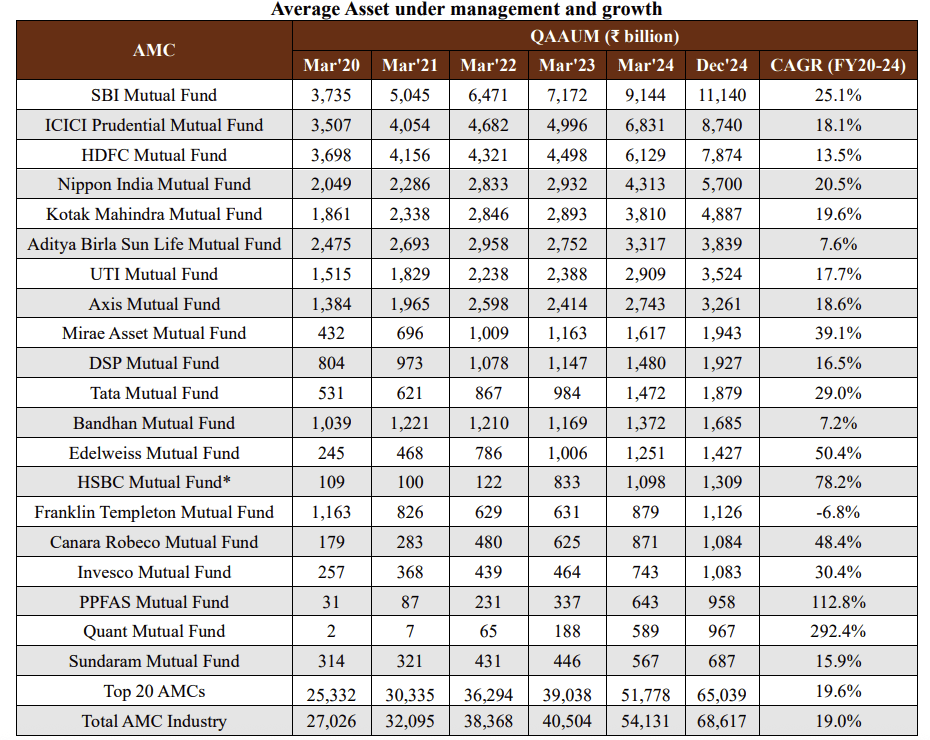

- Canara Robeco manages about ₹1,08,366 crore as of December 2024 and made a profit of ₹149 crore in 9M FY25 (up 40% YoY).

👉 Stock Impact:

- Positive sentiment for Canara Bank (cash inflow from sale).

- AMC sector peers like HDFC AMC, UTI AMC, and upcoming IPO listings may see some excitement.

⚡ Ather Energy Raises ₹1,340 Crore from Anchor Investors

Ather Energy, the electric scooter maker, is getting ready for its IPO on April 28-30.

Ahead of this, they raised a massive ₹1,340 crore from 36 big funds by allotting 4.17 crore shares at ₹321 per share (top end of the IPO price).

Top buyers include SBI Mutual Fund, ICICI Prudential MF, Aditya Birla Sun Life MF, and foreign investors like Morgan Stanley and Abu Dhabi Investment Authority.

👉 Get IPO Analysis Here: Ather Energy IPO: Should You Ride This Electric Wave?

🇺🇸 Tesla Refunds Old Bookings, Hints at India Launch

Tesla has started refunding the $1,000 booking amounts taken way back in 2016 for the old Model 3.

The reason: the older Model 3 is being discontinued.

But the bigger excitement?

This move hints Tesla may finally launch newer models in India soon — especially since Elon Musk is visiting India in 2025 and India-US talks about lowering car import taxes are happening.

👉 Stock Impact:

- Positive for EV ecosystem stocks: Tata Motors (EV leader), M&M (e-SUVs), Exicom (charging infra).

- Tesla’s official India entry could also drive interest in auto ancillaries and charging stations.

