Post-Breakout Play: Sectors to Watch as Nifty Extends Gains

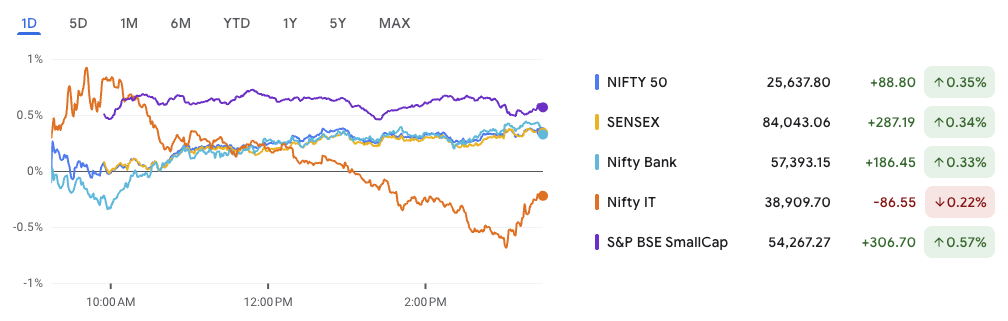

The Indian equity market extended its bullish momentum on Wednesday, with the Nifty 50 rising another 88 points to close at 25,637.80, reinforcing the strength of the recent breakout above the 25,100–25,150 resistance zone. This move, following Tuesday’s powerful surge, confirms a post-breakout market structure that could set the stage for further upside. The Sensex added over 280 points, while Bank Nifty and Smallcap indices also posted respectable gains. Even as the Nifty IT index saw a mild dip, broader sentiment stayed constructive.

In this edition of our newsletter, we break down what this post-breakout market means for investors and traders. You’ll find:

- A deep dive into Nifty’s technical setup, including potential targets, trailing supports, and risk zones

- Sectoral analysis highlighting where institutional flows may head next, with a focus on banks, consumer plays, and industrials

- The latest updates on IPOs, both mainboard and SME, with subscription stats, GMP, and key listing cues

- Our Smallcap of the Day—a stock with strong fundamentals and technical promise amid broader market optimism

- A featured Technical Radar pick: a high-volume breakout setup with multi-week upside potential

- All the latest on macro triggers, including export disruptions, IPO activity, policy moves, and corporate developments that could move the market

With Nifty now in uncharted territory, this is a market that demands informed positioning. Let’s break down the key trends and trades to watch.

Nifty 50 Technical Setup: Strength Builds in the Post-Breakout Market

The Nifty 50 continues to advance steadily after confirming a clean breakout above a critical consolidation zone. With Thursday’s close at 25,637.80, the index extended its gains by another 88.80 points, supported by strong volumes and a robust price structure. This reinforces the bullish narrative that has been taking shape since the breakout earlier this week.

