Urban Company IPO: A Game-Changer in India’s Home Services Market

India’s home services revolution is finally hitting the stock market runway. Urban Company Ltd., the startup that redefined how we book beauty, grooming, cleaning, or plumbing services at home, is now gearing up for its much-awaited ₹1,900 crore IPO.

What began in 2014 as a bold idea by three entrepreneurs — Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan — has today evolved into a full-stack, tech-driven marketplace spanning 51 cities across India, UAE, and Singapore. Whether it’s a salon appointment at home, appliance repair, or professional cleaning, Urban Company has become a trusted household brand, bringing trained and verified service providers right to your doorstep.

Now, with the Urban Company IPO opening on September 10, 2025, the company is inviting retail and institutional investors to participate in the next phase of its growth story. Backed by rising demand in India’s $59.2 billion home services market (2024), which is projected to swell to $97.4 billion by 2029, the Urban Company IPO arrives at a time when consumer adoption is accelerating, but online penetration is still below 1% — a massive opportunity waiting to be unlocked.

This IPO isn’t just about raising funds. It’s about betting on the future of how Indians consume home and beauty services — and whether Urban Company can turn its platform dominance into long-term profitability.

Urban Company IPO Details

The Urban Company IPO is set to be one of the most closely-watched public issues of 2025. Here’s a clear breakdown of all the essential details every investor should know:

IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Size | ₹1,900.00 Cr |

| Fresh Issue | 4.58 Cr shares (₹472.00 Cr) |

| Offer for Sale (OFS) | 13.86 Cr shares (₹1,428.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Face Value | ₹1 per share |

| Price Band | ₹98 – ₹103 per share |

| Lot Size | 145 Shares |

| Minimum Investment (Retail) | ₹14,935 |

| Listing at | BSE, NSE |

| Book Running Lead Manager | Kotak Mahindra Capital Co. Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

| Promoters | Abhiraj Singh Bhal, Raghav Chandra, Varun Khaitan |

Takeaway: A large portion (₹1,428 Cr) is OFS, meaning existing investors are cashing out significantly, while only ₹472 Cr goes to fresh capital infusion.

Important Dates (Tentative)

| Event | Date |

|---|---|

| IPO Opening Date | September 10, 2025 (Wednesday) |

| IPO Closing Date | September 12, 2025 (Friday) |

| Allotment Finalisation | September 15, 2025 (Monday) |

| Refund Initiation | September 16, 2025 (Tuesday) |

| Credit of Shares to Demat | September 16, 2025 (Tuesday) |

| Listing Date (Tentative) | September 17, 2025 (Wednesday) |

| UPI Mandate Confirmation Deadline | September 12, 2025 (5:00 PM) |

Takeaway: Investors need to act fast — the Urban Company IPO window is just 3 days, with listing planned in less than a week.

Objects of the Issue

The net proceeds from the Urban Company IPO will be utilised for:

- ₹190 Cr – New technology development and cloud infrastructure

- ₹75 Cr – Lease payments for offices

- ₹90 Cr – Marketing activities

- General corporate purposes

Takeaway: The focus is clear — Urban Company wants to strengthen its tech backbone, expand office infrastructure, and boost brand visibility through aggressive marketing.

Founders & Early Investors See Massive Wealth Creation in Urban Company IPO

The Urban Company IPO is not just a milestone for the firm but also a big payday for its founders and early investors. As per the RHP, the value of their stakes has soared multi-fold, showcasing the wealth creation potential of India’s home services leader.

