Introduction – Studds Accessories IPO

There’s a certain thrill every rider feels when the helmet clicks shut — it’s not just about safety, it’s a statement of trust. For over four decades, that trust has often carried one familiar name — Studds.

From a small workshop in Faridabad in 1975 to a global powerhouse selling helmets across 70+ countries, Studds Accessories Ltd. has become synonymous with two-wheeler safety and innovation. And now, the brand that has protected millions of riders is gearing up for its next big journey — the Studds Accessories IPO.

This IPO is a book-built issue of ₹455.49 crore, entirely an Offer for Sale (OFS) of 0.78 crore shares. The issue opens on October 30, 2025, and closes on November 3, 2025, with a price band of ₹557–₹585 per share. The lot size stands at 25 shares, making the minimum retail investment ₹14,625 at the upper band.

The Studds Accessories IPO is set to list on NSE and BSE tentatively on November 7, 2025. IIFL Capital Services Ltd. is the Book Running Lead Manager, and MUFG Intime India Pvt. Ltd. will serve as the Registrar.

As India’s equity markets continue to attract both seasoned and first-time investors, Studds’ market debut adds yet another promising opportunity to the list of upcoming mainboard offerings. You can always explore more such updates in our dedicated section on Mainboard IPO Reviews at OneDemat for deeper insights and expert perspectives.

For those who want to dig deeper into the company’s fundamentals, you can refer directly to the Studds Accessories IPO Red Herring Prospectus (RHP) or visit the official Studds website to learn more about their product legacy and innovation journey.

Now that you have the big picture of what this IPO is about, let’s dive into the Studds Accessories IPO Overview — where we break down its structure, schedule, and key investment details.

Studds Accessories IPO Overview

Before diving into the company’s story and financials, let’s look at the complete picture of the Studds Accessories IPO — from issue size and price band to key dates and the intended use of proceeds.

Studds Accessories IPO Details

| Particulars | Details |

|---|---|

| IPO Date | October 30, 2025 to November 3, 2025 |

| Listing Date | November 7, 2025 |

| Face Value | ₹5 per share |

| Price Band | ₹557 – ₹585 per share |

| Lot Size | 25 Shares |

| Issue Type | Book-Building IPO |

| Offer Type | Entirely Offer for Sale (OFS) |

| Total Issue Size | 77,86,120 shares (aggregating up to ₹455.49 crore) |

| Listing At | NSE, BSE |

| Shareholding Pre-Issue | 3,93,53,400 shares |

| Shareholding Post-Issue | 3,93,53,400 shares |

| Promoter Holding (Pre-Issue) | 78.78% |

| Promoter Holding (Post-Issue) | 61.76% |

| Retail Investor Minimum Bid | 1 Lot (25 Shares) – ₹14,625 |

| Retail Investor Maximum Bid | 13 Lots (325 Shares) – ₹1,90,125 |

The IPO being a pure Offer for Sale means that the proceeds will go to existing shareholders, not the company itself — though the listing will still help improve liquidity and visibility for the brand.

Studds Accessories IPO Timeline (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Thursday, October 30, 2025 |

| IPO Close Date | Monday, November 3, 2025 |

| Basis of Allotment | Tuesday, November 4, 2025 |

| Initiation of Refunds | Thursday, November 6, 2025 |

| Credit of Shares to Demat | Thursday, November 6, 2025 |

| Listing Date (Tentative) | Friday, November 7, 2025 |

| Cut-off time for UPI Mandate Confirmation | 5 PM on Monday, November 3, 2025 |

This schedule outlines the expected flow for investors, from application to listing day.

Use of IPO Proceeds – Studds Accessories IPO

As this IPO is entirely an Offer for Sale, the company will not receive any funds from the issue. However, Studds aims to leverage the listing for broader strategic advantages, including:

- Achieving the benefits of listing the Equity Shares on BSE and NSE.

- Enhancing brand visibility and market presence in both domestic and international markets.

- Providing liquidity to existing shareholders and creating a transparent valuation benchmark.

With the IPO structure and timeline now clear, let’s explore the company behind the offering — Studds Accessories Ltd., its legacy, and what makes it a household name in India’s two-wheeler ecosystem.

Company Overview – Studds Accessories Ltd.

Behind every successful IPO lies a strong brand story — and the Studds Accessories IPO is backed by nearly five decades of resilience, innovation, and leadership in two-wheeler safety gear.

