Intro: Nifty slipped below 25,500

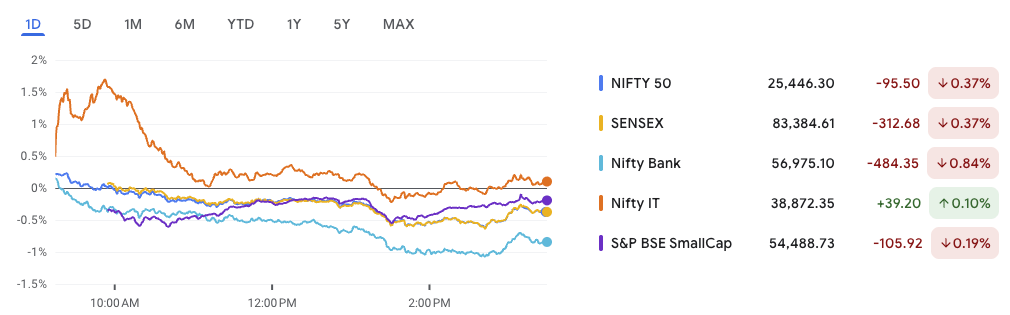

Indian markets witnessed a broad-based decline today, with benchmark indices sliding under key support zones. The Nifty slipped below 25,500, closing down by nearly 96 points, while the Sensex lost over 300 points amid pressure from heavyweight financial, capital goods, and real estate stocks.

The drag was largely attributed to sharp selling in NBFCs like Shriram Finance and Bajaj Finserv, along with banking majors IndusInd Bank and Bajaj Finance. Even infrastructure giant L&T added to the bearish tone.

On the flip side, metal stocks such as Tata Steel and JSW Steel, along with Auto and Cement names like Maruti Suzuki and UltraTech Cement, helped cushion deeper losses. Sectorally, the metal index rose 1.3%, and consumer durables gained 1%, but the gains weren’t enough to offset declines in PSU Banks, Realty, Media, and Oil & Gas, which all fell between 0.5% and 1%.

Meanwhile, the Indian rupee weakened further, ending 18 paise lower at 85.71 per US dollar, raising import-related cost concerns.

💡 What’s Inside This Newsletter?

Market Movers – A full breakdown of today’s top Nifty gainers and losers, and why they moved

Nifty Technical Outlook – Will the index recover or break lower from here? A complete chart-based view

Top News & Impacted Stocks – Big announcements, IPO filings, and sectoral developments

Watchlist Ready – Curated list of stocks that may react tomorrow based on today’s events

IPO Tracker – GMP trends, subscription data, and key dates you need to know

Stock on the Radar – One technically strong stock setup for short-term swing traders

Smallcap Spotlight – A promising smallcap company breakdown with business model, valuations, and metrics

Nifty Slipped Below 25,500 – Technical Outlook

Closing Price: ₹25,453.40

Change: -88.40 (-0.35%)

Volume: ~310M (Below 20-day average of ~335M)

Trend: Bullish with caution near resistance

Market Structure: Breakout followed by sideways consolidation

Chart Structure Analysis

Following a clean breakout above the ₹25,252–₹25,270 range—an area that previously acted as a significant resistance—Nifty slipped below 25,500 by the close of trade today. This indicates mild rejection near the upper end of the recent trading band. The candle pattern formed suggests a pause in bullish momentum, particularly with a long upper wick and a small red body, reflecting profit booking or hesitation at higher levels.

Trend and Momentum Overview

The broader trend remains upward, as the index continues to trade above its 9-day exponential moving average (EMA) and previous swing highs. However, the emergence of supply near the ₹25,670–₹25,675 zone may delay any immediate breakout. Momentum indicators hint at near-term fatigue, although the larger structure still supports an uptrend continuation, provided key levels hold.