Here’s the snapshot:

| Shareholder | Stake (Cr Shares) | Post Price Band Value (₹ Cr) | Avg. Cost (₹) | Cost Value (₹ Cr) | Returns % |

|---|---|---|---|---|---|

| Abhiraj Singh Bhal | 9.8 | 1,007.0 | 0.01 | 0.1 | ~10,000x |

| Raghav Chandra | 9.8 | 1,007.0 | 0.01 | 0.1 | ~10,000x |

| Varun Khaitan | 9.8 | 1,007.0 | 0.01 | 0.1 | ~10,000x |

| Accel India IV (Mauritius) | 14.6 | 1,499.9 | 3.8 | 54.9 | ~2,632% |

| Bessemer India Capital Holdings | 9.5 | 975.5 | 7.1 | 67.6 | ~1,343% |

| Elevation Capital | 15.9 | 1,637.6 | 5.4 | 85.7 | ~1,811% |

| Internet Fund V | 6.1 | 626.6 | 61.7 | 375.1 | ~67% |

| VYC11 Ltd | 13.5 | 1,385.9 | 20.4 | 274.5 | ~405% |

Analysis:

- The three co-founders — Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan — are sitting on astronomical ~10,000x returns.

- Top PE funds like Accel, Bessemer, and Elevation have also multiplied their investments 13–26x.

- This underlines how Urban Company IPO has already delivered exponential wealth creation for its backers, while giving retail investors a chance to ride the next leg of growth.

Company Overview & Business Model – Urban Company Ltd.

The Urban Company IPO is not just about financial numbers; it’s about a platform that has redefined how millions of people access everyday home and beauty services. Founded in 2014, Urban Company operates as a technology-driven, full-stack online marketplace that connects consumers with trained, verified service professionals across categories ranging from plumbing and appliance repair to salon treatments and massage therapy.

A Wide-Reaching Marketplace

As of June 30, 2025, Urban Company had operations across 51 cities in India, the UAE, and Singapore, excluding cities served by its joint venture in Saudi Arabia. Of these, 47 cities are in India, where the bulk of its business thrives. The company serves more than 12,000 micro-markets, with 54,347 average monthly active service professionals, underscoring its deep penetration and network strength.

Through its platform, consumers can book services such as:

- Cleaning & pest control

- Plumbing, electrical, carpentry, and handyman tasks

- Appliance servicing & repairs

- Painting & wall décor

- Skincare, hair grooming, and wellness treatments

- On-demand home-help assistance (InstaHelp, recently launched)

This diverse service offering makes Urban Company a “super app” for home and beauty services, creating stickiness among consumers.

Product Play: Native

Urban Company is not just a services aggregator. It has ventured into the consumer products space with its Native brand, offering water purifiers and electronic door locks. These products not only diversify revenue streams but also strengthen customer trust by extending Urban Company’s brand into home solutions.

Empowering Service Professionals

One of Urban Company’s biggest differentiators is its service professional empowerment model. The company carefully selects and background-verifies professionals, then equips them with:

- In-house training and standard operating procedures

- Tools, consumables, and branded products

- Access to financing, insurance, and branding support

This not only ensures consistent quality for consumers but also helps professionals increase earnings, stability, and skills — tackling a key challenge in India’s largely unorganized home services market.

