False Hope, Real Moves: How to Beat the Market Now

The market just reminded us that hope is not a strategy.

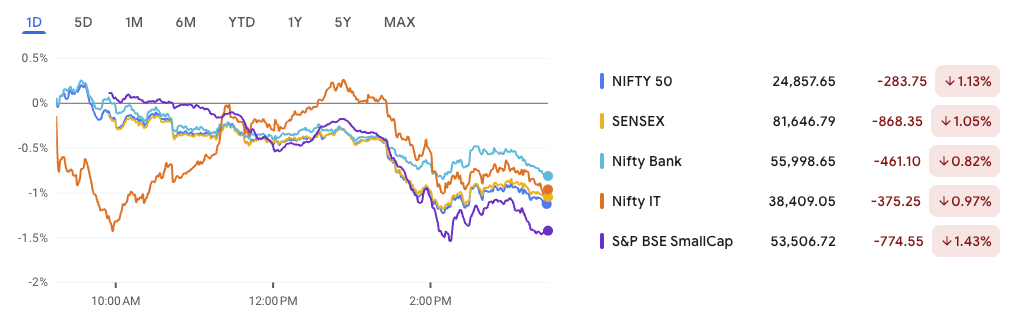

On June 12, the Nifty 50 index staged what looked like a confident breakout above the key 25,100 resistance level—only to reverse sharply and close at 24,888.20, down 253 points. The Sensex tanked 823 points, dragging all sectors into the red. What seemed like a bullish continuation turned out to be a textbook fakeout.

Across the board, auto, FMCG, IT, energy, and realty stocks cracked. Tata Motors, Titan, and Coal India were among the worst performers, while only a few names like Apollo Hospitals and Dr. Reddy’s managed to stay green.

But here’s the thing: fakeouts create opportunities—if you know how to read them. When the index traps momentum buyers at the top, smart traders look for signs of distribution, reversals, or well-timed short setups.

In this issue, we’ll break down the post-fakeout Nifty chart, key support zones, trade setups, and where opportunity lies despite the market’s deception. Whether you’re looking for technical swing picks, small-cap momentum, or the next IPO trigger—this newsletter is packed with smart ways to Beat the Market.

Stay sharp. Let’s get into it.

Nifty 50 Analysis: The Fakeout That Set a Trap — Can You Beat the Market?

