Introduction: Groww to Zerodha Share Shift

Managing your investments across multiple brokers can get complicated — especially when you’re trying to track performance, file taxes, or rebalance your portfolio. That’s why many Indian investors are now choosing to transfer shares from Groww to Zerodha, one of India’s most feature-rich and trader-friendly platforms.

Whether you’re shifting for better charting tools, lower charges, or more advanced features, the good news is:

✅ You don’t need to sell your shares

✅ You won’t incur capital gains tax

✅ You can complete the process 100% free

In this detailed guide, we’ll walk you through two reliable ways to shift your shares from Groww to Zerodha:

- Online transfer using CDSL Easiest (recommended – faster & paperless)

- Offline transfer using a DIS (Delivery Instruction Slip)

We’ll explain both methods, list the documents you need, and common mistakes to avoid— all tailored for 2025.

Can You Transfer Shares from Groww to Zerodha?

Yes, you absolutely can transfer shares from Groww to Zerodha without having to sell them. Both Groww and Zerodha are depository participants (DPs) under CDSL (Central Depository Services Limited), which makes the transfer process smooth and completely online through the CDSL Easiest platform.

If for any reason the online method isn’t available, you can still use the offline route by filling and submitting a DIS (Delivery Instruction Slip) provided by Groww.

Here’s why it works:

- ✅ Same depository (CDSL) – No inter-depository transfer required

- ✅ No taxes – Because you’re not selling your shares

- ✅ Free of cost – CDSL does not charge any fees for BO-to-BO transfers

- ✅ Retains your original holding date – So your long-term/short-term status remains intact

Whether you’re switching for Zerodha’s Kite platform, better charting, or unified investing, transferring your shares is not only possible — it’s easier than you think.

How to Transfer Shares from Groww to Zerodha Using CDSL Easiest (Online Method)

The CDSL Easiest portal allows investors to transfer shares from one CDSL Demat account to another — without paperwork, without charges, and without selling their stocks.

Since both Groww and Zerodha are CDSL-registered, this is the recommended method to transfer shares from Groww to Zerodha.

Here’s how to do it step-by-step:

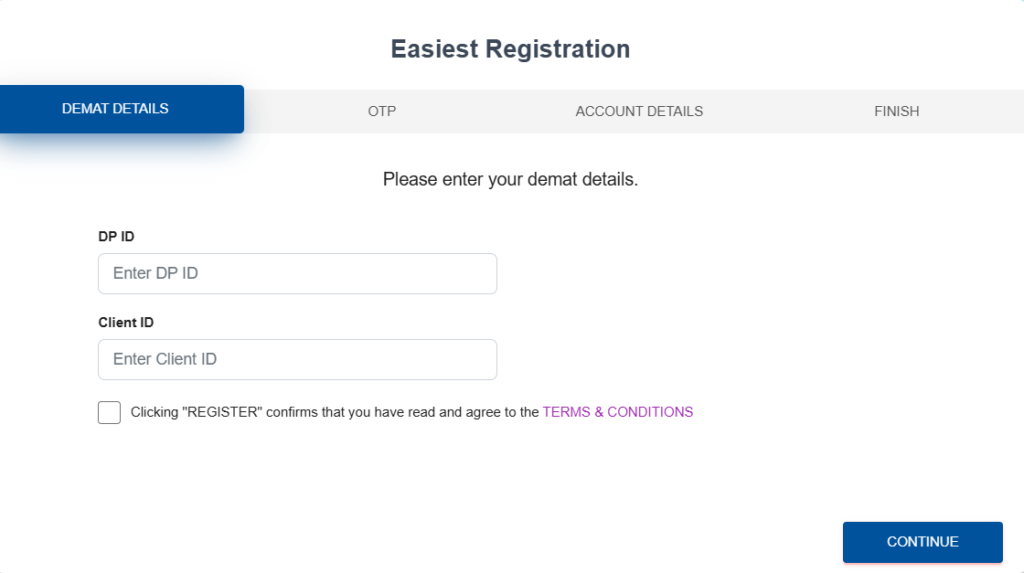

🔹 Step 1: Register on the CDSL Easiest Portal

- Go to the CDSL Easiest website.

