Introduction – Inside the Rubicon Research IPO

The Rubicon Research IPO marks one of the most awaited listings in the Indian pharmaceutical sector for FY2025. Known for its innovation-driven formulation portfolio and a strong U.S. generic market presence, Rubicon Research Ltd. is now entering the capital markets with a sizeable issue worth ₹1,377.50 crore.

Founded in 1999, Rubicon Research has emerged as a leading pharmaceutical formulations company specializing in the development, manufacturing, and commercialization of differentiated drug products for regulated markets — particularly the United States.

This IPO is expected to attract attention from institutional investors given its strong R&D foundation, steady growth in ANDA approvals, and strategic global expansion. With Axis Capital as the book-running lead manager, Rubicon Research aims to utilize the proceeds for debt repayment and strategic acquisitions, further strengthening its innovation-led growth journey.

Rubicon Research IPO Overview

Rubicon Research IPO Details

| Particulars | Details |

|---|---|

| IPO Date | October 9, 2025 to October 13, 2025 |

| Listing Date | October 16, 2025 (Tentative) |

| Face Value | ₹1 per share |

| Price Band | ₹461 – ₹485 per share |

| Lot Size | 30 Shares |

| Issue Type | Book Building Issue |

| Issue Size | 2.84 crore shares (₹1,377.50 crore) |

| Fresh Issue | 1.03 crore shares (₹500.00 crore) |

| Offer for Sale (OFS) | 1.81 crore shares (₹877.50 crore) |

| Employee Discount | ₹46 per share |

| Listing At | NSE, BSE |

| Pre-Issue Shareholding | 15,44,37,251 shares |

| Post-Issue Shareholding | 16,47,46,529 shares |

| Promoters | General Atlantic Singapore RR Pte. Ltd., Pratibha Pilgaonkar, Sudhir D. Pilgaonkar, Parag Sancheti, Surabhi Sancheti, and Sumant Pilgaonkar |

| BRLM | Axis Capital Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

| IPO Document | RHP/DRHP |

Rubicon Research IPO Important Dates (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | October 9, 2025 (Thursday) |

| IPO Close Date | October 13, 2025 (Monday) |

| Allotment Date | October 14, 2025 (Tuesday) |

| Refund Initiation | October 15, 2025 (Wednesday) |

| Credit of Shares | October 15, 2025 (Wednesday) |

| Listing Date | October 16, 2025 (Thursday) |

| UPI Mandate Cut-Off | 5 PM on October 13, 2025 |

Objects of the Rubicon Research IPO

The company intends to utilize the net proceeds from the Rubicon Research IPO for the following purposes:

- Prepayment or repayment of certain outstanding borrowings (₹3,100 million)

- Funding inorganic growth, including potential acquisitions and strategic initiatives

- General corporate purposes and working capital support

Company Background – About Rubicon Research Ltd.

Rubicon Research Ltd., the company behind the much-anticipated Rubicon Research IPO, is a pharmaceutical formulations development company with a strong emphasis on innovation, complex generics, and value-added products targeting regulated global markets.

Incorporated in 1999, the company has built a comprehensive pharmaceutical value chain that covers the entire spectrum — from product conceptualization, formulation, and analytical development to commercial manufacturing and licensing.

Global Reach & Market Footprint

Rubicon Research has established a robust presence in over 50 countries, with primary focus markets including the United States, United Kingdom, Europe, Australia, Canada, and the Middle East. Its export-oriented business model is powered by a combination of in-house research and strategic partnerships with leading global pharmaceutical distributors.

As of June 30, 2025, the company has achieved:

- 72 approved products (ANDA/NDA) by the U.S. FDA, with 66 already commercialized

- 17 additional products awaiting U.S. FDA approval

- 48 filed or registered products across key markets like Australia, the U.K., Singapore, Saudi Arabia, and the UAE

- Over 350 SKUs supplied to 96 customers, including the top three U.S. wholesalers who collectively control 90% of the U.S. pharmaceutical distribution

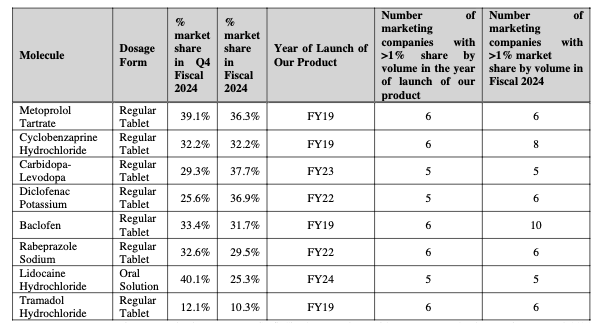

- 7 products commanding more than 25% U.S. market share by volume

This deep penetration into the U.S. and regulated markets has positioned Rubicon as a trusted partner for both branded and generic formulations.