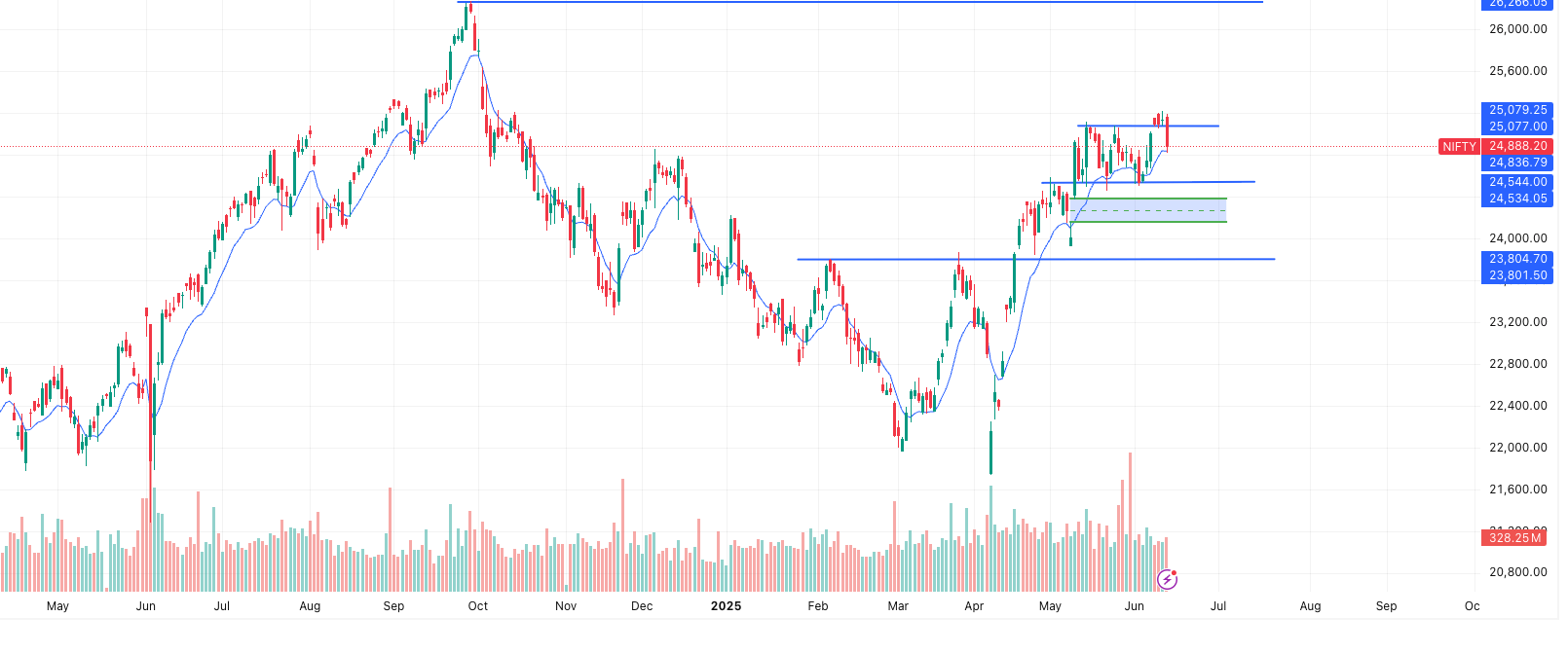

The Nifty closed at 24,888.20, down 253.20 points (−1.01%), forming a bearish engulfing candle right after breaching the 25,100 resistance zone. What looked like a bullish breakout quickly turned into a trap for momentum traders—a classic fakeout.

What Just Happened?

The index gave traders false hope by pushing above the critical 25,079–25,100 resistance zone on June 11. But the breakout didn’t hold. Instead, heavy selling at the top pulled the index back sharply, marking a false breakout—or in trader terms, a bull trap.

If you’re aiming to Beat the Market, this is exactly the kind of trap you must learn to recognize and avoid—or even profit from.

Key Technical Levels to Watch:

| Zone Type | Price Range (₹) |

|---|---|

| 🔼 Resistance | 25,079 – 25,100 |

| 🟩 Immediate Support | 24,540 – 24,530 |

| 🧱 Strong Support | 23,800 – 23,805 |

- Volume spiked during the rejection, hinting at institutional offloading.

- EMA(9) at ₹24,836.79 is currently being tested. A break below it could flip short-term momentum to bearish.

Candlestick View:

Today’s bearish engulfing pattern is a high-conviction signal of supply pressure—sellers stepped in aggressively to reject higher levels.

What to Expect Today:

| Scenario | Bias | Likely Move |

|---|---|---|

| 🔻 Opens below 24,800 | Bearish | Test of 24,540, then possible slide to 23,800 |

| 🔄 Holds above EMA | Neutral/Sideways | Range-bound between 24,800–25,100 |

| ✅ Bounces from 24,540 | Rebound chance | Short-term long trades possible |

Beat the Market Trade Plan:

| Trade Type | Entry | SL | Target(s) |

|---|---|---|---|

| 📉 Intraday Short | ₹24,950–25,000 | ₹25,120 | ₹24,540 / ₹24,400 |

| 📉 Positional Short | Below ₹24,800 | ₹25,100 | ₹24,200 / ₹23,800 |

| 📈 Intraday Long (only if 24,540 holds) | ₹24,550 | ₹24,400 | ₹24,900 |

Bottom Line:

The market just faked a breakout and flushed out the late buyers. But for the prepared, this could be the perfect moment to Beat the Market. Whether through tactical shorts or calculated longs near support, the next move belongs to those who read the signs—not chase the headlines.

Stocks in News: Key Movers You Need to Track to Beat the Market

Today’s sharp sell-off wasn’t just about the index – several headline-driven stock moves stood out. These are the names where volatility created both risks and opportunities. To Beat the Market, you need to know what’s moving – and more importantly, why.

