Introduction – Solarworld Energy Solutions IPO

The Solarworld Energy Solutions IPO marks a significant opportunity for investors looking to enter the fast-growing renewable energy sector in India. SolarWorld Energy Solutions Limited, incorporated in 2013, is a leading solar energy solutions provider specializing in engineering, procurement, and construction (EPC) services for solar power projects.

With India pushing aggressively toward renewable energy adoption, companies like Solarworld Energy Solutions are at the forefront, delivering end-to-end solar solutions through both CAPEX and RESCO models, catering to businesses looking to reduce their carbon footprint.

The IPO presents a chance for investors to participate in a company with a proven track record of strong execution capabilities, growing revenue, and robust profitability, all while being part of a sector with massive long-term growth potential.

IPO Overview – Solarworld Energy Solutions IPO

Solarworld Energy Solutions IPO Details

| Particulars | Details |

|---|---|

| IPO Size | ₹490.00 crore |

| Fresh Issue | 1.25 crore shares, ₹440.00 crore |

| Offer for Sale (OFS) | 0.14 crore shares, ₹50.00 crore |

| Price Band | ₹333 – ₹351 per share |

| Face Value | ₹5 per share |

| Lot Size | 42 shares |

| Issue Type | Bookbuilding IPO |

| Listing On | BSE, NSE |

| Book Running Lead Manager | Nuvama Wealth Management Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

| IPO Document | RHP |

Solarworld Energy IPO Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Opens | Tue, 23 Sep 2025 |

| IPO Closes | Thu, 25 Sep 2025 |

| Allotment Finalization | Fri, 26 Sep 2025 |

| Refunds Initiation | Mon, 29 Sep 2025 |

| Credit of Shares to Demat | Mon, 29 Sep 2025 |

| Tentative Listing Date | Tue, 30 Sep 2025 |

| UPI Mandate Cut-off Time | 5 PM, 25 Sep 2025 |

Objects of the Issue

The company intends to utilize the proceeds from the Solarworld Energy Solutions IPO for the following purposes:

| Objects | Amount (₹ in crore) |

|---|---|

| Investment in Subsidiary KSPL for part-financing the Pandhurana Project | 575.30 |

| General corporate purposes | Remaining proceeds |

Company Background – Solarworld Energy Solutions IPO

Solarworld Energy Solutions Limited, incorporated in 2013, has emerged as a leading provider of solar energy solutions in India. Specializing in Engineering, Procurement, and Construction (EPC) services, the company designs, installs, and commissions solar power projects for a diverse clientele that includes public sector undertakings (PSUs) and commercial & industrial (C&I) clients.

Over the years, Solarworld has built a strong track record in delivering end-to-end, cost-effective solar solutions, demonstrating reliability and technical expertise. As of July 31, 2025, the company has successfully completed 46 projects with a total installed capacity of 253.67 MW AC / 336.17 MW DC and is executing ongoing projects with a capacity of 765 MW AC / 994 MW DC under EPC, along with 325 MW / 650 MWh in Battery Energy Storage Systems (BESS).

Business Model

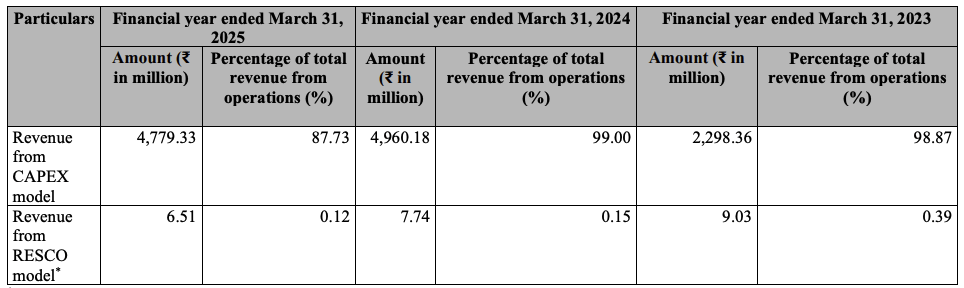

Solarworld Energy Solutions operates under two distinct models, catering to different customer needs:

1. Capital Expenditure (CAPEX) Model:

Under this model, Solarworld provides turnkey solar solutions—designing, installing, and commissioning projects—while the ownership of the solar assets remains with the customer. Services include:

- Land evaluation and project design

- Procurement of raw materials and solar components

- Equipment installation and transmission setup

- Operations & Maintenance (O&M) for a contracted period

2. Renewable Energy Service Company (RESCO) Model:

The RESCO model allows customers to adopt solar energy without any upfront investment. Solarworld owns and operates the project, and the customer purchases power at a fixed tariff via long-term Power Purchase Agreements (PPAs). This model supports businesses in reducing their carbon footprint with minimal financial burden.

