Market Recap

Yesterday, Stock Market-Sensex and Nifty took investors on a rollercoaster ride—one moment up, the next moment down. While heavyweight stocks tried to hold their ground, volatility ruled the session. Zomato (eating up the competition) and Tata Motors were among the top gainers, while BEL and Tech Mahindra struggled to keep pace.

But what about today? Will the bulls charge ahead, or are the bears sharpening their claws? Let’s find out!

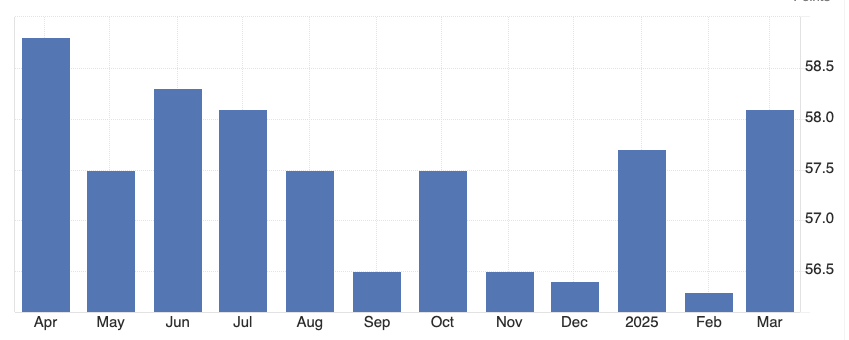

PMI Data Surprise: Factories on Fire (Not Literally, Don’t Panic!)

India’s manufacturing sector just hit the gym, and guess what? It’s lifting heavier than ever! The Manufacturing PMI for March 2025 jumped to 58.1—its highest in eight months. February’s 56.3 is now looking like last season’s flop.

What’s behind this growth? New orders are pouring in, and businesses are working overtime to keep up. Domestic demand is strong, though export orders slowed down a bit. (Maybe foreign buyers are still stuck in holiday mode?)

But here’s the fun part—costs went up, but companies decided not to pass the pain to customers. That’s like your local chaiwala refusing to hike prices even when milk prices go crazy. Respect.

Investors clearly loved this news, and the markets closed in the green yesterday. But the big question: Can this rally continue, or was it just a one-day energy drink boost?

US Tariffs Drama: Trump’s Trade Tantrum & What It Means for India

Just when global markets thought they could take a breather, Donald Trump decided to shake things up—again. The US President is all set to drop new tariffs, calling it “Liberation Day” for American trade. (Sounds dramatic, right? Almost like a sequel to an action movie nobody asked for.)

What’s the fuss about? Well, the US might slap tariffs on multiple sectors—agriculture, machinery, pharma, chemicals, steel, and autos. Basically, if it moves, Trump wants to tax it.

Now, should Indian investors panic? Not really. Experts believe India won’t be hit too hard. In fact, there’s talk that India and the US have already worked out a trade deal to avoid major damage. (Good job, diplomats—saving the stock market while we sleep!)

But here’s the twist—markets hate uncertainty, and global investors are nervous. Expect some volatility until we get full details of these tariffs. For now, India’s market stood strong yesterday, but will today bring a different story? Let’s wait and watch!

Nifty’s Mood Swings: Bullish Harami Signals Optimism

After a rollercoaster ride, the Nifty index closed at 23,332.35, up 166.65 points. Technical analysts spotted a “Bullish Harami” candlestick pattern on the charts, which isn’t a spicy sushi roll but a sign of potential market recovery. With the Relative Strength Index (RSI) at 56, traders are cautiously optimistic, eyeing support at 23,100 and resistance at 23,500. Looks like Nifty might be gearing up for a comeback!

Stock Spotlight – Zomato: Why the Stock is Enjoying a Tasty Rally

Zomato’s stock is rising faster than a delivery guy on a mission. The food delivery giant is serving up strong gains, and investors are loving it. But what’s cooking?

- Profit ka tadka: Zomato’s latest financials show better-than-expected profits. Turns out, people aren’t just ordering food; they’re also helping Zomato fatten its wallet.

- Blinkit’s express delivery: The company’s quick-commerce arm, Blinkit, is booming, bringing in more revenue and proving that Indians really, really hate waiting for groceries.

- More restaurants, more orders: Zomato has expanded its restaurant partnerships, meaning more variety for customers and more cash flow for the company.

So, is this rally sustainable? Well, if Zomato continues to keep costs low and users hooked, this stock might stay hot on the menu. But like with all stocks, watch out for indigestion if things slow down!

Stock Spotlight – BEL: What Caused the Dip? Should You Worry?

Bharat Electronics Limited (BEL) just took a hit, and investors are wondering—is it just turbulence, or are we going down?

- Profit booking alert: After a strong rally, some investors decided to cash out. Nothing personal, just some folks taking their profits and heading for the exit.

- Order flow concerns: There’s a little market gossip that new defense orders might slow down. And in a sector where government contracts are everything, that’s enough to spook some investors.