Aviation in Turbulence: IndiGo & SpiceJet Slide

- IndiGo (InterGlobe Aviation) fell 3.4%

- SpiceJet dropped 2.6%

Both stocks nosedived after reports of an Air India plane crash in Ahmedabad hit the wires, triggering safety-related sentiment shocks across the aviation sector. Combined with overall market weakness, the sector took a hard hit. Despite IndiGo’s strong Q4FY25 profit, the news overshadowed fundamentals.

📊 Watch for: Short-term selling pressure; monitor news flow before considering contrarian entries.

IPO Boom Returns: Big Names Lined Up

India’s IPO pipeline is heating up with over 67 companies waiting for SEBI’s nod to raise ₹1 lakh+ crore. Key names to watch:

- NSDL

- HDB Financial

- Vikram Solar

After two muted quarters, a breakout in primary markets may offer fresh listing gains. Smart investors looking to Beat the Market should keep track of Grey Market Premiums (GMPs) and subscription trends.

Capex Story: Private Sector Surpasses Government

Corporate India has outpaced government spending with ₹11 lakh crore in capex for FY25. According to ICICI Securities:

- RIL leads the chart in absolute numbers

- Capex growth is broad-based across infra, auto, industrials

This signals long-term confidence in India’s economic cycle. For investors aiming to Beat the Market, this is a cue to explore capital goods and infra themes.

Bajaj Finance Bonus Buzz: 10 Becomes 100

Record Date: June 16 (Buy by June 13 to qualify)

Price Before Split: ₹9,368

Bonus Ratio: 1:1 Bonus + 1:10 Split

➡️ Post-split-adjusted price estimate:

- Split (1:10): ₹936.80

- Bonus (1:1): Final adjusted cost per share = ₹468.40

⚠️ Beat the Market tip: Stocks often rally post-split or correct after hype – gauge volumes and delivery percentages to spot real momentum.

Crypto Comeback: Bitcoin Nears ₹112K

Driven by institutional flows and Ethereum’s upgrades, Bitcoin rallied 10% in May, with altcoins following suit. As corporate treasuries increase crypto holdings, investors in fintech or blockchain-adjacent stocks may find opportunities to Beat the Market in satellite allocations.

Cable TV Shake-up: 2 Lakh Jobs at Risk

AIDCF-EY’s report highlights a looming crisis in India’s cable TV industry with falling LCO revenues. As digital streaming continues to dominate, media and telecom players with OTT exposure may emerge as the new leaders.

Adani Airports IPO in the Wings

- IPO Timeline: By 2027

- Operates 8 airports including Mumbai’s upcoming terminal

Infrastructure investors may look at pre-IPO plays or explore other Adani Group stocks linked to aviation infrastructure to Beat the Market in the long term.

NTPC Hits 81,368 MW Milestone

NTPC completed trials for Unit-3 (660 MW) at North Karanpura STPP in Jharkhand, further strengthening its base-load capacity. As India pushes for energy security, NTPC’s project pipeline supports strong fundamentals.

Investors focused on stable dividend plays and power infra can leverage such expansions to Beat the Market.

Trade Spotlight: Can Redington Help You Beat the Market?