Breakout Confirmation and Chart Structure

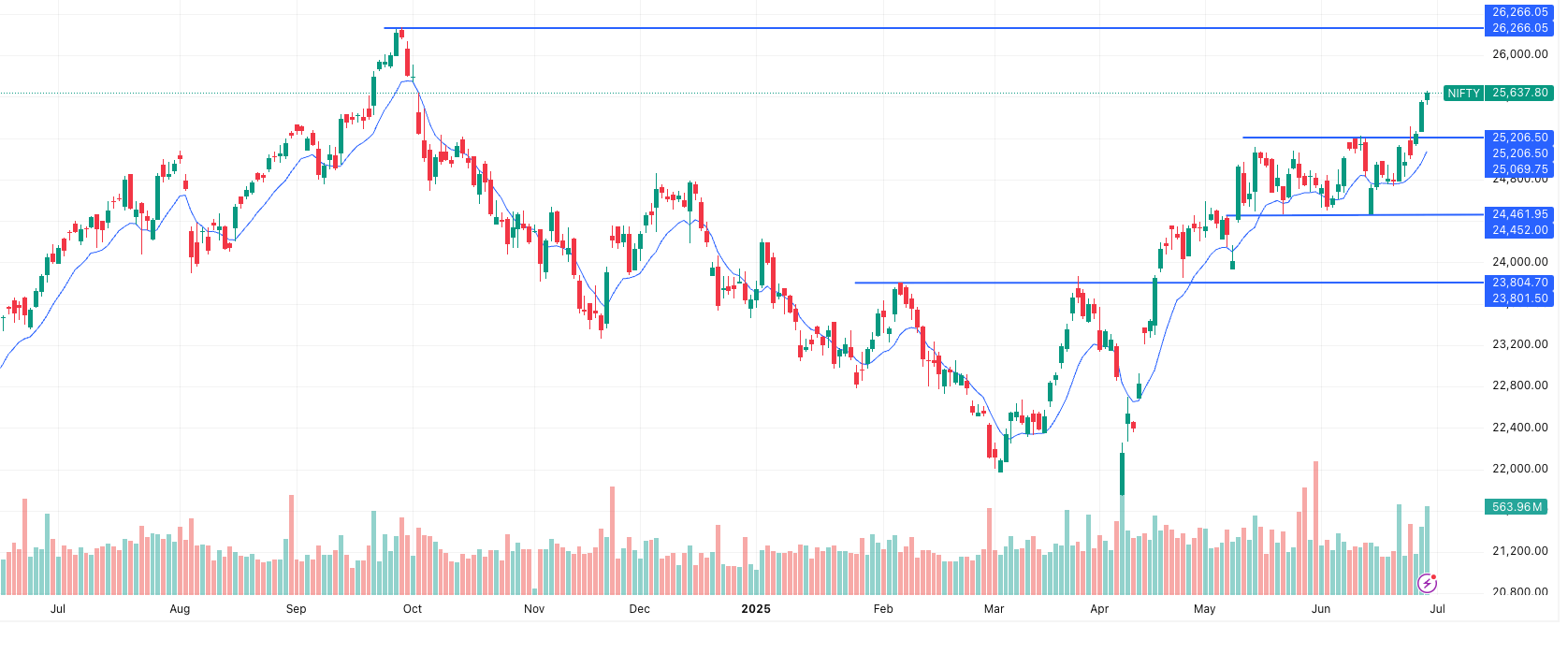

The index had been consolidating in a narrow range between 25,069 and 25,206, absorbing previous gains after a sharp rally in mid-June. This range acted as a base for accumulation, and the eventual breakout above it—on strong volume—confirms the entry into a renewed post-breakout market phase.

Importantly, the 9-day Exponential Moving Average (EMA), now hovering near 25,069, has been acting as dynamic support. The price staying well above this average reinforces the short-term momentum and reflects trader confidence. When an index or stock consistently trades above a rising 9-EMA, it often signifies trend strength.

What the Volume Tells Us

Volume remains one of the most reliable indicators of conviction behind a move, and in this case, the evidence is clear. The recent sessions have seen trading volume consistently higher than the 20-day average, especially on green (up) days. This suggests active institutional buying—an important factor for sustainability of the trend.

Near-Term Roadmap

With the consolidation resistance now converted into support, the next level to watch on the upside is 26,266, which marks the previous all-time high. Between the current levels and that resistance, the market may pause or digest gains, but unless there is a breakdown below 25,069, the broader trajectory remains upward.

Here’s how the scenarios look:

- Scenario 1: Bullish Continuation

Sustaining above 25,200–25,250 could bring in trend-following trades aiming for 26,000–26,266. A close above 25,700 would further affirm this upward bias. - Scenario 2: Pullback & Retest

A healthy pullback to 25,069–25,200, if it comes with declining volume, may act as a classic retest zone—offering fresh long entries with stop-losses below 25,000. - Scenario 3: Failed Breakout (Low Probability)

If Nifty were to fall below 25,000 with high volume, it would negate the breakout setup. In such a case, support zones at 24,450 and even 23,800 could be tested. However, given the strength of the current move, this is a less likely outcome.

Outlook: Bulls Hold the Edge

The current post-breakout market structure gives the bulls a decisive edge. As long as the index holds above 25,069, the trend remains favorable. Traders and investors alike should track price action near key levels, watch for confirmation signals like continued volume support, and position accordingly.

