Introduction: Tamil Nadu Is Leading India’s Manufacturing Revolution

For years, India was seen more as a service economy than a manufacturing hub. However, that perception is changing—and fast. Tamil Nadu, in particular, is leading the shift with a bold mix of tax incentives, infrastructure upgrades, and business-friendly policies.

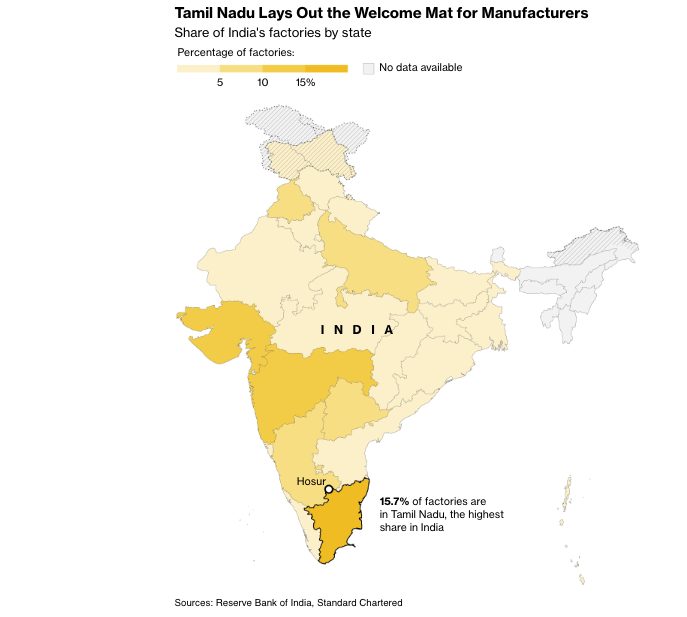

As highlighted in a July 2025 Bloomberg Businessweek article by Dan Strumpf and Ruchi Bhatia, global giants like Delta Electronics, Apple, Ola Electric, and Tata Electronics are choosing Tamil Nadu over other regions. In cities like Hosur and Krishnagiri, factories are scaling up quickly, powered by state support and rising investor interest.

This isn’t just local success. Tamil Nadu is helping India become a serious contender in global supply chains—especially as companies look to reduce their reliance on China. For investors, this shift opens the door to a powerful trend: the rise of South Indian manufacturing stocks.

In this blog, we’ll explore:

- Why Tamil Nadu is attracting manufacturers from around the world

- How state policies and labor advantages are fueling growth

- And most importantly, which listed companies stand to benefit

If you’re serious about riding India’s next big economic trend, start looking south.

What’s Fueling the Manufacturing Boom in Tamil Nadu?

Tamil Nadu isn’t just getting lucky—it’s making the right moves. The state has emerged as India’s industrial hotspot by actively solving the pain points that often frustrate manufacturers elsewhere.

1. Tax Incentives That Matter

Delta Electronics, as Bloomberg reports, chose Tamil Nadu after it received a 10-year income tax exemption. Other companies have received similar benefits, making it far more cost-effective to operate here than in most Indian states.

2. Fast-Tracked Infrastructure Approvals

Setting up a factory in India usually means delays. But in Tamil Nadu, the story is different. Delta’s team got power, water, and land access without bureaucratic hurdles. Similarly, aerospace firm International Aerospace Manufacturing Pvt. Ltd. received land offers within days of meeting government officials.

3. Superior Connectivity

The state boasts wide highways, reliable logistics, and access to Chennai port, making it easier to move goods locally and internationally. That’s a huge advantage for companies exporting electronics, EV parts, or defense components.