In addition, both models include forward-integrated O&M services, ensuring projects perform efficiently throughout their lifecycle. Approximately 95% of EPC projects include bundled O&M contracts ranging from 2–5 years, highlighting the company’s commitment to quality and long-term client support.

Project Types and Customer Base

Solarworld delivers both ground-mounted and rooftop solar projects, designed to meet varying site conditions and energy requirements. Their portfolio includes high-value projects for clients like:

- SJVN Green Energy Limited

- Haldiram Snacks Private Limited

- Ethnic Food Manufacturing Private Limited

- Samiksha Solarworld Private Limited

Notably, the company maintains a balanced presence in government and private sector projects, leveraging tender-based government contracts and proactive in-house marketing for commercial clients.

Completed Projects: 46 projects across 9 states, totaling 253.67 MW AC / 336.17 MW DC.

Ongoing Projects: Large-scale EPC and RESCO projects such as the SGEL-Kutch (260 MW AC), SGEL-Sonitpur (50 MW AC), and BESS projects like RRVUNL Kota (125 MW / 250 MWh) and GUVNL Veloda (200 MW / 400 MWh), showcasing its robust project pipeline.

As of July 31, 2025, the company’s order book stood at ₹2,527.81 crore, reflecting strong demand and growth visibility.

Strategic Partnerships and Forward Integration

On May 14, 2024, Solarworld signed an equity cooperation agreement with ZNSHINE PV-Tech Co. Ltd., a Bloomberg NEF Tier-1 solar panel supplier from China, to establish a solar panel manufacturing facility. Operational since July 21, 2025, this move strengthens the company’s backward integration strategy, enabling in-house production of critical solar components and enhancing control over project costs.

Market Opportunity

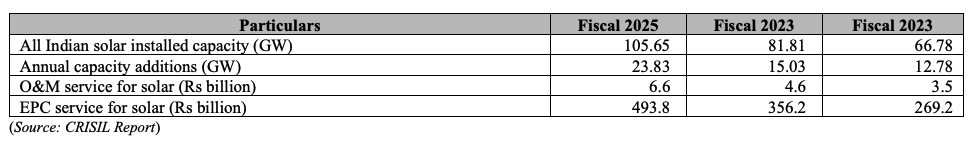

The Indian solar sector is growing rapidly, supported by strong government policies, incentives, and sustainability initiatives. Between Fiscal 2026 and 2030, India is expected to add 170–180 GW of solar capacity. Historical growth highlights:

This expanding market, coupled with Solarworld’s execution expertise and diversified business model, positions the company as a strong player in India’s renewable energy landscape.

Financials & Key Ratios – Solarworld Energy Solutions IPO

Solarworld Energy Solutions Ltd. has demonstrated steady financial growth over the last three years, driven by its asset-light EPC model and diversified revenue streams. Between the fiscal years ending March 31, 2024 and March 31, 2025, the company’s revenue grew by 9%, while Profit After Tax (PAT) surged by 49%, reflecting strong operational efficiency and cost management.

Financial Overview (in ₹ Crore)

| Particulars | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Assets | 598.02 | 155.02 | 120.43 |

| Total Income | 551.09 | 505.50 | 235.05 |

| Profit After Tax (PAT) | 77.05 | 51.69 | 14.84 |

| EBITDA | 106.75 | 71.09 | 22.88 |

| Net Worth | 309.07 | 73.60 | 21.91 |

| Reserves & Surplus | 272.00 | 73.28 | 21.59 |

| Total Borrowings | 114.55 | 61.10 | 64.67 |

Key Takeaways:

- The company’s PAT margin improved to 14.14% in FY 2025, indicating better profitability.

- EBITDA margin rose to 19.60%, reflecting strong operational control.

- Net worth growth from ₹73.60 crore in FY 2024 to ₹309.07 crore in FY 2025 shows a significant increase in shareholder value.