🛢️ SEA Wants 40% Import Duty on Refined Palm Oil

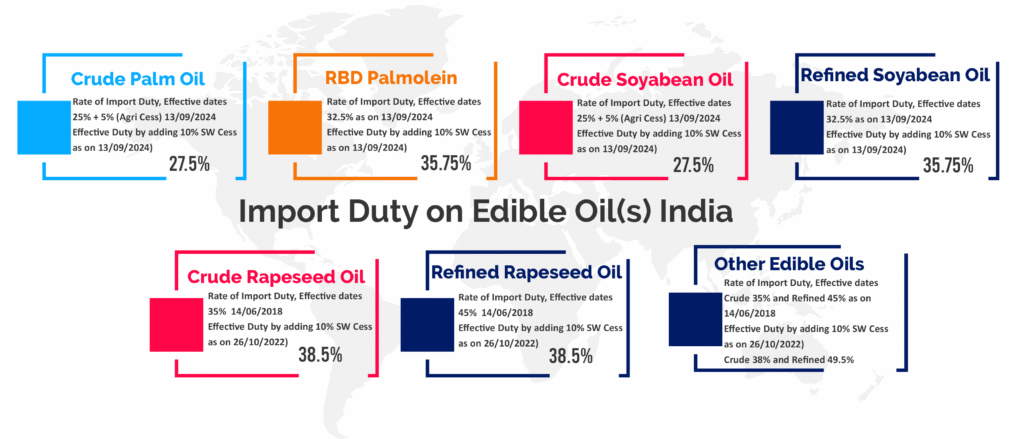

The Solvent Extractors’ Association (SEA) is asking the Indian government to raise the import duty on refined palm oil to 40% (currently ~35.75%).

Reason: Right now, importing refined palm oil is $50/ton cheaper than importing crude palm oil and refining it here.

This hurts Indian companies who invested in refining factories.

SEA blames Malaysia and Indonesia, where lower export taxes make refined oil cheaper.

👉 Stock Impact:

- If government agrees, domestic refiners like Adani Wilmar, Ruchi Soya (Patanjali Foods), and KS Oils could benefit.

🥤 Kinley Soda Crosses ₹1,500 Crore Revenue

Coca-Cola India announced that its packaged soda brand Kinley crossed ₹1,500 crore in yearly revenue.

They achieved this milestone with:

- Trust built over 20 years

- Wide product range (200ml to 2.25L bottles)

- Huge supply chain and retail reach (sold in 1.4 million outlets, including Swiggy, Zepto, and kirana shops).

👉 Stock Impact:

- Positive readthrough for beverage sector stocks like Varun Beverages, Orient Beverages, and FMCG companies expanding into bottled water or soda.

🏠 Indian Bank Cuts Loan Rates on Homes and Vehicles

Indian Bank has cut its interest rates:

- New home loans at 7.90% per year.

- New vehicle loans at 8.25% per year.

This makes it cheaper for people to buy homes and cars, as EMIs will fall.

Effective immediately from April 25, 2025.

| Loan Type | Previous Interest Rate | New Interest Rate | Starting Rate After Reduction |

|---|---|---|---|

| Home Loan | 8.15% | 7.90% | 7.90% per annum |

| Vehicle Loan | 8.50% | 8.25% | 8.20% per annum |

👉 Stock Impact:

- Positive for auto sector (Maruti Suzuki, M&M) and real estate sector (Godrej Properties, DLF).

- Also good for housing finance companies (HDFC Ltd, LIC Housing Finance).

Stocks in Technical Radar: War Fear = Short Setup Alert

With war fears creeping in, the market mood is cautious. Smart money isn’t going all in — instead, it’s preparing to short weak setups. One stock flashing a red flag on the chart today? Hindalco.

