Introduction – Seshaasai Technologies IPO

The Seshaasai Technologies IPO is a ₹813.07 crore book-built issue, comprising a fresh issue and an offer-for-sale. It opens for subscription on Sep 23, 2025, and closes on Sep 25, 2025, with a tentative listing date of Sep 30, 2025.

Incorporated in 1993, Seshaasai Technologies Ltd. is a technology-driven solutions provider catering primarily to the BFSI (Banking, Financial Services, and Insurance) sector. The company specializes in scalable payment solutions, communication and fulfilment services, and IoT-powered products for diverse industries.

With 24 manufacturing units across India, strong compliance certifications, and over 860 employees, the company combines technology, quality, and innovation to serve banks, fintechs, and corporates. The Seshaasai IPO gives investors an opportunity to invest in a high-barrier-to-entry, tech-enabled BFSI solutions company with a proven track record.

Seshaasai Technologies IPO Overview

Seshaasai Technologies IPO is a book-built issue aggregating ₹813.07 crores. The issue comprises a fresh issue of 1.13 crore shares worth ₹480.00 crores and an offer for sale of 0.79 crore shares worth ₹333.07 crores. The IPO opens for subscription on Sep 23, 2025 and closes on Sep 25, 2025. The tentative listing date on BSE and NSE is Sep 30, 2025.

Seshaasai IPO Details

| Parameter | Details |

|---|---|

| Issue Type | Bookbuilding IPO (Fresh + OFS) |

| IPO Size | ₹813.07 Cr |

| Fresh Issue | 1.13 Cr shares (₹480.00 Cr) |

| Offer for Sale | 0.79 Cr shares (₹333.07 Cr) |

| Price Band | ₹402 – ₹423 per share |

| Face Value | ₹10 per share |

| Lot Size | 35 shares |

| Minimum Investment (Retail) | ₹14,805 (35 shares) |

| IPO Document | RHP File |

| Registrar | MUFG Intime India Pvt. Ltd. |

| Listing | BSE & NSE |

| Employee Discount | ₹40 per share |

Seshaasai IPO Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open | Tue, Sep 23, 2025 |

| IPO Close | Thu, Sep 25, 2025 |

| Tentative Allotment | Fri, Sep 26, 2025 |

| Refunds Initiation | Mon, Sep 29, 2025 |

| Credit to Demat | Mon, Sep 29, 2025 |

| Tentative Listing | Tue, Sep 30, 2025 |

| UPI Mandate Cut-off | 5 PM, Thu, Sep 25, 2025 |

Objects of the Issue–Seshaasai Technologies IPO

- Funding capital expenditure for expansion of existing manufacturing units – ₹197.91 Cr

- Repayment/prepayment of certain outstanding borrowings – ₹300.00 Cr

- General corporate purposes

Company Overview & Business Model – Seshaasai Technologies IPO

About the Company

Seshaasai Technologies Ltd., incorporated in 1993, is a technology-driven multi-location solutions provider that offers payment solutions, communications and fulfilment services, and IoT solutions, primarily catering to the banking, financial services, and insurance (BFSI) sector. The company provides scalable, recurring solutions through proprietary platforms, helping BFSI operations in India run efficiently while ensuring data security and compliance. Additionally, it offers IoT solutions across industries like retail, logistics, manufacturing, and renewable energy.

