Nifty’s Big Pause isn’t just a sideways chart — it’s the market’s version of a suspense thriller. After sprinting non-stop through April and May, Nifty is now stuck in a tight range between 24,400 and 25,100. It’s like the index is sipping chai, waiting for the next big headline — whether it’s the election results or a surprise from the RBI.

This isn’t necessarily a bad thing. In technical terms, it’s called a bullish rectangle or flag pattern — a healthy consolidation that often leads to a breakout. But until that happens, traders are caught in “wait-and-watch” mode. It’s the classic calm before the storm.

Meanwhile, action has shifted to individual stocks. YES Bank broke out of a multi-month cup and handle pattern — yes, it finally woke up — while sectors like PSU Banks and Realty are dancing, and IT and Metal are being dragged down by US tariff concerns.

So while the broader index takes a breather, the stock market party is far from over. The question is — where should traders look now?

Let’s break it all down.

Nifty’s Big Pause – Analysis

Nifty has hit the brakes — not crashing, just cruising in neutral. After a sharp rally from under 22,000 in March to above 25,000, the index has slipped into sideways mode, moving between 24,400 and 25,100. This range-bound movement signals one thing: the market is catching its breath.

📊 The Technical Picture:

Nifty has formed a classic rectangle consolidation pattern — bouncing between defined support and resistance. It’s not a sign of weakness; it’s more like the market saying, “Let’s pause and see what comes next.”

- Resistance Zone: ₹25,077 (immediate), ₹26,266 (all-time high)

- Support Zone: ₹24,400–24,500 (strong base), ₹23,800 (major breakdown level)

Recent sessions have seen indecisive candles with small bodies and wicks on both sides — typical of a market unsure of direction. The lack of big triggers is keeping traders cautious, while global volatility and domestic flows are making things… interesting.

📈 Volume Insight:

Volumes have dipped during this pause, suggesting fewer participants are willing to take big bets. Red candle volumes have ticked up, indicating some profit-booking — but bulls are still protecting the 24,400 zone like their favorite cricket pitch.

🧠 What This Means:

This isn’t a reversal — it’s a cooling-off period. A tight range like this usually sets the stage for a breakout. But until that happens, the best strategy is patience with preparation.

🔍 Key Scenarios:

- Bullish Breakout (above ₹25,077):

- Target: ₹25,500 → ₹26,266

- Sectors to Watch: Banks, Autos, Capital Goods

- Bearish Breakdown (below ₹24,400):

- Target: ₹23,800

- Sectors to Avoid: Midcaps, momentum plays

🎯 Trader Strategy:

| Trader Type | Suggested Move |

|---|---|

| Swing Traders | Go long only above ₹25,077 |

| Positional Players | Accumulate on dips near ₹24,400 with SL below ₹23,800 |

| Bears | Short only if ₹24,400 breaks with volume |

Stocks in News

Let’s decode what’s shaking up the markets — from global panic buttons to bullish India headlines.

📉 Kiyosaki’s Crash Call: Silver to Shine?

Robert Kiyosaki (yes, the Rich Dad Poor Dad guy) just dropped another doomsday alert. He claims the “biggest crash in history” could hit this summer. His advice? Dump stocks, ditch bonds, and load up on gold, silver, and Bitcoin. Oh, and he believes silver could 3x from here.

While Kiyosaki has made such warnings before, the timing — just as global markets look a bit exhausted — is making traders cautious.

Impacted Stocks:

- MCX, IIFL Securities, 5paisa – may see a short-term uptick as traders explore alternatives like metals and crypto.

- Hindustan Zinc, Vedanta – silver-related plays could draw attention.

- Sentimentally bearish for high-beta stocks in the midcap space.

🇮🇳 India = Compounder Heaven: BofA’s Mega Bull View

According to Bank of America and IMF, India isn’t just the fastest-growing major economy — it’s also become the top global destination for stock compounders. Driven mainly by earnings, not just valuations, India is finally shedding its “emerging” tag.

They’ve identified 9 structural themes, likely around financial inclusion, manufacturing, digital transformation, etc. (Full list not yet disclosed.)

Impacted Stocks:

- Positive for long-term investors in quality compounders like HDFC Bank, Titan, Trent, DMart, and Bajaj Finance.

- Theme-based funds and domestic mutual funds may see inflows.