Important Technical Levels

| Zone | Level (₹) | Description |

|---|---|---|

| Immediate Resistance | 25,670–25,675 | Recent swing high and rejection area |

| Breakout Target | 26,266–26,270 | Measured move from previous base |

| Immediate Support | 25,250–25,270 | Previous resistance turned support |

| Trend Support Zone | 25,050–25,100 | EMA support and structure confluence |

| Deeper Support | 24,450–24,460 | Major swing low from June |

Volume & Price Action

While the breakout was technically valid, the accompanying volume was not particularly robust—suggesting that institutional conviction may be lacking. Today’s pullback occurred on lower-than-average volume, which often points to market indecision rather than aggressive selling. As a result, the price action leans more toward consolidation than trend reversal.

Forecast Scenarios

Scenario 1: Bullish Continuation (60% Probability)

Should Nifty maintain support above ₹25,250, it is likely to consolidate in a narrow band. A sustained move above ₹25,675 with meaningful volume could then lead to a rally toward ₹26,266.

Trade Plan:

- Entry: Buy on dips near ₹25,270–₹25,300

- Stop Loss: Below ₹25,200

- Targets: ₹25,670 (initial), ₹26,270 (extended)

Scenario 2: Minor Pullback (30% Probability)

If the index loses grip over the ₹25,250 mark, a healthy pullback toward ₹25,050 or even ₹24,900 could occur. This would not damage the primary trend but offer better re-entry zones.

Trade Plan:

- Wait-and-watch approach near ₹25,050–₹25,100

- Re-entry on bullish price action with stop below ₹24,900

- Targets: ₹25,450 and ₹25,675 on rebound

Scenario 3: Breakdown (10% Probability)

A decisive close below ₹24,900 with above-average volume would negate the bullish breakout. This scenario may lead to further downside toward ₹24,450. However, current market structure does not support this view.

Technical Indicator Summary

| Indicator | Observation |

|---|---|

| 9 EMA | Acting as near-term support (₹25,252) |

| Volume | Lacking breakout confirmation |

| Candle Pattern | Bearish rejection at resistance |

| Trend Bias | Still upward, with caution near resistance |

Professional Take

Despite a firm uptrend in recent weeks, Nifty slipped below 25,500 as resistance at ₹25,675 once again proved sticky. This does not imply a breakdown but rather signals the start of a consolidation phase. As long as the index holds above ₹25,250, the bullish structure remains intact. A convincing breakout above ₹25,675 will reignite upward momentum toward ₹26,270.

Recommended Actions:

- Swing Traders: Accumulate on dips toward ₹25,250 with a stop-loss below ₹25,050.

- Intraday Traders: Monitor price behavior around ₹25,670 for a breakout or rejection setup.

- Positional Traders: Maintain long positions with trailing stops and aim for ₹26,270 in the coming sessions.

News and Impacted Stocks – Market Movers You Need to Know

Paras Defence Surges on Rs 22 Crore Anti-Drone Deal

What Happened:

Paras Defence & Space Technologies secured a ₹22.21 crore order from French firm Cerbair to supply its CHIMERA 200 anti-drone system. This deal marks a milestone in India’s growing defence exports.

Why It Matters:

This not only adds to the company’s topline but also signals global acceptance of Indian-built strategic defence tech.

Stock Outlook:

- Short-Term: Technically bullish – strong breakout zones likely to hold

- Medium-Term: Global visibility and order wins could lead to re-rating

Watchlist: Paras Defence – Momentum likely to continue

🚬GST 2.0? Hike Likely on Cigarettes, Cars, Cola

What Happened:

The government is exploring replacing the compensation cess (which expires in March 2026) with health and green cess, potentially increasing GST on sin goods – cigarettes, carbonated drinks, and luxury cars.

Why It Matters:

This would impact FMCG and auto stocks, especially those in the high-end segment.