- Click ‘Register for Easiest’.

- Choose the ‘Trusted Account (PIN) – for individual investors’ option.

- Enter your Groww Demat Account number (16-digit BO ID).

- First 8 digits: DP ID (Groww)

- Last 8 digits: Your Client ID

- Complete the OTP verification linked to your registered mobile number.

- Set your username and password.

Once submitted, your request will be forwarded to Groww for approval.

🔹 Step 2: Approval from Groww

Groww (Nextbillion Technology Pvt Ltd) will receive your CDSL Easiest registration request.

- Approval usually takes 24–48 working hours.

- You can follow up through Groww’s in-app support or helpdesk if it’s delayed.

Once approved, your account will be fully activated for online transfers.

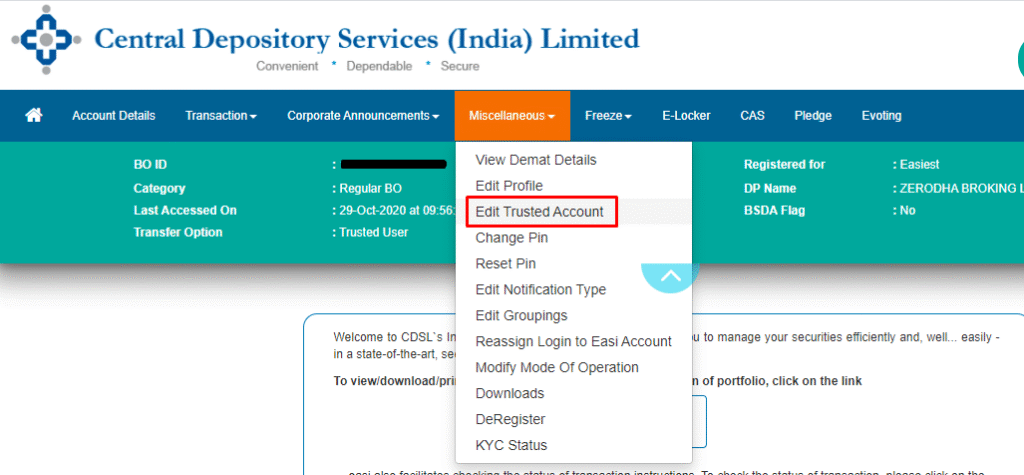

🔹 Step 3: Add Zerodha as a Trusted Demat Account

After login:

- Go to ‘Trusted Account’ → ‘Add BO ID’

- Enter your Zerodha 16-digit Demat Account number (from Kite or console)

- Submit the request

- Wait for confirmation from CDSL (and Zerodha if required)

Once verified, Zerodha will appear as a trusted recipient.

🔹 Step 4: Initiate the Share Transfer

Now you’re ready to move your shares:

- Log in to CDSL Easiest

- Go to ‘Transactions’ → ‘Setup’ → ‘Bulk Setup’

- Choose Zerodha as the ‘Counter BO ID’

- Select the ISIN of each stock you want to transfer

- Enter the quantity

- Set an execution date (can be same-day or scheduled)

- Choose Reason for Transfer – typically “Self” or “Consolidation”

- Submit and authenticate using OTP or PIN

And DONE ✅ Your shares will be transferred to Zerodha in 24 to 48 hours — no charges, no paperwork, no tax triggered.