Legacy & Market Leadership

According to the Studds Accessories IPO Red Herring Prospectus, the company stands as India’s largest two-wheeler helmet manufacturer by revenue (FY2024) and the world’s largest by volume (CY2024) (Source: CARE Report). With a rich legacy dating back to 1975, Studds has transformed from a small workshop in Faridabad into a global safety gear brand trusted in over 70 countries.

As of March 31, 2025, Studds operates three major manufacturing facilities with a combined annualized capacity of 9.04 million units and sold 7.40 million helmets in FY2025 — a testament to its scale and consumer reach.

Brands and Product Portfolio

Studds designs, manufactures, markets, and sells helmets under the “Studds” and “SMK” brands, along with two-wheeler accessories like gloves, luggage, helmet locks, rain suits, riding jackets, and eyewear under the “Studds” brand.

- Studds – Established in 1975, this brand caters to the mass and mid-market segment with helmets priced between ₹875 and ₹4,000. In FY2025, the Studds brand sold over 7 million helmets globally.

- SMK – Launched in 2016, SMK targets premium riders in India and mid-market consumers across Europe and other regions, with helmets priced from ₹3,000 to ₹12,800.

Beyond these, Studds manufactures helmets for Daytona (Jay Squared LLC, USA) and O’Neal, catering to markets in Europe, the U.S., and Australia.

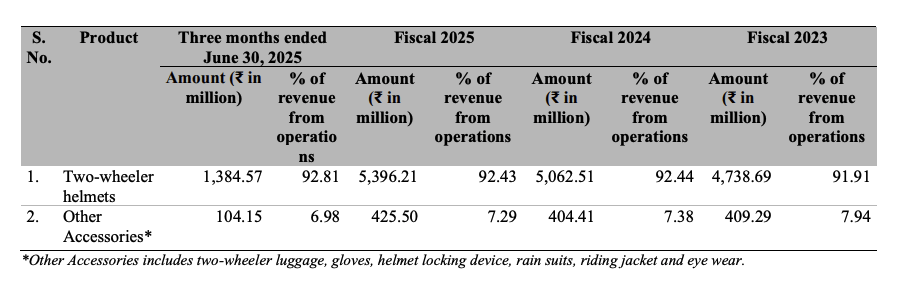

In FY2025, the company earned 92.43% of its revenue from helmets and 7.29% from other accessories.

Global Presence & Partnerships

Studds’ export network spans the Americas, Europe, Asia, and other regions, supported by a strong domestic distribution system of 363 active distributors across India. The company has strategic supply arrangements with leading motorcycle OEMs, including:

- Hero MotoCorp Limited

- Honda Cars India Limited

- Suzuki Motorcycle India Pvt. Ltd.

- Eicher Motors (Royal Enfield)

- India Yamaha Motor Pvt. Ltd.

It also supplies products to institutional customers such as the Central Police Canteens and Canteen Stores Department, and sells through exclusive brand outlets (EBOs), e-commerce platforms, and its own website — studds.com.

Distribution Network

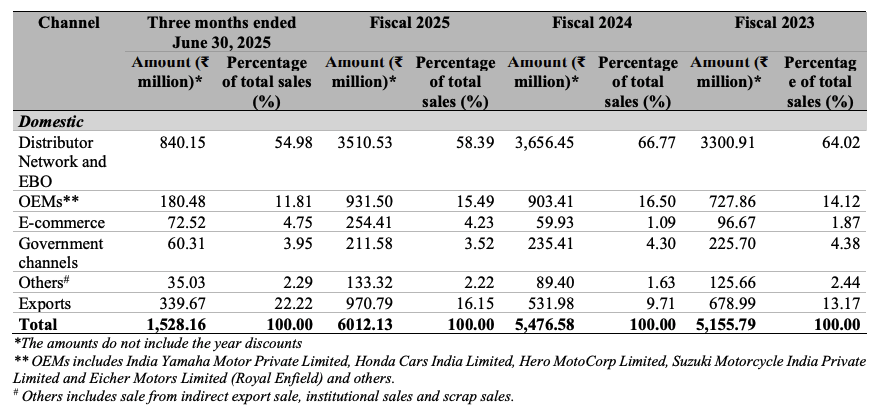

Studds operates a robust multi-channel distribution network that ensures its products reach every corner of India and beyond. As of FY2025, nearly 58% of sales came through its domestic distributor network and exclusive brand outlets (EBOs), while OEM partnerships contributed about 15%.