The road ahead may not be linear—but with strong support, rising institutional participation, and a clear technical breakout, the Nifty 50 appears well-positioned to challenge its all-time high in the coming weeks.

News & Stocks to Watch in the Post-Breakout Market

As Nifty extends its strength in this post-breakout market environment, a series of domestic and global developments are shaping investor sentiment across key sectors. Here’s a curated breakdown of the most relevant news and the stocks likely to be impacted:

1. India-US Trade Deal in the Works

India and the US are moving closer to a potential trade agreement focused on energy, agriculture, and tariff reduction. With $145 billion in bilateral trade in 2024 and tariff cuts of 15–20% being considered, sectors like energy and technology could benefit substantially.

Stocks to Watch:

- ONGC, GAIL – may gain from energy cooperation and LNG deals

- LTIMindtree, Infosys – IT exports may see regulatory tailwinds

- PI Industries, UPL – exposure to agri-exports may benefit from reduced tariffs

2. India’s Growth Outlook Strong, Challenges Remain

India is projected to lead global GDP growth in 2025 at 7.1%, according to Reuters. However, unemployment at 7.8% and inflation at 5.2% indicate macro risks.

Stocks to Watch:

- HUL, ITC – resilient demand drivers in consumption

- HDFC Bank, SBI – credit cycle may stay strong, but watch retail stress

- IRCTC, Indian Hotels – potential play on services-driven GDP expansion

3. JSW Paints to Acquire 74% in Akzo Nobel India

JSW Paints is set to shake up the paints market with a ₹8,986 crore buyout of Akzo Nobel India. This strategic acquisition will alter the competitive dynamics in the decorative and industrial coatings space.

Stocks to Watch:

- Asian Paints, Berger Paints – may face pressure from a larger, consolidated rival

- JSW Group companies – positive sentiment on aggressive growth and diversification

4. JioBlackRock Broking Gets SEBI Nod

Jio Financial’s joint venture with BlackRock has received SEBI’s approval to launch stock broking services. This marks a significant entry into India’s fast-growing retail investing ecosystem.

Stocks to Watch:

- Jio Financial Services (JIOFIN) – bullish sentiment post-approval and technical breakout

- Angel One, IIFL Securities – potential competition-led valuation pressure

5. SoftBank’s Masayoshi Son to Focus on AI

SoftBank’s founder Masayoshi Son has declared AI as his central focus for future investments. His pivot underscores the sector’s rising dominance in global technology allocations.

Stocks to Watch:

- Tata Elxsi, Persistent Systems – AI-focused domestic midcaps may benefit from global funding flows

- Affle India, Nazara – exposure to digital and AI-driven platforms offers optionality

6. Amitabh Kant Joins Fairfax India

Former NITI Aayog CEO Amitabh Kant has joined Fairfax as a senior advisor. His regulatory insight could drive more strategic investments into Indian infrastructure, logistics, and fintech.

Stocks to Watch:

- Fairfax-backed CSB Bank, Thomas Cook – investor focus could increase

- Adani Ports, L&T – may see improved narrative around public-private execution

7. China and US Confirm Trade Deal Framework

Beijing and Washington have finalized a framework for a trade agreement, easing global tensions. This has lifted sentiment across Asian and emerging markets.

Stocks to Watch:

- Tata Motors, Motherson Sumi – benefit from improved global trade flows

- Vedanta, Hindalco – global metal trade may see tariff relief

8. Crude Oil Heads for Weekly Decline

Crude prices are down sharply this week, easing input cost pressures for several industries. This comes as Middle East tensions ease and supply risks diminish.

Stocks to Watch:

- IndiGo, SpiceJet – aviation fuel cost relief

- Asian Paints, Kansai Nerolac – petrochemical-linked input cost benefits

- Oil Marketing Companies (BPCL, HPCL) – improved refining margins

9. Mazagon Dock Buys Colombo Dockyard

Mazagon Dock Shipbuilders has acquired 51% of Colombo Dockyard for ₹452 crore. This gives MDL strategic control over a key repair hub in the Indian Ocean and enhances export capabilities.