How to Transfer Shares from Groww to Zerodha Using DIS Slip (Offline Method)

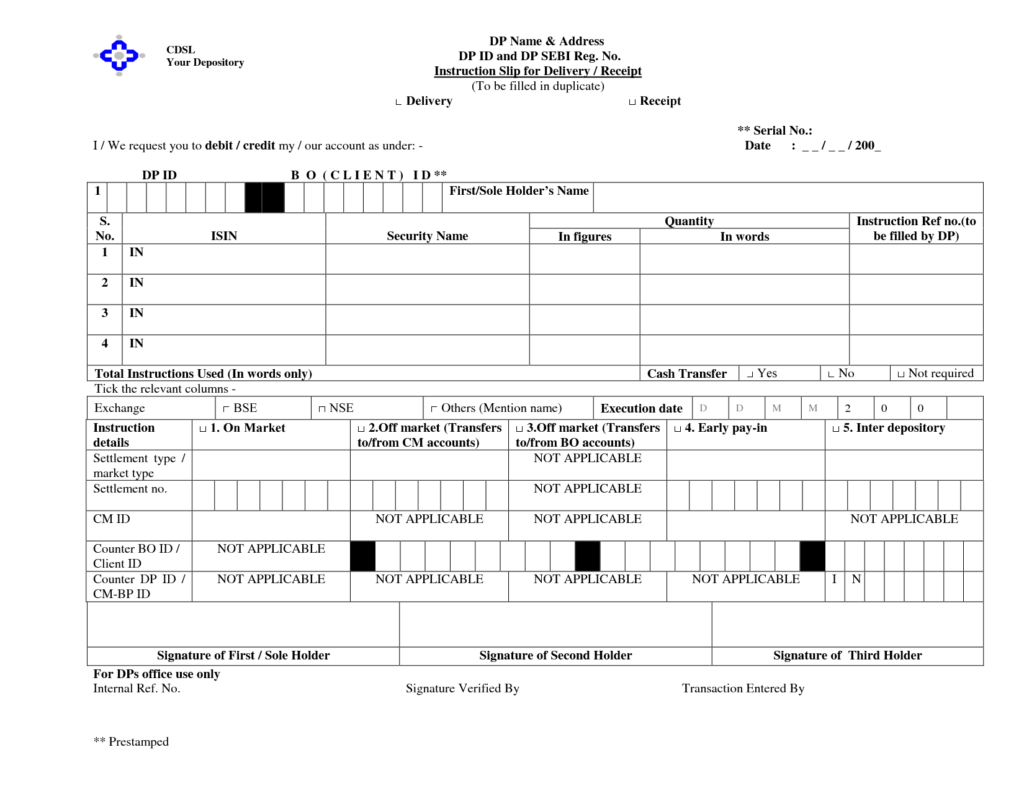

If you’re unable to complete the transfer online through CDSL Easiest — either because your broker doesn’t support it, or due to technical issues — you can still transfer shares from Groww to Zerodha using the Delivery Instruction Slip (DIS) method.

This is a manual, paper-based method where you instruct Groww to move your shares by filling and submitting a DIS form.

Here’s how it works:

🔹 Step 1: Request a DIS Slip from Groww

- Groww is a completely online broker and doesn’t provide a pre-issued DIS booklet like traditional brokers.

- To initiate the process, you need to email Groww’s support team at:

📧 support@groww.in - Ask them to send you a DIS slip (PDF format) or provide instructions on how to submit a transfer request.

- In some cases, they might ask you to courier a written letter with specific details.

🔹 Step 2: Fill in the Transfer Details

You’ll need the following information:

| Field | What to Enter |

|---|---|

| DP ID of Zerodha | 12081600 |

| Client ID | Your 8-digit Zerodha Demat ID (from Kite) |

| ISIN | The ISIN number of the stock to be transferred |

| Quantity | Number of shares you want to transfer |

| Execution Date | Leave blank or enter a date 1–2 days later |

| Reason for Transfer | “Self” or “Account Consolidation” |

Double-check all values. Any mismatch may result in rejection.

🔹 Step 3: Sign and Courier the Form

- Print the filled form and sign exactly as per your Groww Demat account.

- Attach a copy of your PAN card (recommended).