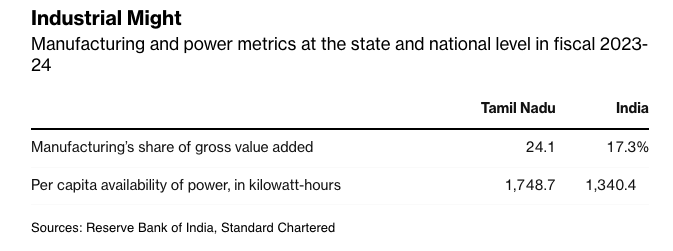

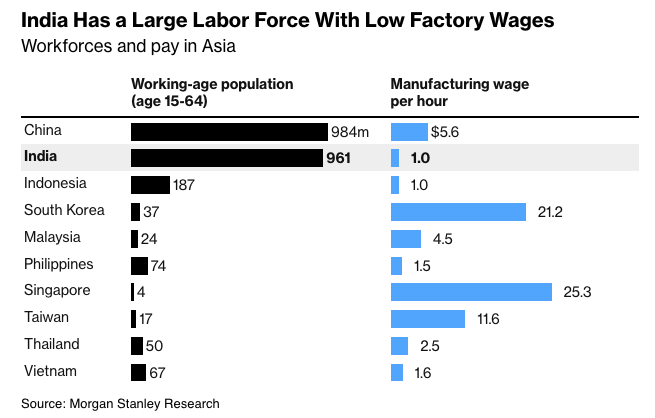

4. Skilled and Affordable Labor

Tamil Nadu offers a large, trained workforce at wages lower than many other Asian countries. Plus, decades of emphasis on education and technical training are now paying off. This combination of scale and skill is hard to beat.

5. Make in India Momentum

While India’s national push toward manufacturing has had mixed results, Tamil Nadu is close to hitting the 25% GDP contribution target set by the “Make in India” campaign. Most other states are far behind.

This boom isn’t driven by one sector or one company—it’s a multi-industry shift backed by coordinated government action. And that’s exactly what makes it a serious opportunity for long-term investors.

Top Global Companies Betting Big on Tamil Nadu

Tamil Nadu’s manufacturing momentum isn’t just a government push—it’s backed by serious global capital. Many of the world’s top electronics, EV, and aerospace players are setting up shop in the state. Here’s a look at who’s leading the charge:

1. Delta Electronics

This Taiwanese giant is going all-in on southern India. As Bloomberg reports, Delta paid ₹650 crore for naming rights to a metro station in Bengaluru—just to show its long-term intent.

It operates a massive 125-acre plant in Krishnagiri, Tamil Nadu. The factory produces EV chargers and components for iPhones, fulfilling rising global demand for India-made electronics.

2. Apple (via Contract Manufacturers)

Apple has started shifting its supply chain out of China. Tamil Nadu is a key part of this strategy. Through its partners like Tata Electronics and Foxconn, Apple now sources a growing share of iPhones from India, especially from newly built plants in the state.

3. Ola Electric

Ola calls its Tamil Nadu factory the world’s largest two-wheeler EV plant. Located in Hosur, the facility is central to the company’s ambition to dominate the electric scooter market both in India and globally.

4. Ather Energy

Also in Hosur, Ather’s second EV scooter factory reflects the state’s EV cluster strength. Even though Ather still depends on China for some parts, the plant shows how Tamil Nadu supports high-tech manufacturing with rapid setup and supplier access.

5. HAL–Rolls Royce Joint Venture

In aerospace, Hindustan Aeronautics Ltd (HAL) and Rolls-Royce have invested ₹85 crore in a facility in Hosur. The plant makes jet turbine components and reflects Tamil Nadu’s growing role in defense and aviation manufacturing.

6. Titan Engineering & Automation Ltd (TEAL)

A hidden gem. TEAL builds factory automation systems used across sectors—EVs, electronics, healthcare, and more. With a 50% growth rate in FY24, it is quickly becoming a key enabler of India’s industrial base.

These aren’t just factory setups. They’re long-term bets on Tamil Nadu’s reliability, talent, and speed of execution.

South Indian Manufacturing Stocks to Watch

As Tamil Nadu becomes the epicenter of India’s industrial revival, several listed companies stand to benefit directly or indirectly. Whether it’s through their factories, partnerships, or supplier networks, these stocks are well-positioned for growth.

1. Ola Electric Mobility Ltd

Ola’s Hosur facility is now fully operational and scaling aggressively. As the company expands its EV and battery divisions, its Tamil Nadu operations are expected to drive both production and innovation. Post-IPO, it’s become a top retail favorite in the EV segment.

2. Ather Energy Ltd

Also listed recently, Ather’s second Hosur plant is key to its production ramp-up. With rising demand for electric scooters and localized assembly, Ather is poised for strong revenue growth. Investors are watching its ability to reduce dependence on Chinese components.