The company also sells through e-commerce platforms, government channels, and an expanding export base, which accounted for over 16% of total sales in FY2025. This balanced distribution mix highlights Studds’ strong domestic footprint and growing global presence.

Innovation & R&D Focus

With a dedicated R&D team of 75 members, Studds continually pushes boundaries in design and safety. The company’s innovation pipeline includes smart helmets equipped with built-in communication systems, rear-view cameras, navigation, and helmet-wear detection technology — features designed for evolving consumer needs, including delivery and mobility platforms.

Studds has also embraced automation in its production lines through robotic cutting systems, automatic PP tape cutting machines, and laser-based painting systems, improving precision and efficiency.

Its products hold key safety certifications, including:

- ISO 9001:2015 (Quality Management)

- ISO 14001:2015 (Environmental Management)

- IS 4151:2015 (Protective Helmets for Motorcycle Riders – BIS Certified)

- ECE 22.06 (Economic Commission for Europe standard)

Leadership

The company’s growth has been guided by the vision of its promoters:

- Madhu Bhushan Khurana (Chairman & Managing Director) – Over 42 years of experience in the helmet and accessories business.

- Sidhartha Bhushan Khurana (Managing Director) – Associated since 1998, he brings expertise in finance, strategy, and manufacturing.

Together, they have built Studds into a global safety powerhouse, backed by a strong management team and a customer-centric innovation strategy.

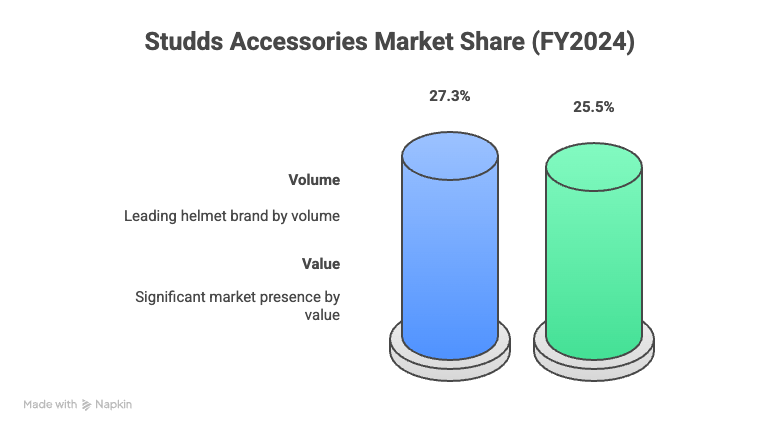

With a commanding domestic market share of 27.3% by volume and 25.5% by value (FY2024), Studds is not just another helmet brand — it’s a market leader redefining rider safety worldwide.

In the next section, we’ll unpack the financial performance of Studds Accessories Ltd., to see how the company’s growth and profitability stack up ahead of the Studds Accessories IPO.

Financial Performance – Studds Accessories IPO

Studds Accessories Ltd. has showcased a steady financial performance over the past few years, reflecting its brand strength, operational efficiency, and expanding market reach. Between FY2024 and FY2025, the company’s revenue increased by 11%, while profit after tax (PAT) grew by an impressive 22%, indicating both top-line and bottom-line growth momentum ahead of its IPO.

Key Financial Summary (₹ in Crores)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 586.61 | 556.71 | 485.56 | 461.07 |

| Total Income | 152.01 | 595.89 | 535.84 | 506.48 |

| EBITDA | 30.26 | 104.84 | 90.19 | 60.05 |

| Profit After Tax (PAT) | 20.25 | 69.64 | 57.23 | 33.15 |

| Net Worth | 469.77 | 449.48 | 387.41 | 338.02 |

| Reserves & Surplus | 450.09 | 429.80 | 377.57 | 328.18 |

| Total Borrowings | 2.91 | 2.91 | 0.61 | 30.58 |

The company has maintained a strong balance sheet with minimal debt, highlighting prudent financial management. Net worth has consistently grown, supported by rising profitability and efficient capital allocation.