- Courier the completed DIS slip to:

Groww (Nextbillion Technology Pvt Ltd)

6th Floor, Tower B, Diamond District,

HAL Airport Road, Bangalore – 560008

🔹 Step 4: Wait for the Transfer to Reflect

Once Groww receives and verifies your documents:

- They’ll initiate the transfer within 3–5 working days.

- You’ll receive an email/SMS once the transfer is processed.

- The shares will reflect in your Zerodha account under the same ISIN.

🔍 Important Notes:

- This method is slower and prone to manual errors, which is why online transfer via CDSL Easiest is preferred.

- Courier charges apply, and Groww may take longer to process physical forms.

- If your holdings are large or time-sensitive, follow up proactively via Groww’s helpdesk.

Details You’ll Need Before You Transfer Shares from Groww to Zerodha

Before you begin the transfer, gather all the required details to avoid delays or rejections. Whether you use the CDSL Easiest online method or the offline DIS slip, having the correct information ensures a smooth share transfer from Groww to Zerodha.

Here’s a checklist of what you’ll need:

1. Your Groww Demat Account Number (BO ID)

You’ll find this 16-digit number in your Groww app:

- Open the app → Tap on your profile icon → Go to “Personal Details”

- Look for your BO ID — this is your Demat account number with CDSL

- It’s structured as:

- First 8 digits: DP ID (Groww’s code)

- Last 8 digits: Your Client ID

You’ll enter this when registering on the CDSL Easiest portal.

2. Your Zerodha Demat Account Number

- Log in to Zerodha Console

- Go to ‘Account → Demat’

- Copy your 16-digit Demat number (starts with 12081600)

You’ll use this to add Zerodha as a “trusted account” on CDSL or in the DIS slip.

3. ISIN of the Shares You’re Transferring

Every listed stock has a unique ISIN (International Securities Identification Number).

To find your stock ISINs:

- Visit groww.in or use NSE/BSE website

- Or go to CDSL’s official ISIN directory

- Example: Infosys → ISIN: INE009A01021

You’ll need this for both online and offline methods.

4. PAN Number

Make sure your PAN is correctly updated with both Groww and Zerodha.

PAN mismatch is a common reason why transfers get delayed or rejected.

5. Reason for Transfer

You must mention a valid reason:

- “Self” – if you own both accounts

- “Consolidation” – if you’re merging accounts

- “Family Transfer” – if moving to a relative’s account

Write this while setting up the transfer on CDSL or in the DIS form.

6. Matching KYC Details

Your name, PAN, and mobile number must match across both Groww and Zerodha accounts.

If they don’t, update your KYC before starting the transfer.

How Long Does It Take to Transfer Shares from Groww to Zerodha?

The time it takes to transfer your shares depends on the method you choose — online via CDSL Easiest or offline using a DIS slip. Here’s what you can expect:

CDSL Easiest (Online Method)

If you complete the process correctly, your shares usually reach Zerodha within:

- 24 to 48 working hours after you initiate the transfer

- Some brokers, like Groww, may take up to 1 business day to approve your registration on CDSL

- Transfers happen only during CDSL working hours (before 5 PM)

✅ This method is fast, paperless, and completely free — ideal for retail investors.

DIS Slip (Offline Method)

If you go with the DIS slip method, the timeline is longer:

- 5 to 7 working days from the time Groww receives your courier

- Courier delays, signature mismatches, or incomplete details can slow things down

- Always follow up with Groww after dispatching the form

⏳ This method is slower and involves manual verification, but it works as a backup.

🔍 Pro Tip:

Start your transfer request before 5 PM on a working day (Mon–Fri) to avoid rollover into the next business cycle. Also, check for CDSL maintenance windows on weekends or holidays.

Things to Keep in Mind While Transferring Shares from Groww to Zerodha

Before you transfer shares from Groww to Zerodha, keep a few key points in mind. These tips can help you avoid delays, failed transfers, or common errors that many investors make during the process.