🔨 Trump’s Steel Tariff 2.0: Minor Bruise for India

Trump wants to double steel tariffs to 50% (again). But don’t panic — India’s steel exports to the US are tiny. Our Commerce Minister says this move will have a “minor impact” on us.

Still, it rattled Asian steel stocks. Indian steel may feel some heat if global demand sentiment sours.

Impacted Stocks:

- JSW Steel, Tata Steel, SAIL – short-term pressure possible due to global sentiment.

- Not a major structural issue unless global steel prices react sharply.

⚡ New EV Scheme: Big Boost for Local Manufacturing

The government has finalised its EV import scheme: Automakers can bring in EVs at just 15% duty (vs 70%) if they invest at least $486 million to build in India.

It’s a smart carrot-and-stick move — attract Tesla-type players but force them to manufacture locally.

Impacted Stocks:

- Positive for Tata Motors, Mahindra & Mahindra, and Maruti Suzuki — who already have EV plans.

- Could boost auto ancillaries like Sona BLW, Motherson, and Bosch in the medium term.

🧲 Magnet Trouble: Auto Makers Face China Shock

China is restricting exports of rare earth magnets — critical for EVs and hybrid cars. Indian automakers warned the government that if supplies don’t resume, production could halt in days.

Maruti says they’re okay for now, but others may not be so lucky.

Impacted Stocks:

- Maruti Suzuki – safe for now, but worth tracking.

- Tata Motors, M&M, and auto part makers – could face short-term production hiccups if China tightens further.