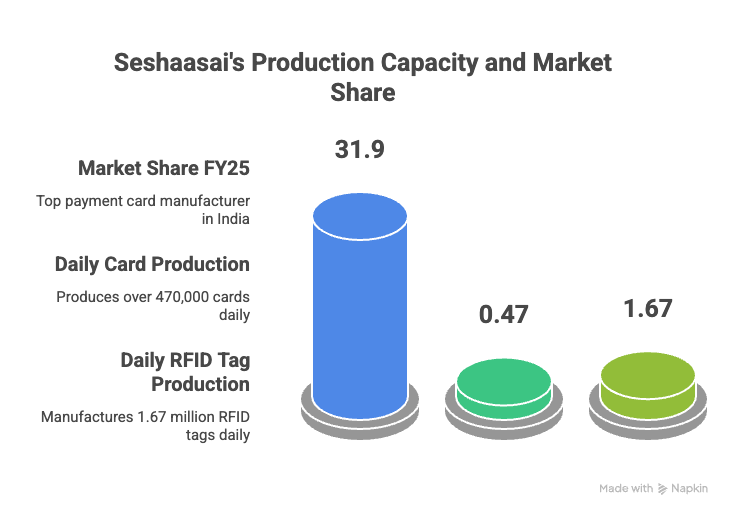

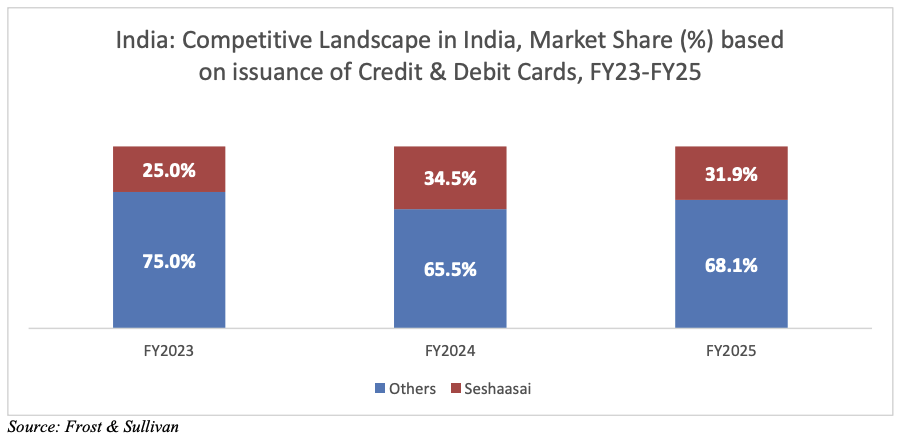

Market Position

Seshaasai is one of the top two payment card manufacturers in India, with a 31.9% market share in credit and debit card issuance in FY25, up from 25% in FY23. It is also among the largest cheque manufacturers in India. The company has 24 self-sustaining manufacturing units across seven locations, with advanced machinery and skilled workforce, capable of producing over 0.47 million cards and 1.67 million RFID tags daily.

Business Verticals

Payment Solutions

Seshaasai manufactures and personalizes debit, credit, prepaid, transit cards, wearables, metal and biometric cards, and payment stickers, including RuPay On-the-Go solutions. The company integrates QR and NFC technologies into its products for enhanced security and convenience. In FY25, FY24, and FY23, it supplied 91.37M, 110.33M, and 76.18M payment cards, respectively, and 1,188.81M, 1,193.78M, and 1,273.80M cheque leaves, respectively. It also develops merchant QR codes to facilitate digital payments via UPI and provides non-card payment options like wearables, key fobs, and wristbands.

Communication & Fulfilment Solutions

The company provides secure omni-channel communication solutions, delivering documents such as insurance policies, financial statements, utility bills, tax IDs, citizen identity cards, and customized communication material. Its Inventory & Order Management System (IOMS) ensures cost-efficient, timely delivery across 35,800+ branches. In FY25, FY24, and FY23, the company supplied 27.35M, 35.82M, and 38.40M policy documents and 23.31M, 34.90M, and 40.54M communications for insurance companies, alongside millions of citizen and tax identity cards.

IoT Solutions

Seshaasai offers RFID-enabled inlays, tags, labels, and devices, integrated with IoT middleware platforms to support inventory management, product authentication, and supply chain optimization. Its IoT solutions cater to multiple industries including BFSI, retail, logistics, and manufacturing. In FY25, FY24, and FY23, it supplied 322.86M, 150.95M, and 4.88M RFID tags and labels, respectively.

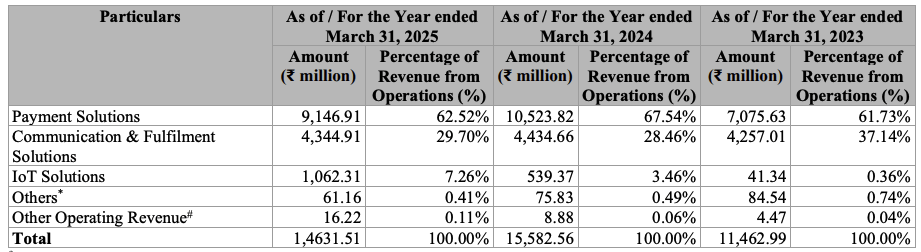

Revenue Contribution by Segment:

Certifications & R&D

The company’s units are certified by global payment schemes, NPCI (RuPay), PCI, and IBA, ensuring compliance with payment, IT, and physical security standards. Seshaasai runs two dedicated R&D labs in Bengaluru and Faridabad to develop innovative and customized solutions, helping maintain its competitive edge in the payments and IoT industries.

