Introduction

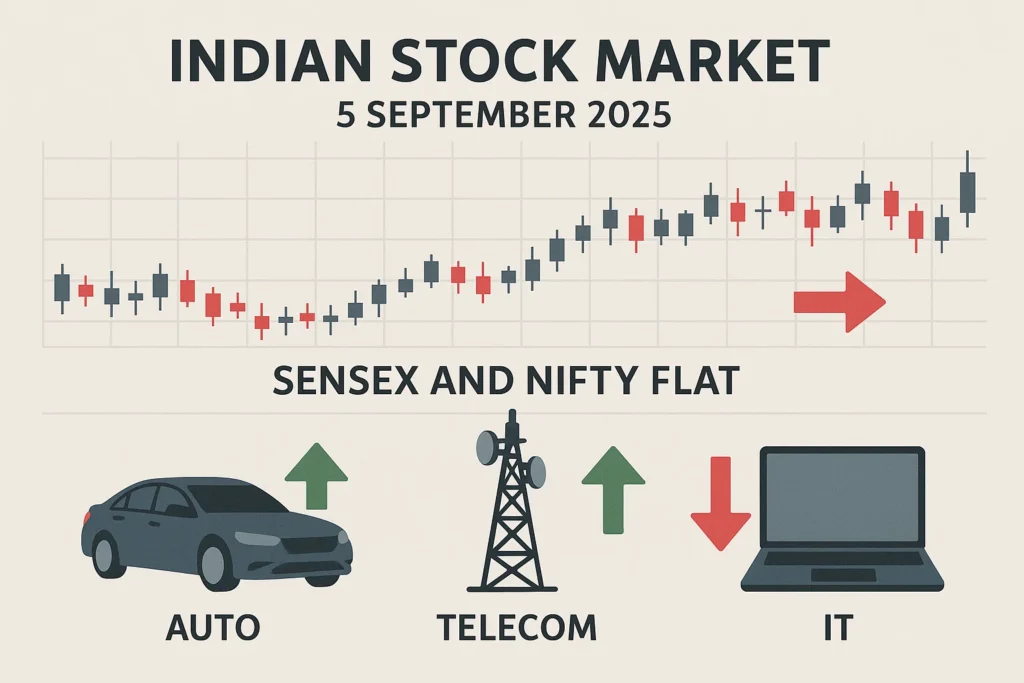

The Stock Market 5 September delivered another session of cautious trading, where early optimism quickly faded into a flat close. Benchmarks opened higher on continued GST optimism and supportive global cues, especially hopes of U.S. rate cuts after weak jobs data. However, selling pressure in IT and consumer names kept a lid on the rally.

Despite the intraday strength, investors shifted towards selective buying in autos, telecom, and PSU-linked stocks, while broader market participation in smallcaps and midcaps offered some relief. Overall, the Stock Market Today displayed the classic signs of consolidation after a volatile week, with investors watching both domestic policy outcomes and global macro signals.

Index Performance on Stock Market 5 September

Key benchmark indices ended the session with marginal gains, reflecting the tug-of-war between sectoral winners and losers:

- Nifty 50 closed at 24,741.00, up 6.70 points (+0.027%).

- Sensex settled at 80,749.63, higher by 31.62 points (+0.039%).

- Nifty Bank inched up to 54,098.20, adding 22.75 points (+0.042%).

- Nifty IT plunged to 34,664.55, losing 478.55 points (−1.36%), becoming the biggest sectoral drag.

- S&P BSE SmallCap climbed to 52,807.29, up 100.86 points (+0.19%), showing investor appetite in the broader market.

Snapshot of Index Performance – Stock Market Today

| Index | Closing Level | Change | % Change |

|---|---|---|---|

| Nifty 50 | 24,741.00 | +6.70 | +0.027% |

| Sensex | 80,749.63 | +31.62 | +0.039% |

| Nifty Bank | 54,098.20 | +22.75 | +0.042% |

| Nifty IT | 34,664.55 | −478.55 | −1.36% |

| BSE SmallCap | 52,807.29 | +100.86 | +0.19% |

Top Gainers on Stock Market 5 September

A handful of stocks stole the spotlight today with strong rallies driven by corporate updates and policy tailwinds:

- Netweb Technologies surged 16.11% to ₹3,079.4, hitting a 10-year high after bagging a significant order win.

- Brainbees Solutions rallied 13.88% to ₹401.1 on robust volumes and market interest in e-commerce plays.

- Gujarat Mineral Development Corporation (GMDC) jumped 11.82% to ₹509 on the back of an incentive scheme, hitting fresh highs.

- Vodafone Idea advanced 9.38% to ₹7.23, as optimism around telecom reforms and relief packages fueled buying.

- SKF India climbed 6.05% to ₹4,878.1, backed by strong operational performance and heavy trading volumes.

Top Losers on Stock Market 5 September

On the flip side, several counters faced sharp profit booking and sector-specific headwinds:

- Ola Electric slipped 7.1% to ₹59.92 after news of a stake sale, triggering investor concerns.

- Varun Beverages dropped 4.06% to ₹469.65, reacting negatively to GST-related changes in beverage taxation.

- eClerx Services fell 3.34% to ₹4,290.6 amid insider trade disclosures.

- Firstsource Solutions declined 3.24% to ₹349.9, weighed down by selling pressure in midcap IT.

- Abbott India eased 3.19% to ₹31,150, dragged by weak sentiment in pharma stocks.

Summary Table of Top Gainers & Losers – Stock Market Today

| Top Gainers | % Change | LTP (₹) |

|---|---|---|

| Netweb Technologies | +16.11% | 3,079.4 |

| Brainbees Solutions | +13.88% | 401.1 |

| Gujarat Mineral Development | +11.82% | 509 |

| Vodafone Idea | +9.38% | 7.23 |

| SKF India | +6.05% | 4,878.1 |

| Top Losers | % Change | LTP (₹) |

|---|---|---|

| Ola Electric | −7.10% | 59.92 |

| Varun Beverages | −4.06% | 469.65 |

| eClerx Services | −3.34% | 4,290.6 |

| Firstsource Solutions | −3.24% | 349.9 |

| Abbott India | −3.19% | 31,150 |

Why Did the Market Close Slightly Up on 5 September?

- GST-Driven Optimism in Autos & Consumer Durables

- The GST Council’s tax cuts on small cars and two-wheelers kept the auto index in focus, sparking strong buying in M&M, Maruti Suzuki, and ancillary plays.

- Global Tailwinds Supported Risk Appetite

- Weak U.S. jobs data raised hopes of a Federal Reserve rate cut, providing global equity support and limiting downside risk in Indian markets.

- Profit Booking in IT & Consumer Stocks

- Nifty IT slipped over 1.3%, continuing its weak trend as concerns over U.S. demand hurt tech majors.

- Consumer stocks like ITC and beverages names also saw selling after GST-related uncertainties.

- Smallcap & Midcap Resilience

- Despite volatility in large caps, small and midcap indices remained positive, with selective buying in PSUs, minerals, and telecom players.

Conclusion: Stock Market 5 September

The Stock Market 5 September session was a case of sectoral push and pull. While autos, telecom, and minerals stocks powered ahead, sharp weakness in IT and consumer names capped the upside. Both Sensex and Nifty managed to end with only marginal gains, highlighting a consolidation phase after recent volatility.

For investors, the focus remains on policy cues, GST Council outcomes, and global central bank decisions, which will likely dictate near-term market direction. The Stock Market Today once again reminded traders of the importance of sector rotation and profit booking at higher levels.

(Source)

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Best Screener Queries for Stock Selection: Find Hidden Gems Before Others Do

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh