Something remarkable is happening in India’s financial markets.

While global headlines scream “Selloff,” “Slowdown,” and “Volatility,” a quiet but powerful transformation is unfolding — and it’s being led by everyday people.

Yes, Indian retail investors — the salaried engineer from Indore, the homemaker in Hyderabad, the gig worker in Gurugram — are rewriting the rules of India’s equity markets.

Let’s break down what’s going on, why it matters, and what comes next.

A Doubling That Changed the Game

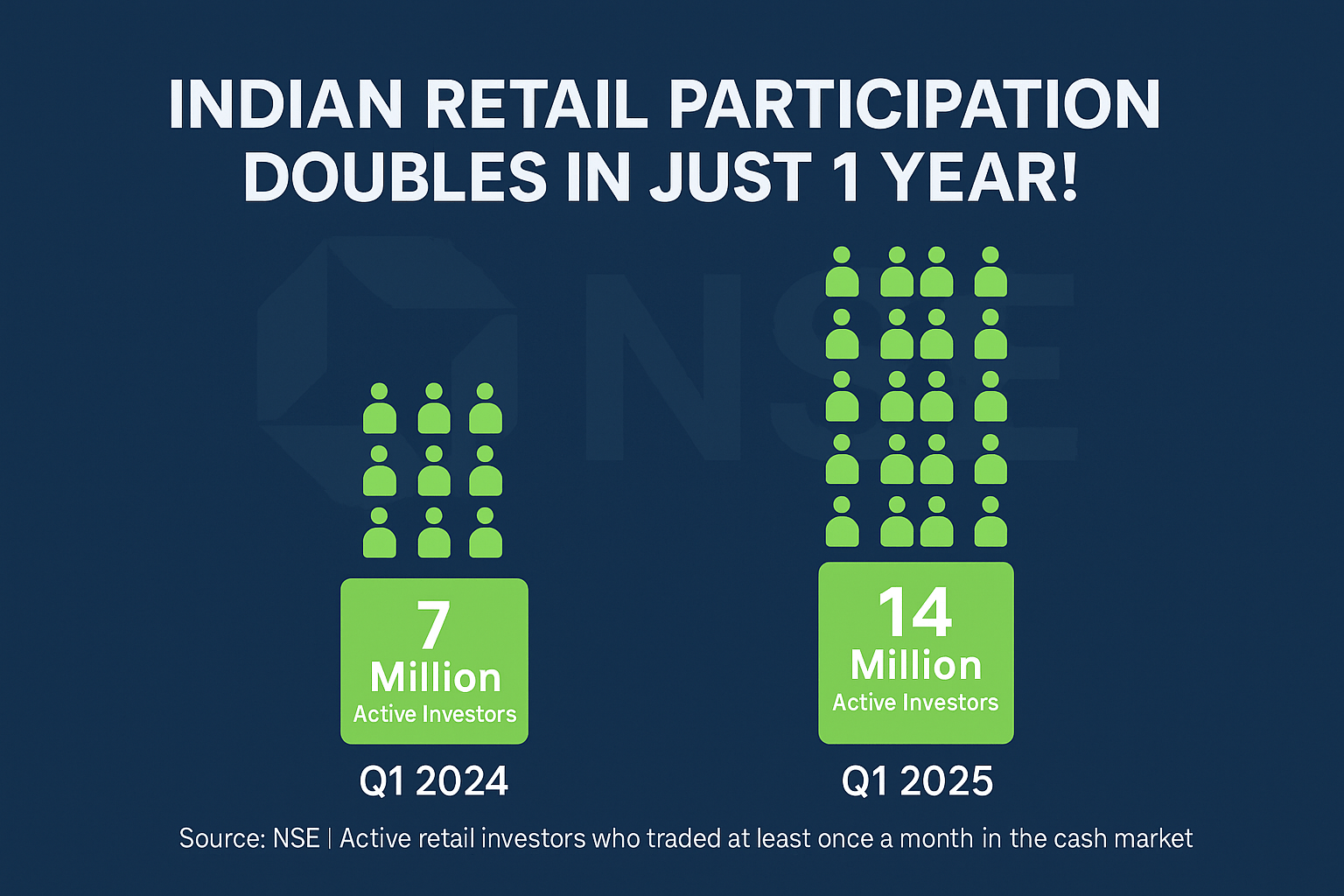

According to the National Stock Exchange (NSE), the number of active retail investors — those who trade at least once a month — in the cash market has doubled from 7 million in Q1 2024 to 14 million in Q1 2025.

What makes this even more impressive? It happened during a downturn.

From September 2024 peaks, Nifty 50 and Sensex dropped ~14%, while mid and small caps slipped into bear territory. But retail investors? They didn’t run. They stayed. Some even bought the dip.

That’s not just participation. That’s maturity.

Retail vs. FIIs: David Beats Goliath?

In FY25, Foreign Institutional Investors (FIIs) pulled out a massive $14.6 billion from Indian equities. Historically, this would’ve rattled the market.

But instead, domestic retail investors stepped up — and poured in $72 billion.

Let that sink in.

Retail now accounts for over 26% of market activity, surpassing FIIs’ 17% share. It’s no longer FIIs that set the tone; Indian retail investors are now a force that can stabilize, support, and sway the market.

SIPs: Small Tickets, Big Impact

Part of this retail revolution is powered by a habit: the Systematic Investment Plan (SIP).

With consistent monthly flows, SIPs are helping investors navigate volatility with discipline. Platforms like 5paisa, Zerodha, and Groww have simplified investing to a few taps — making stock markets accessible to even first-time investors in Tier 2 and Tier 3 cities.

In March 2025, there were 8.11 crore contributing SIP accounts in India. The number of new SIPs registered was 40.18 lakh, while 51 lakh SIPs were discontinued. SIP inflows were ₹25,926 crore, a slight dip from the previous month.

This shift — from saving in gold or FDs to investing in equity via SIPs — isn’t just about returns. It’s about mindset.

It signals confidence, financial awareness, and a growing belief in long-term wealth creation.

Volatility: A Test of Resolve

Let’s not sugarcoat it — markets have been shaky.

- Nifty and Sensex fell ~14% from peak

- Mid and small caps plunged 20%+

- Consumer spending took a hit — two-wheeler sales dropped 9% in February

For many post-pandemic investors who only knew the bull run, this was their first taste of real risk. Some exited in panic. But many others held firm — or kept investing.

That’s a sign of growing resilience, but it also brings risk.

Risks: What the Government is Watching

The Economic Survey (Jan 2025) took note of this retail surge. It acknowledged the positives — democratized access, deepened markets — but also raised caution.

Key concerns include:

- Inexperience of new investors who haven’t seen long bear cycles

- Overreliance on global cues, especially the US market (correlation is increasing)

- The risk to consumer sentiment, if markets fall sharply and retail losses mount

In short, India’s retail revolution needs to be paired with investor education, platform accountability, and regulatory oversight.

Why This Matters for the Market (and You)

Here’s what this means, big picture:

| Trend | Impact |

|---|---|

| Doubling of retail investors | Greater market depth, lower volatility |

| Record $72B inflows in FY25 | Retail now anchors the market |

| Growing SIP participation | Stable, long-term capital |

| Shift from FDs to equities | Higher risk appetite, higher potential returns |

| Policy shifts abroad (US rates, China trade) | Less damaging if domestic retail holds strong |

This isn’t just about numbers. It’s a behavioral shift — Indians aren’t just saving, they’re investing. Not just in gold or property, but in businesses, ideas, and the future.

Looking Ahead: What’s Next?

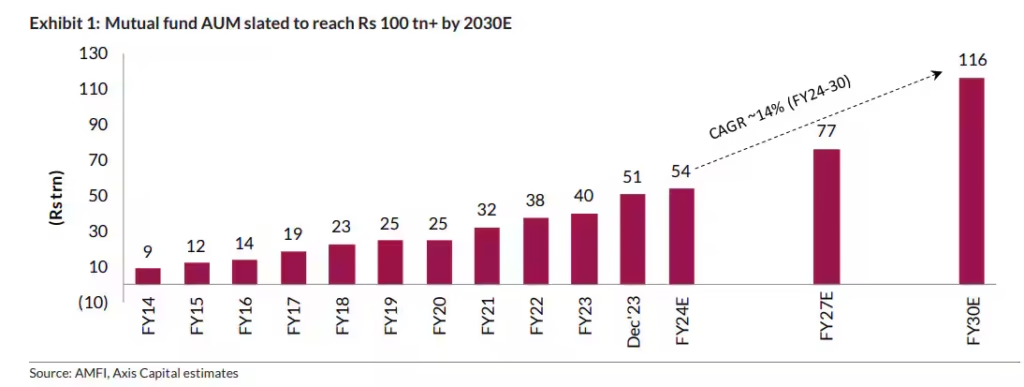

The rise of Indian retail investors is no flash in the pan. It’s a long-term structural shift.

- More people will join the market as platforms simplify access

- SIPs and index investing will grow

- Regulation will likely evolve to protect retail capital

- Market cycles will be less FII-dependent

- Financial literacy will become a defining economic theme

But with great power comes great responsibility — and volatility.

Investors must educate themselves, avoid herd mentality, and treat equity as a long-term wealth creation tool, not a quick fix.

Stocks That Benefit as Retail Investors Rise

When millions of new investors enter the stock market, they don’t just bring money — they reshape the business landscape. Certain companies see a direct boost from this retail investing boom. Here are a few to keep on your radar:

1. Angel One Ltd. – The Gateway to the Market

Angel One is one of India’s top stockbrokers, especially popular among first-time investors because of its easy-to-use app and affordable brokerage.

Why it benefits:

More retail investors = more trading = more accounts and transactions for Angel One.

In FY25, Angel One added lakhs of new customers and reported record transaction volumes.

2. CAMS (Computer Age Management Services) – The Backbone of Mutual Funds

CAMS handles the backend operations for many mutual fund companies. As SIPs rise, so do CAMS’s earnings.

Why it benefits:

Every new SIP and mutual fund investment generates processing and servicing fees for CAMS.

It’s like a toll booth on India’s investing highway.

3. BSE Ltd. & CDSL – Where Trades Live and Breathe

These are the core infrastructure players. BSE runs the Bombay Stock Exchange, and CDSL is a depository where your shares are stored digitally.

Why they benefit:

More retail trading = more demat accounts + more transactions = higher income for these companies.

CDSL, for example, saw a sharp increase in demat openings during the FY25 rally.

Apart from this, there is one more stock which will be most beneficial and that is NSE. And in a few days, NSE’s IPO is coming.

So for detailed information about NSE, click here: NSE IPO: A New Era or Another Missed Opportunity?4. ICICI Securities & Motilal Oswal – Full-Service Brokers in Focus

Unlike discount brokers, these firms also offer research, wealth management, and advisory services — perfect for new investors who want guidance.

Why they benefit:

As retail investors mature, many upgrade to more advanced services — which brings more revenue per customer.

Final Thought: A Market by the People, for the People

This new wave of Indian retail investors isn’t just reshaping the markets — it’s reshaping India’s financial future.

They’re showing grit in down cycles, consistency in SIPs, and the courage to bet on India Inc. That’s not just impressive — that’s transformative.

As participation deepens, the next bull run may not come from global inflows, but from a nation finally backing itself.

Join the new India that’s investing smart.

Open your Demat account with Angel One — and start your journey with tools made for the modern investor.

FAQs

What is driving the surge in Indian retail investors in 2025?

A mix of better financial literacy, easy-to-use investing platforms, and a cultural shift toward equity investments has led to a sharp rise in retail participation.

How many active retail investors does the NSE have in 2025?

According to NSE data, 14 million individuals traded at least once a month in Q1 2025 — double the number from Q1 2024.

What is the impact of retail inflows compared to FII outflows?

While FIIs pulled out $14.6 billion in FY25, Indian retail investors invested over $72 billion, offsetting the outflow and supporting market stability.

Are retail investors here to stay?

Yes, with the growth of SIPs and tech-enabled platforms, retail participation is expected to remain strong and structurally important.

What are the risks of this retail boom?

New investors may lack experience with bear markets, and a sudden correction could hurt both market sentiment and consumer spending.

How do SIPs help during market volatility?

SIPs promote disciplined, long-term investing, helping investors average costs over time and resist emotional decisions during market drops.

What does the government say about rising retail participation?

The Economic Survey 2025 acknowledged the benefits but also flagged risks, emphasizing the need for investor awareness and safeguards.

Which sectors benefit from higher retail participation?

Brokerages, fintech platforms, AMC firms, and financial education services are seeing increased demand and user growth.

Will this trend affect FII influence on Indian markets?

Yes. As retail investors become more dominant, India’s equity market may become less vulnerable to sudden foreign capital withdrawals.

How can I start investing as a retail investor?

You can open a Demat account with brokers like Angel One and begin investing via SIPs, mutual funds, or direct equity in just a few steps.