Key Performance Indicators (KPI)

| KPI | Value (as of 31 Mar 2025) |

|---|---|

| ROE (Return on Equity) | 40.27% |

| ROCE (Return on Capital Employed) | 54.53% |

| Debt/Equity Ratio | 0.37 |

| Return on Net Worth (RoNW) | 40.27% |

| PAT Margin | 14.14% |

| EBITDA Margin | 19.60% |

Investor Insights:

- High ROE and ROCE indicate efficient utilization of capital and equity, highlighting strong returns for investors.

- Moderate debt levels (Debt/Equity 0.37) ensure a balanced capital structure and lower financial risk.

- Solarworld Energy Solutions IPO presents a financially robust and growth-oriented opportunity, supported by its improving margins, expanding asset base, and strong order book in the solar sector.

Valuation & Peers – Solarworld Energy Solutions IPO

Investors considering the Solarworld Energy Solutions IPO can evaluate its valuation using key metrics like EPS, P/E, and RoNW, compared with peers in the renewable energy and solar EPC sector.

Solarworld Energy Solutions IPO Valuation

| Particulars | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 10.39 | 8.89 |

| P/E (x) | 33.77 | 39.48 |

Insights:

- The pre-IPO EPS reflects the earnings per share based on current shareholding and FY 2025 profits.

- The post-IPO P/E of 39.48x indicates a premium relative to earnings after capital raise, reflecting investor expectations of growth in India’s solar energy sector.

Peer Comparison – Solar EPC & Renewable Energy Companies

| Company Name | EPS (Basic) | EPS (Diluted) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Solarworld Energy Solutions Ltd. | 10.68 | 10.68 | 41.69 | 39.48 | 40.27 | – |

| Sterling And Wilson Renewable Energy Ltd. | 3.49 | 3.49 | 42.59 | 76.48 | 8.78 | 6.33 |

| KPI Green Energy Ltd. | 16.23 | 16.09 | 133.57 | 30.57 | 18.77 | 3.69 |

| Waaree Renewable Technologies Ltd. | 22.00 | 21.95 | 43.64 | 47.32 | 65.29 | 24.14 |

| Oriana Power Ltd. | 79.52 | 79.52 | 254.75 | 29.01 | 47.59 | 9.08 |

Key Takeaways:

- Solarworld Energy Solutions Ltd. has a strong RoNW of 40.27%, higher than many peers, reflecting efficient capital use and profitability.

- Its NAV per share of ₹41.69 is moderate, indicating healthy net worth backing for investors.

- Compared to listed peers, the post-IPO P/E of 39.48 is reasonable given the company’s growth prospects in EPC and RESCO solar projects.

- Although some peers like Waaree Renewable and Oriana Power have higher EPS or RoNW, Solarworld combines steady growth, strong order book, and backward integration in solar panels, positioning it competitively in the sector.

Strengths & Risks – Solarworld Energy IPO

| Strengths | Risks / Weaknesses |

|---|---|

| Established Track Record: Over a decade of experience in solar EPC and RESCO projects with 46 completed projects and 765 MW ongoing projects. | Sector Dependency: Revenue is highly dependent on government policies, subsidies, and tender-based projects. |

| Strong Financial Performance: FY25 revenue of ₹551 Cr (+9% YoY) and PAT of ₹77 Cr (+49% YoY); robust ROE 40.27% and EBITDA margin 19.60%. | High Competition: Faces competition from other solar EPC companies, RESCO providers, and new entrants. |

| Diversified Business Models: CAPEX and RESCO models cater to customers with and without upfront capital, increasing market reach. | Project Execution Risks: Delays or cost overruns in large-scale EPC or BESS projects can affect profitability. |

| Backward Integration: Partnership with ZNSHINE PV-Tech for in-house solar panel manufacturing reduces dependency on suppliers. | Financial Leverage: Although moderate (Debt/Equity 0.37), rising interest rates or high project financing needs can increase risk. |

| Strong Client Relationships: Serving PSUs and prominent C&I clients ensures repeat business and stable order book. | Regulatory & Policy Changes: Changes in tariffs, incentives, or renewable energy regulations can impact project viability. |

| Experienced Management Team: Promoters and leadership have expertise in EPC, renewable energy, and project management. | RESCO Model Risks: Performance depends on long-term PPA agreements and customer creditworthiness. |

| Large Order Book: ₹2,527.81 Cr order book as of July 2025 ensures near-term revenue visibility. | Technological Risks: Rapid changes in solar technology or BESS efficiency may require continuous investment in R&D. |

Solarworld Energy Solutions IPO GMP / Grey Market Premium

The Grey Market Premium (GMP) provides an early indicator of market sentiment for the Solarworld Energy Solutions IPO. As of 22nd September 2025, the IPO price is set at ₹351 per share, while the GMP is currently trading at ₹65, indicating a positive market sentiment despite a slight downward movement today.