Also Under Discussion:

- Moving to a 3-tier GST structure by removing the 12% slab

- Goods may shift to either 5% or 18% GST – food, essentials may get cheaper; appliances could get costlier

Stocks to Watch:

- ITC, Godfrey Phillips, Maruti, Tata Motors, Bajaj Auto, Whirlpool – Sector-sensitive stocks to tax changes

Woolah Tea: From Shark Tank to Patent Power

What Happened:

Assam’s startup Woolah Tea secured a 20-year patent for its compressed bagless tea dip innovation.

Why It Matters:

This is a sustainability-first, microplastic-free innovation that could disrupt the premium tea market globally.

Market Buzz:

- Shark Tank S4 fame

- Preparing for exports to US, UK, UAE, and more

- Represents Assam in global events

No listed entity yet, but a brand to watch as India’s premium D2C play.

Lloyds Metals Acquires Thriveni Earthmovers

What Happened:

Lloyds Metals & Energy acquired a 79.82% stake in mining firm Thriveni Earthmovers for ₹70 crore.

Why It Matters:

- Reduces mining costs significantly

- Improves backward integration

- Boosts revenue via new domestic and international contracts

Operational Update:

- 4 MTPA pellet plant and 85km slurry pipeline operational

- DRI output up 3% YoY

Watchlist: Lloyds Metals – Post-acquisition revaluation possible

HDB Financial Now 8th Most Valuable NBFC

What Happened:

On listing day, HDB Financial hit a high of ₹845.75, giving it a market cap of ₹70,198 crore – 8th largest NBFC in India.

Why It Matters:

This strengthens the ICICI Group’s capital market presence, boosting investor confidence in group entities.

Stock Action:

Strong listing, tracking institutional interest

Could set the tone for more ICICI group re-ratings

Watchlist: HDB Financial, ICICI Bank, ICICI Securities

NBCC Wins Rs 355 Cr Gorewada Zoo Project

What Happened:

NBCC bagged a ₹354.88 crore project for managing the African Zoo & Safari Plaza at Gorewada.

Why It Matters:

Secures long-term revenue and expands NBCC’s role in wildlife infrastructure.

Watchlist: NBCC – Orderbook boost could trigger technical upside

ICICI Prudential AMC Prepares for ₹10,000 Cr IPO

What Happened:

ICICI Prudential Asset Management is likely to file for a ₹10,000 crore IPO, entirely via OFS by UK partner Prudential Plc.

Why It Matters:

- Will become the 5th mutual fund stock to list

- One of India’s largest AMCs by AUM

- Investors bullish on India’s MF growth story

Watchlist: UTI AMC, HDFC AMC, Nippon AMC – Peer stocks may react in sympathy

Govt Won’t Raise Stake in Vodafone Idea Beyond 49%

What Happened:

Telecom Minister Jyotiraditya Scindia clarified the government has no intention to convert further dues into equity in Vodafone Idea. The current 49% stake is the limit.

Why It Matters:

Puts an end to PSU fears, but also limits financial safety net. Vodafone Idea must now attract external investment to survive post-FY26.

Watchlist: Vodafone Idea – High risk, event-driven play

Stock on Technical Radar: Sagility Ltd | Breakout Amid Broader Market Weakness

While the Nifty slipped below 25,500, some small- and mid-cap names are defying the broader trend and showing fresh breakout patterns. Sagility Ltd is one such stock exhibiting strong technical momentum backed by volume.

Stock Overview

- CMP: ₹43.87

- Volume: 163.3M ( 4x above 20-day avg of ~38M)

- 9-Day EMA: ₹40.77

- Trend: Short-term trend reversal from bearish to bullish

- Structure: Breakout from ascending flag channel

Technical Breakdown: Pattern & Structure

✅ Flag Breakout Formation:

Sagility formed a rounded bottom near ₹38, then consolidated within an ascending flag channel. The breakout occurred today with a large bullish candle and explosive volume — a classic bullish continuation signal.

✅ Volume Confirmation:

The surge in volume confirms institutional buying, indicating conviction in the breakout. Today’s move shows the strongest candle-body expansion in recent weeks.