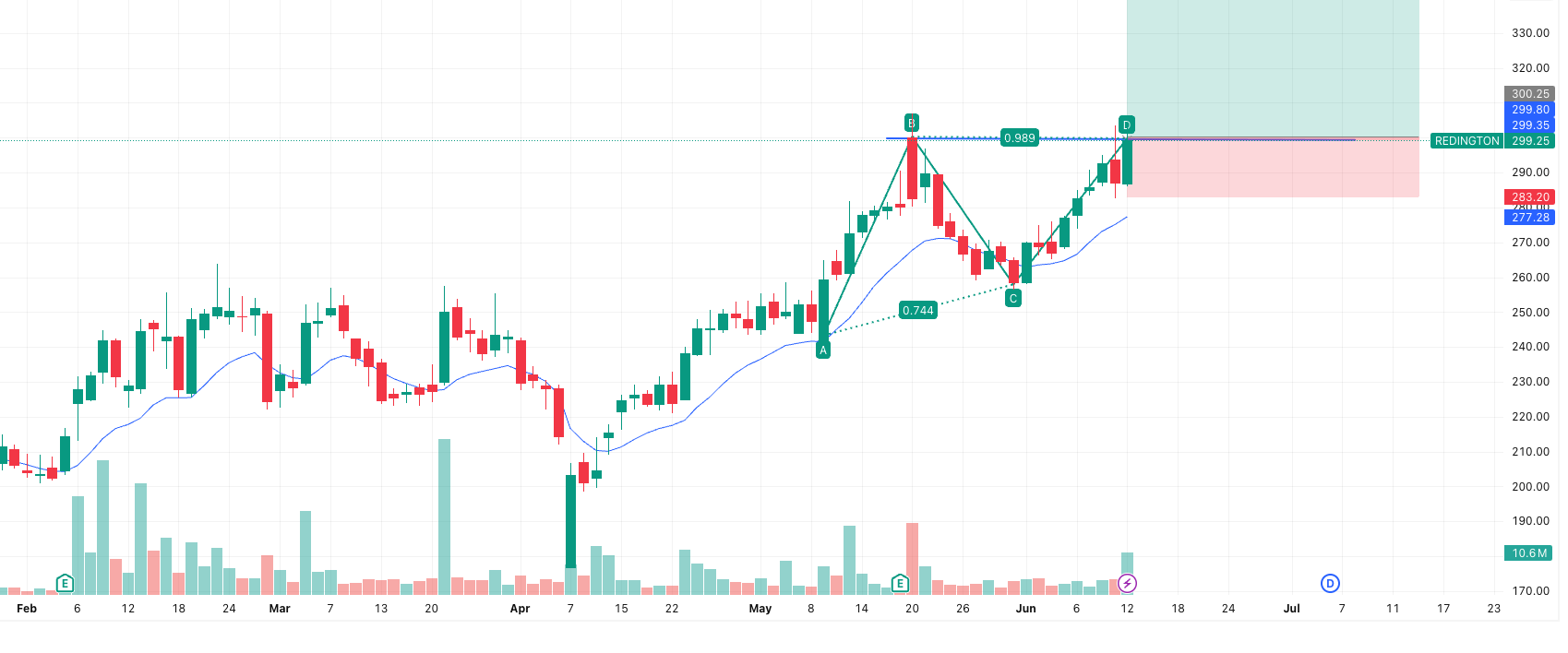

Closing Price: ₹299.25 | Date: June 12, 2025

Volume: 10.6 million (above average) | 9-EMA: ₹277.28

Pattern Observed: Bullish ABCD Harmonic

What’s Happening on the Chart?

Redington is showing signs of a short-term bullish breakout, supported by both pattern structure and momentum. The stock has completed a well-formed ABCD harmonic pattern, with point D landing around ₹299.80–₹300.25. Historically, this level has been a resistance zone, and a breakout above it signals fresh buying interest.

A large green candle broke above the previous swing high (~₹299.80) on strong volume—often a sign of institutional activity. The stock also trades well above its 9-day EMA, which has acted as dynamic support during recent pullbacks.

This setup could offer a timely opportunity for traders looking to Beat the Market with disciplined entries and risk control.

Swing/Short-Term Trade Plan

| Parameter | Value |

|---|---|

| Entry | ₹299.25 (CMP) |

| Stop Loss | ₹283.20 (below swing low) |

| Target 1 | ₹315 |

| Target 2 | ₹330 |

| Risk-Reward | Approx. 1:2.5 (at CMP) |

Optional Entry Strategy: Wait for a retest of ₹295–₹300 zone for added confirmation if price holds with volume.

Risk Pointers

- ₹300–₹301 zone is historically a supply area. Failure to sustain above it could pull the stock back toward ₹285 (minor support) or ₹277 (9 EMA).

- If the stock closes below ₹283.20, the bullish thesis is invalidated.

Summary

Redington Ltd presents a clean, volume-supported bullish structure with identifiable risk levels. A breakout above the critical ₹300 zone could offer a momentum trade, especially for traders looking to Beat the Market through technical setups with favorable risk-reward.