Customer Base

Seshaasai serves a diverse set of BFSI clients, including 10 of 12 public sector banks, 9 of 11 small finance banks, 15 of 21 private banks, and multiple insurance companies in FY25. Its clients value trust, quality, and the ability to meet regulatory and operational requirements, positioning Seshaasai as a preferred partner in India’s BFSI sector.

Financials & Key Ratios – Seshaasai Technologies IPO

Financial Overview

Seshaasai Technologies Ltd.’s revenue decreased by 6%, while profit after tax (PAT) rose by 31% between FY25 and FY24. The company has maintained strong profitability and operational efficiency, with growth in net worth and reserves reflecting robust financial health.

| Particulars | FY25 (₹ Cr) | FY24 (₹ Cr) | FY23 (₹ Cr) |

|---|---|---|---|

| Assets | 1,160.39 | 958.41 | 782.54 |

| Total Income | 1,473.62 | 1,569.67 | 1,153.84 |

| Profit After Tax (PAT) | 222.32 | 169.28 | 108.10 |

| EBITDA | 370.37 | 303.01 | 207.43 |

| Net Worth | 669.67 | 465.58 | 321.64 |

| Reserves & Surplus | 490.52 | 286.43 | 201.29 |

| Total Borrowings | 378.68 | 350.24 | 311.99 |

Commentary: Despite a slight dip in revenue, the strong PAT growth highlights effective cost management and operational efficiency. The company’s net worth and reserves have grown significantly, supporting future expansion.

Key Performance Indicators (KPI)

The market capitalization of Seshaasai Technologies IPO is estimated at ₹6,844.18 Cr. The company demonstrates strong returns, low leverage, and healthy margins.

| KPI | Value |

|---|---|

| ROE | 34.84% |

| ROCE | 31.87% |

| Debt/Equity | 0.37 |

| RoNW | 33.20% |

| PAT Margin | 15.09% |

| EBITDA Margin | 25.13% |

Seshaasai Technologies shows high return ratios and low financial leverage, indicating financial stability and efficient use of capital. Strong PAT and EBITDA margins reinforce the company’s profitability and sustainable growth potential.

Valuation & Peer Comparison – Seshaasai Technologies IPO

Seshaasai Technologies IPO is priced at ₹402–₹423 per share, reflecting a Price-to-Book Value (P/BV) of 13.41. The company’s EPS stands at ₹14.78 pre-IPO and ₹13.74 post-IPO, with a P/E ratio of 28.63 pre-IPO and 30.79 post-IPO, indicating a premium valuation based on expected growth and profitability.

Key Valuation Metrics of Seshaasai IPO

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 14.78 | 13.74 |

| P/E (x) | 28.63 | 30.79 |

| Price to Book Value | 13.41 | – |

Peer Comparison of Seshaasai Technologies IPO

While Seshaasai Technologies is a leading payments and identity solutions provider in India, the company’s peers include:

Domestic peers (not listed):

- Manipal Payment and Identity Solutions (MPi)

- KL-Hitech

Global vendors operating in India:

- Idemia

- G+D

Analysis:

- Seshaasai Technologies holds a strong domestic market position, especially in payment card manufacturing, with 31.9% market share for debit and credit cards in FY25.

- The absence of listed Indian peers means valuation comparisons are limited, and the P/E and P/BV indicate a premium based on growth potential, proprietary technology, and BFSI client base.

Risks & Strengths – Seshaasai Technologies IPO

| Strengths | Risks |

|---|---|

| Leading position in India’s payment card manufacturing with 31.9% market share | Exposure to BFSI sector concentration, may impact revenue if banking clients reduce orders |

| Diversified solutions: Payment, Communication & Fulfilment, and IoT solutions | Regulatory changes in payment and data security norms could impact operations |

| Proprietary platforms (RUBIC, eTaTrak, IOMS) enabling scalable and recurring solutions | Global competition from Idemia, G+D, and potential domestic competitors |

| Pan-India advanced manufacturing facilities with certifications from NPCI, PCI, IBA | Technology obsolescence risk due to rapid innovation in payments and IoT |

| Long-standing relationships with large BFSI customers and government agencies | Dependence on key personnel and management expertise for operations |

| Focus on R&D with two dedicated labs for customized solutions | Forex and macroeconomic fluctuations could impact costs for imported materials |

| Healthy financial performance: ROE 34.84%, PAT margin 15.09% | IPO market risks: listing performance may vary based on market sentiment |

| Diversified customer base including public & private banks, insurance companies, and fintechs | Competition for talent in tech and manufacturing can impact growth and execution |

