Introduction

Foreign Institutional Investors (FIIs) are entities that invest in financial assets in a country outside their own. These include mutual funds, pension funds, hedge funds, insurance companies, and investment banks. FIIs play a crucial role in the Indian stock market as they bring in significant foreign capital, increasing liquidity and impacting stock prices.

FII Influence in the Indian Stock Market

- Market Control: As of mid-February 2025, FIIs’ Assets Under Custody (AUC) stood at approximately ₹64.78 lakh crore, marking their lowest level since March 2024. This represents a decline of ₹13.18 lakh crore from their peak of ₹77.96 lakh crore in September 2024.

- Investment Trends: Between October 2024 and March 2025, FIIs sold nearly $29 billion worth of Indian shares, leading to a 13% decline in the Nifty 50 index from its peak in late September 2024.

- Economic Impact: In March 2025, FIIs continued their selling spree, particularly in the information technology (IT) and consumer goods sectors, driven by concerns about the U.S. and Indian economies.

- Regulation: The Securities and Exchange Board of India (SEBI) oversees FII activities to ensure market stability and prevent excessive volatility.

Recent FII Activity

- March 2025: In the first half of March, foreign investors sold $3.5 billion worth of Indian stocks, with significant sell-offs in the IT and consumer sectors.

- Late March 2025: There was a reversal in trend, with FIIs investing approximately ₹23,000 crore into Indian equities over five trading sessions as of March 25, 2025. This resurgence is attributed to favorable economic indicators and strong corporate performance.

How to Find FII-Bought Stocks on Screener.in?

If you want to track stocks that Foreign Institutional Investors (FIIs) are buying, you can use Screener.in, a popular stock research platform. Follow these steps:

Step-by-Step Guide:

Go to Screener.in – Visit Screener.in and log in (if needed).

Use the Stock Query Feature – In the search bar, type the name of the stock (e.g., Infosys).

Check FII Holdings – Scroll down to the Shareholding Pattern section and look at the FII percentage over recent quarters.

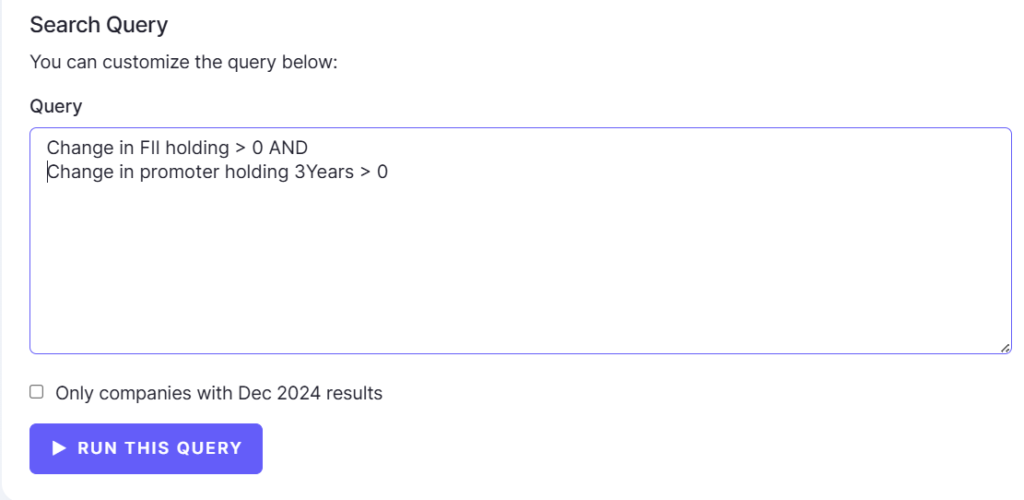

Use Custom Filters – To find multiple stocks with increasing FII holdings, click on Screens → Create a New Screen, and enter a filter like:

Analyze Financials – Review important metrics like P/E Ratio, Market Cap, Revenue Growth, and Profitability to make informed decisions.

Compare with Peer Stocks – Check how the stock performs against competitors in the same sector.

By following these steps, you can easily identify and track stocks that are gaining attention from FIIs.

Top 5 Stocks FIIs Are Buying in 2025

1. Adani Wilmar

- Sector: FMCG (Fast-Moving Consumer Goods)

- Why FIIs Are Buying: Strong brand presence, steady growth in revenue, and expansion into new product segments.