✅ Short-Term Momentum:

Price is decisively above the 9 EMA. This, along with the high-volume breakout, indicates fresh trend formation and upside strength.

Key Technical Levels

| Level | Price (₹) | Description |

|---|---|---|

| Immediate Support | 42.00–42.30 | Flag top + 9 EMA confluence |

| Breakout Zone | 43.50–43.70 | Today’s breakout range |

| Stop Loss | 40.50 | Below 9 EMA and base of the flag |

| Swing Target 1 | 49.50–50.00 | First resistance zone |

| Swing Target 2 | 55.20–56.00 | Measured move projection |

Trade Setup – What’s the Plan?

Bullish Scenario (High Conviction):

If price sustains above ₹43.70 on continued volume, an upside move toward ₹50 is likely in the next 5–10 sessions, and ₹55+ in the next 2–3 weeks.

📌 Strategy – Swing Long Setup:

- Entry: Current Market Price (₹43.87) or dips near ₹43.00–43.30

- Stop Loss: ₹40.50 (structure invalidation)

- Target 1: ₹49.50

- Target 2: ₹55.00–₹56.00

- Risk-Reward Ratio: ~1:3 or better

Bearish Reversal (Low Probability):

If the stock breaks below ₹40.50 on volume, the bullish thesis is negated, and price may revisit ₹38–₹39 levels.

Summary – Why It Matters Now

Despite Nifty slipping below 25,500, Sagility is showcasing a powerful breakout, suggesting stock-specific strength. This divergence is particularly valuable for swing traders looking to capitalize on names outperforming the index.

| Aspect | Verdict |

|---|---|

| Trend | Bullish breakout with momentum |

| Volume | Institutional activity noted |

| Price Action | Clean breakout confirmation |

| RR Ratio | Strong risk-reward setup |

Conclusion:

Sagility is a classic bullish breakout candidate, offering high-probability swing opportunities even as broader indices remain under mild pressure. Traders may consider staggered entries and trail stops for optimal performance.

IPO Update: Mixed Sentiment as Markets Stay Cautious

While Nifty slipped below 25,500, IPO action continues across both mainboard and SME segments. Let’s decode the latest trends in grey market premiums (GMPs), fire ratings, and oversubscription updates.