Stocks to Watch:

- Mazagon Dock (MDL) – may rerate on enhanced R&D and new markets

- Cochin Shipyard, Garden Reach – peer revaluation likely as defence sector expands reach

Summary

This week’s news flow reflects a mix of macro confidence and sectoral realignments. From the India-US trade negotiations to JSW’s consolidation push and Jio’s broking debut, the post-breakout market is being driven not just by technical momentum, but also by meaningful fundamental shifts. Investors should align portfolios accordingly, balancing near-term momentum trades with longer-term thematic exposure.

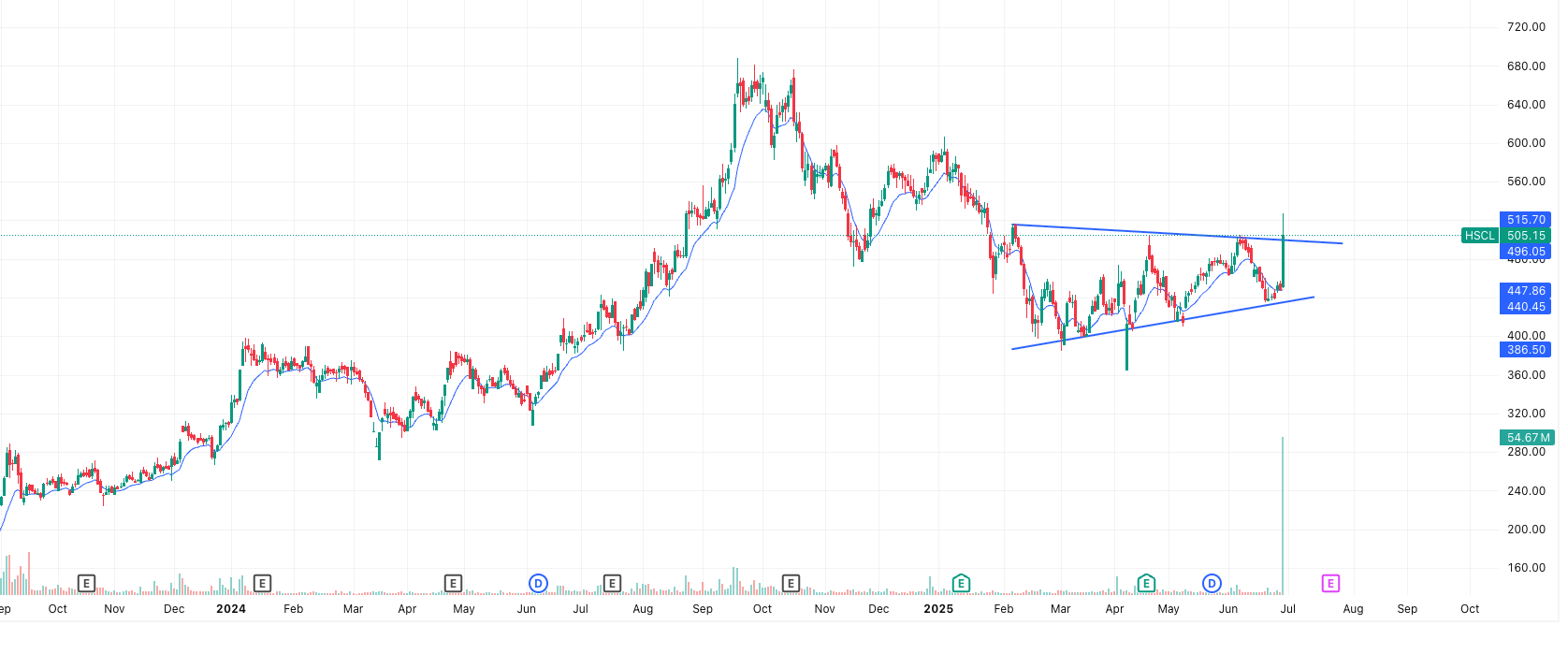

Technical Radar: Himadri Speciality Chemical (HSCL) Sets Up for a Major Post-Breakout Move

Stock: Himadri Speciality Chemical Ltd (NSE: HSCL)

Closing Price: ₹505.15

Volume: 54.67 million (highest in recent months)

9-EMA: ₹447.86

In a post-breakout market where leadership is rotating into select midcaps, HSCL has stood out with a strong breakout from a 4–5 month symmetrical triangle. This pattern had been tightening since early 2025, with lower highs and higher lows signaling imminent directional movement.

On June 27, the stock surged past its upper boundary near ₹496–₹500 with a wide-bodied bullish candle and highest volume in recent months. Such decisive action typically signals not only technical strength but also the possibility of institutional buying.

Short-Term View (1–5 Days)

The next resistance lies around ₹525–₹540, with profit booking expected near this zone. If the price retraces to ₹495–₹500 on low volume, it offers a fresh low-risk entry for active traders. The short-term stop-loss should be maintained below ₹486.

Swing View (1–4 Weeks)

Using the triangle’s height (~₹129), the measured breakout target projects to ₹625. Intermediate zones at ₹540 and ₹580 could offer resistance along the way. The 9-EMA remains a reliable trend guide and is currently well below price, suggesting continued bullish momentum. Traders looking for positional exposure can accumulate on dips and trail partial profits as the stock moves higher.

HSCL Trade Setup Table

| Parameter | Level/Zone | Comment |

|---|---|---|

| Breakout Zone | ₹496–₹500 | Strong breakout on high volume |

| CMP | ₹505.15 | Trading above breakout zone |

| Short-Term Target | ₹525–₹540 | Based on price congestion from Jan 2025 |

| Swing Target | ₹580–₹625 | Triangle height added to breakout level |

| Entry (on dip) | ₹495–₹500 | Ideal entry if price retests on low volume |

| Stop-Loss (short) | ₹486 | Below breakout zone |

| Stop-Loss (swing) | ₹447 | Below 9-EMA and trendline support |

| Support Zone | ₹447–₹450 | EMA + trendline support |

In this post-breakout market, Himadri Speciality offers a technically sound opportunity for both short-term momentum traders and medium-term swing holders. The breakout has solid backing in terms of structure, volume, and broader market context.

IPO Radar: Surge in Participation Reflects Confidence in Post-Breakout Market

With benchmark indices hitting new highs, investor confidence is spilling over into the primary markets. The current IPO landscape mirrors the broader post-breakout market sentiment—buoyant, selective, and increasingly retail-driven. Here’s a quick overview of the latest action in the IPO space.

🏛 Mainboard IPOs

| Company | Open–Close | Total Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|

| HDB Financial Services | Jun 25–27 | 17.64x | ₹57 (7.70%) |

| Sambhv Steel Tubes | Jun 25–27 | 30.25x | ₹10 (12.20%) |

| Indogulf Cropsciences | Jun 26–30 | 0.98x | ₹9 (8.11%) |

📈 SME IPOs (BSE & NSE Platforms)

| Company | Open–Close | Total Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|

| Adcounty Media India | Jun 27–Jul 1 | 1.84x | ₹38 (44.71%) |

| Neetu Yoshi | Jun 27–Jul 1 | 0.54x | ₹24 (32.00%) |

| Moving Media Entertainment | Jun 26–30 | 1.61x | ₹11 (15.71%) |

| Ace Alpha Tech | Jun 26–30 | 1.03x | ₹13 (18.84%) |

| Valencia India | Jun 26–30 | 0.69x | ₹21 (19.09%) |

| PRO FX Tech | Jun 26–30 | 1.38x | ₹– (0%) |

Quick Takeaway

The IPO frenzy is clearly alive in the SME space, where niche companies are attracting solid interest and delivering stronger listing gains. Meanwhile, mainboard deals like HDB Financial and Sambhv Steel Tubes signal that institutional appetite is picking up as well. With the post-breakout market tailwind, traders should stay alert for listing-day pops and keep an eye on strong QIB participation for short-term trades.