Key Financial Ratios – Studds Accessories IPO

| Particulars | 3M Ended Jun 2025 | FY2025 | FY2024 | FY2023 |

|---|---|---|---|---|

| Revenue from Operations (₹ mn) | 1,491.83 | 5,838.16 | 5,290.23 | 4,991.69 |

| Revenue Growth (YoY %) | N.A. | 10.36 | 5.98 | 7.93 |

| EBITDA (₹ mn) | 302.61 | 1,048.40 | 901.92 | 600.53 |

| EBITDA Margin (%) | 20.28 | 17.96 | 17.05 | 12.03 |

| PAT (₹ mn) | 202.46 | 696.41 | 572.26 | 331.48 |

| PAT Margin (%) | 13.57 | 11.93 | 10.82 | 6.64 |

| Return on Net Worth (RoNW %) | 4.31 | 15.49 | 14.77 | 9.81 |

| Return on Capital Employed (RoCE %) | 5.65 | 20.25 | 18.98 | 12.81 |

| Net Debt / Equity (Times) | (0.10) | (0.07) | (0.07) | 0.02 |

Studds Accessories Ltd. continues to demonstrate healthy profitability, with EBITDA margins improving from 12.03% in FY2023 to 17.96% in FY2025. The company’s return ratios (RoNW and RoCE) also show strong operational efficiency and effective use of capital.

With a market capitalization of ₹2,302.17 crore (as per RHP), the company enters the market as a mid-cap player backed by consistent earnings, low leverage, and improving margins.

The consistent financial uptrend positions Studds Accessories Ltd. favorably among its industry peers. In the next section, we’ll analyze the valuation metrics and peer comparison to understand how the Studds Accessories IPO stacks up against competitors.

Valuation & Peer Comparison – Studds Accessories IPO

The Studds Accessories IPO valuation reflects a strong market position backed by steady earnings growth and brand leadership in the two-wheeler helmet segment. The company is being valued at a Price-to-Book Value of 5.12x and a market capitalization of ₹2,302.17 crore.

Based on the Red Herring Prospectus (RHP), the EPS stands at ₹17.70 (pre-IPO) and ₹20.58 (post-IPO), translating to a P/E multiple of 33.06x pre-IPO and 28.43x post-IPO. Considering its strong return ratios and leadership in a safety-driven industry, the valuation appears reasonable for a growth-oriented mid-cap manufacturing company.

Studds Accessories IPO Valuation

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| Earnings Per Share (EPS) (₹) | 17.70 | 20.58 |

| Price to Earnings (P/E) (x) | 33.06 | 28.43 |

| Price to Book Value (P/BV) | – | 5.12 |

| Market Capitalization (₹ crore) | – | 2,302.17 |

Studds Accessories IPO Peer Comparison

Although there are no listed peers for direct comparison, as per the Studds Accessories RHP, unlisted players like Vega Auto Accessories Pvt. Ltd. and Steelbird Hi-Tech India Ltd. operate in the same industry. The comparison below (FY2024 data) highlights Studds’ superior financial scale, profitability, and capital efficiency.

| Parameters (FY2024*) | Studds Accessories Ltd. | Vega Auto Accessories Pvt. Ltd. | Steelbird Hi-Tech India Ltd. |

|---|---|---|---|

| Revenue from Operations (₹ mn) | 5,290.23 | 4,740.30 | 2,098.09 |

| EBITDA (₹ mn) | 901.93 | 892.30 | 404.28 |

| EBITDA Margin (%) | 17.05 | 18.82 | 19.27 |

| PAT (₹ mn) | 572.26 | 530.50 | 273.17 |

| PAT Margin (%) | 10.68 | 11.19 | 13.02 |

| RoE (%) | 14.77 | 16.15 | 29.11 |

| RoCE (%) | 18.98 | 20.88 | 36.72 |

| Debt-to-Equity (x) | -0.07 | 0.21 | 0.24 |

*FY2024 is the latest year for which data is publicly available for peers (Source: CAREEdge Research, RHP).

Compared to its unlisted peers, Studds Accessories Ltd. stands out with:

- Highest revenue base, supported by global operations across 70+ countries.

- Stable margins and a low-debt structure, enhancing return on equity consistency.

- Strong brand recall with its dual-brand strategy – Studds for mass and mid-market, and SMK for premium riders.

Despite a slightly lower RoE compared to smaller peers, Studds’ scale, profitability, and export-driven growth justify its valuation premium.

With these metrics, the Studds Accessories IPO seems well-positioned in a niche segment with strong global scalability.