- Global defense shifts: With shifting global geopolitics, some worry that defense budgets could get stretched, affecting BEL’s future projects.

Should you panic? Not really. BEL still has a strong order book, government backing, and solid fundamentals. If you’re a long-term investor, this might just be a small hiccup in an otherwise steady journey. But if you were expecting a quick return, you might want to keep your seatbelt fastened for some turbulence.

Trending Business News in India: What’s Cooking in the Corporate Kitchen?

India’s business scene is never dull—one day we’re signing trade deals, the next we’re debating Waqf laws. Let’s take a quick look at the hottest updates that could stir up the market!

🇺🇸 India-US Trade Deal: A Sweet Escape from Tariffs?

India and the US finalized terms for a trade deal, and just in time! With Trump gearing up for new tariffs, this deal might just be India’s golden ticket to dodge some of the heat. Think of it as a VIP pass to the tariff party—entry restricted for troublemakers.

📊 FM Sitharaman Talks Money: No Politics, Just Business!

Finance Minister Nirmala Sitharaman reminded everyone that public finance isn’t about politics—it’s about keeping the economy strong. Translation: Whether you like the government or not, taxes aren’t going anywhere. She also hinted at responsible revenue management, which should keep investors at ease.

🏦 RBI Governor on Customer Service: “No More Bank Headaches?”

The RBI boss promised better customer service in banking. That’s great, but let’s be honest—until banks stop asking for three copies of your Aadhar, your electricity bill, and a blood sample just to update a mobile number, we’ll hold our applause.

💰 Nikhil Kamath Bets on Lehlah: Content Creators, Rejoice!

Zerodha co-founder Nikhil Kamath’s firm Gruhas just invested ₹12.5 crore in Lehlah, a content-commerce platform. Basically, influencers get to monetize their “link in bio” hustle even better. Expect more “Buy this, it changed my life!” posts on Instagram.

📉 Vodafone Idea: Government Takes a Bigger Slice

The government is now set to own 49% of Vodafone Idea, which is basically like ordering a small meal and ending up with a family pack. Will this rescue the struggling telco? Only time will tell.

BSNL’s ‘Generous’ Decade: A ₹1,757 Crore Oopsie!

In a plot twist worthy of a Bollywood drama, BSNL managed to “forget” billing Reliance Jio for sharing infrastructure over ten years, leading to a ₹1,757.56 crore loss. The Comptroller and Auditor General (CAG) highlighted this monumental oversight, noting BSNL’s failure to enforce its own agreements. One might say BSNL’s billing department took a decade-long power nap!

🍿 Haldiram’s Serves Up a Stake Sale

Indian snack giant Haldiram’s sold another 6% stake to International Holding Company and Alpha Global. So, while you’re munching on bhujia, someone’s making big money behind the scenes.

🔬 India Eyes Nuclear Power Expansion

India is exploring new fuel cycle options to boost nuclear power—because let’s face it, coal isn’t the future. The goal? More power, less pollution, and hopefully, fewer electricity cuts during IPL matches.

📚 PhysicsWallah Eyes Drishti IAS: From NEET to ‘Neat’ UPSC Aspirations?

Edtech unicorn PhysicsWallah is reportedly in advanced talks to acquire Drishti IAS, a renowned coaching institute for civil services exams. The deal, rumoured to be worth around ₹2,500 crore, could be a game-changer in the education sector. While PhysicsWallah has made waves in engineering and medical coaching, this move could signal its ambition to conquer the UPSC coaching arena. However, Drishti IAS’s CEO, Vivek Tiwari, has dismissed the news as mere rumors. Only time will tell if this is just classroom gossip or the real deal.

Bottom Line: What Does It Mean for You?

From trade deals to telecom shake-ups, these stories could have long-term effects on stocks, sectors, and your investments. But don’t worry, we’ll keep breaking it down for you—without the financial PhD requirement.

Tomorrow, we’ll see how the market reacts to these updates. Will investors celebrate or panic? Stay tuned, because One Demat always has the inside scoop!

Conclusion: Bulls, Bills, and Billion-Dollar Deals!

What a day for the markets! Sensex and Nifty flexed their muscles, shrugging off global jitters like a gym bro ignoring leg day. The strong Manufacturing PMI showed that India’s factories are working overtime, while the US tariff drama kept traders on edge. Meanwhile, Zomato’s stock was feasting, and BEL took a slight tumble, making investors wonder whether to buy the dip or just dip out.

On the policy front, the Waqf Amendment Bill and Immigration & Foreigners Bill stirred political debates, but their direct market impact remains limited. The India-US trade deal gave us hope that the tariff storm might just pass us by. And let’s not forget the spicy corporate news—from PhysicsWallah eyeing Drishti IAS to Ola zooming into EV dominance—it’s clear that the business world never sleeps!

So, what’s next? Keep an eye on upcoming RBI policy decisions, FII trends, and global cues. As always, stay informed, stay invested, and remember—One Demat, endless possibilities!