Stocks on Technical Radar

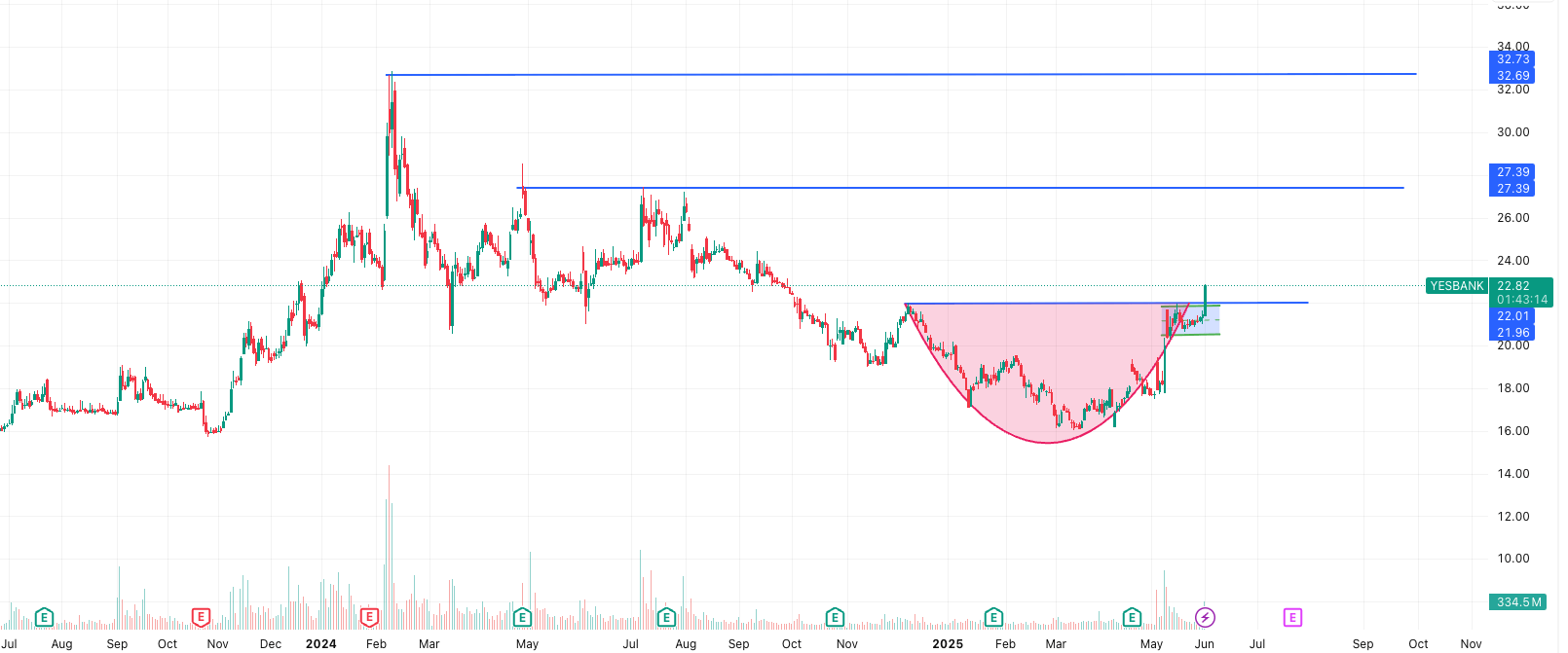

☕ YES BANK: Breakout Brewing Amid Nifty’s Big Pause

While Nifty’s Big Pause is keeping broader markets in a consolidation range, individual stocks are quietly making bold moves — and YES BANK just joined that list.

The stock has completed a classic Cup and Handle breakout on the daily chart, breaking above its ₹23.70 resistance level with strong volumes. This bullish pattern signals a potential continuation of an upward trend, just as the broader index is stuck in its sideways slumber.

In a market where Nifty’s Big Pause is testing traders’ patience, breakouts like YES BANK’s are exactly what swing traders hunt for — setups with momentum, clarity, and a tight risk-reward window.

📊 Key Trading Levels:

- Entry: ₹24 (preferably on a retest of the breakout)

- Stoploss: ₹22.80 (below the handle low)

- Targets: ₹26.50 (near-term), ₹28.80 (pattern projection)

🔍 What’s Working Here:

- Volume spike on breakout day confirms institutional buying.

- Relative strength compared to the broader PSU bank pack.

- Cup and Handle patterns tend to work best when the overall market is indecisive — like now, during Nifty’s Big Pause.

So while the index is catching its breath, YES BANK seems ready to run.

IPO Update: Momentum Defies Nifty’s Big Pause

While the broader market is taking a breather with Nifty’s Big Pause, SME IPOs are sprinting ahead. Both Scoda Tubes and Prostarm Info Systems made solid market debuts, riding on strong subscription numbers and giving double-digit listing gains.

Scoda Tubes IPO

- Issue Price: ₹140

- Listing Price: ₹159 (+13.57%)

- Subscription: 57.37x

- Listing Date: 2 June

Scoda Tubes impressed with demand nearly 60x and rewarded investors with a clean 13% gain. Despite Nifty’s Big Pause, IPO bulls stayed active.

Prostarm Info Systems IPO

- Issue Price: ₹105

- Listing Price: ₹119 (+13.33%)

- Subscription: 96.68x

- Listing Date: 3 June

Prostarm came in hotter—subscribed nearly 97x and delivered strong listing pop. It’s clear retail interest hasn’t paused even if Nifty’s Big Pause continues.

