Introduction

After a turbulent September, the Weekly Market Update October 1st Week brought signs of cautious optimism for Indian investors. Markets staged a rebound following a seven-day slide, supported by the Reserve Bank of India’s dovish policy stance, festive season demand optimism, and reforms in capital market lending.

However, the optimism was tempered by external headwinds: uncertainty around the India–US trade deal, H-1B visa fee hikes weighing on IT firms, and persistent rupee weakness. Foreign Institutional Investors (FIIs) continued to sell heavily, recording net outflows worth ₹8,074 crore, while Domestic Institutional Investors (DIIs) cushioned the fall with inflows of ₹13,834 crore.

Interestingly, midcap and smallcap indices showed resilience by the week’s close, signaling selective investor confidence despite global volatility. Crude oil prices rose 2.7% to $64.42, while the rupee hovered near its 52-week low of ₹88.78/USD, reflecting ongoing global risk aversion.

Weekly Index Performance

| Index | Closing Value | Weekly Change | % Change |

|---|---|---|---|

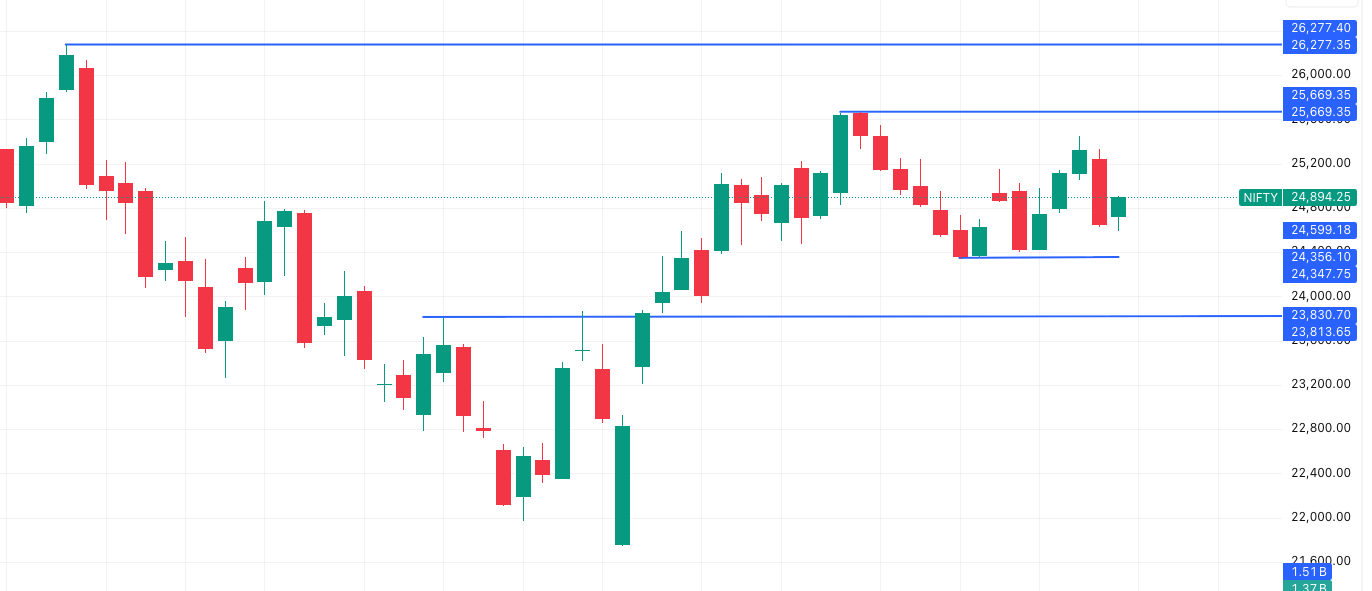

| NIFTY 50 | 24,892.10 | +101.40 | +0.41% |

| SENSEX | 81,196.33 | +338.60 | +0.42% |

| Nifty Bank | 55,592.00 | +922.00 | +1.69% |

| Nifty IT | 33,940.40 | -274.25 | -0.80% |

| S&P BSE SmallCap | 53,369.64 | +361.46 | +0.68% |

The Weekly Market Update October 1st Week showed a mild rebound, with frontline indices like Nifty and Sensex gaining about 0.4%. Banking stocks led the rally, with Nifty Bank climbing 1.69%, supported by RBI’s unchanged policy stance. On the other hand, IT stocks continued to feel the pinch from US visa restrictions and weak global guidance, dragging Nifty IT down 0.80%.

Small and midcaps outperformed slightly, reflecting retail-driven momentum and expectations of festive season demand.

Sectoral Performance

| Best Sector | % Change |

|---|---|

| Metals & Mining | +2.03% |

| Others | +1.58% |

| Telecom Equipment | +1.48% |

| Banking & Finance | +1.13% |

| Textiles & Apparels | +1.12% |

| Worst Sector | % Change |

| Telecom Services | -1.84% |

| Consumer Durables | -1.70% |

| Healthcare | -1.67% |

| Software & Services | -1.42% |

| Fertilizers | -1.39% |

The Weekly Market Update October 1st Week revealed a mixed sectoral picture. Metals and mining shone as top gainers, fueled by the global copper rally and speculation over EU tariff hikes. PSU banks also found strength in RBI’s steady policy stance, while private banks and oil & gas maintained modest gains.