3. Titan Company Ltd (TEAL parent)

Titan is best known for watches and jewelry. But its subsidiary, TEAL, is a powerful play on factory automation. TEAL supplies precision machinery to EV, defense, and electronics manufacturers. Its stronghold in Tamil Nadu and 50% growth in FY24 make it a quiet multibagger.

4. Hindustan Aeronautics Ltd (HAL)

HAL’s joint venture with Rolls-Royce in Hosur is producing jet turbines and defense parts. As India boosts aerospace manufacturing, HAL could benefit from rising defense orders, exports, and Make-in-India contracts.

5. Ashok Leyland Ltd

With deep roots in Tamil Nadu, Ashok Leyland remains one of India’s top commercial vehicle makers. It’s well-placed to benefit from infrastructure growth, electric truck adoption, and the state’s logistics advantage.

6. Tata Elxsi / Tata Motors (for Apple’s Tamil Nadu push)

While Apple’s direct partners like Tata Electronics are unlisted, investors can gain exposure via Tata Motors (EV segment) and Tata Elxsi (design and software for electronics and automation). Both are beneficiaries of the group’s hardware expansion in the south.

These stocks reflect different layers of India’s manufacturing wave—from EVs and aerospace to automation and components. By investing smartly across this ecosystem, you can ride the Tamil Nadu industrial growth story for the long haul.

What Investors Should Watch Next

As Tamil Nadu cements its role as India’s factory floor, investors should keep a close eye on a few emerging trends:

1. Supply Chain Shifts

More global players may move their sourcing from China to India. If suppliers follow Delta’s lead and set up near Krishnagiri, production costs could drop further—boosting margins for local manufacturers.

2. Localization Push

Despite growth, companies like Ather still rely on Chinese components. However, government incentives and rising demand may accelerate local production of chips, magnets, and EV parts.

3. Policy Support

With southern states offering tax breaks and quick clearances, others may follow. A national-level manufacturing policy revision could unlock broader investment.

4. IPO Pipeline

Now that Ola Electric and Ather are listed, more EV and component startups from Tamil Nadu could tap public markets. Watch for new listings in automation, semiconductors, and defense.

In short, Tamil Nadu’s growth is just getting started. If you’re tracking South Indian manufacturing stocks, these trends could help you stay ahead of the curve.

Conclusion: Tamil Nadu Is Building the Future—Are You Investing in It?

Tamil Nadu isn’t just competing with China—it’s rewriting the playbook for industrial growth in India. With tax incentives, fast-tracked approvals, and a skilled workforce, it has become the top choice for global giants like Delta, Apple, and Ola Electric.

Meanwhile, listed companies like HAL, Titan, Ather, and Ashok Leyland are quietly powering this boom. For investors, this presents a rare opportunity: to ride a state-led manufacturing wave with national and global potential.

So, while the headlines focus on policy shifts and trade wars, savvy investors are looking south—where India’s next big growth story is already underway.

South India is manufacturing the future. The only question is—are you part of it?

FAQs: South Indian manufacturing stocks

Q1. Why is Tamil Nadu becoming a manufacturing hub?

Tamil Nadu offers tax breaks, fast-tracked approvals, strong infrastructure, and a skilled workforce—making it attractive for global and Indian manufacturers.

Q2. Which global companies are investing in Tamil Nadu?

Delta Electronics, Apple (via Tata and Foxconn), Ola Electric, Ather Energy, and Rolls-Royce-HAL are leading the charge.

Q3. Are Ola Electric and Ather Energy listed?

Yes, both are now listed, giving retail investors direct exposure to the EV boom in Tamil Nadu.

Q4. What are the best South Indian manufacturing stocks to watch?

Top picks include Titan Company (TEAL), Hindustan Aeronautics Ltd (HAL), Ashok Leyland, Ather Energy, and Ola Electric.

Q5. Is Tamil Nadu ahead of other states in manufacturing?

Yes. It contributes more to India’s electronics, auto parts, and exports than any other state and is close to hitting the 25% GDP manufacturing target.

Related Articles

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

India’s $100 Billion Silicon Bet: The Semiconductor Investment Opportunity No One Should Ignore

How India Borrows in 2025: Key Lending Trends and Top Stocks to Watch