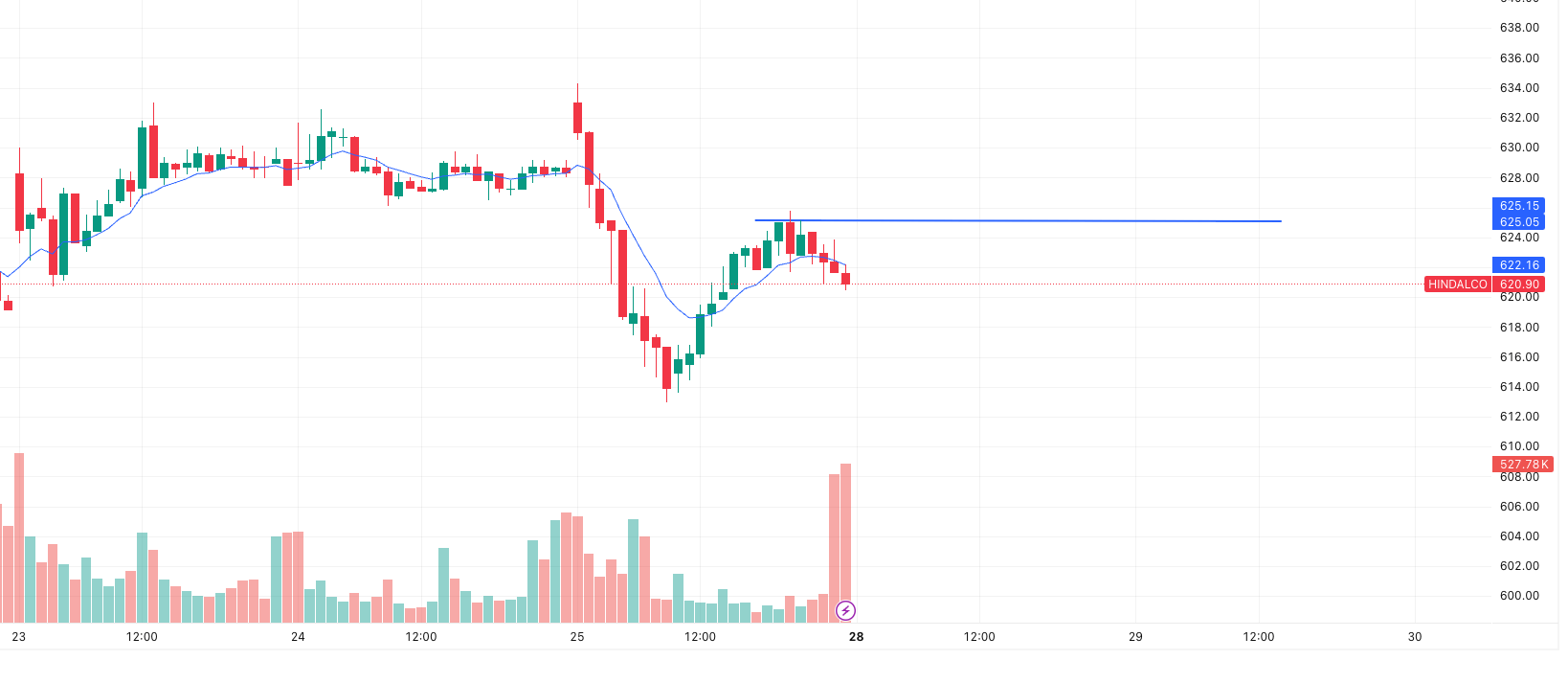

🧨 Hindalco: Short Setup on 15-Min Chart

Why Short?

- Price rejected hard from the ₹625 resistance zone — ouch.

- Now trading below its 9 EMA (₹622) — weakness confirmed.

- That last big red candle? Heavy volume selling.

- Forming lower highs after a failed breakout attempt.

- Add war jitters = perfect recipe for selective shorting.

📝 Trade Plan

- Entry: Below ₹620 (Aggressive) or ₹618 (Safe)

- Stoploss: ₹625.50 (Just above resistance)

- Targets: ₹615 (T1), ₹610 (T2)

- Risk-Reward: 1:2+ — solid for intraday scalpers

📌 Note: Nifty’s cautious sentiment supports short trades, but don’t overtrade. Stick to the plan and manage risk like a boss.