Conversely, consumer-facing sectors struggled. Nifty IT and consumer durables dragged down sentiment, pressured by the US visa fee hikes and trade uncertainties. Realty also slipped as borrowing cost concerns persisted.

Industry-Wise Performance

| Top Gainers | % Change |

|---|---|

| Other Non-Ferrous Metals | +6.07% |

| IT Training Services | +4.41% |

| Oil Marketing & Distribution | +3.83% |

| Aluminium & Aluminium Products | +3.71% |

| Copper | +3.01% |

| Top Losers | % Change |

|---|---|

| BRO/KRO | -5.71% |

| Healthcare Supplies | -5.37% |

| Consumer Electronics | -4.46% |

| Computer Hardware | -4.26% |

| Dyes & Pigments | -3.54% |

The Weekly Market Update October 1st Week highlighted clear winners in metals and commodities. Non-ferrous metals, aluminium, and copper surged as investors priced in stronger industrial demand. Meanwhile, oil marketing firms benefitted from easing crude concerns.

Industries linked to electronics and healthcare, however, bore the brunt of global risk-off sentiment. Consumer electronics and computer hardware stocks slid as export demand weakened, while healthcare supplies declined due to US tariff concerns on pharma inputs.

Top Gainers & Losers (Stocks)

| Top Gainers | Week % Chg | LTP |

|---|---|---|

| Sammaan Capital | +19.74% | 165.03 |

| Aegis Logistics | +17.72% | 881.15 |

| Netweb Technologies | +16.68% | 4311.90 |

| Aegis Vopak Terminals | +16.38% | 283.40 |

| Tata Investment | +15.42% | 10002 |

| Top Losers | Week % Chg | LTP |

|---|---|---|

| Firstsource Solutions | -8.58% | 321.45 |

| Century Textiles | -7.12% | 1619.20 |

| Bajaj Holdings | -6.92% | 11819 |

| eClerx Services | -5.51% | 3928 |

| Dixon Technologies | -5.25% | 16591 |

In the Weekly Market Update October 1st Week, stock-specific action was vibrant. Sammaan Capital and Aegis Logistics topped the gainers’ list, supported by an open offer and strong logistics demand, respectively. Netweb Technologies and Tata Investment hit multi-year highs on robust earnings momentum.

On the losing side, Firstsource Solutions and eClerx were hit by weak IT sector sentiment. Century Textiles touched a 52-week low on muted demand outlook, while Dixon Technologies corrected sharply after a long rally.

Global Market Overview

| Global Index | Last | Change | % Change |

|---|---|---|---|

| Dow 30 | 46,758.30 | +238.56 | +0.51% |

| S&P 500 | 6,715.79 | +0.44 | +0.01% |

| Nasdaq Composite | 22,780.50 | -63.55 | -0.28% |

| FTSE 100 | 9,491.25 | +63.52 | +0.67% |

| CAC 40 | 8,081.54 | +24.91 | +0.31% |

| DAX | 24,378.80 | -43.76 | -0.18% |

| Nikkei 225 | 45,769.50 | +832.77 | +1.85% |

| Hang Seng | 27,140.90 | -146.20 | -0.54% |

| Shanghai Composite | 3,882.78 | +20.25 | +0.52% |

The Weekly Market Update October 1st Week showed global markets largely steady, with US indices trading flat to positive on hopes of a soft landing. Japan’s Nikkei surged 1.85%, while Hong Kong’s Hang Seng declined on Chinese property sector concerns. European markets maintained resilience, reflecting energy stability and investor optimism.

Upcoming Events Next Week

| Date | Event | Forecast/Impact |

|---|---|---|

| Oct 6 | HSBC Composite PMI Final | Key measure of overall economic activity. Higher readings indicate expansion. |

| Oct 6 | HSBC Services PMI Final | Services PMI at 62.5 signals strong demand momentum despite global risks. |

| Oct 10 | Bank Loan Growth (YoY) | 10.3% growth expected, reflecting steady credit demand. |

| Oct 10 | Deposit Growth (YoY) | 9.8% growth projected, indicating continued liquidity support. |

| Oct 10 | Foreign Exchange Reserves | $700.24B, stability here is critical amid rupee weakness and FII outflows. |

The Weekly Market Update October 1st Week points to a busy week ahead. PMI data will test India’s services momentum, while bank loan and deposit growth will reflect domestic credit appetite. Forex reserves will remain in focus as rupee volatility lingers, with investors watching RBI’s intervention stance closely.

Conclusion & Outlook

The Weekly Market Update October 1st Week showcased a delicate balance between domestic resilience and global headwinds. RBI’s dovish policy stance and festive demand optimism provided stability, while FII outflows and IT sector weakness capped the upside.

Looking ahead, market participants will watch PMI data, credit growth trends, and currency movements closely. With midcaps and smallcaps showing resilience, selective stock-picking may outperform broad indices in the near term. Metals and banking remain strong, while IT and consumer sectors could stay under pressure.

In summary, the Weekly Market Update October 1st Week reflects a cautious recovery, with investors balancing festive cheer at home against global uncertainties abroad.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

SEBI New IPO Rules Unlock 2 Historic IPOs – Jio & NSE to Deliver Huge Investor Gains

TechD Cybersecurity SME IPO 2025: Mega Listing Gain Ahead? Price, GMP, Financials & Full Details