Strengths & Risks – Studds Accessories IPO

The Studds Accessories IPO presents a compelling mix of operational strength and growth opportunity, balanced by a few industry-specific and valuation-related risks.

The table below summarizes the key strengths and potential risks investors should evaluate before subscribing.

| Strengths | Risks / Concerns |

|---|---|

| Market Leadership: Studds is India’s largest and the world’s biggest two-wheeler helmet manufacturer by volume (CARE Report FY2024), commanding over 25% domestic market share. | Dependence on Two-Wheeler Industry: Sales are directly linked to two-wheeler demand. Any slowdown in this segment due to weak consumer spending or regulatory changes could impact volumes. |

| Strong Brand Portfolio: The dual-brand strategy — Studds (mass & mid-segment) and SMK (premium) — enables it to serve a wide customer base across price points in 70+ countries. | Export Market Exposure: With significant exports, Studds faces foreign exchange fluctuations and changing import regulations in key markets like Europe and the Americas. |

| Robust Financials: Revenue grew by 11% YoY and PAT by 22% in FY2025, supported by improving EBITDA margins (17.96%). | High Valuation: At a P/E of ~28x (post-IPO), valuations appear rich compared to the broader manufacturing sector average. Sustained earnings growth is needed to justify this. |

| Low Debt, Strong Balance Sheet: Nearly debt-free operations (D/E of -0.07) provide flexibility for expansion and R&D investments. | Raw Material Price Volatility: Costs of polymers and paints — key raw materials — can impact margins if not effectively passed on to customers. |

| Innovation & R&D Focus: A 75-member design and development team drives innovation in smart helmets, safety tech, and automated manufacturing. | Limited Product Diversification: The business is heavily dependent on helmet sales (92% of revenue); slower diversification may limit long-term growth. |

| Extensive Distribution Network: Presence across 363 distributors, OEM tie-ups with Hero MotoCorp, Yamaha, Suzuki, and Royal Enfield, and fast-growing e-commerce channels ensure strong reach. | Competition from Unlisted Players: Intense rivalry from unlisted brands like Vega and Steelbird may affect pricing power in domestic markets. |

The Studds Accessories IPO showcases a well-established brand with solid fundamentals, wide distribution, and global visibility. Its strong growth trajectory, brand recall, and efficient capital structure make it a quality long-term play in the safety and mobility segment.

However, valuation premium, cyclical demand dependency, and limited diversification remain short-term concerns that investors should monitor post-listing.

Grey Market Premium (GMP) & Listing Sentiment – Studds Accessories IPO

The Studds Accessories IPO has generated healthy investor interest in the unlisted market, reflecting optimism around its brand dominance, financial strength, and consistent earnings growth. While the grey market is unofficial and unregulated, it often indicates early listing-day sentiment among investors.

Studds Accessories IPO GMP Update

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|---|

| 29-Oct-2025 | ₹585.00 | ₹55 (No Change) | ₹1000/₹14000 | ₹640 (↑9.40%) | ₹1375 |

| 28-Oct-2025 | ₹585.00 | ₹55 (No Change) | ₹1000/₹14000 | ₹640 (↑9.40%) | ₹1375 |

*Estimated profit based on upper price band and current GMP trend.

The GMP (Grey Market Premium) is not an official indicator and does not guarantee listing performance. It simply reflects investor sentiment and demand in the informal market before listing. Actual listing price may vary based on overall market conditions, institutional participation, and retail subscription levels.

Listing Day Expectations

Given the steady ₹55 GMP and consistent subscription interest, the Studds Accessories IPO could list at a 9–10% premium over its issue price. Strong fundamentals, leadership in the two-wheeler safety gear space, and debt-free balance sheet further support a positive listing outlook.

However, with broader market volatility and premium valuations already priced in, short-term investors should remain cautious, while long-term investors may find it a solid addition to a growth-oriented portfolio.

Conclusion – Final Verdict on the Studds Accessories IPO

The Studds Accessories IPO presents an interesting opportunity for investors who believe in India’s growing two-wheeler market and the long-term potential of branded safety accessories. With over four decades of legacy, pan-India distribution, and a rising export footprint, Studds has positioned itself as a market leader in the helmet and motorcycle accessories segment.

Financially, the company has demonstrated consistent revenue growth of 11% and a strong 22% rise in profit after tax (PAT) in FY25, indicating robust demand and operational efficiency. Its low debt-to-equity ratio, healthy RoNW of 15.49%, and expanding EBITDA margin of 17.96% highlight sound financial management.