IPO Watch: Fresh Bets to Beat the Market

Mainboard IPOs

| Company | Open | Close | Listing | GMP (Est. Gain) |

|---|---|---|---|---|

| Oswal Pumps | Jun 13 | Jun 17 | Jun 20 | ₹73 (+11.89%) |

SME IPOs (High Risk – High Reward)

| Company | Open | Close | Listing | GMP (Est. Gain) |

|---|---|---|---|---|

| Monolithisch India | Jun 12 | Jun 16 | Jun 19 | ₹45 (+31.47%) |

| Aten Papers & Foam | Jun 13 | Jun 17 | Jun 20 | ₹0 (Flat) |

| Patil Automation | Jun 16 | Jun 18 | Jun 23 | ₹15 (+12.5%) |

| Samay Project Services | Jun 16 | Jun 18 | Jun 23 | ₹0 (Flat) |

| Eppeltone Engineers | Jun 17 | Jun 19 | Jun 24 | ₹51 (+39.84%) |

| Influx Healthtech | Jun 18 | Jun 20 | Jun 25 | ₹12 (+12.5%) |

| Mayasheel Ventures | Jun 20 | Jun 24 | Jun 27 | ₹0 (Flat) |

📌 Note: GMPs are dynamic and may change pre-listing. Use disciplined entry strategies to truly Beat the Market.