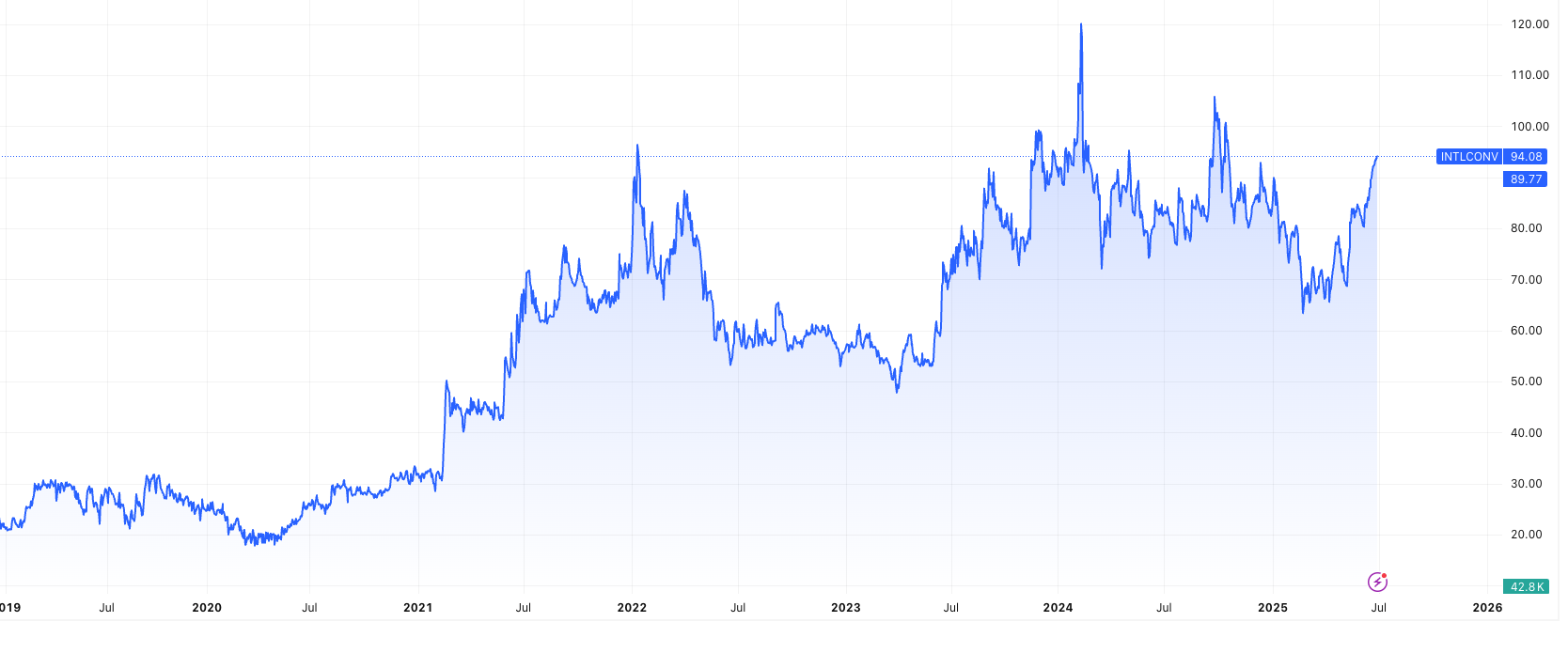

Small-Cap Spotlight: International Conveyors Ltd – Riding the Conveyor Growth Wave

Stock Price: ₹94.10

Market Cap: ₹596 Cr

P/E: 6.49

Dividend Yield: 1.17%

ROE (FY25): 28.9%

Debt-to-Equity: 0.24

Promoter Holding: 69.13%

Why It Stands Out

International Conveyors Ltd (ICL) is a small-cap stock with strong fundamentals, operating in a niche yet vital industrial space—PVC conveyor belting, essential for sectors like coal, potash, salt, and bulk logistics. It’s India’s only listed player in this category and among the largest solid woven belting manufacturers globally.

Business Highlights

- Export Powerhouse: Over 60% of revenue comes from exports, primarily to the U.S. and Canada, with marquee clients like Glencore, Peabody, and Tata Steel.