1. Verify Both Brokers Use CDSL

You’re transferring shares between two CDSL-registered brokers — Groww and Zerodha — so you can use the CDSL Easiest portal.

If your destination broker was on NSDL instead, you’d need a DIS slip or inter-depository transfer.

2. Use the Same PAN in Both Accounts

Make sure your PAN number is the same across both Demat accounts.

If there’s any mismatch in PAN or KYC details (like name spelling or date of birth), the transfer may fail.

3. No Tax or Brokerage Applies

Since you’re not selling the shares, this is a non-market transfer.

That means:

- No capital gains tax

- No brokerage fees

- No STT (Securities Transaction Tax)

It’s a clean, cost-free shift of your existing holdings.

4. You Retain Original Buy Dates

When you transfer your shares, Zerodha will show the same buy price and holding period as Groww.

This is useful for tax filing and keeping track of long-term/short-term capital gains.

5. Only Transfer Approved Stocks

Some stocks — like ESOPs, IPO-locked shares, or unlisted securities — may not be eligible for transfer via CDSL Easiest.

Make sure your shares are fully credited and unlocked in your Groww Demat before starting.

6. Transfer Mutual Funds Separately

This guide only covers equity share transfers.

If you hold mutual funds in Groww, you’ll need a separate transfer request using the RTAs (like CAMS or KFintech) or Zerodha Coin’s process.

Conclusion: Moving from Groww to Zerodha? Here’s the Smart Way to Do It

Transferring your shares from Groww to Zerodha is easier than most investors realize. Whether you’re doing it to access Zerodha’s advanced tools, better charting features, or just to simplify your portfolio, the process is 100% free, secure, and doesn’t require you to sell your investments.

Using the CDSL Easiest online portal is the fastest and cleanest method. If that’s not available, the DIS slip method still gets the job done — just with a bit more time and paperwork.

✅ You avoid taxes

✅ You retain your original holding periods

✅ You get everything consolidated under one platform for easier tracking

At Onedemat.com, we believe in human-powered tools — we simplify complex processes so retail investors like you can take smart, informed actions with confidence. From transferring shares between brokers to managing multiple Demat accounts in one place, we’re here to help you every step of the way.

So if you’re thinking about moving to Zerodha, now is the right time. With the right steps and correct details, you can complete your transfer smoothly — and focus on what matters most: growing your wealth.

FAQs – Transfer Shares from Groww to Zerodha

Can I transfer shares from Groww to Zerodha online?

Yes, you can transfer shares online using the CDSL Easiest portal. It’s free, paperless, and usually takes 1–2 working days.

Is there any fee to transfer shares from Groww to Zerodha?

No, CDSL does not charge any fee for BO-to-BO (Beneficial Owner) transfers between Demat accounts like Groww and Zerodha.

Do I have to sell my shares to shift them?

No. You don’t need to sell your shares. You can move them directly without triggering taxes or brokerage fees.

Can I transfer mutual funds from Groww to Zerodha?

Not directly. You need to initiate a separate transfer through the mutual fund RTAs (CAMS or KFintech) or move them manually via Coin (Zerodha’s mutual fund platform).

Will my holding period reset after the transfer?

No, your original purchase date stays the same. This helps you maintain your short-term or long-term capital gain status.

Can I transfer shares from Groww to Zerodha without using CDSL?

Yes, if you prefer offline methods, you can request a DIS (Delivery Instruction Slip) from Groww and submit it manually.

How long does the transfer take?

- Online (CDSL Easiest): 24–48 hours

- Offline (DIS slip): 5–7 working days

Do Groww and Zerodha use the same depository?

Yes, both use CDSL, which makes the transfer seamless and free of charge.

Related Articles:

How to Transfer Shares to Family from One Demat to Another (2025 Guide)

How to Transfer Shares Between Demat Accounts Online: A Complete Guide

What Happens to Your Shares and Mutual Fund After Death? Transmission Process Explained

More Articles

Best Stock Broker in India: How to Choose Best Broker in 2025

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check