Mainboard IPOs – Snapshot

| IPO Name | Open | Close | Listing | GMP (Gain %) |

|---|---|---|---|---|

| Anthem Biosciences | TBD | TBD | TBD | ₹– (0%) |

| Travel Food Services | 7-Jul | 9-Jul | 14-Jul | ₹– (0%) |

| Crizac Ltd | 2-Jul | 4-Jul | 9-Jul | ₹32 (13.06%) |

| Indogulf Cropsciences | 26-Jun | 30-Jun | 3-Jul | ₹16 (14.41%) |

SME IPOs – Momentum Strong

| IPO Name | Open | Close | Listing | GMP (Gain %) |

|---|---|---|---|---|

| GLEN Industries | 8-Jul | 10-Jul | 15-Jul | ₹– (0%) |

| Smarten Power Systems | 7-Jul | 9-Jul | 14-Jul | ₹– (0%) |

| Chemkart India | 7-Jul | 9-Jul | 14-Jul | ₹– (0%) |

| Meta Infotech | 4-Jul | 8-Jul | 11-Jul | ₹24 (14.91%) |

| White Force | 3-Jul | 7-Jul | 10-Jul | ₹5 (6.58%) |

| Cryogenic OGS | 3-Jul | 7-Jul | 10-Jul | ₹20 (42.55%) |

| Cedaar Textile | 30-Jun | 2-Jul | 7-Jul | ₹10 (7.14%) |

| Silky Overseas | 30-Jun | 2-Jul | 7-Jul | ₹45 (27.95%) |

| Adcounty Media India | 27-Jun | 1-Jul | 4-Jul | ₹50 (58.82%) |

| Neetu Yoshi | 27-Jun | 1-Jul | 4-Jul | ₹25 (33.33%) |

| Ace Alpha Tech | 26-Jun | 30-Jun | 3-Jul | ₹30 (43.48%) |

| PRO FX Tech | 26-Jun | 30-Jun | 3-Jul | ₹13 (14.94%) |

| Moving Media | 26-Jun | 30-Jun | 3-Jul | ₹16 (22.86%) |

IPO Outlook

Despite Nifty slipping below 25,500, IPO markets—especially SME—are witnessing selective exuberance. While mainboard IPOs are seeing tepid QIB interest, SMEs remain driven by retail and HNI momentum.

What This Means for You:

- Traders: Focus on oversubscribed SME issues for quick listing gains

- Investors: Evaluate fundamentals post-listing for potential long-term holds

- Risk Takers: GMPs over 40% often lead to volatile post-listing action

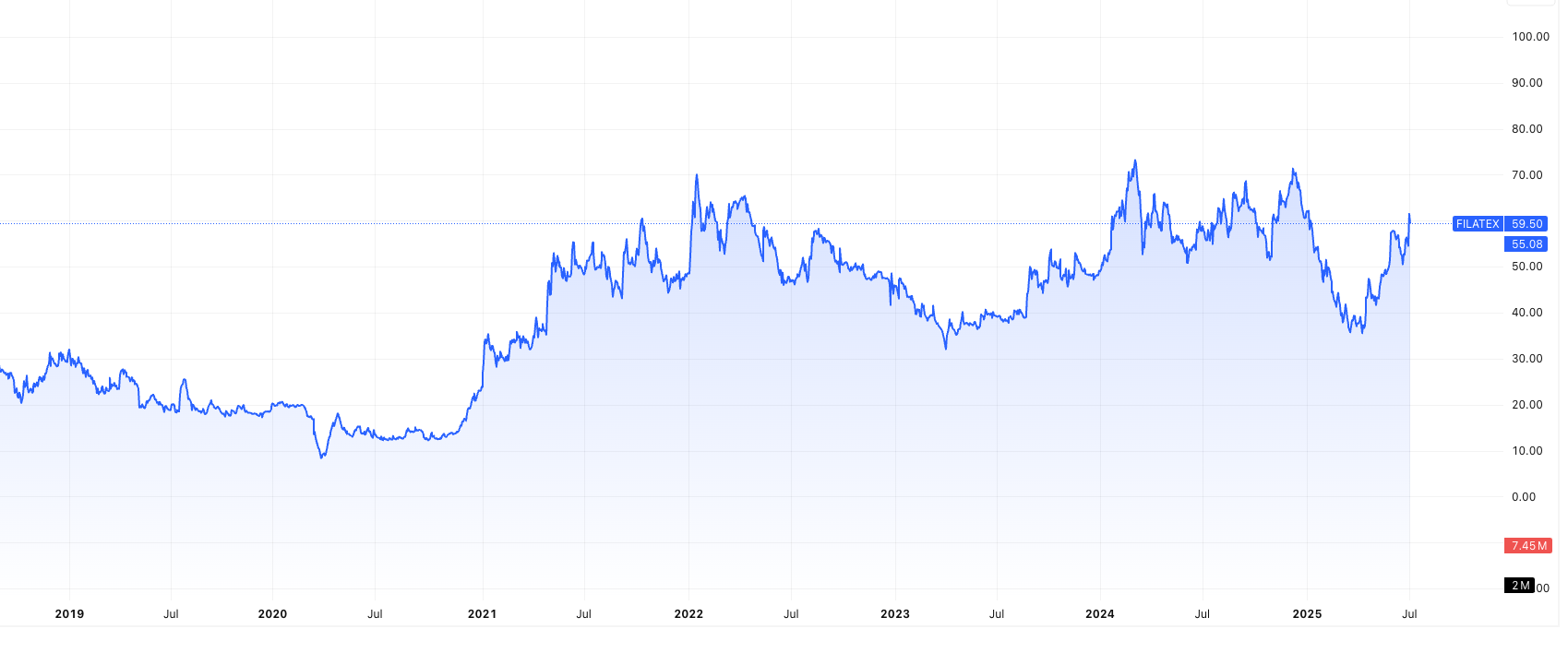

Smallcap of the Day – Filatex India Ltd (₹59.40)