Market Opportunity

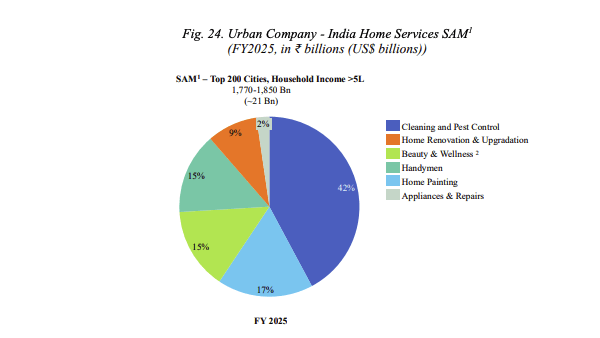

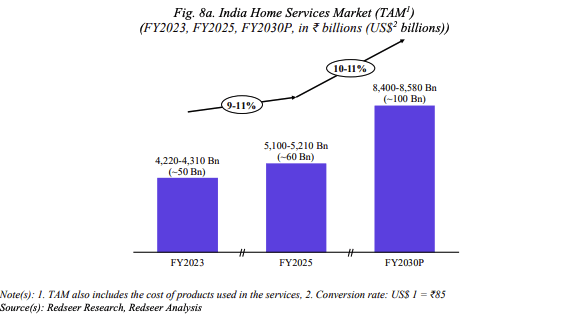

The Indian home services market was valued at ~USD 60 billion in FY2025 and is projected to reach USD 100 billion by FY2030, growing at a 10–11% CAGR. Yet, online penetration is less than 1%, highlighting the enormous headroom for growth. According to Redseer, online full-stack platforms like Urban Company could address structural inefficiencies and expand to ₹105–110 billion by FY2030, at a CAGR of 18–22%.

Three Key Business Segments

Urban Company operates under three structured segments:

- India Consumer Services – Home services (cleaning, repairs, InstaHelp, pest control, painting, etc.) and beauty/wellness (skincare, grooming, massage therapy). Revenue also comes from selling tools and consumables to service professionals.

- Native (Consumer Products) – Sale of water purifiers and electronic door locks, expanding Urban Company’s brand into physical consumer products.

- International Business – Services offered in UAE, Singapore, and Saudi Arabia (via JV from January 2025), along with sales of tools and consumables to international service professionals.

Takeaway: Urban Company has built more than a services marketplace; it has created a tech-enabled ecosystem where consumers get convenience, professionals get empowerment, and investors see scalable growth in a market with huge untapped potential.

Urban Company IPO – Financial Performance

Urban Company has shown a remarkable turnaround over the past three years, moving from steep losses to profitability in FY25. The company’s improving contribution margin, strong revenue growth, and operational leverage are key highlights that make the Urban Company IPO noteworthy for investors.

Financial Summary (₹ in Crore)

Urban Company Ltd.’s revenue increased by 36% and profit after tax (PAT) rose by 358% between the financial year ending March 31, 2025, and March 31, 2024.

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|

| Assets | 2,200.64 | 1,638.65 | 1,631.22 |

| Total Income | 1,260.68 | 927.99 | 726.24 |

| Profit After Tax | 239.77 | -92.77 | -312.48 |

| Net Worth | 1,781.28 | 1,292.64 | 1,339.46 |

| Reserves & Surplus | 2,646.12 | 2,404.69 | 2,402.82 |

Amount in ₹ Crore– Urban Company IPO Financial Information (Restated Consolidated)

👉 Analysis:

- Urban Company swung to a net profit of ₹239.77 Cr in FY25, compared to a net loss of ₹-92.77 Cr in FY24.

- Revenues have been steadily compounding, with a ~36% YoY jump in FY25.

- Net worth strengthened to ₹1,781 Cr, giving the company a stronger balance sheet footing.

Key Ratios & KPIs (FY25)

The market capitalization of Urban Company IPO is pegged at ₹14,789.55 Cr (as of March 31, 2025).

| KPI | FY25 | Insights |

|---|---|---|

| Return on Net Worth (RoNW) | 13.35% | Reflects Urban Company’s improving profitability |

| Price to Book Value | 8.27x | Premium valuation backed by growth & brand leadership |

| Contribution Margin (%) | 19.53% | Indicates strong unit economics |

| Adjusted EBITDA (₹ Cr) | 12.09 | First positive EBITDA after years of losses |

| Adjusted EBITDA Margin (%) – on Revenue | 1.06% | Early signs of operating leverage |

| Net Transaction Value (₹ Cr) | 3,270.91 | Healthy demand across home & beauty services |

| Annual Transacting Consumers (Mn) | 6.78 | Expanding consumer adoption |

| Avg. Monthly Active Service Professionals | 47,833 | Strong supply base ensures service delivery capacity |

| India Business Adjusted EBITDA (₹ Cr) | 48.91 | Core business profitable |

| International Business Adj. EBITDA (₹ Cr) | -36.82 | Loss-making but narrowing YoY |

| Native Business Adj. EBITDA (₹ Cr) | -39.02 | Still in investment stage |

Amount in ₹ Crore except consumers/professionals

Analysis:

- Profitability Inflection Point: FY25 marked the first profitable year with positive EBITDA.