⚠️ Disclaimer: This is for educational purposes only. Always do your own research, use a stoploss, and avoid trading just based on headlines. Markets are wild.

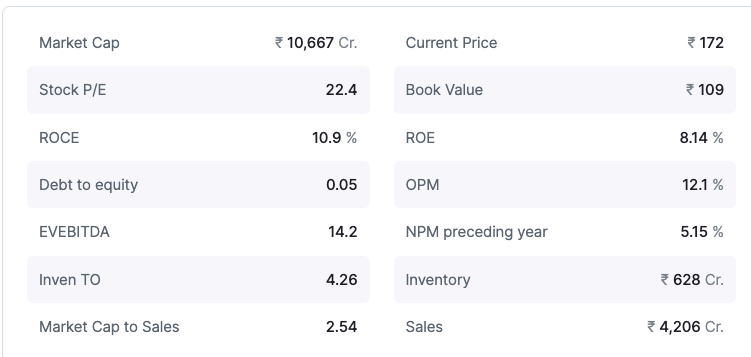

Small Cap Stock of the Day: Finolex Industries Ltd

When it rains (war fears), it’s good to stick to strong businesses. Today’s small-cap pick is Finolex Industries Ltd (FIL) — a PVC king that’s quietly building India’s pipes and fittings backbone.

🏗️ What Does Finolex Do?

- PVC Resin: Major raw material for pipes (and they make it in-house — smart!)

- PVC Pipes & Fittings: Huge range — plumbing, sanitation, agriculture, you name it.

🏆 Why is Finolex Interesting?

- Market Leadership:

- 3rd-largest in PVC Resin.

- 2nd-largest in PVC Pipes.

- Only backward-integrated pipes company — controls both raw material and final product.

- Business Mix Shift:

- Pipes & fittings = 99% of business now (vs 83% in FY22).

- Resin segment shrank, but it was strategic — better margins in pipes!

- Strong Distribution:

- 900 dealers, 30,000 retailers across India.

- Big presence in major cities through 8 branch offices.

- Manufacturing Power:

- 4 factories with 70–77% utilization (solid efficiency).

- 70,000 MT new capacity added recently.

- Another ₹150 Cr capex planned to expand even more by Q4 this year.

- Growth Plans:

- Targeting 10%-12% volume growth this year.

- Pushing more into non-agriculture sectors (plumbing, construction) — aiming 50% non-agri sales in 3–4 years.

📊 Quick Numbers to Know

- Pipes Sales Volume H1 FY25: 1.6 lakh MT

- Resin Sales Volume H1 FY25: 2,680 MT (huge drop — part of the shift)

- Pipe Sales Realization: ₹1.21 lakh/MT

🚨 Why Watch Finolex Now?

While PVC resin prices are volatile, Finolex’s focus on pipes (where margins are better) can shield it from raw material price shocks. Plus, expansion plans show management is thinking long term — not just sitting pretty.

⚡ Risk Note: PVC market is cyclical. Volatile resin prices and slowdown in construction/agri demand can hit short-term growth.

What To Do Now: Your Action Plan

- War fears have made the market moody — expect sudden swings, especially in metals and global-facing sectors.

- Stay cautious, not scared: Focus on sectors like FMCG, Defense, and Pipes (hello Finolex!).

- Short-selling opportunities like Hindalco look tempting — but only for quick, experienced traders.

Overall Tip:

👉 Trade light.

👉 Stick to quality stocks.

👉 Keep your stop-losses tight.

Final Thoughts

Markets love to overreact first and think later.

In times like these, it’s better to have a clear plan instead of chasing news headlines. Stay sharp, stay selective, and don’t forget — cash is also a position!

By the way…

If you’re looking to trade smarter during these rollercoaster times, Angel One’s app can help you with lightning-fast charting, real-time alerts, and ready-made screeners — without making you feel like you’re solving a maths exam. 📈😉

Click here to check out Angel One!

Related Articles

The Economics of Sports in India: A Deep Dive into a Billion-Dollar Game