Red, But Not Dead!

Ever opened your stock app and felt like your portfolio in red just got hit by a truck? Yep, that sea of red is brutal. But before you call your astrologer or unfriend your financial advisor, take a breath.

The market isn’t out to get you—at least not personally. Stocks fall, mutual funds wobble, and panic sets in. But here’s the catch: just because your portfolio is in red doesn’t mean it’s dying. In fact, this is exactly when long-term investors are quietly smiling and buying more.

So if your portfolio in red looks like it needs CPR, don’t treat it like a crime scene. Instead, treat it like a shopping mall during a discount sale. With the right strategy, that portfolio in red could be tomorrow’s winner.

Let’s figure out what’s going on and how not to mess this up when your portfolio turns red.

Why is Your Portfolio in Red?

So your screen is bleeding red. But before blaming it on Mercury retrograde or your friend who recommended that “sure-shot multibagger,” let’s figure out what’s really going on.

1. Market Sentiment = Mood Swings

Sometimes the market just… wakes up cranky. A global recession fear, interest rate hikes, or a random war in some corner of the world—and boom, everyone’s selling. Even the strongest stocks go red in this herd panic.

Take this week for example:

Trump went full “America First” and announced fresh tariffs on Chinese goods. That sparked recession fears in the US. US markets fell. Global markets followed. And voila—Indian markets took the hit.

Result? Your portfolio in red. Thank you, geopolitics!

Trump Tariff → US Recession Risk → Global Selloff → Indian Markets Fall → Portfolio in Red2. Sector-Specific Sagas

Maybe it’s not you. Maybe it’s your sector. IT stocks getting hammered because of US tech slowdown? Pharma stocks opening higher but unable to hold gains? Your portfolio in red might just be caught in a temporary storm.

3. Company-Specific Chaos

Ah, the classic “management issues,” debt pile-ups, or disappointing results. If you’re holding individual stocks, this is where your research (or lack of it) starts showing.

4. FOMO Buys Now Turned Slow Poison

Remember that hot tip from Twitter or that small-cap rocket “recommended” by your gym buddy? Yeah, those gems often turn into long-term museum exhibits in your portfolio in red.

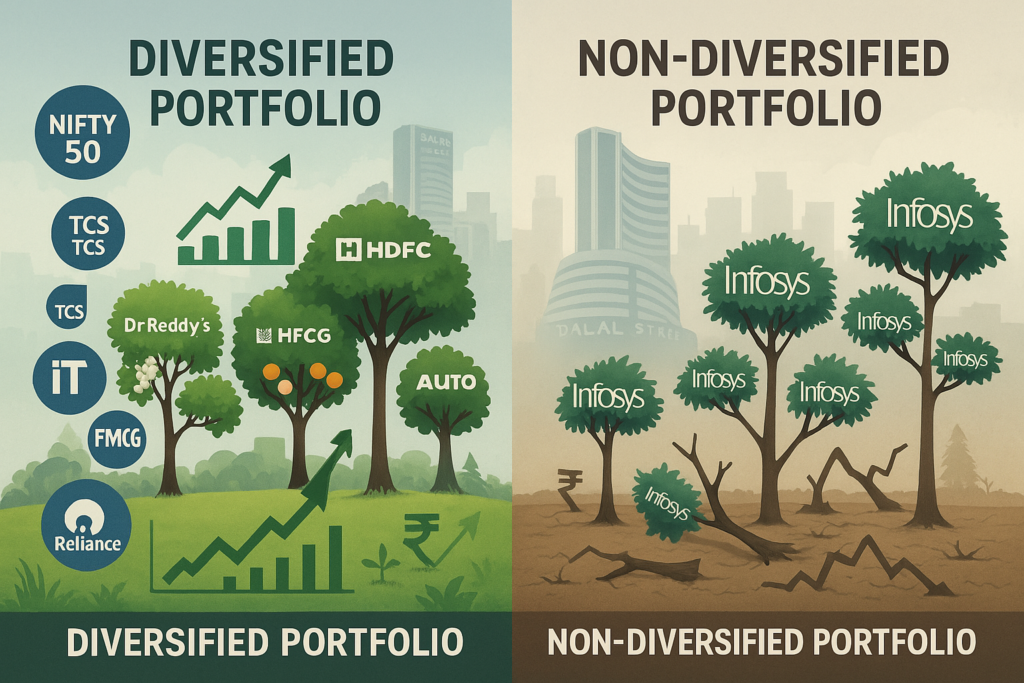

5. Overexposure to One Theme

All eggs. One basket. If you went all-in on PSU banks or midcaps because they were trending, congrats—you’re now trending too… in the red zone.

The Diagnosis:

Red is not always a signal to panic. It’s a clue. Understand why it’s happening. Market tantrum? Sector-specific mood swing? Or just bad stock picking?

Ready for the remedy? Let’s talk strategy in Next Section.

What Not to Do When Your Portfolio Turns Red

This is the part where most investors go from “long-term visionaries” to “emotional panic sellers” in record time. So here’s your Do-Not-Do list when your portfolio is in red:

1. Don’t Hit the Sell Button in Panic

Selling just because prices fell is like selling your house during an earthquake. Wait. Let the tremors pass.

Because unless the company or fund is fundamentally broken, paper loss ≠ real loss.

2. Don’t Refresh Every 2 Minutes

Checking your portfolio every 2 minutes won’t make it green. It will only make your BP red. Take a break. Go outside. Breathe.

3. Don’t Dump Everything and Jump into FD

We get it. FDs are comforting. But dumping equities after every correction kills long-term wealth. Volatility is the price you pay for growth.