About the Company:

Filatex India Ltd is a leading manufacturer and trader of synthetic yarns and polymers. With a diversified product basket, it caters to both domestic and international textile markets.

Key Highlights

To understand Filatex India better, let’s dive into its product offerings and financial backbone.

Diverse Product Portfolio:

Filatex operates at the intersection of synthetic yarn innovation and textile versatility. Its core product line includes Polyester Chips, Drawn Textured Yarn (DTY), Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), Air Textured Yarn (ATY), and Polypropylene Multifilament Yarns.

In addition to these essentials, the company also produces Narrow Woven Fabrics, catering to both industrial and apparel applications.

Value-Added Segments:

Beyond standard yarns, Filatex has moved up the value chain. It has developed branded textile innovations categorized into four variants — Comfort, Touch, Fancy Effect, and Others.

Some of its flagship specialty yarns include:

- Sewfil – Designed for sewing durability

- Fillory – Lightweight and soft-touch

- Filaspun – Enhanced texture feel

- Wooly and Flexifil – Offering elasticity and warmth

This shift toward premium yarns helps differentiate Filatex in a commoditized industry.

Financial Snapshot:

From a numbers perspective, Filatex has a market capitalization of ₹2,634 crore, supported by annual revenues exceeding ₹4,250 crore.

Despite facing margin pressure, the company posted a profit after tax of ₹135 crore and an operating profit of ₹254 crore in FY24.

Its low debt-to-equity ratio of 0.11 underscores a conservative balance sheet, while zero promoter pledge reflects strong governance and trust.

Valuation & Fundamentals

| Metric | Value | Comment |

|---|---|---|

| Price to Book | 1.95x | Slightly premium but reasonable |

| Intrinsic Value Estimate | ₹42 | Trades ~41% above IV |

| PE Ratio | 19.6x | Below Industry PE (26.2x) |

| ROE / ROCE | 10.6% / 13.8% | Stable return profile |

| EV/EBITDA | 9.90x | Fair valuation |

| Inventory Turnover | 7.96x | Efficient inventory management |

Strategic Outlook

✅ Strengths:

- Diversified product mix in technical textiles

- Healthy balance sheet with low leverage

- Improving margin profile in recent quarters

- No promoter pledge

⚠️ Challenges:

- EPS growth has been negative over 3 years

- Operating margins still sub-6%

- Sensitive to input cost volatility (oil-linked raw materials)

Investment Outlook

Filatex India is a mid-sized textile and synthetic yarn player with a stable core, clean books, and a low debt profile. It’s trading reasonably below the industry average on PE basis and has decent room for upside—if margins improve and export orders pick up.

This could be a watchlist stock for long-term investors seeking exposure to textile manufacturing and specialty yarns.

Final Word

As Nifty slipped below 25,500, markets reminded us of their vulnerability despite broader bullish undertones. Sector rotation is clearly visible — while financials and realty dragged the indices down, metal and consumer durables held up the frontline.

From Paras Defence’s global breakthrough to Filatex India’s strategic value-driven focus, and from Sagility’s bullish breakout setup to IPO markets buzzing with new listings, there’s plenty for investors to stay watchful and opportunistic.

Key Takeaway: This week’s pullback isn’t necessarily a reversal. Instead, it may offer tactical entry points — both in primary markets via IPOs and secondary markets through breakout stocks.

Stay disciplined, stay diversified — and as always, we’ll be here breaking down the noise into actionable insights in your next edition.

Related Articles

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check