Introduction: Why Psychology Matters in Investing

Investing is not just about numbers, charts, or stock tips—it’s also about managing your emotions and decision-making processes. Legendary investor Warren Buffett once said on Investing Psychology,

“The most important quality for an investor is temperament, not intellect.”

This highlights the critical role psychology plays in determining investment success.

In this blog, we’ll explore the impact of psychological factors on investing, common behavioral biases, and strategies to develop a winning mindset.

How Psychology Influences Investing

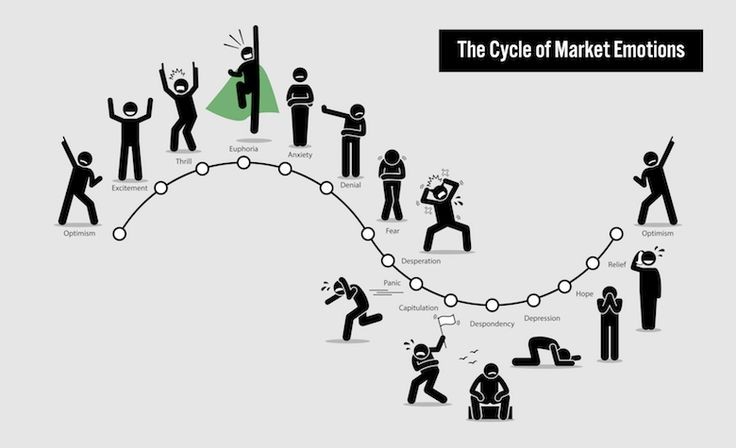

Your emotions and thought processes can heavily influence how you invest. Fear, greed, overconfidence, and regret are just some of the psychological factors that can drive decisions, often leading to suboptimal outcomes.

Common Psychological Factors in Investing

- Fear: Selling during market downturns due to panic.

- Greed: Holding onto overvalued stocks in the hope of greater profits.

- Overconfidence: Believing your market predictions are always right.

- Loss Aversion: Avoiding risks to prevent losses, even if it means missing opportunities.

Common Behavioral Biases in Investing

1. Herd Mentality

This occurs when investors follow the crowd rather than making independent decisions. For example, during market rallies, many people buy stocks simply because others are doing so.

How to Avoid It: Conduct your own research and focus on fundamentals rather than market hype.

2. Anchoring Bias

Investors often fixate on a specific piece of information, such as the purchase price of a stock, and let it influence their decisions.

Example: Refusing to sell a stock because its price hasn’t reached your purchase level, even if the company’s fundamentals have deteriorated.

Solution: Regularly reassess your investments based on current information.

3. Confirmation Bias

Seeking out information that supports your existing beliefs while ignoring contradictory data.

How to Counter It: Expose yourself to diverse opinions and be willing to change your perspective if evidence suggests otherwise.

4. Loss Aversion

People tend to feel the pain of losses more acutely than the pleasure of gains. This can lead to holding onto losing stocks for too long or avoiding investments altogether.

Tip: Focus on long-term goals and view market corrections as opportunities rather than threats.

The Importance of Emotional Discipline

1. Controlling Fear and Greed

Fear can make you sell too early, while greed can lead to overexposure in risky assets. Balancing these emotions is key to maintaining a stable portfolio.

2. Patience in Volatile Markets

Benjamin Graham, the father of value investing, wrote in The Intelligent Investor,

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Patience allows you to weather short-term volatility and benefit from long-term growth.

3. Setting Realistic Goals

Unrealistic expectations often lead to disappointment and impulsive decisions. Define clear, achievable investment goals to maintain focus.

Strategies to Master Your Investing Psychology

1. Have a Clear Plan

Develop an investment strategy that outlines your goals, risk tolerance, and asset allocation. A well-defined plan helps you stay grounded during market fluctuations.

2. Automate Investments

Systematic Investment Plans (SIPs) automate your investments, reducing emotional interference and ensuring consistency.

3. Practice Diversification

Spreading your investments across different asset classes and sectors reduces risk and prevents overreaction to individual stock movements.

4. Take Breaks from the Market

Constantly monitoring your portfolio can lead to stress and impulsive decisions. Periodic reviews are enough for long-term investors.

5. Learn from Mistakes

Ray Dalio, in his book Principles, emphasizes learning from failures:

“Pain plus reflection equals progress.”

Reflect on your past decisions to identify patterns and improve future performance.

Real-Life Examples of Psychological Impact

Example 1: The 2008 Financial Crisis

During the 2008 crisis, many investors panicked and sold their portfolios at rock-bottom prices. Those who stayed invested and continued to contribute to their portfolios during the downturn saw significant gains in the years that followed.

Example 2: Bitcoin’s Volatility

The fear of missing out (FOMO) led many retail investors to buy Bitcoin during its peaks, only to sell during crashes. This cycle of emotional decision-making caused substantial losses for many.

Conclusion: Master Your Mindset for Success

Investing isn’t just a numbers game; it’s a test of emotional resilience and mental discipline. By understanding the psychological factors that influence your decisions, you can avoid common pitfalls and build a more stable, successful investment strategy.

Remember, as Charlie Munger aptly said,

“The big money is not in the buying and selling, but in the waiting.”

Stay disciplined, stay informed, and let time and patience work in your favor.

FAQs

1. Can psychology really impact investment performance?

Yes, psychological factors like fear, greed, and biases play a significant role in investment decisions, often influencing outcomes more than market conditions.

2. How can I avoid emotional decision-making?

Having a clear plan, automating investments, and focusing on long-term goals can help reduce emotional interference.

3. Are behavioral biases common among experienced investors?

Yes, even seasoned investors are prone to biases, but they often develop strategies to manage them effectively.

4. What role does financial education play in managing psychology?

Understanding market dynamics and financial principles can help you make informed decisions and reduce emotional reactions.

5. Can a financial advisor help with investing psychology?

Absolutely. A good advisor provides objective guidance and helps you stay focused on your goals during market volatility.