- Diversified Revenue Stream: Apart from its core conveyor business, ICL also earns ~27% of income from strategic treasury operations.

- High-Margin Play: Net profit margins for FY25 stood at a solid 43.3%, thanks to efficient operations and high-value exports.

- Sustainable Angle: Operates wind energy assets across 4 Indian states, contributing 1% to revenue and enhancing ESG credentials.

Key Growth Drivers

- Increasing global demand for bulk material handling solutions

- High entry barriers with long approval cycles for new vendors

- Strategic expansion into European and Australian markets

- Strengthening order book and widening product portfolio from FY26 onwards

Financial Strength and Analysis

International Conveyors Ltd has quietly built one of the most robust balance sheets in the small-cap segment. With consistent profitability, conservative leverage, and strong return ratios, it stands tall as a small-cap stock with strong fundamentals. Here’s how:

Profitability & Margins

- Net Profit Margin (FY25): 43.3%

Driven by high-margin export contracts and strategic treasury income (~27% of total revenue), the company maintains industry-leading bottom-line efficiency. - Operating Profit Margin (OPM): 14.1%

Stable despite moderate topline growth, showcasing cost control and pricing power.

Return Ratios

- ROCE (FY25): 29.5%

- ROE (FY25): 28.9%

- 5-Year Avg ROE: 19.1%

These numbers indicate exceptional capital efficiency—a rare feat among micro and small-cap industrial names.

Growth Metrics

- EPS Growth (3Y CAGR): 82.1%

- Net Profit CAGR (5Y): 62%

- TTM Profit Growth: 58%

Despite tepid revenue growth (~9% 5Y CAGR), earnings have soared due to improving asset utilization and investment income.

Balance Sheet Health

- Debt-to-Equity: 0.24

- Interest Coverage Ratio: 14.8

- Cash Equivalents: ₹9.36 Cr

The company’s low leverage, ample cash buffer, and high coverage ratio point to minimal financial risk.

Other Key Metrics

| Metric | Value |

|---|---|

| Book Value | ₹57.1 |

| P/B Ratio | 1.65x |

| Intrinsic Value | ₹201 |

| Market Cap to Sales | 3.92 |

| Inventory Days (FY25) | 85 days |

| Working Capital Days (FY25) | 1,022 days |

Note: High working capital days reflect large receivables and inventory holdings due to export cycles and long-term contracts. This is typical for niche B2B exporters.

Valuation & Outlook

At a P/E of just 6.49 and EV/EBITDA of 5.32, ICL trades at a steep discount to industry peers with far inferior return ratios. Its intrinsic value is estimated at ₹201, offering a substantial margin of safety at current levels.

This small-cap stock with strong fundamentals may appeal to investors seeking a high-ROE niche play with export tailwinds, low debt, and diversification potential.

Conclusion: Navigating the Post-Breakout Market with Precision

As the Nifty powers ahead in a post-breakout market, the underlying message is clear—momentum has returned, and opportunities are opening up across select sectors and stocks. From a technical standpoint, the index looks well-supported above 25,069, with the next leg of the rally possibly targeting the 26,266 zone. Traders and investors alike must stay nimble and align positions with price action.

This week’s macro updates—including progress on India-US trade talks and growth optimism for 2025—further strengthen the fundamental backdrop. Corporate actions like JSW Paints’ acquisition and Mazagon Dock’s strategic expansion hint at long-term sectoral churn that deserves closer tracking.

On the technical radar, Himadri Speciality Chemical offers a textbook symmetrical triangle breakout setup, ideal for both short-term momentum and swing traders. Meanwhile, on the fundamental front, International Conveyors Ltd shines as a small-cap stock with strong fundamentals, combining high ROE, niche market dominance, and minimal debt—making it a compelling long-term pick.

IPO activity also remains vibrant with strong SME traction and marquee names like HDB Financial Services garnering high institutional interest. This reflects deeper investor confidence in the ongoing bull cycle.

In summary, the market is offering a mix of breakout trades, structural compounders, and macro tailwinds. Staying selective, disciplined, and data-driven will be the key to navigating the post-breakout market ahead.