- Key Data:

- Current Market Price (CMP): ₹250.85

- Price-to-Earnings (P/E) Ratio: 26.86

- Market Capitalization: ₹32,633.87 crore

- Recent FII Holding Increase: 3.10%

2. Caplin Point Laboratories

- Sector: Pharmaceuticals

- Why FIIs Are Buying: Strong presence in niche pharmaceutical markets, healthy financials, and consistent earnings growth.

- Key Data:

- CMP: ₹1,990.65

- P/E Ratio: 29.38

- Market Capitalization: ₹15,132.01 crore

- Recent FII Holding Increase: 1.15%

3. Garware Hi-Tech Films

- Sector: Specialty Films

- Why FIIs Are Buying: Strong demand for high-quality polyester films, global expansion strategies, and strong financials.

- Key Data:

- CMP: ₹3,975.30

- P/E Ratio: 29.68

- Market Capitalization: ₹9,236.88 crore

- Recent FII Holding Increase: 1.13%

4. Caplin Point Laboratories Ltd

- Sector: Pharmaceuticals

- Why FIIs Are Buying: Strong presence in niche pharmaceutical markets, healthy financials, and consistent earnings growth.

- Key Data:

- Current Market Price (CMP): ₹1,991

- Price-to-Earnings (P/E) Ratio: 29.38

- Market Capitalization: ₹15,132.01 crore

- Recent FII Holding Increase: 1.15%

5. MOS Utility

- Sector: Utilities

- Why FIIs Are Buying: Consistent financial performance, stable revenue streams, and growth potential in infrastructure projects.

- Key Data:

- Current Market Price (CMP): ₹220.75

- Price-to-Earnings (P/E) Ratio: 18.42

- Market Capitalization: ₹8,750 crore

- FII Holding in December 2024 Quarter: Increased from 0.5% to 1.8%

Risks Associated with FII Investments

While FII investments can indicate strong market confidence, they also come with potential risks:

- Market Volatility: FIIs can move large sums of money in and out of the market quickly, causing sudden price fluctuations.

- Global Economic Factors: External factors like interest rate hikes in the U.S. or global economic slowdowns can lead to FII outflows.

- Regulatory Changes: Changes in SEBI regulations or government policies may impact FII investment strategies.

- Currency Risk: A weakening Indian Rupee against the U.S. Dollar may deter FIIs from investing in Indian equities.

- Sector-Specific Risks: Industries such as pharmaceuticals, utilities, and FMCG face risks related to regulations, competition, and supply chain disruptions.

Conclusion

While FIIs have historically held significant sway over the Indian stock market, recent trends indicate a dynamic interplay of factors influencing their investment decisions. The substantial outflows observed between October 2024 and early March 2025 underscore concerns about economic conditions and valuations. However, the late March resurgence suggests renewed confidence in India’s economic prospects.

It’s essential for investors to monitor FII activities as they can provide insights into market trends. Nonetheless, a comprehensive investment strategy should also consider domestic institutional and retail investor behaviors, along with fundamental analyses of target investments.

FAQs

1. What are Foreign Institutional Investors (FIIs)?

Foreign Institutional Investors (FIIs) are large investment entities such as mutual funds, hedge funds, pension funds, and insurance companies that invest in a country’s financial markets. In India, their investments significantly impact market liquidity and stock price movements.

2. How can I track FII buying trends in the Indian stock market?

You can track FII investments through:

- NSE & BSE Websites: They provide quarterly shareholding data.

- Screener.in: Use filters to identify stocks with increasing FII holdings.

- SEBI Reports: Regular updates on foreign investments in India.

- Stock Brokerage Reports: Many brokers provide insights into FII trends.

3. Why do FIIs invest in certain stocks?

FIIs typically invest in stocks with strong fundamentals, high growth potential, and global demand. Sectors like IT, Pharmaceuticals, FMCG, and Banking often attract FIIs due to their stability and long-term potential.

4. Do FIIs influence stock prices in India?

Yes, FIIs significantly impact the market. Large-scale FII buying can drive stock prices up, while heavy selling can trigger market corrections. Investors often track FII activities to predict market movements.

5. Should retail investors follow FII investment patterns?

While tracking FII activity provides useful insights, retail investors should not blindly follow them. Always conduct fundamental analysis, assess market risks, and consider long-term investment goals before investing.

To enhance your understanding of market trends and FII activities, check out these insightful articles:

📌 When Will Stock Market Recover? A Deep Analysis

This article provides an in-depth look at market recovery trends, factors influencing bull & bear cycles, and expert insights into when Indian markets might bounce back.