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹) | Remarks |

|---|---|---|---|---|---|---|

| 22-09-2025 | 351.00 | 65 | 2100/29400 | 416 (18.52%) | 2730 | Todays Movement – GMP Down |

Key Takeaways for Investors:

- The GMP suggests an expected listing premium of around 18.5%, making the IPO attractive for short-term investors.

- Minor fluctuations in the GMP indicate slight corrections in market demand, which is common in the grey market before allotment.

- Retail and HNI investors can use GMP trends as a reference point for potential listing gains but should consider overall market conditions and long-term fundamentals before investing.

Conclusion & Strategy – Solarworld Energy Solutions IPO

The Solarworld Energy Solutions IPO presents an attractive investment opportunity in India’s rapidly growing solar energy sector. With a strong track record in EPC projects, both CAPEX and RESCO business models, and strategic partnerships like ZNSHINE PV-Tech Co., the company is well-positioned to capitalize on the nation’s renewable energy expansion.

Investment Strategies

1. Short-Term Strategy (Listing Gains):

- With the current GMP at ₹65 and an expected listing price around ₹416 per share, short-term investors could potentially earn 18–20% gains on listing.

- Suitable for investors looking for quick gains based on market sentiment, especially given positive grey market trends.

2. Long-Term Strategy (Wealth Creation):

- Solarworld Energy Solutions has robust fundamentals, healthy margins, strong ROE (40.27%), and a growing order book.

- Long-term investors can benefit from sustainable growth in India’s solar sector, government incentives, and increasing corporate adoption of renewable energy.

- Ideal for those seeking capital appreciation over 3–5 years or more.

3. Allotment Strategy:

- Retail investors should apply for the minimum lot or a few multiples to maximize chances of allocation.

- Diversifying subscription across other quality IPOs can reduce risk while maintaining exposure to Solarworld Energy Solutions’ growth story.

- Monitor subscription trends; if heavily oversubscribed, chances of allotment decrease, making a balanced application strategy prudent.

Investor Takeaway:

- The Solarworld Energy Solutions IPO combines strong fundamentals, a growing renewable energy sector, and favorable government policies.

- While listing gains appear attractive, long-term value creation is the key strength, making it suitable for investors with an appetite for growth and sustainability.

FAQs – Solarworld Energy Solutions IPO

1. What is the Solarworld Energy Solutions IPO?

The Solarworld Energy Solutions IPO is a ₹490 crore book-built issue, comprising a fresh issue of ₹440 crore and an offer for sale of ₹50 crore. It aims to raise funds for project expansion and general corporate purposes.

2. When does the Solarworld Energy IPO open and close?

The IPO opens on September 23, 2025, and closes on September 25, 2025.

3. What is the price band and lot size of the IPO?

The price band is ₹333 to ₹351 per share, with a lot size of 42 shares. The minimum retail investment is ₹14,742 (42 shares).

4. Where will the Solarworld Energy Solutions IPO be listed?

The IPO will list on BSE and NSE, with a tentative listing date of September 30, 2025.

5. Who are the promoters of Solarworld Energy Solutions Ltd.?

The company promoters are Kartik Teltia, Rishabh Jain, Mangal Chand Teltia, Sushil Kumar Jain, and Anita Jain.

6. What is the business model of Solarworld Energy Solutions Ltd.?

The company operates through CAPEX and RESCO models, offering EPC solutions, rooftop and ground-mounted solar projects, and long-term O&M services for its customers.

7. How has the company performed financially?

For FY 2025, Solarworld Energy Solutions reported total income of ₹551.09 crore and PAT of ₹77.05 crore, reflecting 9% revenue growth and 49% PAT growth year-on-year.

8. What are the key risks of investing in this IPO?

Risks include project execution delays, regulatory changes, dependence on government tenders, and fluctuations in solar module prices.

9. Who are the book running lead managers and registrar?

Nuvama Wealth Management Ltd. is the book running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

10. What are the objectives of the Solarworld Energy IPO?

Proceeds from the IPO will be used for part-financing the Pandhurana Project through the subsidiary KSPL and for general corporate purposes.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?