Research, Development & Manufacturing Excellence

The Rubicon Research IPO represents a company built on R&D-led innovation. Its two advanced R&D centers — located in India and Canada — are fully equipped for novel formulation design, bioequivalence studies, and stability testing for regulated markets.

In addition, the company operates three state-of-the-art manufacturing facilities in India, each compliant with U.S. FDA, MHRA (UK), and Health Canada standards.

Rubicon’s R&D division focuses on complex oral solids, extended-release formulations, and abuse-deterrent technologies, allowing it to maintain an edge in high-margin niche therapeutic categories like:

- CNS (Central Nervous System)

- Cardiovascular (CVS)

- Pain Management and Anti-inflammatory drugs

- Anti-infectives

The company’s product pipeline also includes sustained-release injectables and oral thin films, marking its entry into advanced delivery systems.

Business Growth & Industry Standing

According to Frost & Sullivan (F&S Report), Rubicon Research was among the Top 10 Indian companies in USFDA ANDA approvals for FY2024, achieving 14 ANDA approvals in FY24, compared to 12 in FY23 and 9 in FY22.

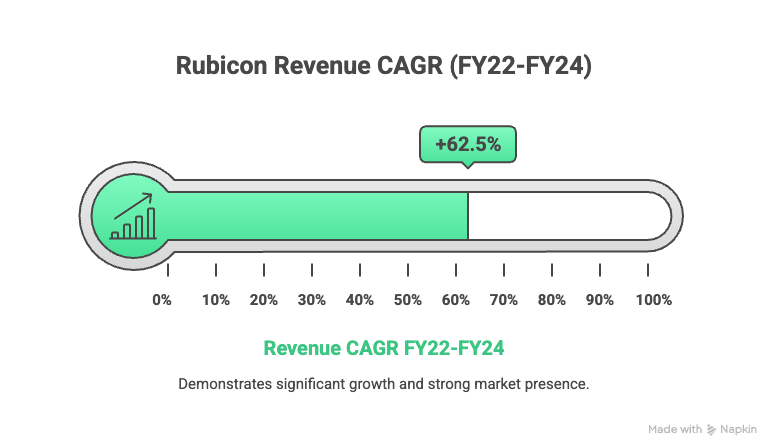

Between FY22 and FY24, Rubicon posted an impressive revenue CAGR of 62.5%, highlighting its scalable growth model and consistent focus on innovation-led differentiation.

The company’s commercialization success rate (≈80%) ensures that most of its R&D investments translate into revenue-generating assets — a key strength that sets Rubicon apart from typical formulation developers.

Strategic Vision Ahead

With the proceeds from the Rubicon Research IPO, the company plans to:

- Strengthen its R&D capabilities and expand global partnerships

- Pursue strategic acquisitions to enter new therapeutic areas

- Continue debt reduction and enhance operational leverage

Rubicon’s long-term vision is to evolve from a formulation exporter into a fully integrated, innovation-driven pharmaceutical company with a strong global presence and a sustainable growth engine.

Financial Performance and Key Metrics of Rubicon Research IPO

The Rubicon Research IPO showcases a company with impressive financial momentum, demonstrating consistent top-line and bottom-line growth over the last three fiscal years. Between FY2024 and FY2025, revenue surged by 49%, while profit after tax (PAT) jumped 48%, highlighting operational efficiency and expanding margins driven by strong exports and a robust product mix.

Financial Summary (₹ in Crores)

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 1,647.60 | 1,451.43 | 1,109.49 | 749.70 |

| Total Income | 356.95 | 1,296.22 | 872.39 | 419.00 |

| Profit After Tax (PAT) | 43.30 | 134.36 | 91.01 | -16.89 |

| EBITDA | 79.74 | 267.89 | 173.09 | 43.97 |

| Net Worth | 593.67 | 540.98 | 385.00 | 286.38 |

| Reserves & Surplus | 397.50 | 525.57 | 369.79 | 281.31 |

| Total Borrowings | 495.78 | 393.17 | 396.41 | 317.91 |

Performance Overview

Rubicon Research’s FY2025 total income of ₹1,296.22 crore marks a 49% increase over FY2024’s ₹872.39 crore. The EBITDA also rose sharply by 55%, reflecting the company’s improving operational leverage and efficient cost management.

The PAT growth of 48% demonstrates strong earnings quality, especially as Rubicon transitions from a loss-making position in FY2023 to a high-margin business within two years. The return ratios indicate excellent capital efficiency — a sign of prudent financial management and profitable expansion.