Seshaasai Technologies IPO GMP & Listing Analysis

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹)* |

|---|---|---|---|---|---|

| 19-09-2025 | 423.00 | 107 (Up) | 2800/39200 | 530 | 3745 |

GMP Analysis:

- The GMP of ₹107 indicates strong investor demand in the grey market, showing enthusiasm for the Seshaasai IPO even before listing.

- The estimated listing price of ₹530 reflects a potential upside of 25.3% over the issue price, suggesting healthy short-term listing gains for retail investors.

- Sub2 Sauda activity shows active secondary market participation, signaling confidence from early investors and high subscription interest.

- Overall, the positive movement in GMP indicates that the market expects strong post-listing performance for Seshaasai Technologies IPO.

Conclusion – View on Seshaasai Technologies IPO

Seshaasai Technologies IPO presents a compelling opportunity in the payments and BFSI solutions space, backed by a strong market position, proprietary technology platforms, and diversified operations across payment solutions, communication & fulfilment, and IoT solutions. With consistent PAT growth, robust ROE, and healthy operating margins, the company is well-positioned to benefit from the growing demand for secure payment instruments and digital solutions in India. The positive GMP and strong subscription trends indicate healthy short-term listing potential.

Short-Term Strategy

- Investors seeking listing gains may consider applying at the cut-off price, as the GMP suggests 25% potential upside.

- Retail investors should evaluate their investment capacity and apply within permissible lot limits.

Long-Term Strategy

- Seshaasai’s strong market share, scalable proprietary platforms, and diversified solutions make it a promising long-term investment.

- Focus on the company’s expansion into IoT solutions and recurring revenue streams for sustainable growth.

Allotment Strategy

- Maximum permissible lots should be applied to optimize allocation under retail category.

- Using multiple demat accounts can increase allotment chances for retail investors.

Seshaasai Technologies IPO blends strong fundamentals with promising growth potential – a rare mix for both listing gains and long-term wealth creation.

Seshaasai Technologies IPO – FAQs

1. What is Seshaasai Technologies IPO?

Seshaasai Technologies IPO is a Book Building IPO of ₹813.07 Cr, comprising a fresh issue of ₹480 Cr and an Offer for Sale of ₹333.07 Cr.

2. What is the IPO price band?

The price band is ₹402 – ₹423 per share.

3. What is the lot size and minimum investment?

Each lot consists of 35 shares, and the minimum retail investment is ₹14,805 (based on upper price band).

4. When does the IPO open and close?

- Open: September 23, 2025

- Close: September 25, 2025

5. When is the tentative allotment and listing date?

- Allotment: September 26, 2025

- Listing: September 30, 2025 (BSE & NSE)

6. Who are the promoters of Seshaasai Technologies?

Promoters are Pragnyat Pravin Lalwani and Gautam Sampatraj Jain.

7. What are the objectives of the IPO?

- Fund capital expenditure for expansion

- Repay/prepay borrowings

- General corporate purposes

8. How much can I invest as a retail individual investor?

- Minimum: 1 lot (₹14,805)

- Maximum: 13 lots (₹1,92,465)

9. What is the GMP and listing potential?

As of September 19, 2025, the GMP is ₹107, indicating a potential listing price of ₹530 (~25% upside).

10. Who are the peers of Seshaasai Technologies?

Top Indian peers include Manipal Payment & Identity Solutions (MPi) and KL-Hitech. Global competitors like Idemia and G+D also operate in India.

📌 Disclaimer:

All information and data presented in this blog about Anand Rathi Share & Stock Brokers IPO has been sourced from the company’s Red Herring Prospectus (RHP), stock exchange filings, and publicly available resources. This blog is for educational and informational purposes only and should not be considered as investment advice. Investors are advised to read the RHP carefully and consult their financial advisor before making any investment decisions.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?