If you’re always running to FDs, maybe you’re not investing—you’re just flirting with the stock market.

4. Don’t Trust “Tips” to Recover Fast

Now is when all kinds of “experts” crawl out with recovery stocks, jackpot stocks, and “your losses will be recovered in 3 days” promises.

Run. Just run. This is how you end up turning your red portfolio… blood red.

5. Don’t Forget the Basics

This is a test. Of your patience. Of your plan. If your plan was made with proper asset allocation, you’ll survive.

If your plan was “jo chalega usmein paisa daaldo,” well, now you know.

Bottom Line:

Your portfolio being in red is not the end of the world. But reacting emotionally can make it one.

So the first step? Don’t do stupid things.

Don’t Panic, Don’t Exit

Seeing red on your screen? Breathe. It’s not a bloodbath—it’s just the market throwing a tantrum.

Here’s the golden truth:

📉 Paper loss ≠ real loss.

Until you hit “sell,” you haven’t actually lost money. It’s just numbers doing yoga.

Market dips are like monsoons—annoying, messy, but they pass. And guess what? They’re great for your long-term health… err, wealth.

🎯 SIPs love red days: You’re literally buying more units for less. Think of it as a sale—would you leave a mall just because there’s a discount?

💬 Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.”

So chill. Log out of your trading app. Maybe sip a chai.

Re-evaluate, Don’t React

Okay, so the portfolio looks like a tomato—ripe and red. But before you scream “I’m doomed!” and rage-sell everything, pause and ask: Is the problem me or the market?

📌 Start with fundamentals:

- Is the company still making money?

- Are their products still relevant, or have they gone full Nokia?

- Is your mutual fund underperforming the market consistently, or just caught in a storm like everyone else?

📊 Compare and reflect:

Let’s say you own an auto stock that fell 15%, but the entire Nifty Auto index is down 18%—then you’re actually doing fine. It’s not you, it’s the system.

Rebalancing tip:

When your equity is 80% and you planned 60%, don’t panic—rebalance. Sell a bit, buy some debt or gold. Portfolio = thali, not extra-large butter chicken.

This stage is all about reviewing, not reacting. Got it?

Diversify Like Masala Chai, Not Plain Milk

If your portfolio is just equity, then you’re drinking plain milk. No elaichi, no zing, just… meh.

But real investors? They make masala chai portfolios—full of flavour and balanced kick!

🫙 Here’s how you mix it right:

- Equity for growth 🍃

Like tea leaves—essential, but don’t overdo it. - Debt for stability 🧊

Your sugar, because what’s life without sweetness and balance? - Gold for shock-proofing ✨

The ginger—spicy, defensive, and fights inflation like a desi dadi. - REITs or Real Estate 🏠

That clove you didn’t expect but makes everything better.

And don’t forget the SIP magic:

You can sip into index funds, gold funds, and Balanced Advantage Funds that auto-switch between equity and debt—no stress, no mess.

🎯 Diversification = no single event can mess up your whole chai. Be like chai, not butter naan dipped in lassi. #BalancedBliss

When Should You Exit?

Look, we’re not saying “never sell.” We’re saying “don’t sell just because your neighbour did.”

But yes—there are red flags that scream: “Get out, now!”

🧾 Checklist before the exit drama:

- 📉 Company fundamentals are crumbling-If the company’s debt is higher than your stress, it’s time to let go.

- 🧑💼 Fund manager has changed and the fund is now performing like a lazy intern.

- 🎯 It no longer fits your goals-Investing for retirement? Why are you still holding that YOLO crypto fund?

- 🏚️ You invested based on tips from your gym trainer, and you just realized he can’t spell NAV.

Remember: Exiting is smart, but only when it’s part of a strategy—not an emotional reaction.

🔔 Pro tip: Review your portfolio quarterly. Not every time Sensex sneezes.

Final Advice: Build a Strategy, Not Drama

Your portfolio’s in red? Sip your chai, breathe deep, and repeat after us:

“This too shall pass.”

Because here’s the truth most people avoid—markets fall, then they rise, and then fall again. It’s their way of staying in shape. But you? You don’t need to emotionally collapse every time Nifty drops 100 points.

Instead of panic-selling or doomscrolling:

- Set up quarterly reviews, not hourly refreshes.

- Focus on your goals—retirement, home, world tour… not tomorrow’s opening bell.

- Have a written plan and stick to it like your morning filter coffee routine.

- And yes, use smart tools like Angel One to track, rebalance, and invest like a pro—even if you feel like a newbie.

Because drama is best left to Bollywood. Your money deserves discipline.

FAQs

1. What does it mean when my portfolio is in red?

It means your investments are currently showing a loss. The red color simply indicates that their value has dropped below your purchase price—not that they’re worthless.

2. Should I sell my stocks when my portfolio turns red?

Nope! That’s often the worst time to sell. If you panic and exit during a market dip, you turn a paper loss into a real one. Hold tight and review fundamentals first.

3. How can I avoid seeing red in my portfolio again?

Diversify. Don’t go all-in on one sector or asset class. Mix up equity, debt, gold, and maybe some REITs. Also, invest with goals in mind—not FOMO or hot tips.

4. When should I actually exit a stock or mutual fund?

Only when:

- The company’s fundamentals have worsened

- Your financial goals have changed

- The fund manager changed and underperformed

Don’t exit just because markets are moody.

5. How does Angel One help during red markets?

Angel One offers advanced tracking, real-time alerts, and easy SIP options to help you stay on track—even when your portfolio throws tantrums. Perfect for long-term planning with minimal drama.

Related Articles

Trump’s 26% Tariffs: Which Sectors Will Win & Who’s in Trouble?