Key Performance Indicators (KPI)

| KPI | Values (FY2025) |

|---|---|

| Return on Equity (ROE) | 29.02% |

| Return on Capital Employed (ROCE) | 26.45% |

| Debt-to-Equity Ratio | 0.73 |

| Return on Net Worth (RoNW) | 29.02% |

| PAT Margin | 10.37% |

| EBITDA Margin | 20.67% |

Analyst Viewpoint

The Rubicon Research IPO represents a fundamentally strong play in the pharmaceutical innovation and export segment. With rising profitability, robust margins, and a healthy balance sheet, Rubicon is positioned for sustained growth in both regulated and emerging markets.

The company’s increasing return ratios (ROE, ROCE) and balanced leverage profile (Debt/Equity at 0.73) highlight its ability to scale efficiently while maintaining strong financial discipline.

Valuation and Peer Comparison of Rubicon Research IPO

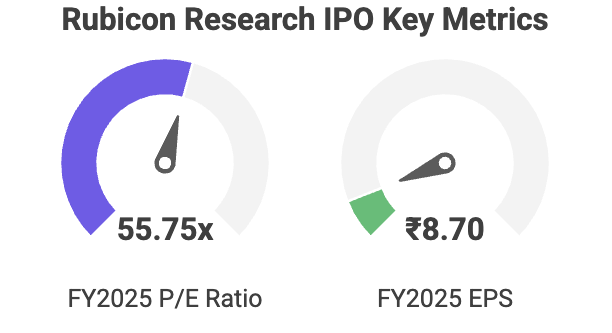

The Rubicon Research IPO comes with a price band of ₹461–₹485 per share. Based on the company’s FY2025 EPS of ₹8.70, the P/E ratio works out to approximately 55.75x at the upper end of the price band.

This valuation indicates that Rubicon Research is being offered at a premium to most of its listed peers, reflecting strong growth potential, leadership in differentiated formulations, and a rising presence in regulated markets such as the U.S.

Rubicon Research IPO Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio | Financials |

|---|---|---|---|---|---|---|---|

| Rubicon Research Ltd. | 8.82 | 8.68 | 35.53 | 55.75 | 29.02 | — | Consolidated |

| Sun Pharmaceutical Industries | 45.60 | 45.60 | 300.99 | 34.98 | 16.16 | 5.31 | Consolidated |

| Aurobindo Pharma | 59.81 | 59.81 | 560.22 | 18.12 | 11.15 | 1.93 | Consolidated |

| Zydus Lifesciences | 44.97 | 44.97 | 238.05 | 21.83 | 21.34 | 4.12 | Consolidated |

| Strides Pharma Science | 45.05 | 45.05 | 277.34 | 18.27 | 17.21 | 2.97 | Consolidated |

| Dr. Reddy’s Laboratories | 67.89 | 67.79 | 402.78 | 18.05 | 18.53 | 3.04 | Consolidated |

| Alembic Pharmaceuticals | 29.68 | 29.68 | 264.09 | 30.43 | 11.63 | 3.41 | Consolidated |

| Lupin | 71.95 | 71.69 | 377.18 | 26.64 | 21.00 | 5.07 | Consolidated |

Valuation Analysis

- At a P/E of 55.75x, Rubicon Research IPO is valued higher than the industry average P/E of ~25x, signaling strong investor expectations around its high-margin business, R&D-driven growth, and U.S.-focused product portfolio.

- The Return on Net Worth (RoNW) of 29.02% is significantly above peers, suggesting efficient capital utilization and superior profitability.

- However, the high valuation multiple also implies that much of the near-term growth potential may already be priced in.

The Rubicon Research IPO appears expensively valued compared to established players like Aurobindo Pharma and Dr. Reddy’s Laboratories, but its high growth rate, FDA-approved portfolio, and focus on complex generics and specialty drugs justify the premium to an extent.

Investors with a long-term view and belief in Rubicon’s innovation-driven model may find this IPO appealing, especially given its strong R&D investment and expansion into regulated markets.

Strengths & Risks – Rubicon Research IPO

| Strengths | Risks / Weaknesses |

|---|---|

| Strong Growth Track Record — Revenue up ~49% and PAT up ~48% YoY. | U.S. Tariff Risk — If the U.S. imposes 100% tariff on Indian pharma imports from firms lacking U.S. manufacturing plants, Rubicon (with primarily India-based manufacturing) could face severe export headwinds. |

| High Margins & Efficient Operations — EBITDA margin ~20.67%, PAT margin ~10.37%. | Valuation Stretch — Priced at ~55.75× P/E (upper band), leaves little room for multiple compression. |