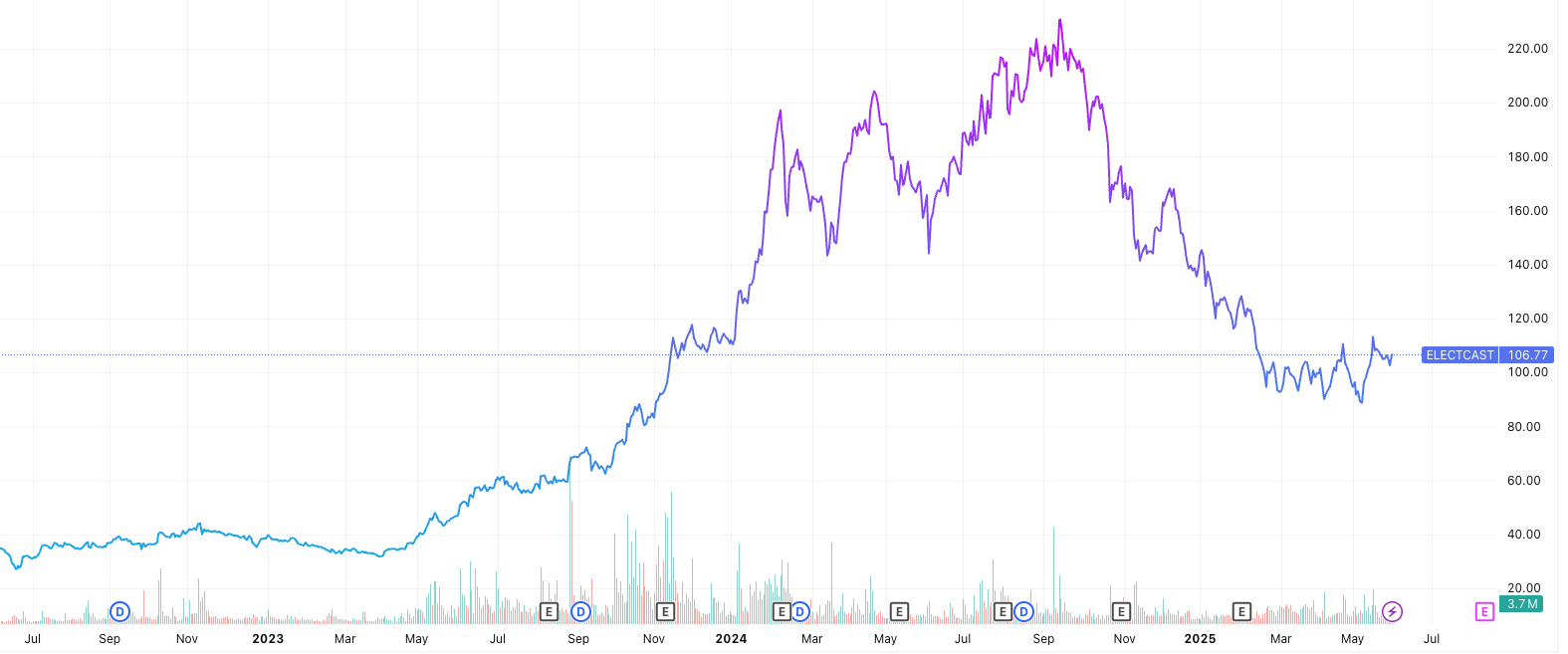

Small Cap Stock of the Day: Electrosteel Castings Ltd

While Nifty’s Big Pause continues to test traders’ patience, the small-cap universe is quietly making moves. And leading that silent rally is Electrosteel Castings Ltd, a ₹6,500+ Cr pipe powerhouse.

This company isn’t just laying pipelines—it’s laying the groundwork for solid, sustainable returns. Electrosteel manufactures Ductile Iron (DI) pipes and fittings, serving both domestic and global water infrastructure projects. With urban water supply and smart city missions gaining steam, this one’s riding a long-term megatrend.

Let’s break it down:

- CMP: ₹107

- Book Value: ₹93.5

- P/E: 9.3 (way below industry average of 23.2)

- ROE: 13%, ROCE: 13.2%

- OPM: 14.2%

- NPM (last year): 10.1%

- Debt-to-Equity: Just 0.37

- EPS growth (3Y): 25.8%

And here’s the kicker: its Intrinsic Value is estimated at ₹254—more than double the current market price. Add in a 1.31% dividend yield, and you’ve got a classic “value hiding in plain sight” setup.

With Nifty consolidating in a range, this might be the time to look for breakout potentials in fundamentally sound small caps like Electrosteel.

Disclaimer: Not a recommendation. Just a highlight for research-worthy radar.

What To Do Now: Navigate Nifty’s Big Pause with Smart Moves

As Nifty’s Big Pause keeps the market in a wait-and-watch mode, here’s your action plan to stay ahead:

- Wait for Clear Breakout or Breakdown: The index is consolidating between ₹24,400 and ₹25,077. Avoid jumping in until you see a confirmed move beyond these levels.

- Focus on Sector Strength: Banks, autos, and capital goods look ready to lead once the pause ends. Consider adding quality stocks from these sectors on dips.

- Trade the Breakout in YES Bank: This stock just broke out of a bullish cup and handle pattern with strong volume—ideal for swing traders aiming for 20–25% gains in the short term.

- Keep an Eye on IPOs: With Scoda Tubes and Prostarm Info Systems showing strong listing gains, IPOs can be a good way to diversify during market consolidation.

- Avoid High-Beta Stocks for Now: Until the market direction is clear, stay away from overly volatile stocks to manage risk better.

Final Word: Stay Ready, Stay Invested

Nifty’s Big Pause might feel frustrating, but it’s also a sign that the market is gearing up for its next move. Instead of rushing, use this time to build a watchlist, study charts, and position yourself wisely.

If you want a simple and smart way to manage your investments, try Angel One — India’s fastest-growing stockbroker trusted by millions. Their easy-to-use platform and insightful tools can help you catch the breakout as soon as it happens.

Stay calm, stay informed, and let the market make the first move!

Related Articles

5 Best Bullish Candlestick Patterns Every Trader Should Know