However, since this IPO is entirely an Offer for Sale (OFS), no fresh capital will flow into the company — meaning investors are primarily participating in a promoter stake sale. Additionally, competition from unorganized players and dependency on two-wheeler sales cycles could impact short-term growth.

Still, with a steady ₹55 GMP and estimated 9–10% listing gain, sentiment around the Studds Accessories IPO remains positive.

Onedemat Verdict

| Category | Verdict |

|---|---|

| Business Fundamentals | Strong |

| Valuation | Fairly Priced |

| Listing Gains Outlook | Positive (9–10%) |

| Long-Term Investment Potential | Moderate to High |

| Overall Rating (by Onedemat) | ⭐⭐⭐⭐☆ (4/5) |

In conclusion, the Studds Accessories IPO looks promising for both short-term listing gains and medium-term investors who prefer fundamentally strong consumer brands with scalable business models.

For more IPO insights, detailed financial breakdowns, and post-listing analysis, visit our IPO Section on OneDemat.com.

FAQs — Studds Accessories IPO

1. What is the Studds Accessories IPO?

The Studds Accessories IPO is a book-built Offer for Sale (OFS) of 77,86,120 shares aggregating up to ₹455.49 crore. The issue is an OFS by existing shareholders (no fresh equity is being issued to the company). (Source: RHP)

2. When is the Studds Accessories IPO open for subscription and when will it list?

The IPO opens on October 30, 2025 and closes on November 3, 2025. Tentative allotment is on November 4, 2025, credit to demat and refunds on November 6, 2025, and tentative listing on November 7, 2025. (Source: RHP)

3. What is the price band, lot size and minimum investment for retail investors?

The price band is ₹557 – ₹585 per share. The lot size is 25 shares. Minimum retail investment (1 lot at upper band) = ₹14,625 (25 × ₹585). (Source: RHP)

4. How is the issue allocated across investor categories?

Allocation: QIBs – up to 50%, Retail – not less than 35%, NII – not less than 15% of the offer. (Source: RHP)

5. Who are the lead manager and registrar for the Studds Accessories IPO?

IIFL Capital Services Ltd. is the Book Running Lead Manager and MUFG Intime India Pvt. Ltd. is the Registrar to the issue. (Source: RHP)

6. What are the key financial highlights ahead of the IPO?

Between FY2024 and FY2025: Revenue grew ~11% and PAT rose ~22%. For FY2025: Revenue from operations ~₹5,838.16 million, EBITDA margin ~17.96%, PAT ~₹696.41 million, RoNW 15.49%, and Net Debt/Equity ~-0.07 (near debt-free). Market cap (post-issue basis per RHP) is ₹2,302.17 crore. (Source: RHP)

7. What valuation metrics should investors note for the Studds Accessories IPO?

Key metrics: Pre-IPO EPS = ₹17.70; Post-IPO EPS = ₹20.58. P/E = 33.06x (pre-IPO) and 28.43x (post-IPO). Price-to-Book ≈ 5.12x (RHP figures). (Source: RHP)

8. What is the company’s business mix and distribution footprint?

Studds derives ~92% of revenue from helmets and the remainder from accessories (gloves, luggage, rain suits, etc.). Distribution mix (FY2025): Domestic distributor network & EBOs ~58%, Exports ~16%, OEMs ~15%, plus e-commerce and government channels. Studds sold ~7.40 million helmets in FY2025 and exports to 70+ countries. (Source: RHP)

9. What is the current Grey Market Premium (GMP) and estimated listing expectation?

As of 29-Oct-2025, GMP reported at ₹55 (on the upper band ₹585), implying an estimated listing price of ~₹640 (≈9.4% over ₹585). That equates to ~₹1,375 estimated profit per retail lot (25 shares × ₹55). Note: GMP is unofficial and not a guarantee of listing performance.

10. Who are Studds’ peers and how does it compare?

There are no listed direct peers per the RHP. Unlisted industry players used for benchmarking include Vega Auto Accessories Pvt. Ltd. and Steelbird Hi-Tech India Ltd. (FY2024 comparison shows Studds with the largest revenue base — ₹5,290.23 mn in FY2024 — and competitive margins/returns). (Source: RHP / CareEdge tables in RHP)