| Robust R&D & Regulatory Approvals — 72 ANDA/NDA approvals; pipeline of 17 pending; strong presence in regulated markets. | Regulatory Risk — FDA warning letters, compliance lapses, or regulatory changes can impact product approvals. |

| Global Diversification — Beyond U.S., product registrations across UK, Australia, UAE, Saudi Arabia. | Customer Concentration — A handful of U.S. wholesalers dominate distribution; loss of a major customer could hurt revenues. |

| Scalable Business Model — High commercialization rate (~80%) ensures R&D spend converts into sales. | Raw Material & Input Costs — Volatility in APIs, packaging, logistics could squeeze margins. |

| Healthy Asset Base & Capital Structure — Strong net worth, expanding operations, and room for leverage. | Execution Risks in Acquisition Strategy — M&A missteps or integration challenges could derail growth plans. |

The Rubicon Research IPO presents a compelling narrative — combining high growth, regulatory credentials, and international diversification. But investors must weigh these strengths against valuation risk and the looming possibility of U.S. trade actions (e.g. 100% tariffs on Indian pharma without U.S. footprint). A balanced approach, favorable for those confident in Rubicon’s compliance, pipeline, and execution, is advised.

Rubicon Research IPO GMP– Grey Market Premium

The Rubicon Research IPO GMP has remained steady, signaling consistent interest from grey market investors despite broader volatility in the pharma sector due to U.S. tariff concerns.

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|---|

| 07-Oct-2025 | 485.00 | ₹80 (No Change) | 1800/25200 | ₹565 (+16.49%) | ₹2400 |

| 06-Oct-2025 | 485.00 | ₹80 (Up) | 1800/25200 | ₹565 (+16.49%) | ₹2400 |

GMP Analysis:

The steady ₹80 GMP indicates a 16% potential premium over the issue price. While this reflects optimism around Rubicon’s product pipeline and financial growth, investors should remain cautious — as sentiment could shift quickly if the U.S. 100% tariff on Indian pharma exports moves from proposal to enforcement.

Conclusion & Outlook – Rubicon Research IPO

The Rubicon Research IPO showcases a high-growth, innovation-driven pharmaceutical company with a strong presence in regulated markets like the U.S. and Europe. Its rich product pipeline, robust R&D investment, and track record of FDA approvals strengthen its competitive moat.

However, there are clear red flags:

- The valuation (P/E ~55.7×) looks stretched compared to peers.

- Geopolitical and tariff risks (especially U.S. trade policy under Trump’s renewed stance) could materially impact export margins.

- Heavy dependency on U.S. distribution channels adds concentration risk.

For long-term investors, Rubicon Research IPO offers an exciting growth story but at a premium price. Given the potential tariff turbulence, “Buy on dips post-listing” seems a prudent approach. Short-term traders might benefit from listing gains, but value-seeking investors should wait for a more attractive entry point once the stock stabilizes.

FAQs on Rubicon Research IPO

Q1. What is the Rubicon Research IPO issue size?

A1. The total issue size is ₹1,377.50 crore, including a fresh issue of ₹500 crore and an OFS of ₹877.50 crore.

Q2. What is the Rubicon Research IPO price band?

A2. The price band is ₹461–₹485 per share.

Q3. When does the Rubicon Research IPO open and close?

A3. It opens on October 9, 2025, and closes on October 13, 2025.

Q4. When will Rubicon Research IPO list on exchanges?

A4. The tentative listing date is October 16, 2025, on BSE and NSE.

Q5. What is the minimum investment for retail investors?

A5. The minimum application is 30 shares, requiring ₹14,550 (at upper price).

Q6. What are the main objectives of this IPO?

A6. To repay borrowings, fund strategic acquisitions, and meet general corporate purposes.

Q7. Who are the lead managers of the issue?

A7. Axis Capital Ltd. is the book-running lead manager, and MUFG Intime India Pvt. Ltd. is the registrar.

Q8. What are Rubicon Research’s key financial highlights?

A8. FY25 revenue grew 49%, PAT rose 48%, with EBITDA margin of 20.67% and ROE of 29.02%.

Q9. What is the current Rubicon Research IPO GMP?

A9. The GMP is around ₹80, indicating a ~16% premium over the upper issue price.

Q10. Should you apply for Rubicon Research IPO?

A10. For short-term gains, listing upside looks decent. For long-term, wait for a post-listing dip to accumulate — considering valuation and tariff-related risks.

Related Articles

Tata Capital IPO 2025: Expert Analysis on a High-Growth Investment Opportunity

Anantam Highways Trust IPO 2025: Strong Profit Jump & Growth Outlook

More Articles

One Demat, Multiple Benefits: Power of a Single Demat Account

One Demat vs Multiple Demat – Which is Better for IPO Allotment?