- Scalable Model: Contribution margin of nearly 20% shows efficiency in operations.

- Consumer Stickiness: Over 6.7 Mn transacting consumers highlight platform trust.

- Balanced Ecosystem: Nearly 48,000 active service professionals strengthen fulfillment capacity.

- Growth Bets: While international and Native segments are currently dragging profits, they offer long-term diversification.

Valuation & Peer Comparison of Urban Company IPO

Urban Company IPO is hitting the markets at a premium valuation, reflecting its dominant market position in India’s under-penetrated home services industry.

Valuation Metrics

| Metric | Pre-IPO | Post-IPO | Insights |

|---|---|---|---|

| EPS (₹) | 1.72 | 1.67 | Slight dilution post fresh issue |

| P/E (x) | 59.71 | 61.68 | Demanding valuation, but backed by strong growth |

| Price to Book Value (P/BV) | 8.27 | 8.27 | Indicates premium market positioning |

Valuations are based on FY25 earnings as per RHP

Peer Benchmarking

Unlike food delivery (Zomato), fashion e-commerce (Nykaa), or insurance-tech (PB Fintech), Urban Company operates a unique “full-stack, on-demand home & beauty services platform.”

As per the company’s RHP:

“Accordingly, there are no listed companies in India or globally which operate in a similar business model which can be used for our KPI comparison with industry peers. Accordingly, we have not provided an industry comparison in relation to our Company.”

This makes Urban Company a near-monopoly player in the listed space, offering investors a first-of-its-kind opportunity to bet on India’s $60 billion home services market.

What This Means for Investors

- The high P/E multiple (60x+) may look stretched, but investors are essentially paying for future growth and market leadership.

- With less than 1% online penetration, Urban Company has a massive headroom for expansion.

- Being a category creator and market leader, Urban Company IPO may attract long-term institutional interest similar to Zomato or Nykaa during their listing years.

Key Takeaway: Urban Company IPO is a rare chance to invest in a platform with no listed peers, operating at the intersection of technology, services, and lifestyle.

Strengths & Risks of Urban Company IPO

| Strengths | Risks |

|---|---|

| Market Leader in Home Services: Urban Company is India’s largest tech-driven, full-stack platform for home and beauty services. | Offer for Sale (OFS) Dominates: A large portion of the IPO is OFS (₹1,428 Cr), meaning most proceeds won’t go to business expansion but to early investors’ exit. |

| Expanding Footprint: Operates in 51 cities across India and internationally in UAE, Singapore, and KSA (via JV). | High Valuation: With a P/E of ~60x post-IPO, valuations leave little room for error in execution. |

| Diversified Offerings: From beauty & wellness to home repairs, InstaHelp, and Native (smart products), Urban Company has strong category diversification. | Execution Risk: Success depends on scaling new categories (Native, InstaHelp) while maintaining service quality. |

| Strong Financial Turnaround: PAT of ₹239.77 Cr in FY25 vs. losses in previous years shows improving profitability. | Reliance on Service Professionals: Retaining and incentivizing quality partners is critical; high attrition could impact service consistency. |

| Massive Market Opportunity: India’s home services market is ~$60B (FY25), projected to reach $100B by FY30 with just ~1% online penetration today. | International Competition: Scaling in international markets poses higher costs and uncertain demand. |

| Founders’ Vision & Early Backer Confidence: Founders’ stake values soared ~10,000x; top PE firms like Accel and Elevation backed growth strongly. | Partial Exit by Early Investors: Significant selling by PE investors raises questions about near-term growth versus profit-booking. |

⚖️ Investor Lens:

- The strengths highlight monopoly positioning, financial turnaround, and growth runway.

- The risks balance this with valuation concerns, OFS-heavy issue, and execution challenges.