High Risk, High Reward: Small Cap to Beat the Market

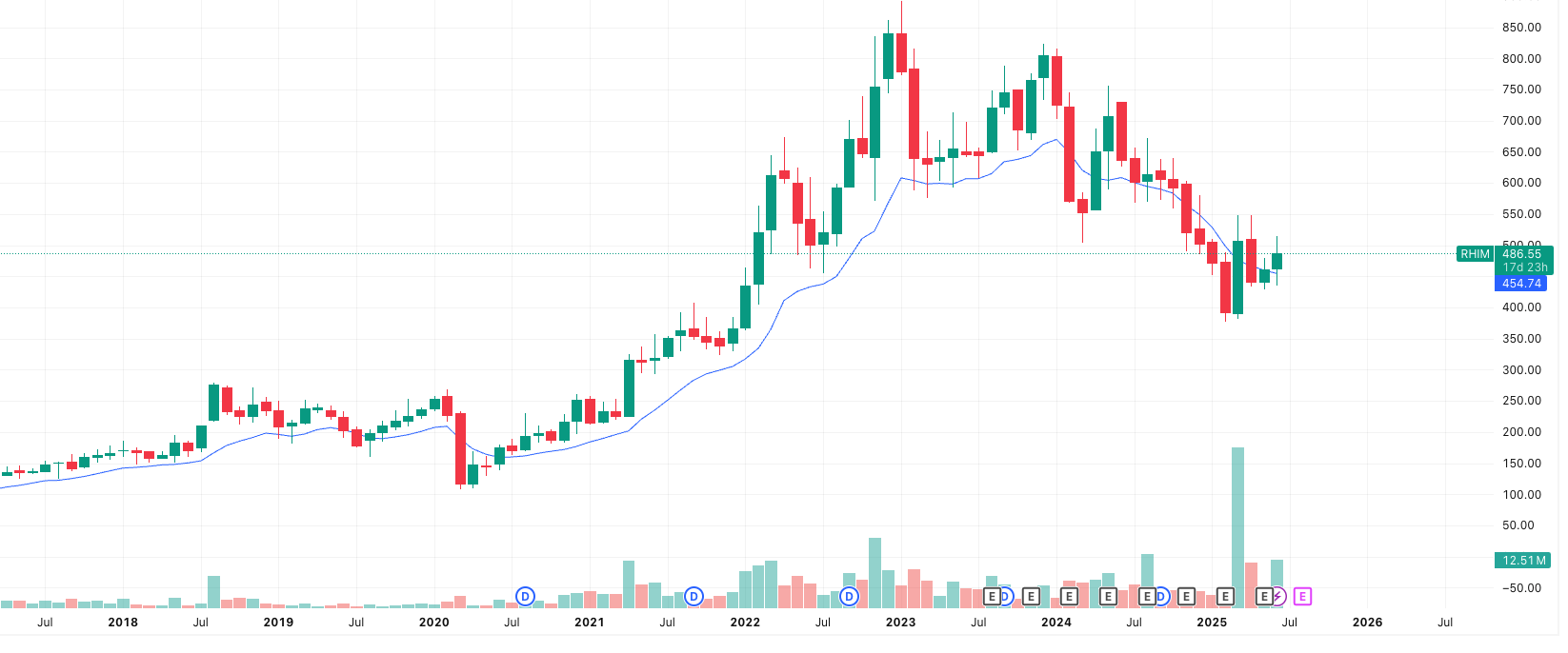

RHI Magnesita India Ltd (RHIM) – Strength Building Quietly

After months of sideways movement, RHI Magnesita India Ltd is starting to show signs of accumulation. A strong close above key moving averages on the weekly and monthly charts hints at a possible trend reversal. For those aiming to beat the market, this quiet strength in a niche industrial leader could offer a strategic swing opportunity.

Business Snapshot: A Hidden Champion in Refractories

Formerly known as Orient Refractories Ltd, RHIM is a leading global supplier of high-grade refractory products — materials critical to the steel, cement, and glass industries. It holds ~30% market share in India and exports to multiple countries, benefiting from both industrial capex and global steel demand.

Its integration into the global RHI Magnesita Group gives it access to advanced tech and a vast global network — a key moat in a typically fragmented sector.

Financial Pulse

| Metric | Value | Remarks |

|---|---|---|

| Market Cap | ₹10,058 Cr | Mid-cap, strong institutional interest |

| Sales (FY25) | ₹3,674 Cr | Solid recovery from previous lows |

| Net Profit Margin | 8.54% | Respectable for its segment |

| Debt/Equity | 0.09 | Extremely low leverage |

| ROCE / ROE | 7.01% / 5.16% | Improving post-downcycle |

| PE Ratio | 49.5x | Higher, but pricing in growth |

| Cash Reserves | ₹99.2 Cr | Healthy liquidity cushion |

Although recent EPS growth has been soft, operating efficiency is stabilizing. If steel demand sustains and capex trends stay upbeat, margins could expand going forward.

Technical + Fundamental Confluence

- Monthly Trend Shift: Price has closed above its 9 EMA on the monthly chart after a long time — a signal that long-term trend may be turning.

- Weekly Price Action: Recent breakout above ₹475–₹480 with volume signals buyer interest.

- Support Zone: ₹449–₹460 appears to be acting as a base, supported by both price structure and EMAs.

What to Watch for

If RHIM can sustain above ₹475–₹480 zone over the next few sessions, it may be quietly preparing for a broader move. This technical alignment, when paired with improving fundamentals and low leverage, makes RHIM a small-cap worth tracking for those looking to beat the market through calculated swing setups.

🟨 Caution: Stock trades at a premium valuation, so entry timing and position sizing matter. Keep an eye on ₹530 and ₹575 as potential resistance zones if the move holds.

Final Thought: To Beat the Market, You Must Read Between the Lines

Markets don’t just respond to news—they anticipate it, interpret it, and often overreact. This week, we saw a textbook example. Nifty’s fakeout caught many off guard, but if you were tuned into structure, volume, and resistance zones, the signs were already flashing red.

Meanwhile, stories are unfolding beyond the index: IPOs are heating up again, select mid- and small-caps are aligning on technicals and fundamentals, and corporate capex is quietly outpacing government spending—a strong macro tailwind for Indian equities.

To truly beat the market, it’s not about chasing momentum or reacting emotionally to red days. It’s about preparation, pattern recognition, and patience. This newsletter equips you with all three.

Whether you’re watching resistance zones, tracking IPOs, or scanning for high-reward setups, stay grounded, stay informed—and always play the trend, not the noise.

One last move? Open your Angel One Demat account and start beating the market smarter.

Related Articles

Ready-to-Drink (RTD) Cocktails: The Fastest-Growing Segment in the Liquor Market