Urban Company IPO GMP (Grey Market Premium)

The Grey Market Premium (GMP) offers an early hint of investor sentiment ahead of listing. While it is not an official indicator, traders often track GMP trends to estimate potential listing gains.

Urban Company IPO GMP Trend

| GMP Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit* | Movement |

|---|---|---|---|---|---|

| 08-Sep-2025 | 103.00 | ₹31.5 | ₹134.5 (30.58%) | ₹4567.5 | GMP Up |

*Estimated profit is based on upper price band & lot size.

GMP Analysis

- Current GMP of ₹6 suggests an estimated listing gain of around 5–6% over the issue price.

- The downward movement in GMP indicates cautious optimism, possibly due to high valuations (~60x P/E).

- That said, brand strength and near-monopoly positioning could still drive decent listing demand, especially from retail investors.

Takeaway: While the GMP trend points to modest listing gains, the real value of Urban Company IPO may lie in long-term growth rather than short-term speculation.

Conclusion – View on Urban Company IPO

The Urban Company IPO is more than just another public issue — it is a landmark event in India’s startup ecosystem. The offering has already unlocked astronomical wealth creation for its founders and early backers, with the co-founders Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan clocking ~10,000x returns, and top PE funds like Accel, Bessemer, and Elevation multiplying their investments over 13–26x.

This demonstrates the immense value creation potential of Urban Company’s business model. However, for retail investors coming in now, the real question is whether future growth in India’s $100 billion home services market can sustain valuations and deliver similar compounding over the next decade.

Short-Term Strategy

With a modest GMP trend (~₹6 as of Sept 3, 2025), the short-term upside looks limited. Listing gains may be in the 5–8% range, depending on market sentiment. Traders should approach this IPO for listing gains with caution.

Long-Term Strategy

Urban Company is still in the early innings of India’s organized home services revolution. With a scalable tech-driven model, expansion into new categories (Native, InstaHelp), and presence in international markets, the company has strong tailwinds for long-term growth. Investors with a 5–7 year horizon may see significant wealth creation if Urban Company can steadily improve profitability while maintaining market dominance.

Allotment Strategy

Given the hype, the IPO may see strong subscription. Retail investors looking for listing gains should apply with caution, while long-term investors can consider allotment with a diversified approach — keeping expectations realistic about near-term returns.

💡 “Urban Company IPO is not just about the services you book at home — it’s about booking your share in the future of India’s home services revolution.”

Urban Company IPO – FAQs

1. What is the size of the Urban Company IPO?

The IPO size is ₹1,900 crore, including a fresh issue of ₹472 crore and an offer for sale (OFS) of ₹1,428 crore.

2. What is the price band of the Urban Company IPO?

The price band has been set at ₹98 – ₹103 per share.

3. When will the Urban Company IPO open and close?

It opens on September 10, 2025 and closes on September 12, 2025.

4. Who are the promoters of Urban Company?

The co-founders — Abhiraj Singh Bhal, Raghav Chandra, and Varun Khaitan — each holding 9.8 crore shares, are the key promoters.

5. How much wealth have founders and early investors created in this IPO?

The three co-founders are sitting on ~10,000x returns, while investors like Accel, Bessemer, and Elevation have made 13–26x returns.

6. What will Urban Company use the IPO proceeds for?

Funds will go towards technology development, office lease payments, marketing, and general corporate purposes.

7. What is the Grey Market Premium (GMP) of the IPO?

As of September 3, 2025, the GMP is around ₹6, suggesting an estimated listing gain of ~5–8%.

8. Does Urban Company have listed peers for comparison?

No. As per its RHP, there are no listed companies in India or globally with a similar full-stack home services business model.

9. Is Urban Company profitable?

Yes, Urban Company turned profitable in FY25, reporting a PAT of ₹239.77 crore compared to a loss of ₹92.77 crore in FY24.

10. Should investors apply for the Urban Company IPO?

For long-term investors: Attractive opportunity in a near-monopoly, tech-driven home services market.

For traders: Small listing gains possible, but GMP trend is modest.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?